Create a cash receipts template to simplify tracking transactions and maintaining organized records. This ensures accuracy and accountability in managing received payments.

Structure of a Cash Receipt

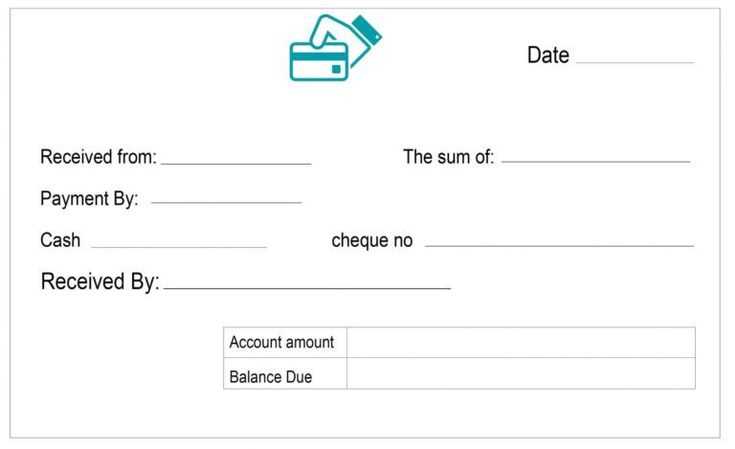

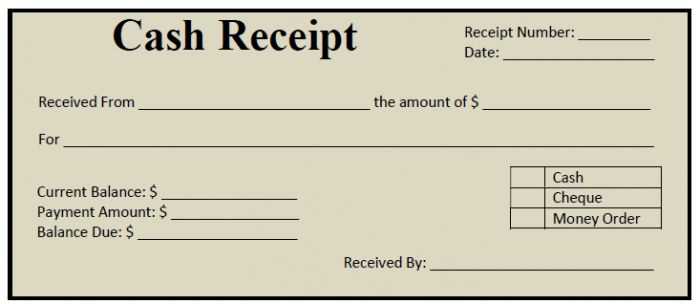

A solid template includes the following details:

- Date: The date the payment is made.

- Receipt Number: A unique identifier for each transaction.

- Payer Information: The name of the individual or organization making the payment.

- Amount: The total money received.

- Payment Method: The type of payment (cash, check, card, etc.).

- Purpose: A brief description of what the payment is for.

- Signature: The signature of the person receiving the payment.

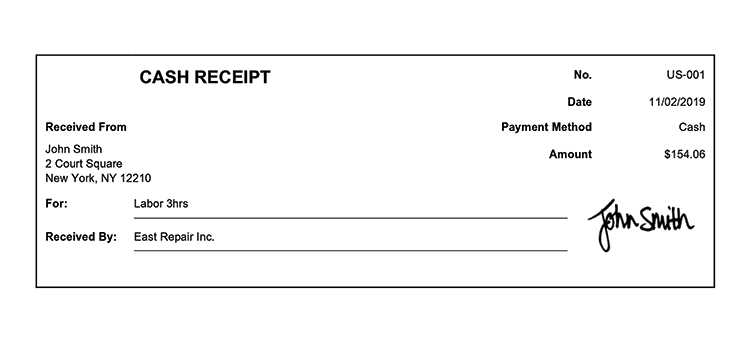

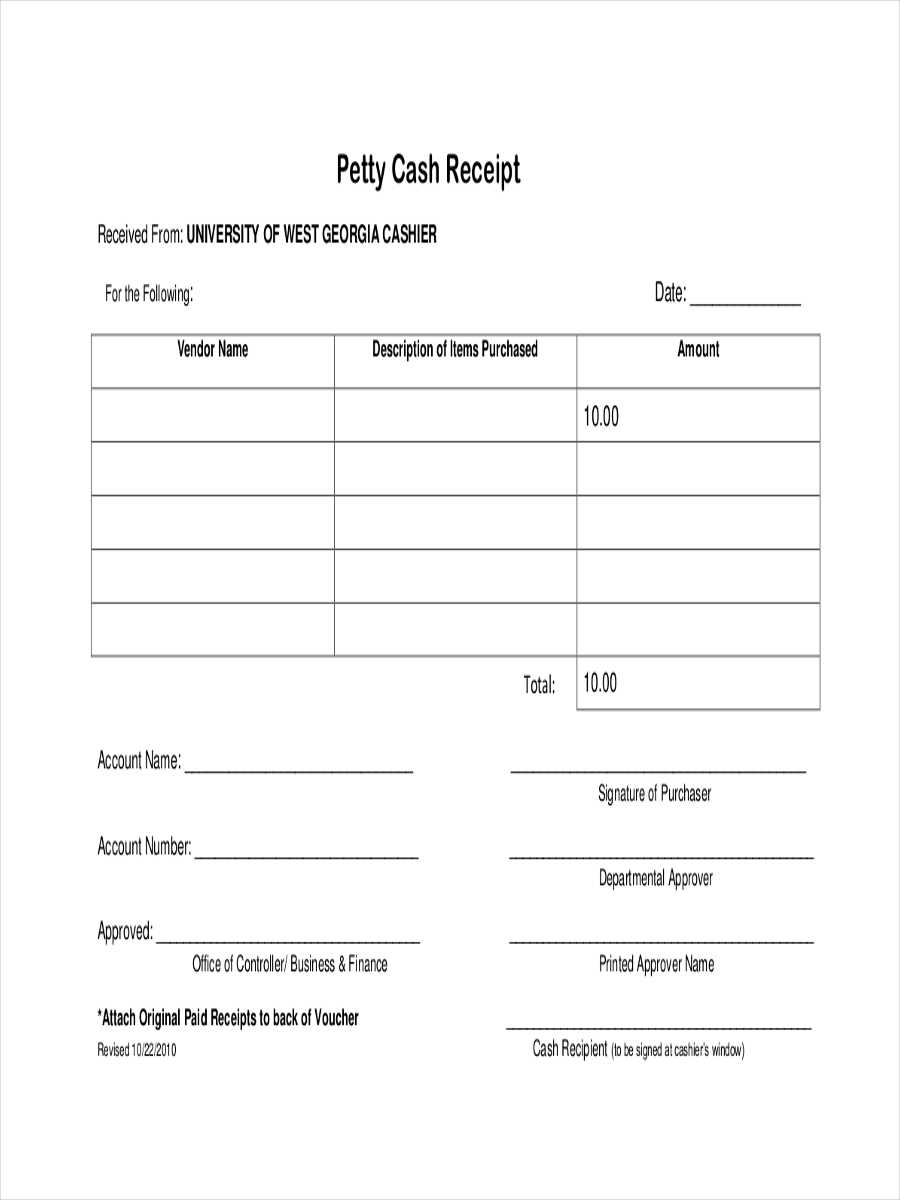

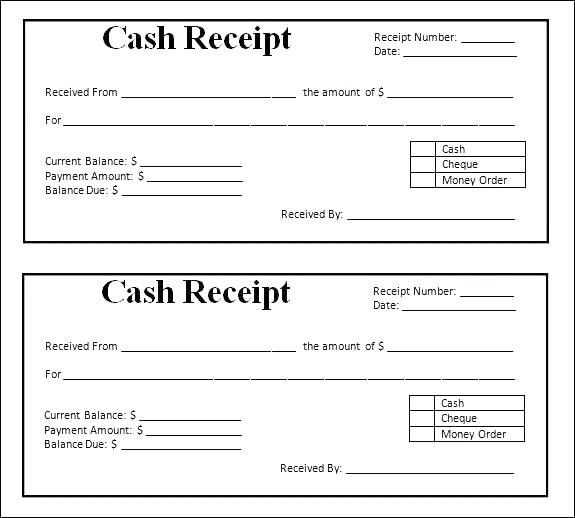

Template Example

Here is an example of a basic cash receipt template:

| Receipt No. | Date | Payer Name | Amount | Payment Method | Purpose | Signature |

|---|---|---|---|---|---|---|

| 001 | 2025-02-11 | John Doe | $200.00 | Cash | Service Payment | Jane Smith |

Best Practices

To ensure your template works well:

- Use sequential numbers for each receipt to track payments easily.

- Record the payment immediately after receiving it to avoid errors.

- Keep copies of receipts for both the payer and receiver for reference.

This simple approach helps you stay organized and avoids any confusion regarding payments. A consistent, easy-to-use template enhances financial clarity and transparency.

Cash Receipts Template

Include the following elements in your cash receipts form for clarity and accuracy: the receipt number, date, payer’s name, description of goods or services provided, amount received, payment method (cash, check, credit), and the signature of the person issuing the receipt. These details help both parties track and verify the transaction later.

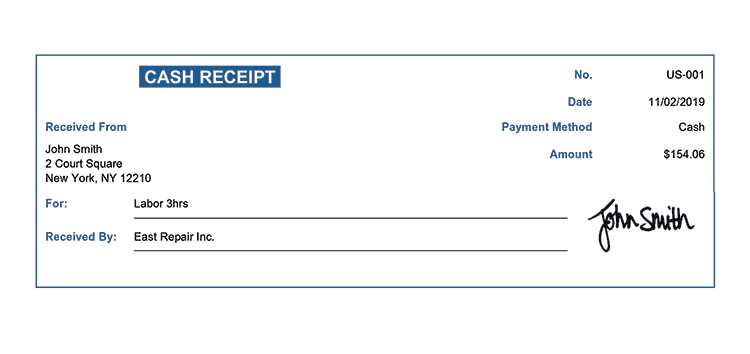

How to Customize a Payment Receipt Template for Your Business

Adjust your payment receipt template to align with your business model. For instance, if you run an online store, add an order number and a link to the purchase invoice. If your business deals with recurring payments, include a billing cycle reference. Make sure your logo and contact details are visible to establish a professional image and facilitate communication with customers.

Best Practices for Recording and Storing Payment Records

Store payment records securely, whether digitally or on paper. For digital storage, use cloud storage with encrypted backups to ensure data safety. Keep records organized by transaction type and date to easily locate information when needed. Regularly update your files and audit them to ensure everything is accurate and up-to-date.