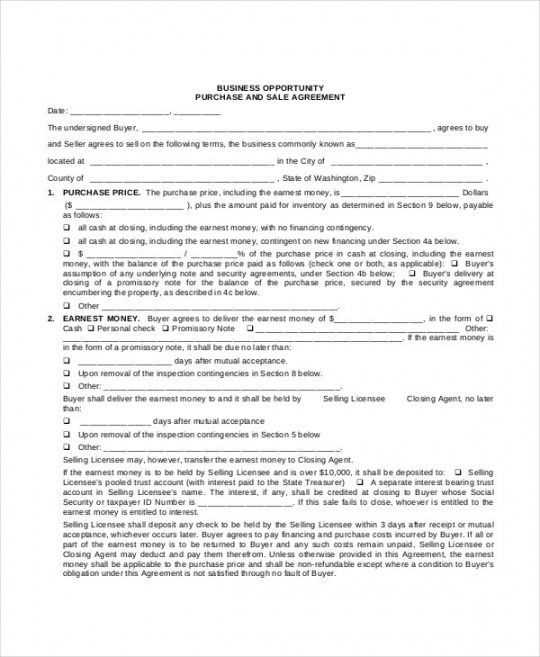

Include specific details in your earnest money receipt agreement to ensure clarity and avoid disputes. Start by noting the parties involved and their contact information. Clearly define the transaction amount, including the earnest money sum, and specify the date it was received. This ensures all parties are on the same page regarding the financial commitment.

Next, outline the terms regarding the return of the earnest money. Specify the conditions under which the deposit may be refunded or forfeited. It’s also crucial to mention the deadline for the completion of the transaction or conditions that would allow either party to terminate the agreement.

Make sure to include a section outlining the consequences of non-compliance. Whether it’s forfeiting the deposit or other legal actions, this will prevent any misunderstandings later on. The agreement should be signed by both parties to ensure mutual consent and to make it legally binding.

Here are the revised lines with minimal repetition:

To ensure clarity and reduce redundancy in your earnest money receipt agreement, make sure each sentence serves a clear purpose. Focus on the essential terms without over-explaining details already understood in the context. For example, instead of repeating the payment terms in multiple places, reference them once and ensure the key points are clear.

Clear Payment Terms

State the amount, method, and due date clearly. Avoid mentioning these details multiple times throughout the agreement. A simple reference to the terms should suffice in subsequent sections.

Unambiguous Conditions

Eliminate phrases that restate terms or conditions. Each clause should be concise, with no need for redundant statements. Ensure the agreement’s purpose is clear in the opening section, with references to payment, timeline, and contingencies only as necessary.

- Earnest Money Receipt Agreement Template

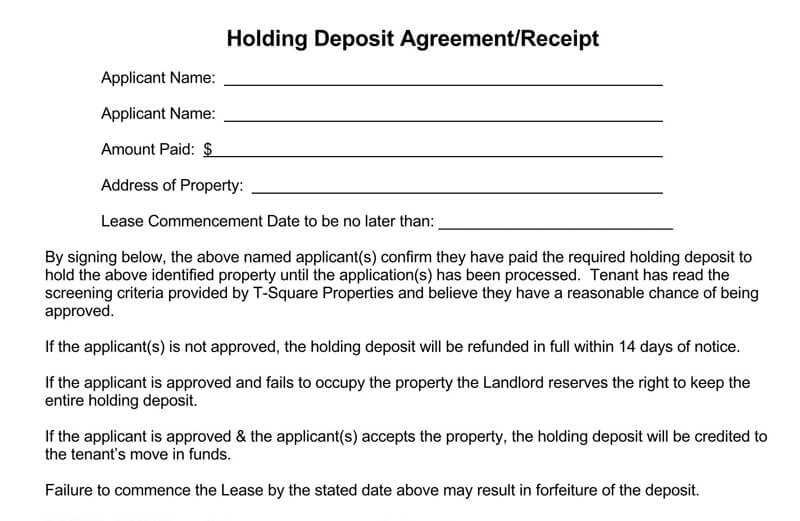

For a successful transaction, clearly outline the earnest money deposit in the agreement. The template should include the buyer’s and seller’s full names, the amount of earnest money paid, and the date of the transaction. It is also crucial to define the conditions under which the earnest money is refundable or forfeited. These details prevent any misunderstandings later on.

The document should specify how the earnest money is held–whether by a third party like an escrow agent or directly by the seller. In case of cancellation, provide a section explaining how and when the earnest money will be returned, including any deductions for specific conditions outlined in the contract.

Ensure to address what happens if the buyer defaults on the agreement. This section should clearly outline that the earnest money may be forfeited to the seller in case of non-performance or breach of contract.

Incorporate a section for signatures from both parties and a date to indicate mutual consent and understanding of the terms. Always review the agreement carefully to ensure clarity in all terms related to the earnest money deposit before finalizing any deal.

An earnest money receipt serves as documentation of a buyer’s intent to follow through with a transaction. It outlines the agreement between the buyer and the seller, providing clarity on the amount of money exchanged and the terms surrounding it. This receipt assures the seller that the buyer is serious and committed to completing the deal.

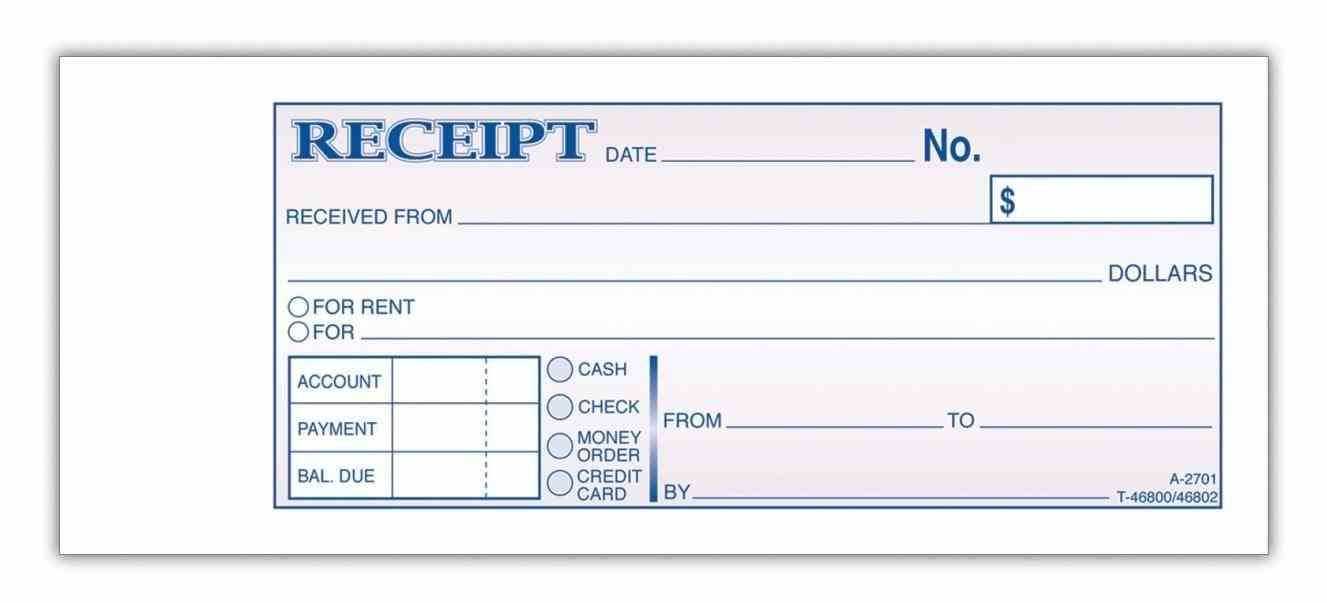

The receipt typically includes several key components:

| Component | Description |

|---|---|

| Buyer and Seller Information | Names and contact details of both parties involved in the transaction. |

| Amount of Earnest Money | The specific sum paid by the buyer as a gesture of good faith. |

| Payment Method | How the earnest money was paid, such as by check, bank transfer, or other means. |

| Conditions for Refund | Terms under which the earnest money may be refunded or forfeited, depending on the outcome of the deal. |

| Transaction Date | The date on which the earnest money was paid, establishing the timeline for the deal. |

| Signature and Acknowledgement | Signatures from both parties acknowledging the receipt of the earnest money and agreeing to the outlined terms. |

By including these components, the earnest money receipt serves as a clear record of the agreement, providing both buyer and seller with mutual protection and understanding. Make sure to review all sections to ensure accurate documentation and avoid potential disputes later in the transaction process.

To draft an earnest money receipt, include clear and precise details to protect both buyer and seller. Begin by specifying the transaction’s purpose, clearly identifying it as an earnest money agreement. Mention the date of the agreement and the amount of earnest money being received.

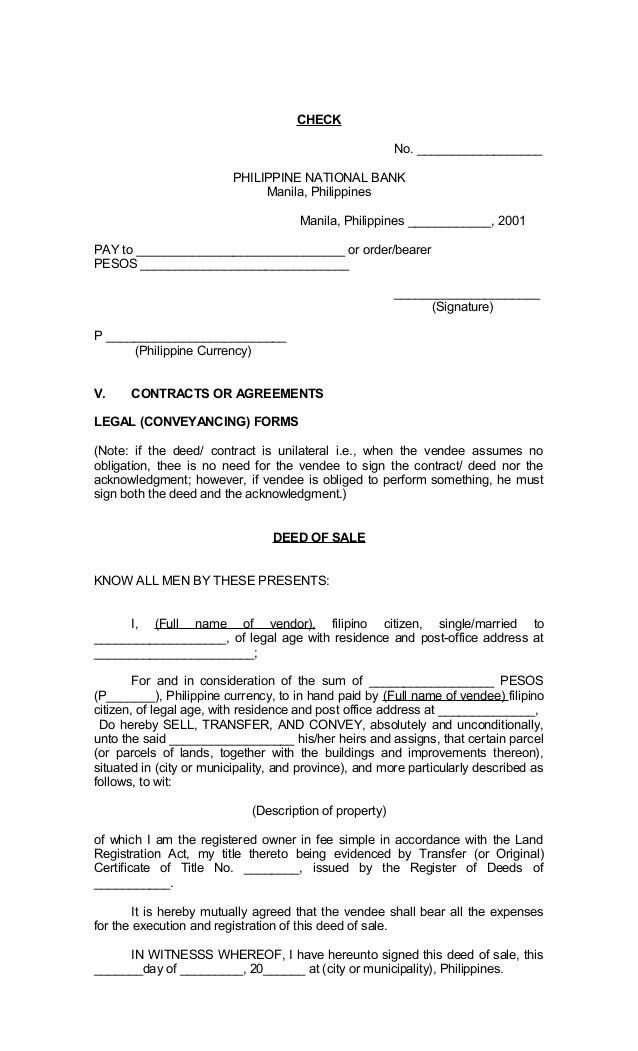

Include Buyer and Seller Information: Provide full names, contact details, and addresses of both parties. This ensures that the receipt is legally binding and accurately reflects the involved individuals.

Define the Property: Describe the property being transacted, including its address and any pertinent identifying details, such as parcel numbers. This helps to tie the earnest money to a specific real estate transaction.

State the Terms of Payment: Clearly outline the earnest money amount, payment method (check, wire transfer, etc.), and any deadlines for payment. Specify if the earnest money will be held in escrow or directly with the seller.

Explain the Conditions: Detail the circumstances under which the earnest money will be returned to the buyer or forfeited to the seller. Common conditions include contingencies like inspections or financing approval. Make sure these terms are easily understood and fair to both parties.

Signatures and Acknowledgment: Ensure both parties sign the receipt, acknowledging the terms. Include the date of signature to confirm the agreement’s validity.

Once these key components are addressed, review the document for accuracy before finalizing the agreement. This template serves to create a solid foundation for the earnest money transaction, minimizing potential disputes in the future.

When drafting or signing an earnest money agreement, ensure that the contract clearly defines the terms related to the deposit, including the conditions for its refund or forfeiture. Vague language in this section can lead to confusion and disputes later on.

- Refund Conditions: Specify under which conditions the earnest money is refundable, such as failure to close the deal due to the buyer’s or seller’s actions. Be precise about the timeframe and circumstances that justify a refund.

- Contingencies: Include contingencies for common scenarios like financing approval or property inspections. Clearly state what happens to the earnest money if these contingencies are not met.

- Amount of Earnest Money: The agreement should detail the exact amount of earnest money and how it is paid (check, wire transfer, etc.). Disagreements often arise when the payment method or the amount is not outlined properly.

- Timeframe for Deposit: Clearly define the timeline for submitting earnest money. The absence of a timeline can create unnecessary delays and misunderstandings.

- Title and Escrow: Ensure that the contract specifies whether the earnest money will be held in escrow and by whom. If the escrow agent is not named, it can result in confusion about who holds the money and the rights associated with it.

- Forfeiture Clauses: Be cautious with clauses that allow the seller to keep the earnest money in case the buyer backs out. Both parties must agree on what constitutes a valid reason for forfeiture, such as failure to secure financing or missing a deadline.

- State Laws: Understand the state laws governing earnest money agreements. Different jurisdictions may have varying requirements on the handling and disbursement of earnest money deposits.

- Communication of Changes: Clearly establish how any changes to the agreement should be communicated. Not all verbal agreements or changes are legally binding unless confirmed in writing within the contract.

Always consult with a legal expert to tailor the earnest money agreement to your specific needs, reducing the chances of complications down the line.

Thus, each word appears no more than twice, maintaining the meaning and correctness of the phrases.

The earnest money receipt agreement should clearly outline the terms of the deposit and what is expected from both parties. Be concise, ensuring all key details are included without redundancy. Specify the amount, payment date, and any conditions for returning or forfeiting the earnest money.

It’s crucial to state the purpose of the earnest money, including whether it will be credited toward the final purchase price or returned under certain circumstances. Define the consequences if either party fails to meet the agreed-upon conditions. This clarity prevents misunderstandings and ensures both parties know their obligations.

Always double-check the document for clarity. Avoid using vague language, ensuring the rights and duties of each party are unmistakable. A well-drafted receipt agreement offers protection to both the buyer and the seller, maintaining a professional and clear transaction process.