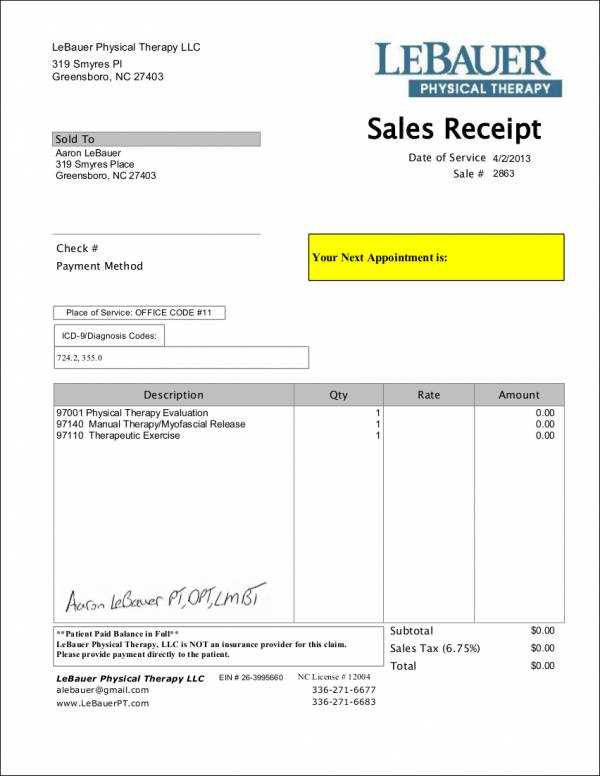

A well-structured receipt template ensures that your LLC maintains clear financial records and meets tax requirements. It should include essential details such as the company name, transaction date, itemized list of goods or services, total amount, and payment method. Adding a unique receipt number helps with tracking and bookkeeping.

For professional presentation, use a clean layout with clear sections. Digital templates in formats like PDF, Word, or Excel allow quick customization and easy distribution. If receipts are issued frequently, consider an automated invoicing tool to streamline the process.

Adding your company logo and contact details enhances credibility. If applicable, include tax-related information such as sales tax or VAT. Providing a concise note on return policies or payment terms clarifies expectations and reduces disputes.

Ensuring accuracy in receipts not only keeps records organized but also builds trust with clients. A consistent format improves efficiency and simplifies financial reporting, making tax filing and audits more manageable.

Receipt Template LLC Sample

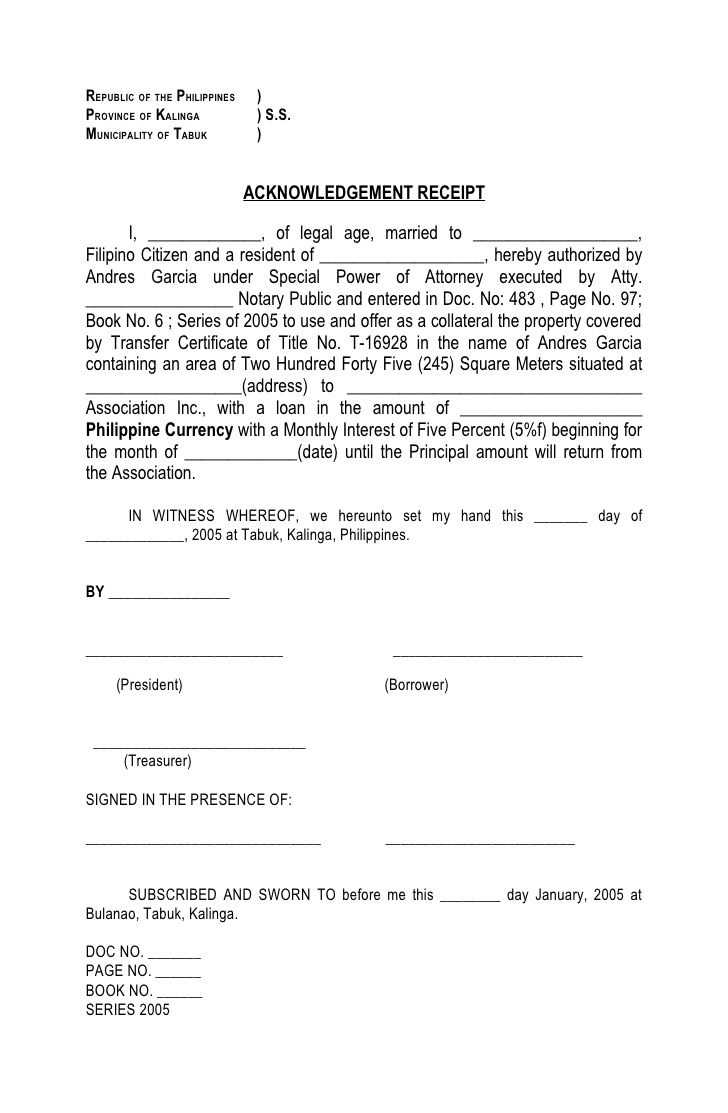

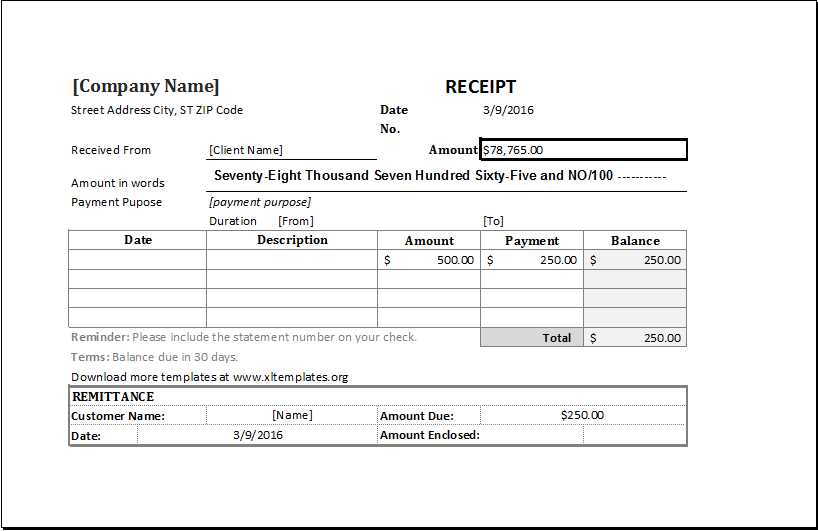

Use a structured format to create a professional receipt for your LLC. Start with your company’s name, address, and contact details at the top. Clearly label the document as a “Receipt” and include a unique receipt number for tracking.

Key Details to Include

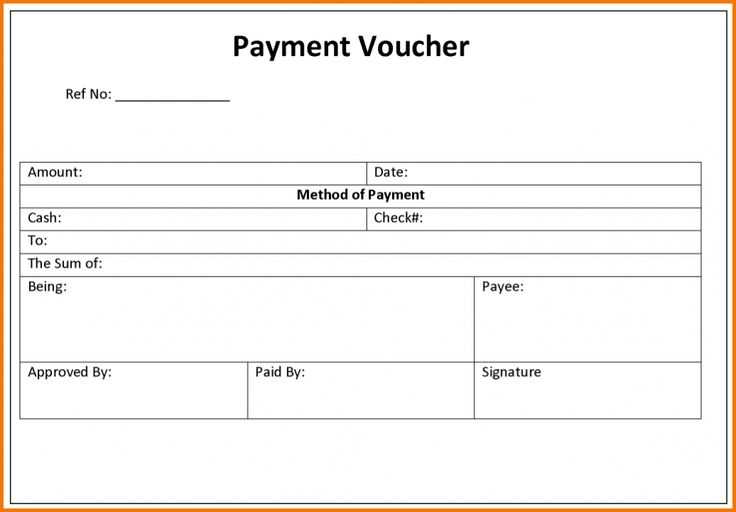

List the transaction date, payment method, and payer’s information. Specify the service or product provided, including a breakdown of costs, taxes, and discounts. Ensure all amounts are correctly calculated to avoid discrepancies.

Legal and Business Considerations

Include a disclaimer stating that the receipt serves as proof of payment. If applicable, add refund policies or terms. Digital receipts should feature a secure signature or company stamp for authenticity.

Save copies for your records, whether in digital format or printed versions, to maintain compliance and ensure smooth financial management.

Key Elements to Include in an LLC Receipt

Include these details in every LLC receipt to ensure clarity and compliance:

- Business Name and Contact Information: Clearly display the LLC’s legal name, address, phone number, and email.

- Receipt Number: Assign a unique identifier for tracking and record-keeping.

- Date of Transaction: Specify the exact date the payment was received.

- Customer Information: Include the name and contact details of the payer.

- Payment Description: List the product or service provided with brief but precise details.

- Amount Paid: State the exact sum received, specifying the currency and applicable taxes.

- Payment Method: Indicate whether the payment was made via cash, credit card, bank transfer, or another method.

- Terms and Conditions: If necessary, mention refund policies or other relevant terms.

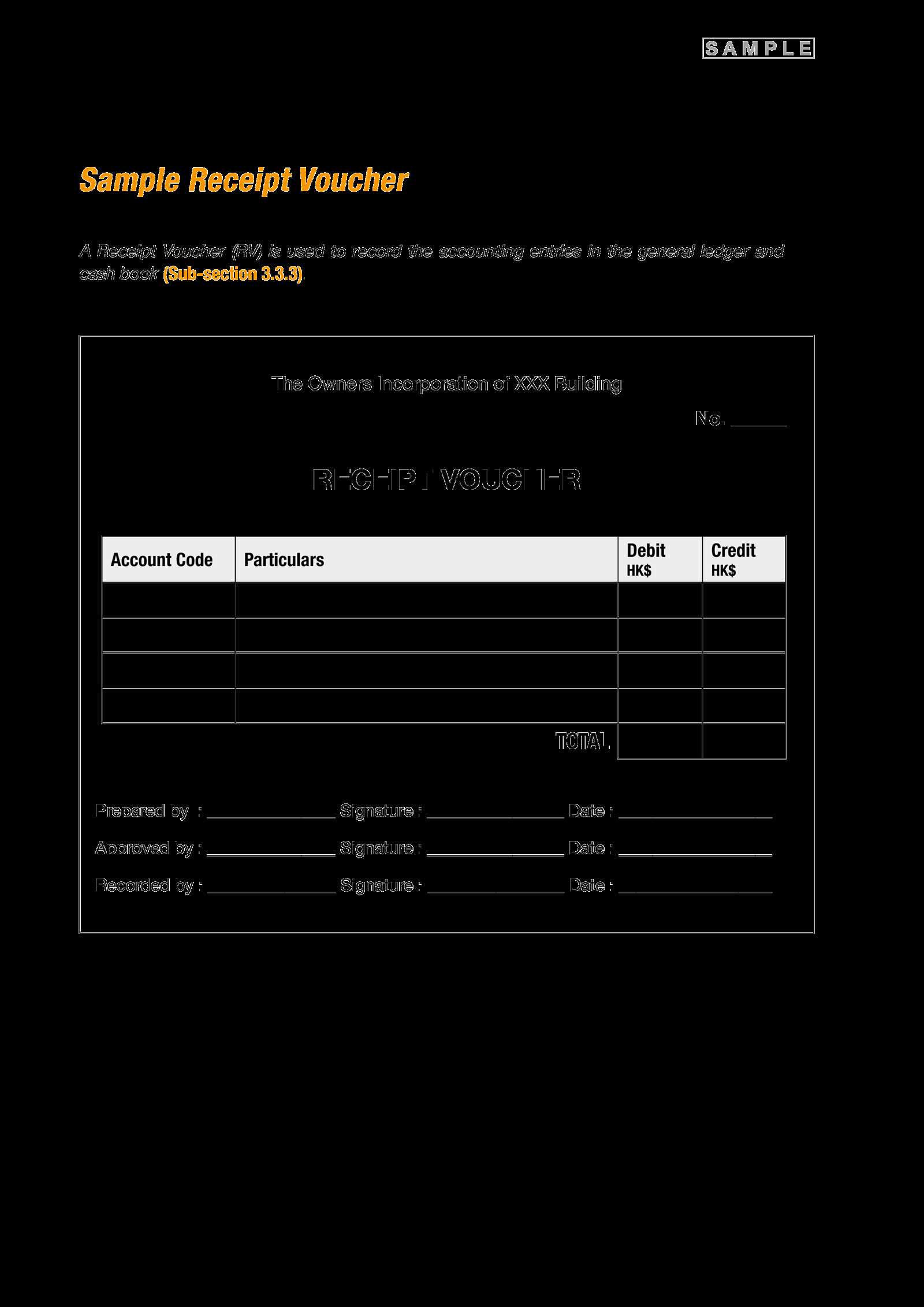

- Authorized Signature: If issuing a physical receipt, provide a signature or company stamp for authenticity.

Keep receipts organized and easily accessible for financial tracking and tax purposes.

Formatting Guidelines for a Professional Receipt

Use a clear, legible font such as Arial, Helvetica, or Times New Roman in at least 10-point size. Align all text elements properly to enhance readability and ensure a structured layout.

Include the company’s name, address, and contact details at the top. Center or left-align this information for a polished appearance. Below, prominently display the word “Receipt” in bold or slightly larger font.

Assign a unique receipt number to every transaction. Place it near the top right or left corner for quick reference. Add the date of issuance directly below or beside it.

List the buyer’s name and contact information clearly. If the purchase is business-related, include the company’s name and tax identification number.

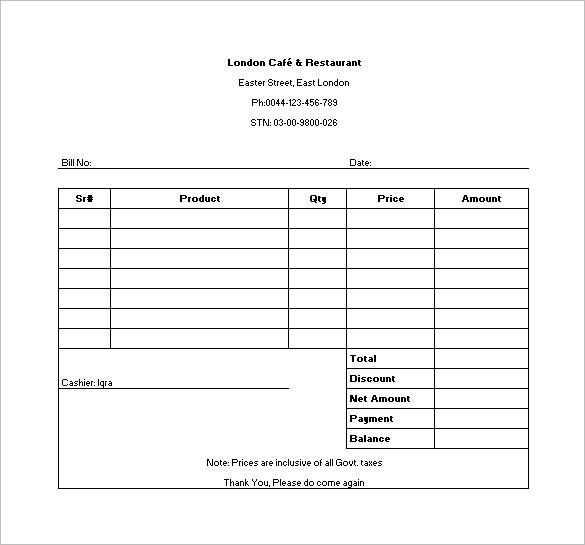

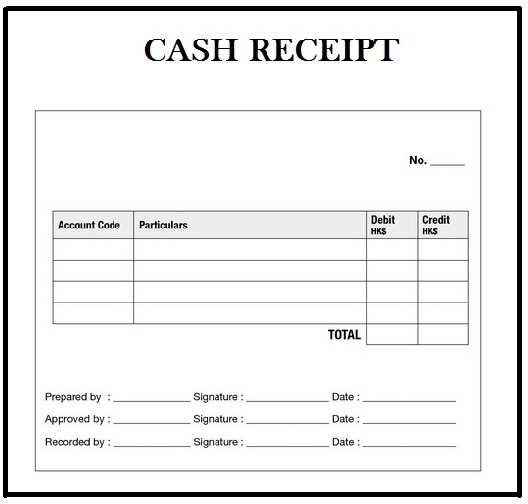

Break down charges into individual line items. Each entry should include a brief description, quantity, unit price, and total amount. Use a table format or consistent spacing for clarity.

Sum up all charges at the bottom, including any applicable taxes and discounts. Clearly separate the subtotal, tax amount, and final total using bold or underlined text.

Specify the payment method (cash, credit card, bank transfer) and include any relevant details, such as the last four digits of a card or a transaction reference number.

For added legitimacy, include a signature line or digital authorization stamp if required. Ensure receipts are formatted consistently to maintain a professional image.

Common Mistakes to Avoid in LLC Receipts

Omitting key details creates confusion and accounting issues. Always include the date, amount, payer, payee, and a clear description of the transaction. Without these, tracking payments and verifying expenses becomes difficult.

Failing to use a unique receipt number leads to disorganization. Assign sequential or structured numbers to each receipt to simplify record-keeping and audits.

Using vague descriptions causes misunderstandings. Instead of generic terms like “services rendered,” specify the exact nature of the transaction, such as “consulting fee for Q1 financial review.”

Neglecting tax information results in compliance risks. If applicable, include sales tax or VAT details to ensure accurate reporting and avoid legal complications.

Inconsistent formatting reduces readability. Maintain a uniform structure across all receipts, using clear headings and aligned data to prevent misinterpretation.

Failing to keep digital backups leads to potential loss. Store copies electronically to protect records against damage or misplacement.

Skipping the payer’s details weakens documentation. Always record the full name or business name of the paying party to avoid disputes and ensure traceability.