Essential Elements of a Charity Gift Receipt

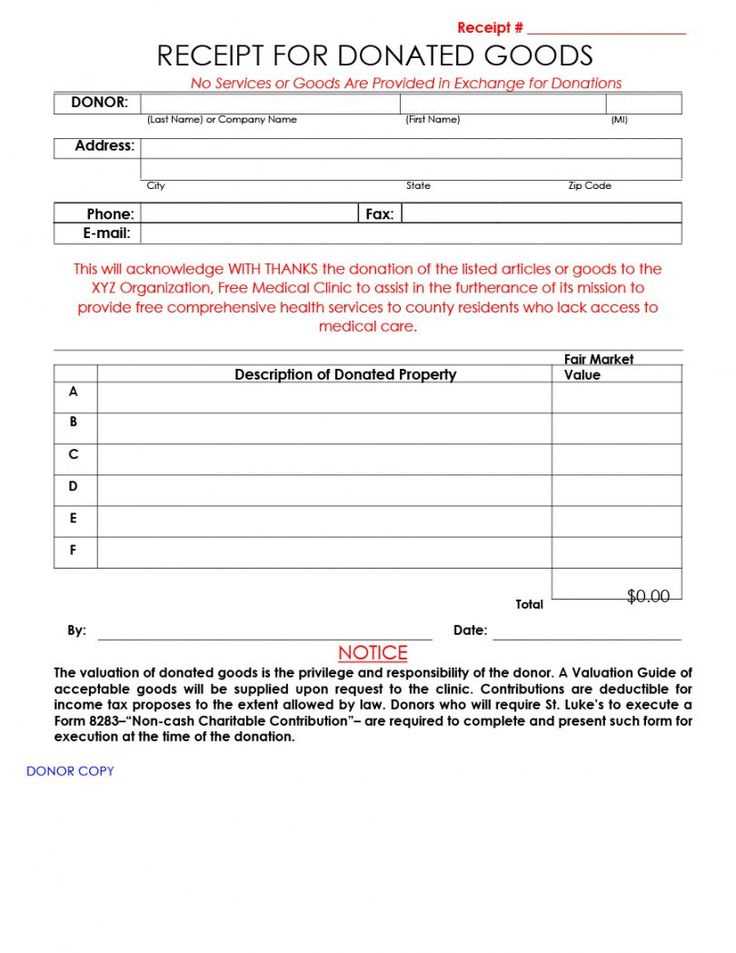

A proper charity gift receipt ensures donors can claim tax deductions and helps organizations maintain transparency. Include these key details:

- Donor’s Name: The full name or business name of the contributor.

- Organization’s Name and EIN: The charity’s legal name and Employer Identification Number (EIN).

- Date of Donation: The exact date the contribution was received.

- Donation Amount or Description: The monetary value or a clear description of non-cash items.

- Statement of No Goods or Services: If nothing was given in return, state: “No goods or services were provided in exchange for this donation.”

- Authorized Signature: A representative’s name and signature to validate the receipt.

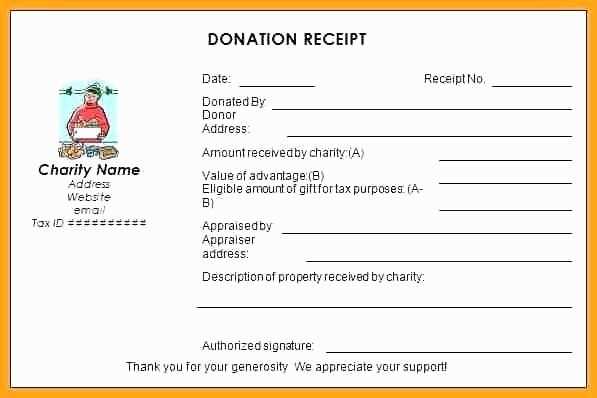

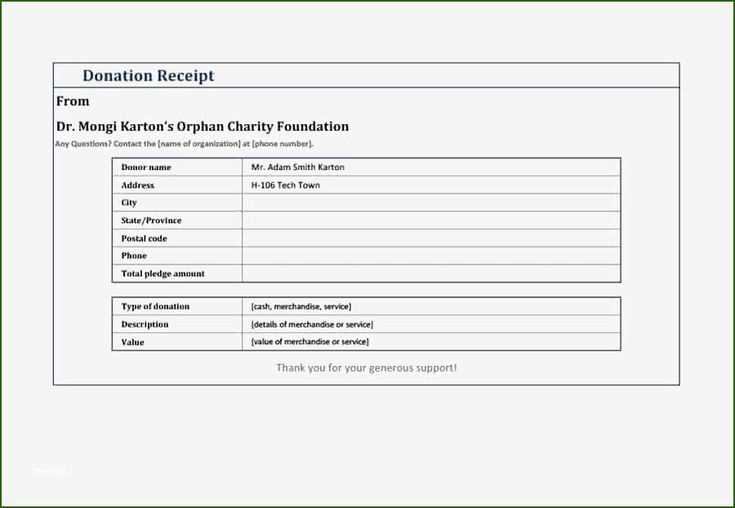

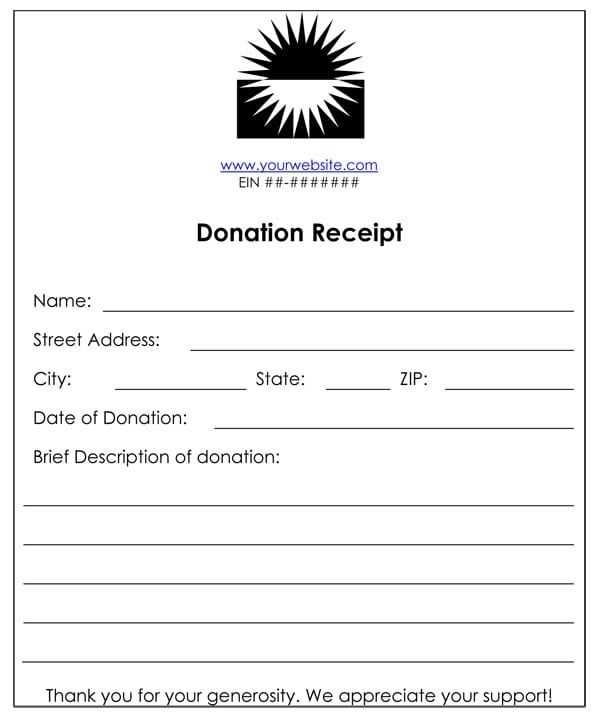

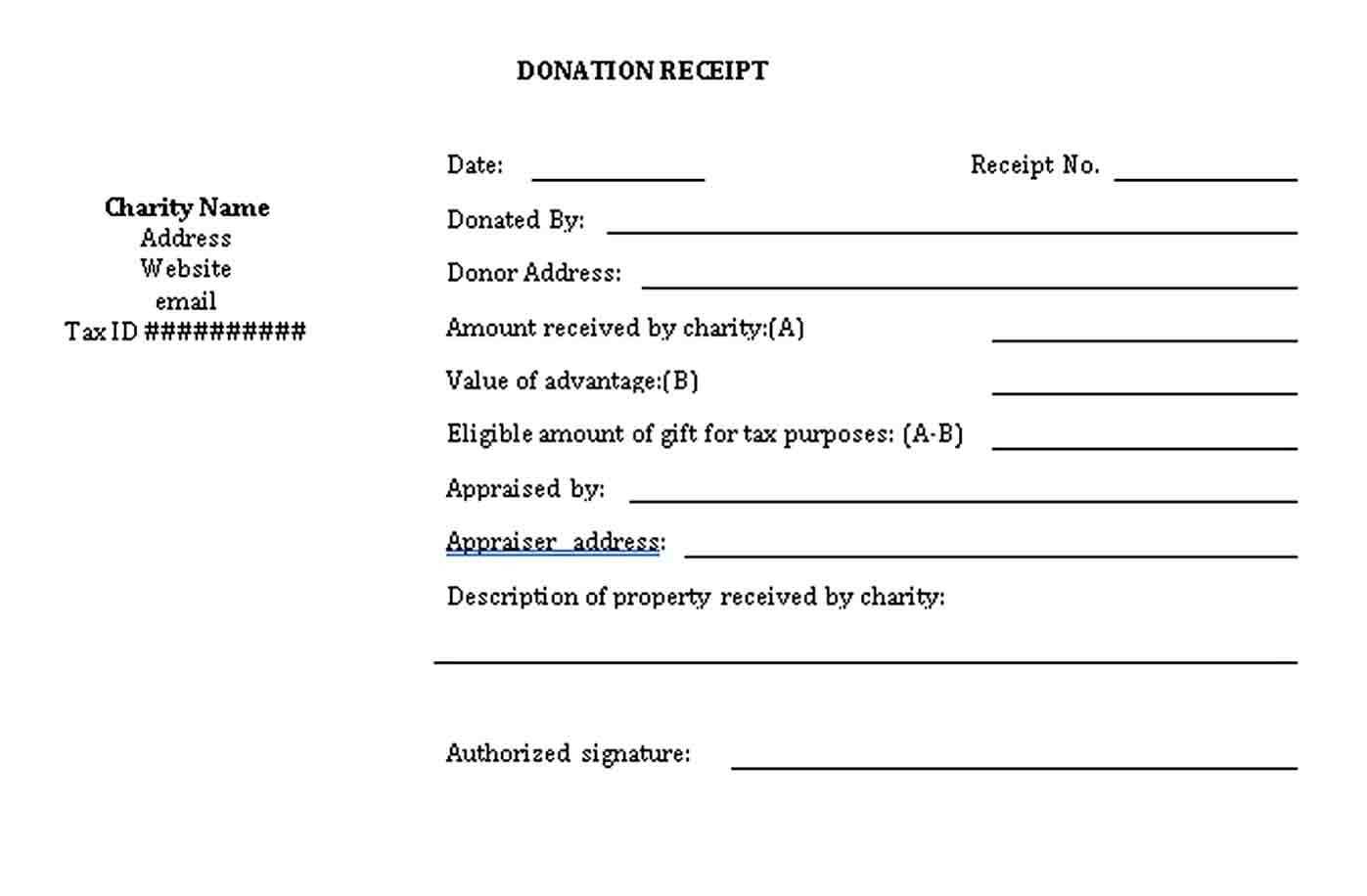

Sample Charity Gift Receipt Template

Use this simple format to create a valid donation receipt:

[Charity Name] [Charity Address] [City, State, ZIP] [Charity Phone Number] [Charity Email] [Charity EIN] Donation Receipt Donor Name: ______________________________ Donor Address: ____________________________ Date of Donation: _________________________ Donation Amount: $_________________________ Description of Non-Cash Donation (if applicable): ____________________________ This receipt acknowledges that no goods or services were provided in exchange for this donation, making it tax-deductible to the extent allowed by law. Authorized Signature: ______________________ Date: ______________________

Additional Considerations

For online donations, send receipts via email with the same details. If providing a year-end summary, ensure each transaction is listed with relevant dates. Keeping organized records protects both donors and charities from compliance issues.

Charity Gift Receipt Template: Key Elements and Best Practices

Required Details for a Valid Donation Receipt

Include the donor’s full name, the charity’s legal name, and the organization’s tax identification number. Specify the donation amount or describe non-monetary gifts in detail, including their estimated value. Clearly state whether any goods or services were exchanged for the donation. Add the receipt issuance date and a declaration of tax-exempt status if applicable.

Customizing a Gift Receipt for Various Contributions

For cash donations, list the amount and payment method. For non-cash gifts, describe the item, its condition, and estimated fair market value. For services or volunteer work, note that the IRS generally does not consider them deductible but acknowledge the contribution with a formal letter. For recurring donations, provide a consolidated annual receipt summarizing total contributions.

Mistakes to Avoid When Issuing Donation Receipts

Omitting the charity’s official name or tax ID can invalidate the receipt for tax purposes. Avoid vague descriptions–non-cash gifts should have a clear itemized list. Ensure compliance with legal wording by including a statement on whether any benefits were received in return. Delayed issuance can cause donor frustration, so provide receipts promptly.