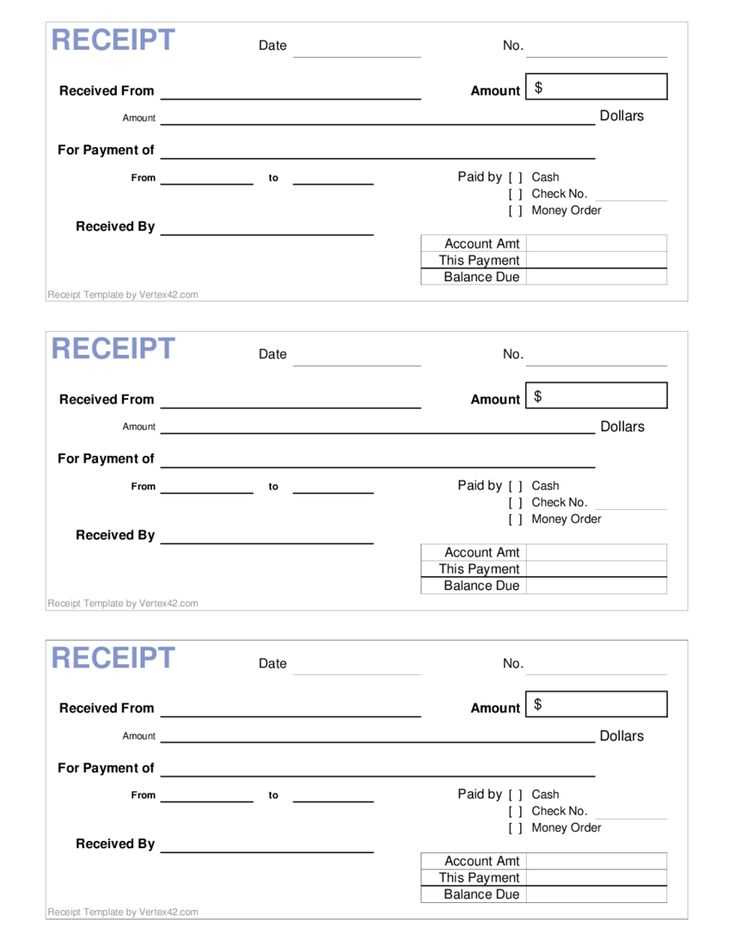

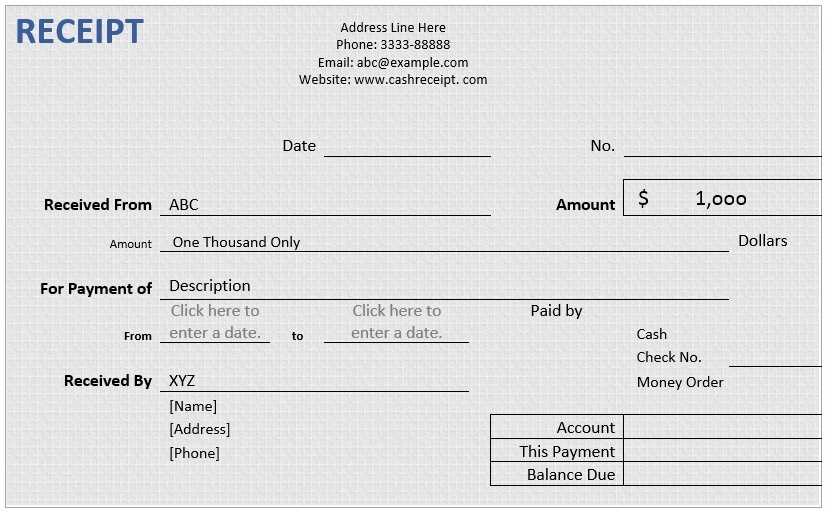

A well-structured sales receipt protects both the seller and the buyer by documenting the transaction clearly. It should include key details such as the date, seller’s and buyer’s information, product description, quantity, price, and payment method. A properly formatted template ensures consistency and simplifies record-keeping.

Essential details to include: The seller’s business name, address, and contact information should be at the top. The receipt number and transaction date help with tracking. Listing each product separately with a brief description, unit price, and total amount makes it easy to review. Taxes, discounts, and additional fees should also be itemized to avoid confusion.

For digital and printed receipts, clarity is key. Using a structured layout with distinct sections improves readability. A signature or company stamp can add an extra layer of authenticity, especially for high-value transactions. Whether you’re selling goods online or in person, a reliable receipt template keeps transactions transparent and professional.

Receipt of Product Sold Template

Include the seller’s and buyer’s full names, contact details, and transaction date at the top. Clearly state the product description, including model, serial number, and condition. Specify the price, payment method, and any applicable taxes or fees. If a warranty or return policy applies, outline the terms in a separate section. Both parties should sign the receipt to confirm the transaction. Provide a digital or printed copy for record-keeping. A structured format ensures clarity and prevents disputes.

Key Elements to Include in a Sales Receipt

Include the business name, address, and contact details at the top. This ensures customers know where the receipt came from and how to reach out if needed.

Clearly state the transaction date. This helps both parties track purchases and manage warranties or returns.

List purchased items with descriptions, quantities, and individual prices. This prevents confusion and provides transparency.

Show subtotal, taxes, and the final amount paid. Breaking down costs builds trust and simplifies bookkeeping.

Specify the payment method (cash, credit card, online transfer). This adds clarity and can help resolve disputes.

Include a unique receipt number for easy reference. This is useful for refunds, exchanges, and accounting.

Add return and refund policies if applicable. Customers appreciate knowing their options upfront.

For digital receipts, ensure a clear format and easy readability. Avoid clutter and use a simple layout.

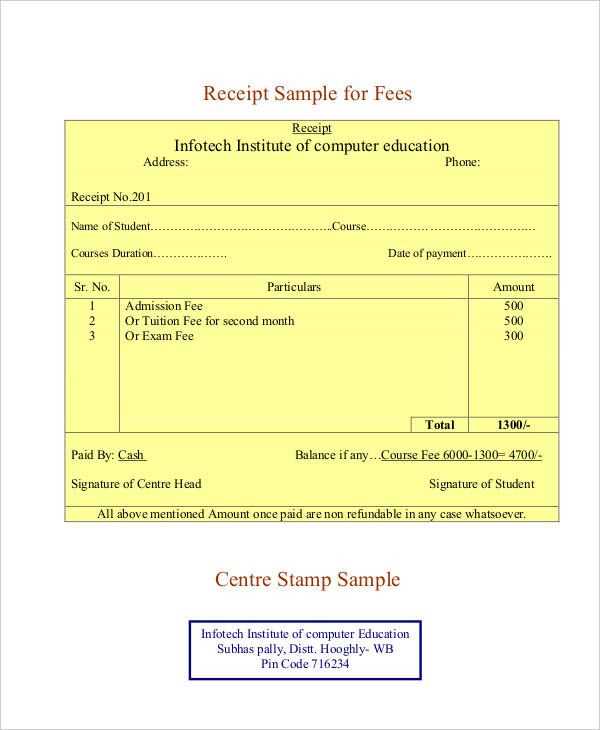

How to Format a Receipt for Different Business Types

Retail stores should include the date, itemized list with prices, subtotal, taxes, total amount, and payment method. Adding a return policy clarifies customer rights.

Service providers need to specify the service date, detailed descriptions, hourly rates or flat fees, and total cost. Including the provider’s contact details ensures easy follow-up.

Freelancers benefit from listing project details, payment terms, and due dates. A unique invoice number helps with tracking.

Restaurants should include table number (if applicable), itemized food and beverage charges, gratuity suggestions, and a breakdown of taxes.

Online businesses must show shipping fees, estimated delivery dates, and digital payment confirmation. A downloadable receipt option enhances accessibility.

Each format should match industry needs while maintaining clarity and compliance with local regulations.

Legal and Tax Considerations for Sales Receipts

Ensure that each sales receipt includes the required legal details: business name, address, tax identification number, and a clear breakdown of taxable and non-taxable items. Missing these elements can result in fines or audits.

Compliance with Tax Regulations

- Verify tax rates for your jurisdiction and apply them correctly on receipts.

- Include a subtotal, tax amount, and total payment to meet transparency standards.

- Store digital or paper copies as per local retention laws (typically 3–7 years).

Protecting Your Business Legally

- Use clear language to avoid disputes over product descriptions, prices, or refund policies.

- Ensure customer details are protected in compliance with data privacy laws.

- For international sales, specify applicable exchange rates and tax obligations.

Accurate and legally compliant receipts reduce tax risks and strengthen customer trust. Regularly review regulations to stay updated and avoid penalties.