Provide clear and detailed receipts to acknowledge donations and comply with tax regulations. A well-structured template includes the donor’s name, donation amount, date, and a statement confirming no goods or services were provided in exchange. This ensures transparency and simplifies record-keeping for both parties.

Include the organization’s legal name and tax-exempt status to establish credibility. If applicable, mention the organization’s EIN (Employer Identification Number) to help donors with tax deductions. A brief note on how donations support the organization’s mission can strengthen donor relationships.

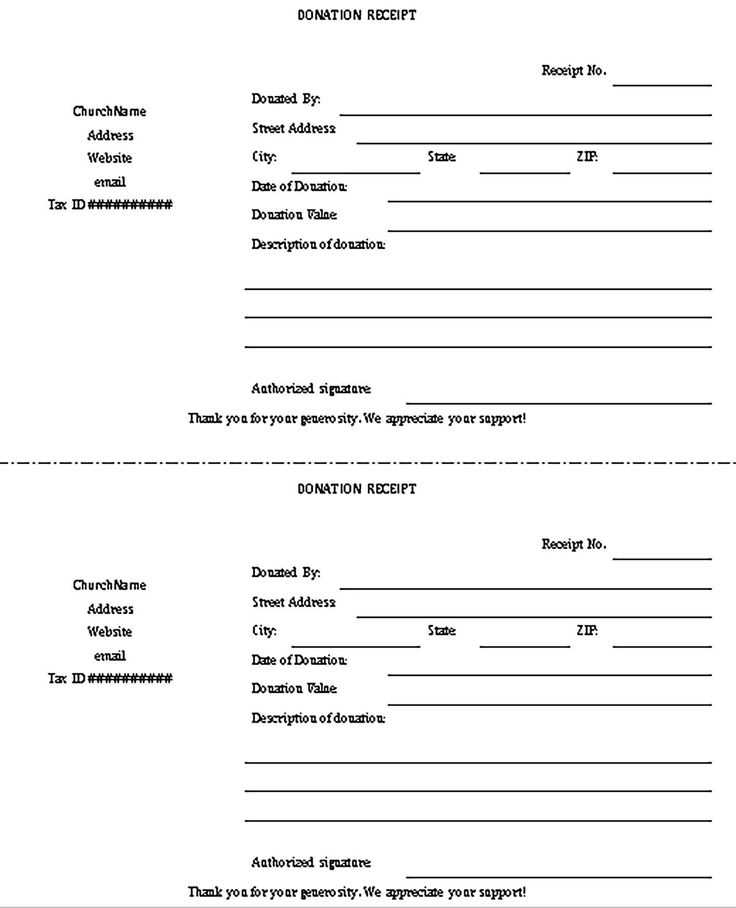

Use consistent formatting for professionalism. A simple layout with clearly labeled sections improves readability. Whether sending receipts by email or mail, ensure they are accessible and easy to store. Digital receipts should be in PDF format to prevent alterations.

For recurring donations, consider automating receipts to save time and reduce errors. Many donor management systems offer this feature, making it easier to track contributions and ensure compliance.

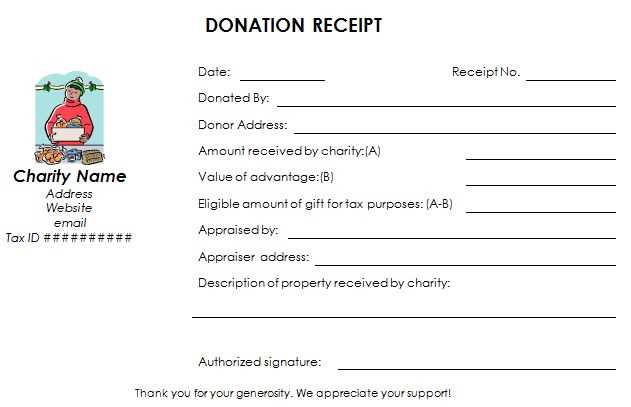

Receipt of Donation Template for Non-Profit Organizations

Ensure every donation receipt includes key details to maintain compliance and transparency. Provide a clear record for donors and simplify tax reporting with a structured format.

- Organization Details: Include the legal name, address, and tax identification number.

- Donor Information: Capture the donor’s full name and contact details.

- Donation Description: Specify the amount or describe non-monetary contributions.

- Date of Donation: Clearly indicate when the contribution was received.

- Statement of No Goods or Services: Confirm whether any benefits were provided in exchange.

- Signature: Add an authorized representative’s signature if required.

Keep records organized by using digital templates. Automate receipt generation for efficiency and accuracy.

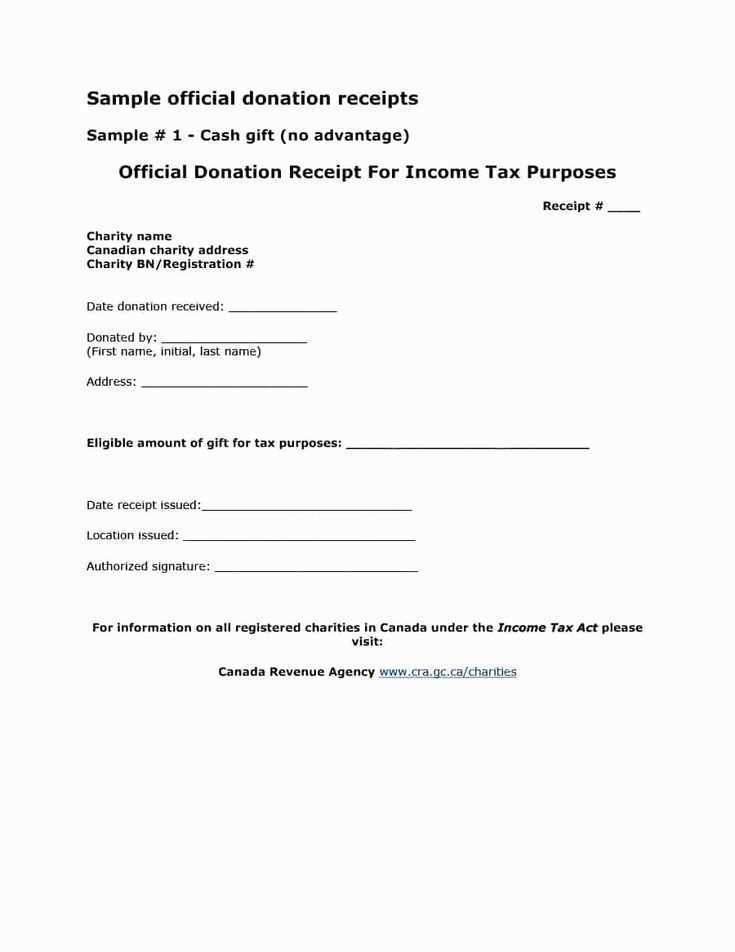

Key Elements to Include in a Donation Receipt

Donor Information: Always include the donor’s full name and, if applicable, their mailing address. This ensures proper record-keeping and makes tax reporting easier.

Organization Details: Clearly state the nonprofit’s name, address, and tax identification number. This verifies the organization’s status and provides donors with the necessary details for tax deductions.

Donation Description: Specify the type of contribution–whether it’s cash, goods, or services. For non-cash donations, describe the item but avoid assigning a value; the donor is responsible for that.

Required Tax Statement

If no goods or services were provided in return for the donation, explicitly state that the contribution is tax-deductible as allowed by law. If any benefits were received, such as event tickets or gifts, include a breakdown of their estimated value.

Date and Receipt Number

Include the date the donation was received, as it determines the applicable tax year. Adding a unique receipt number helps with internal tracking and donor inquiries.

A well-structured receipt not only fulfills legal requirements but also reinforces transparency and trust between your organization and its supporters.

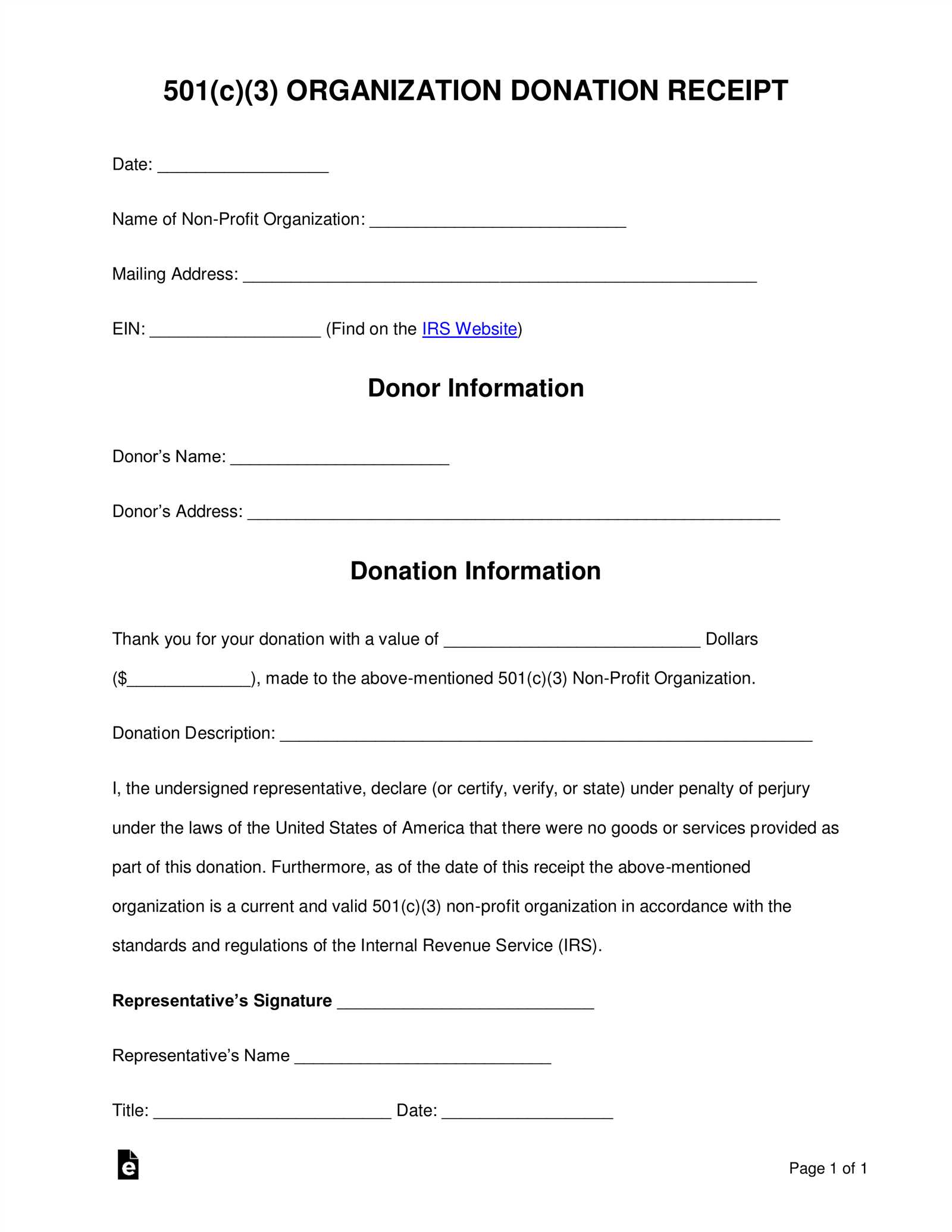

Legal Requirements and Compliance Considerations

Ensure proper donor acknowledgment by issuing receipts that meet tax regulations. Include the organization’s name, donation date, amount, and a statement confirming no goods or services were provided in return unless applicable.

Follow IRS and Local Regulations

Verify IRS requirements if operating in the U.S., ensuring receipts comply with Section 170(f)(8). If based elsewhere, check national tax laws. Retain records for the required period to maintain compliance during audits.

Transparency and Accuracy

Use clear language to prevent misinterpretation. If providing benefits to donors, specify fair market value and deductible amount. Regularly review documentation to align with legal updates.

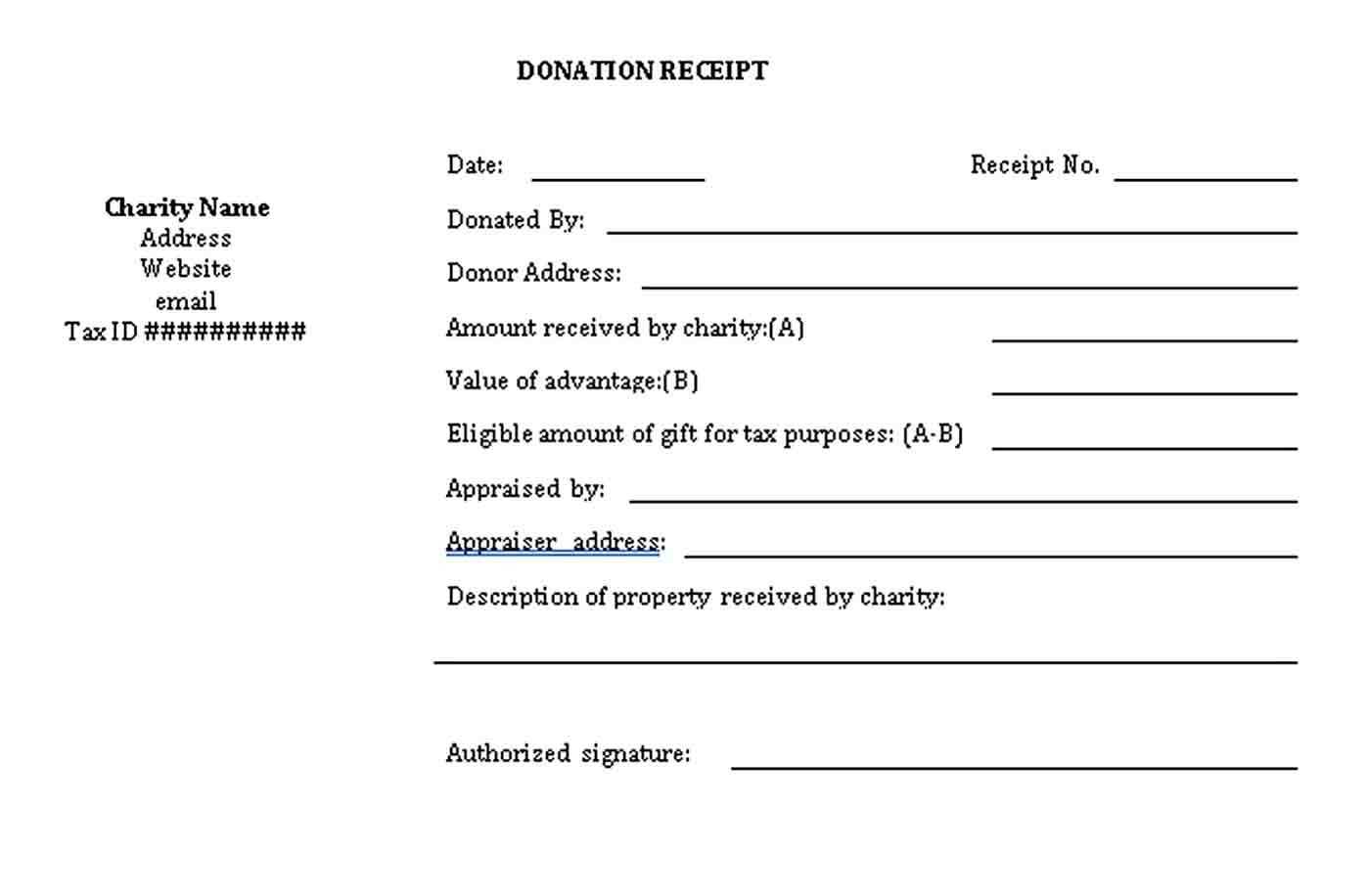

Best Practices for Structuring and Formatting the Receipt

Include Clear Donor and Organization Details

List the donor’s full name and contact information, along with the nonprofit’s legal name, address, and tax identification number. This ensures compliance with tax regulations and makes record-keeping easier for both parties.

Specify the Donation Amount and Type

State the exact amount donated if it was a monetary contribution. For non-cash donations, provide a detailed description of the donated items or services without assigning a value, as the donor is responsible for determining fair market value.

Provide a Statement of No Goods or Services

If no tangible benefits were given in exchange for the donation, include a statement confirming this. If any goods or services were provided, describe them and estimate their value to ensure accurate tax reporting.

Use a Consistent Format

Structure receipts uniformly by using clear headings, bullet points, and straightforward language. This improves readability and helps donors quickly locate key information.

Ensure Timely Delivery

Send the receipt immediately after receiving the donation. Digital formats, such as PDFs or automated emails, help streamline the process and reduce paperwork.