Use a structured sale receipt template to provide clear transaction details and ensure compliance with accounting standards. A well-designed receipt includes essential elements such as item descriptions, prices, payment method, and tax calculations.

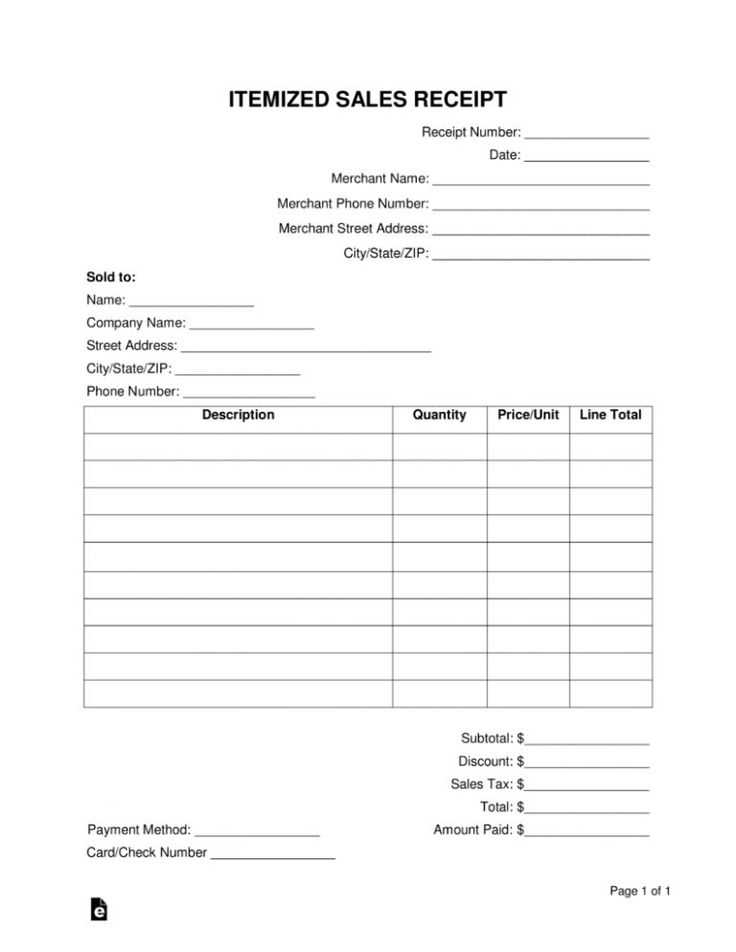

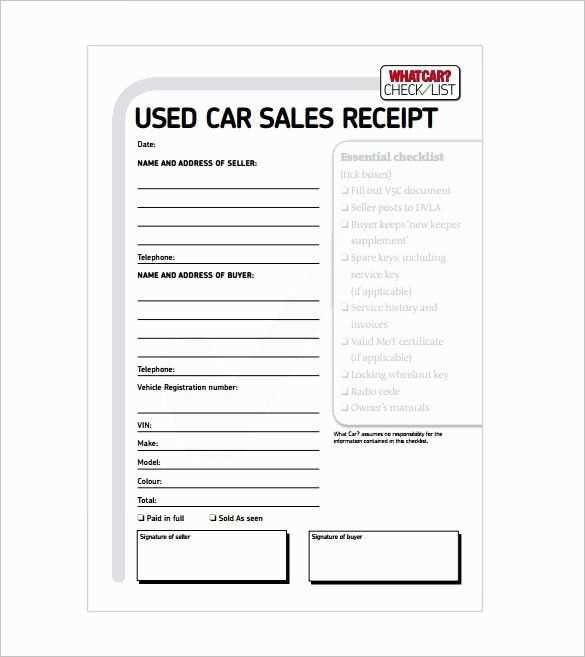

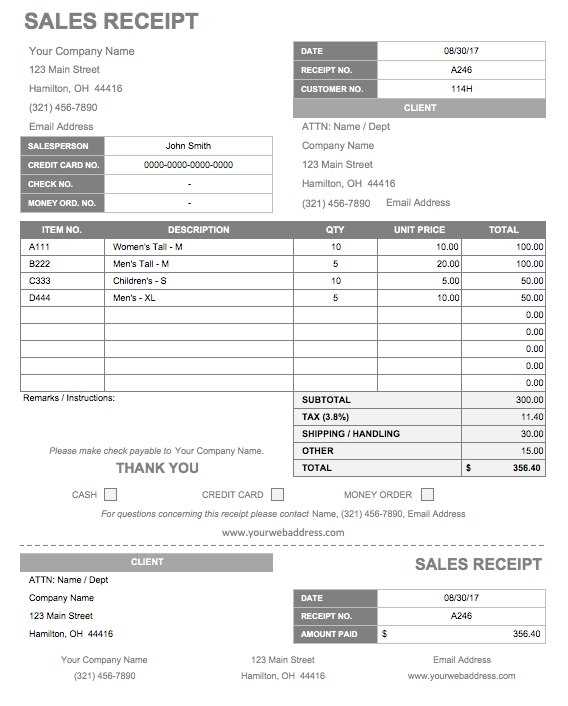

Buyer and seller details: Include the business name, address, and contact information. Add the buyer’s name or company details if applicable.

Transaction breakdown: List each product or service separately with the unit price, quantity, and total cost. If applicable, display discounts and tax amounts clearly.

Payment and additional notes: Specify the payment method (cash, card, transfer) and any reference numbers. Include a section for terms, return policies, or thank-you messages.

Maintain consistency in formatting for readability. Digital templates streamline record-keeping, while printed receipts provide a professional touch. Choose a format that suits your business needs.

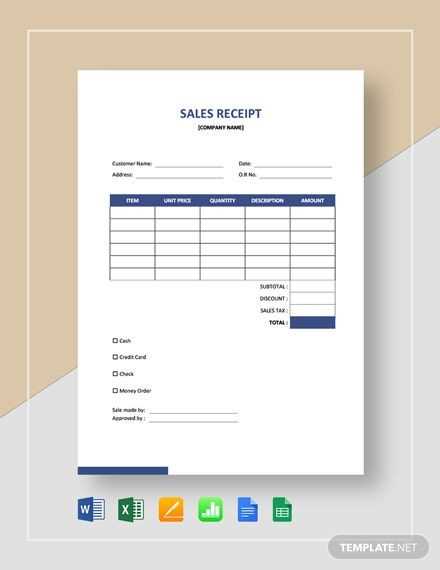

Template for Sale Receipt

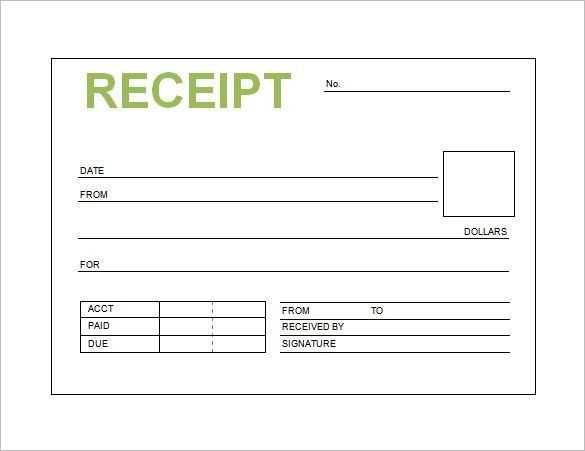

Choose a structured format that includes key details: date, receipt number, seller and buyer information, itemized list, total cost, and payment method. A well-organized layout ensures clarity for both parties.

Use a clear, professional font and align text properly. Keep descriptions concise, list prices separately, and calculate totals accurately. Include tax details if applicable.

For digital receipts, ensure they are easy to read on any device. PDFs work well for printing and storage. Add a contact section for support or refunds.

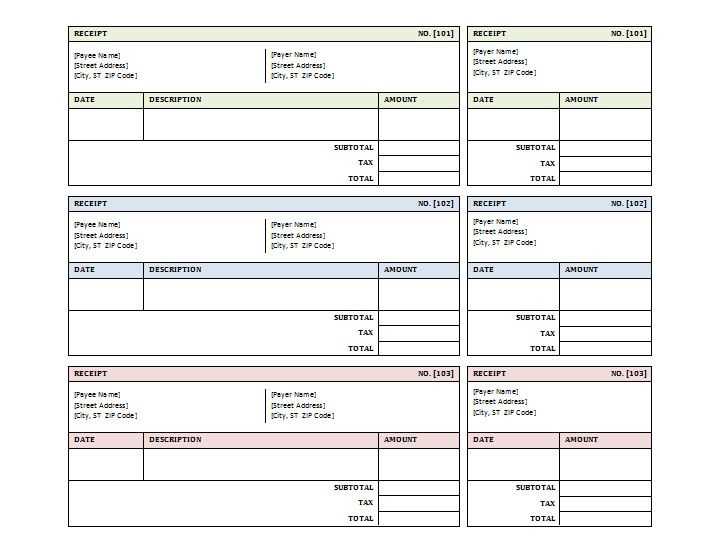

Automate receipts with templates in Excel, Google Docs, or accounting software. This saves time and reduces errors. If using a custom template, test it with real data before finalizing.

Key Elements to Include in a Sale Receipt Template

Include these essential details to create a clear and professional sale receipt:

- Business Information: Display the company name, address, phone number, and email. If applicable, include a tax identification number.

- Receipt Number: Assign a unique identifier to each receipt for easy tracking and record-keeping.

- Date and Time: Indicate when the transaction occurred to help with warranties, returns, and bookkeeping.

- Customer Details: Capture the buyer’s name and contact information for reference.

- Itemized List: Specify each product or service, quantity, unit price, and total amount for clarity.

- Subtotal, Taxes, and Discounts: Break down costs to show applied taxes, discounts, and the final amount due.

- Payment Method: Note whether the payment was made via cash, credit card, or another form.

- Terms and Conditions: Include refund policies, warranty details, or other relevant terms.

- Authorized Signature: If required, add a space for an employee or customer signature.

Consistently formatting these elements ensures transparency and simplifies financial tracking.

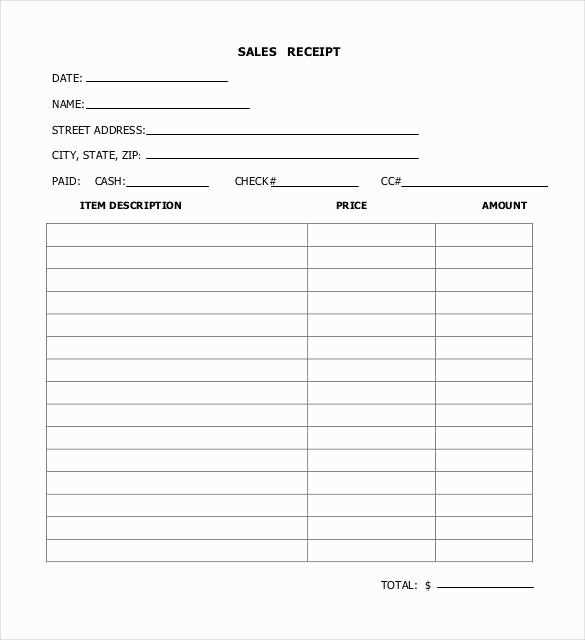

Formatting and Layout for Clear Presentation

Use a structured layout with clearly defined sections for seller details, buyer information, itemized list, total cost, and payment method. Align content consistently to enhance readability.

Choose a legible font like Arial or Times New Roman, keeping the size between 10pt and 12pt. Avoid excessive bold or italic text to maintain clarity.

Organize item descriptions, quantities, and prices into a table with borders for easy scanning. Ensure currency symbols and decimal points are aligned for accuracy.

Separate sections with subtle spacing instead of heavy lines. Use white space strategically to prevent clutter and guide the eye naturally through the receipt.

Include a summary section for subtotal, taxes, discounts, and total amount due. Make the total bold for emphasis, ensuring it stands out.

Place contact details and return policies at the bottom in a smaller font size. Keep essential information concise to maintain a professional appearance.

Customization Options for Different Business Needs

Adjusting a receipt template to fit specific business needs starts with selecting the right layout. Retail stores benefit from itemized receipts with product descriptions, while service providers often require detailed breakdowns of labor and materials.

For branding, include a company logo, contact details, and a unique color scheme. Adding a QR code can streamline digital interactions, directing customers to surveys, promotions, or loyalty programs.

Tax settings should reflect regional regulations. Configure VAT, sales tax, or exemptions based on local laws. Custom fields allow businesses to include legal disclaimers, return policies, or personalized messages.

Businesses operating internationally should offer multi-currency support and language customization. This ensures clear communication and compliance with financial requirements in different regions.

For recurring clients, integrating customer details and purchase history enhances the experience. Automated discounts, membership perks, or personalized thank-you notes add value and encourage repeat transactions.