If you’re looking to simplify the process of tracking bank transactions, an Excel template for bank receipt vouchers can save you time and effort. This template helps you organize all the necessary details such as the transaction date, amount, account numbers, and payer details in a structured format. You can easily adjust the columns to match your business needs and automate calculations for better accuracy.

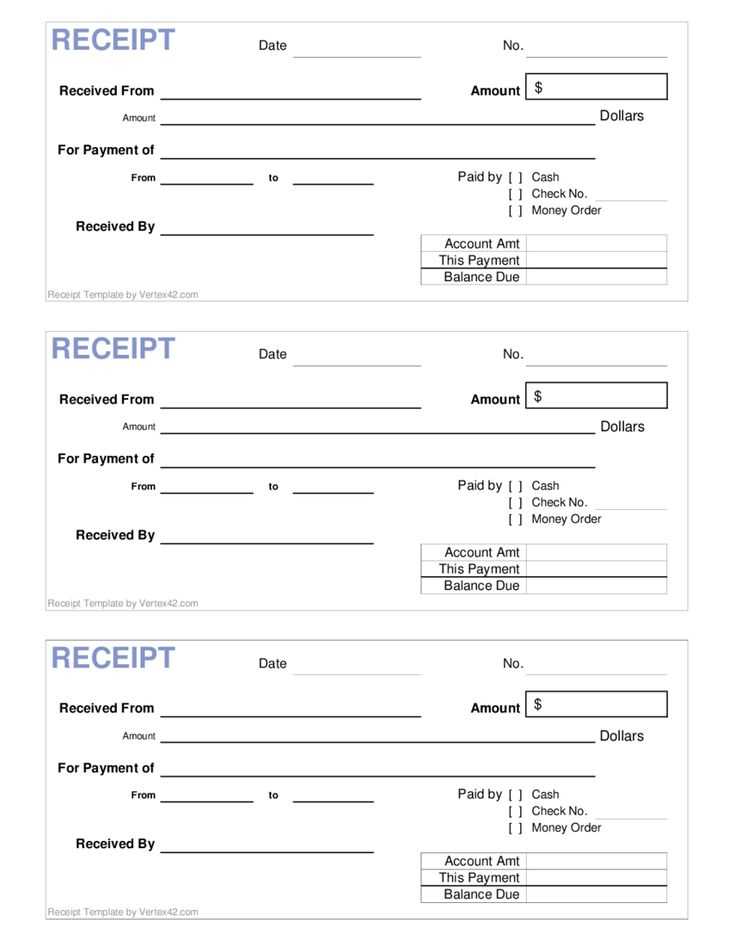

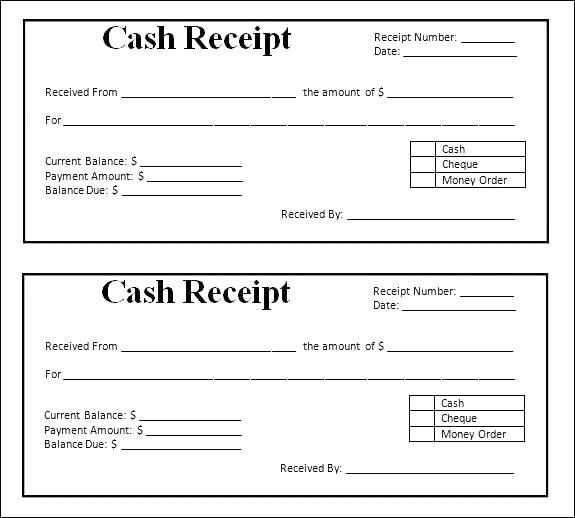

To create a functional template, start by including basic information such as receipt number, payment method, and description of the transaction. Customizable fields ensure that you capture all the data relevant to your specific accounting or business process. Excel’s built-in formulas can help calculate totals and create summaries, allowing for seamless financial reporting.

Using a bank receipt voucher template in Excel also makes it easier to store and retrieve transaction records. By using consistent formats, you’ll maintain accuracy and have everything you need for quick audits or reconciliations. If you need to handle multiple currencies, Excel’s currency conversion functions can assist in managing foreign transactions smoothly.

Here are the corrected lines with minimal repetitions:

Ensure clarity: Use a clear and concise format for each entry on your bank receipt voucher template. Avoid unnecessary jargon that might confuse the reader.

Format consistently: Stick to one style for dates, amounts, and descriptions. This eliminates confusion and maintains professionalism throughout the document.

Eliminate redundancies: Avoid repeating the same information within a short span. For example, if a date or amount is already noted, there’s no need to state it again unless it adds value.

Focus on accuracy: Double-check all data entries to minimize mistakes. This ensures the template reflects the right amounts, dates, and account information without errors.

Be direct: Opt for straightforward language in the description section. Avoid vague terms and ensure the purpose of each line item is easy to understand.

- Bank Receipt Voucher Template in Excel

Use an Excel bank receipt voucher template to streamline your transaction records. Start by setting up columns for date, voucher number, account name, amount, and payment mode. Add formulas to calculate totals automatically, reducing the risk of errors.

Setting Up Key Fields

Focus on creating clearly labeled columns:

- Date: Use a date format (e.g., MM/DD/YYYY) for easy tracking.

- Voucher Number: Ensure each receipt has a unique identifier for easy reference.

- Account Name: List the payer’s name or company for clear records.

- Amount: Use currency formatting for better readability.

- Payment Mode: Specify whether it’s a cash deposit, check, or online transfer.

Automating Calculations

To improve accuracy, use formulas for summing totals and checking for errors. Apply the SUM formula to calculate the total amount, ensuring the numbers align with the bank statement. Excel’s conditional formatting can highlight discrepancies automatically.

Begin by creating a clear structure for your bank voucher template. Use Excel to design the layout. Start with a title at the top, such as “Bank Voucher,” followed by the transaction details section.

Set up a table with columns for the date, description, amount, and the account involved. Ensure that these sections are aligned properly to keep everything readable and organized. Use borders to separate each section for clarity.

In the description column, provide space to write the reason for the transaction. You can adjust the column width to ensure the text fits well without being cramped.

For the amount, make sure to format the cells in currency format. This will help prevent any errors in entering numerical data. You can also include a “Total” row at the bottom to sum all the amounts.

Make sure there’s a space for signatures or approval stamps to verify the transaction at the end of the template. This section ensures that the voucher is authenticated and complete.

To make the template visually appealing and easy to use, keep the colors minimal. Use light shading for headers or totals, but avoid cluttering the template with excessive design elements.

Use the SUM function to quickly calculate the total amount across multiple voucher entries. Simply select the range of cells and apply the formula to get an instant sum without manual calculation. This is especially helpful when dealing with large amounts of data.

The IF function allows you to create conditional calculations based on specific criteria. For example, you can automatically flag payments above a certain threshold or categorize transactions into different types based on the amounts. This function adds flexibility to your voucher templates.

VLOOKUP is another essential tool. It helps pull related information from a different table or worksheet, allowing you to automatically populate fields like vendor names or payment methods based on the voucher number. This function improves accuracy and saves time when handling multiple entries.

The TEXT function enables you to format numbers, dates, and times in specific ways. You can ensure that voucher dates are displayed in a uniform format or adjust how monetary amounts are shown, making the document more readable and professional.

To protect sensitive data, use PROTECT to lock certain cells or ranges from editing. This keeps your template intact while allowing users to input data only where necessary.

Adjusting the bank voucher template to match your unique requirements begins with identifying the key fields you need. Customize columns to reflect specific transaction details such as account numbers, transaction dates, or payment methods relevant to your business. Consider adding additional rows for notes or references for easier tracking.

Ensure the formatting aligns with your internal standards by modifying font sizes, borders, and cell colors. This can help in differentiating various sections, making it easier to distinguish between incoming and outgoing payments. Use conditional formatting to highlight important data, such as amounts exceeding a certain threshold, to draw attention to critical figures quickly.

If you’re using the voucher template for different departments or teams, incorporate drop-down lists to standardize entries. For example, a drop-down for payment types like cash, check, or bank transfer ensures consistent recording of transactions. Custom formulas for calculating totals or tax deductions can save time and reduce errors in manual calculations.

Adding a section for approvals or signatures could streamline the verification process, ensuring that all necessary authorizations are captured within the document. Keep the design clean, with enough space for additional data if needed. Adjusting the template for easy integration with other financial systems will enhance workflow and reduce the time spent on manual data entry.

To create a bank receipt voucher template in Excel, organize the data with clear categories. Start with the date, then include the payer’s information, and finally, detail the payment amount and method.

Recommended Fields

- Date: The exact date of the transaction should be clearly stated.

- Payer Information: Include the payer’s name, account number, and any relevant details.

- Payment Details: List the amount paid, currency, and payment method (e.g., bank transfer, cash).

- Transaction Reference: Provide a unique reference number for easy tracking.

- Notes: Add any additional notes or terms related to the transaction.

Design Tips

- Simple Layout: Keep the design clear and easy to read by using proper spacing and alignment.

- Easy Editing: Ensure the template is easily customizable with fields that can be filled out for each new transaction.

- Consistent Formatting: Use consistent fonts, colors, and borders for a professional appearance.