For landlords in Ontario, providing a rental receipt is a key part of maintaining proper documentation. A rental receipt serves as proof of payment and is important for both tax purposes and tenant record keeping. It should include specific details to ensure clarity and legal compliance.

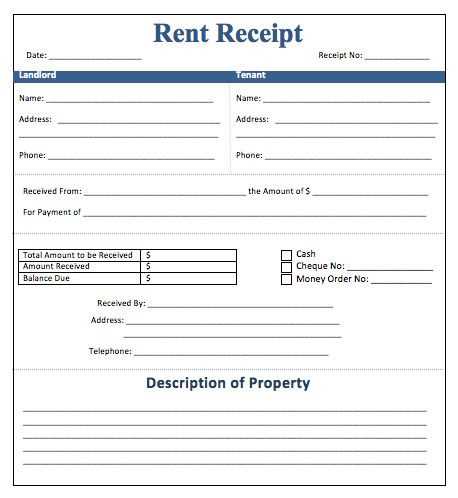

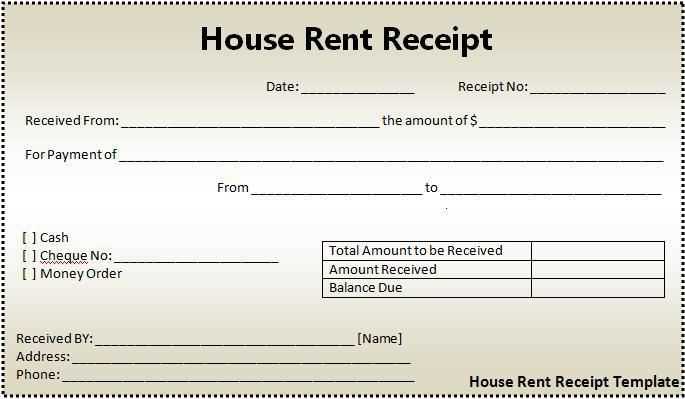

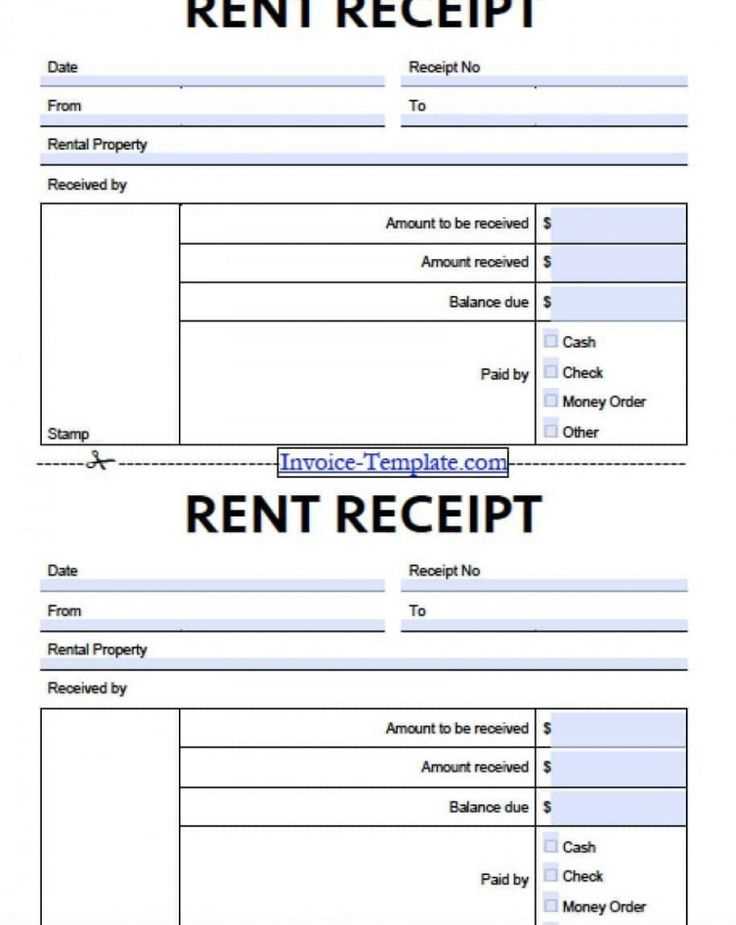

Start by including the tenant’s name, rental property address, and the date of payment. The receipt should clearly state the amount paid, the rental period it covers, and any additional fees, such as utilities or maintenance costs. Make sure to provide a unique receipt number for tracking and record-keeping purposes.

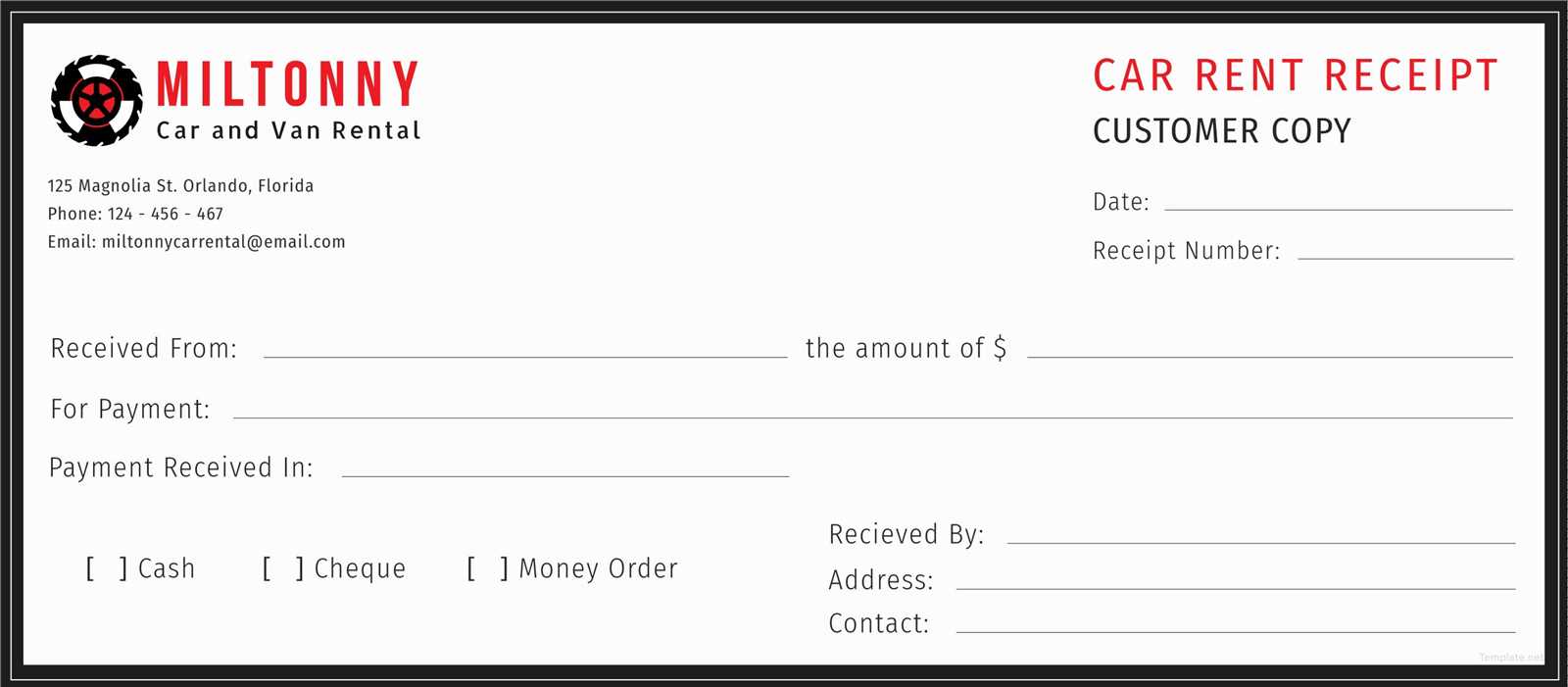

It’s also beneficial to mention whether the payment was made in cash, cheque, or another method. Providing space for both the landlord’s and tenant’s signatures can further validate the document, adding an extra layer of accountability for both parties involved.

By using a rental receipt template tailored to Ontario’s standards, landlords can simplify their documentation process and ensure compliance with the law while offering transparency to tenants.

Sure! Here’s a revised version of the text without unnecessary repetitions:

A rental receipt in Ontario should include several key elements. First, it must list the date of the transaction, tenant’s name, and the landlord’s contact details. Make sure to include the rental period covered by the payment and a clear breakdown of the rent amount. Any additional charges, such as utilities or late fees, should also be specified. Always provide the payment method used, whether cash, cheque, or electronic transfer, and state the total amount received.

Details to Include in a Rental Receipt

The receipt should be signed by the landlord or authorized representative. Additionally, for record-keeping purposes, the landlord should offer a copy of the receipt to the tenant at the time of payment. This ensures both parties have documentation of the transaction for future reference.

- Rental Receipt Template for Ontario

Here is a rental receipt template tailored for Ontario that includes all necessary details:

| Receipt Number: | [Unique Receipt Number] |

| Landlord Name: | [Landlord’s Full Name] |

| Tenant Name: | [Tenant’s Full Name] |

| Address of Rental Property: | [Full Property Address] |

| Payment Date: | [Date of Payment] |

| Rental Period: | [Start Date] to [End Date] |

| Rent Amount: | [Amount in Dollars] |

| Additional Charges: | [Any Additional Charges] |

| Total Paid: | [Total Amount Paid] |

| Payment Method: | [Payment Method] |

| Landlord’s Signature: | [Signature] |

To create a rental receipt in Ontario, ensure the document includes key details required by law. First, clearly state the rental property address and identify the landlord and tenant. Include the rental period, the total amount paid, and the payment method used (e.g., cash, cheque, bank transfer).

Each receipt should contain the following elements:

- Landlord’s full name and address

- Tenant’s full name

- Rental property address

- Payment date

- Amount paid

- Payment method (cash, cheque, or another form of payment)

- Rental period covered by the payment

- Receipt number for reference

If any part of the rent payment includes deposits or other specific charges, list these separately. Ensure that the document is signed and dated by the landlord to confirm its authenticity.

Why Keep a Rental Receipt?

Rental receipts are important for both landlords and tenants. They serve as proof of payment, helping to resolve any disputes related to rent. Keep a copy of the receipt for your records to maintain a clear history of payments made or received.

Digital Options

If you prefer, rental receipts can also be issued electronically. Make sure that all required details are included, and consider using receipt software or a template to simplify the process. Electronic receipts are legally valid as long as they contain the same information as a paper receipt.

Ensure the rental receipt includes the rental property address. This provides clarity about the location and avoids any confusion.

Tenant and Landlord Information

Include both tenant and landlord full names. This helps identify who is involved in the rental agreement and confirms the transaction.

Payment Information

State the exact rental amount paid, the payment method, and the payment date. This provides a clear record for both parties to refer back to.

Make sure to mention the rental period, whether it’s weekly, monthly, or another arrangement. This detail helps to understand the scope of the payment.

Incorporate a receipt number or unique identifier. This makes tracking the receipt easier in case of disputes or future reference.

Ensure the date is clearly stated on the receipt. Failing to include the date can lead to confusion, especially if tenants request proof of payment for specific periods.

Accurately list the payment amount received. A common mistake is rounding the amount or listing an incorrect figure, which can create disputes. Double-check the numbers to ensure they match the payment made.

Omitting Landlord and Tenant Details

Both parties’ names and contact information should be included on the receipt. Leaving out these details can cause uncertainty about who the payment was made to or received by, leading to unnecessary complications.

Not Including the Property Address

It’s essential to specify the property address to avoid confusion, particularly if the landlord owns multiple rental properties. Not including the address may make it difficult for tenants or authorities to verify the transaction.

Provide a description of the payment. Whether it’s for rent, utilities, or other fees, clarity on what the payment covers can prevent misinterpretations later on. Avoid generic terms that don’t specify the purpose of the payment.

Make sure to sign the receipt. An unsigned receipt may be viewed as invalid. Even if it’s a digital signature, ensure it is clearly visible to avoid disputes.

For creating a rental receipt in Ontario, include key details like the tenant’s name, rental property address, and the payment amount. Make sure to list the rental period clearly and state whether the amount covers partial or full payment. Indicate the date when the payment was made and the method of payment (e.g., cash, cheque, bank transfer). Also, provide a unique receipt number for tracking purposes.

Ensure both the landlord’s and tenant’s contact information is included. This helps with any future communication regarding the rental agreement. If the tenant has paid a deposit, it should be noted separately. Consider adding a section for additional notes, such as late fees or maintenance charges, if applicable. This ensures all terms are transparent and easily traceable.