Business ReceiptAnswer in chat instead

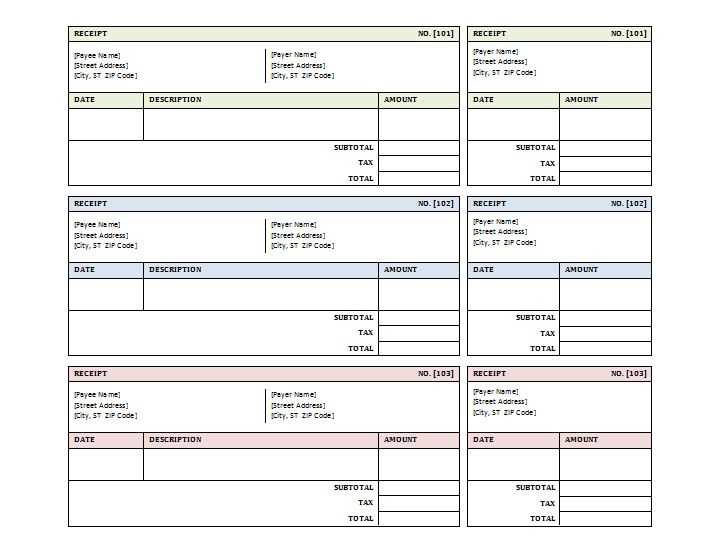

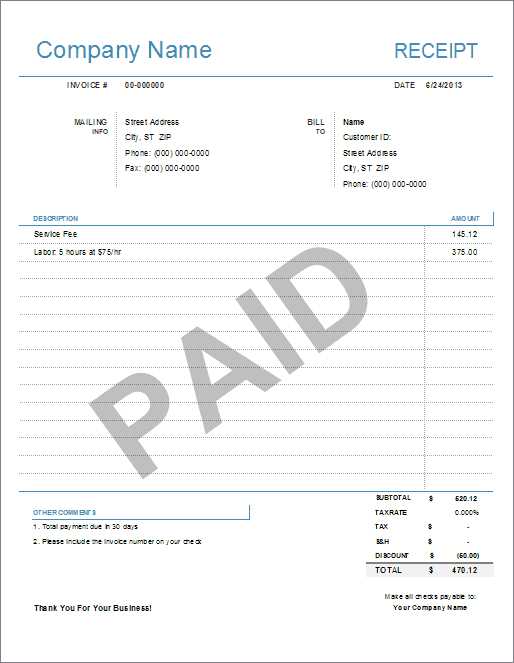

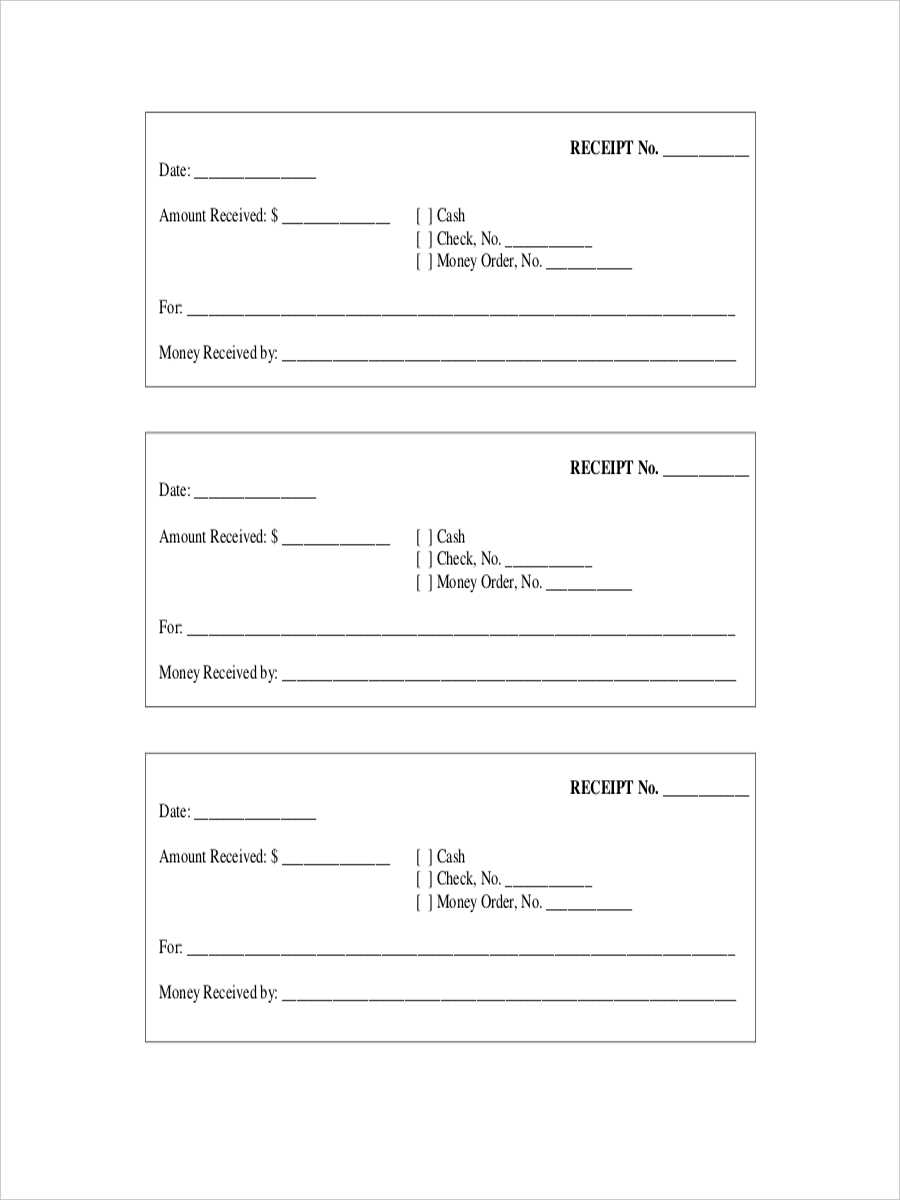

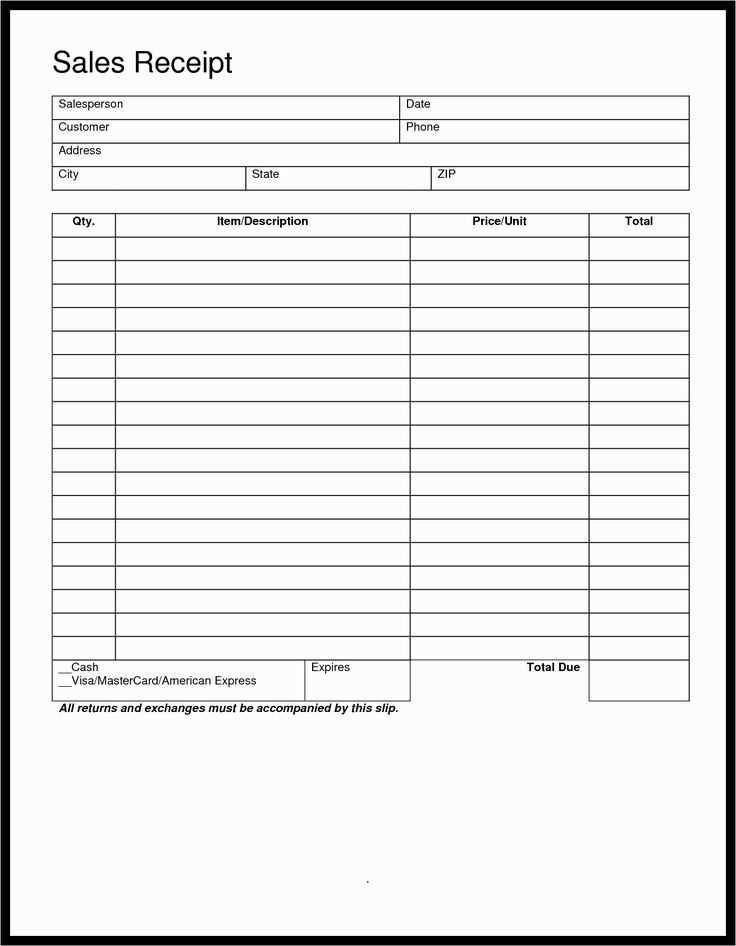

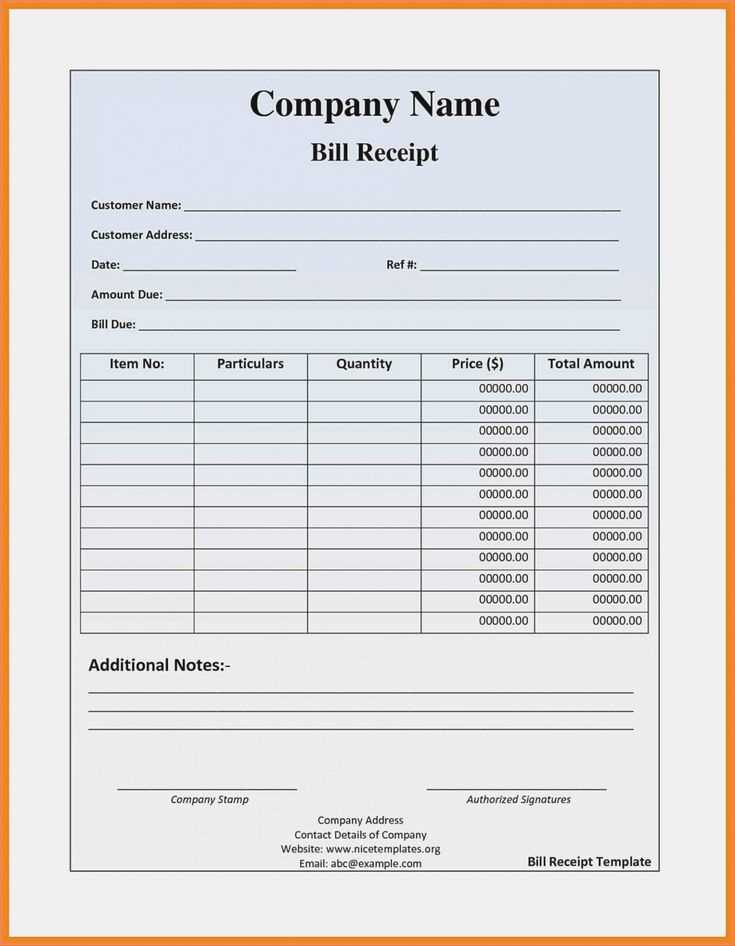

Template for Business Receipt

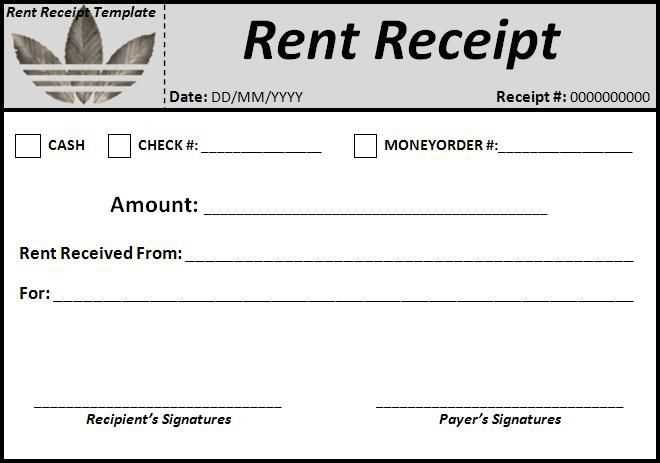

Key Elements to Include in a Receipt

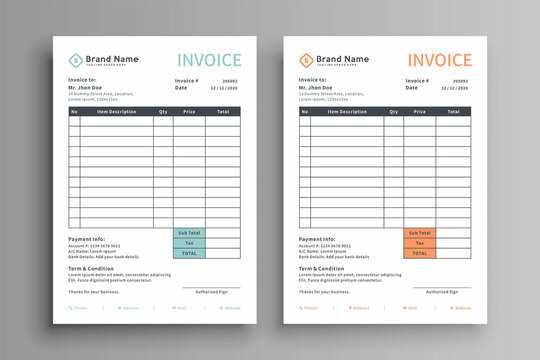

How to Customize It for Your Brand

Legal and Tax Considerations

Business Name and Contact Details: Clearly display your company’s name, address, phone number, and email. This builds credibility and ensures customers can reach you if needed.

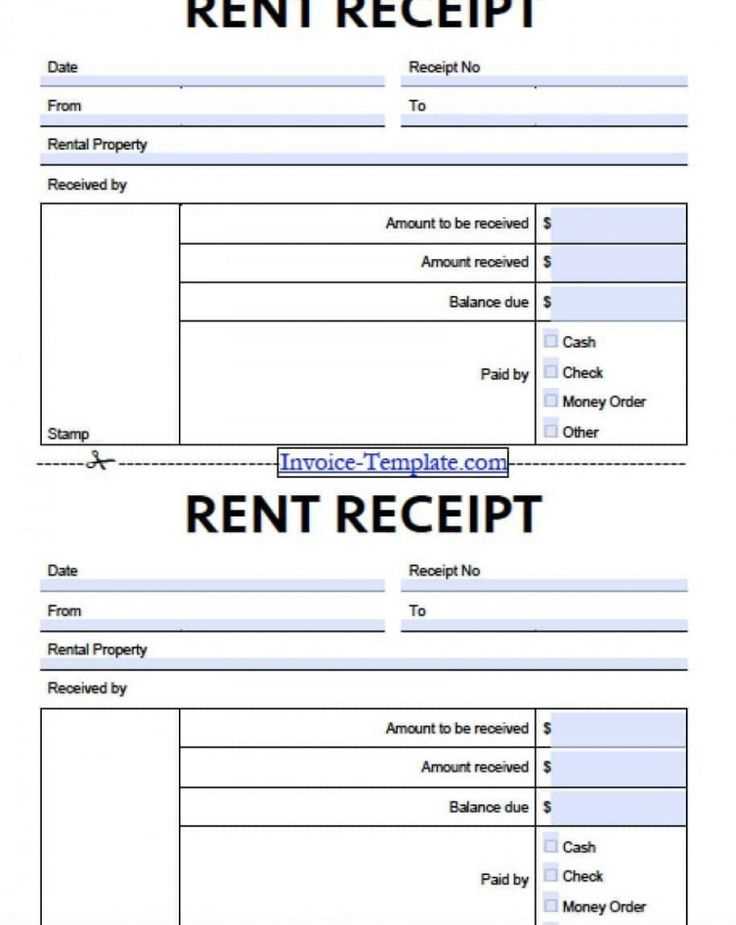

Transaction Date and Time: Record the exact date and time of the purchase. This detail helps with bookkeeping, returns, and warranty claims.

Unique Receipt Number: Assign a sequential or structured receipt number for tracking purposes. This simplifies record-keeping and makes it easier to locate past transactions.

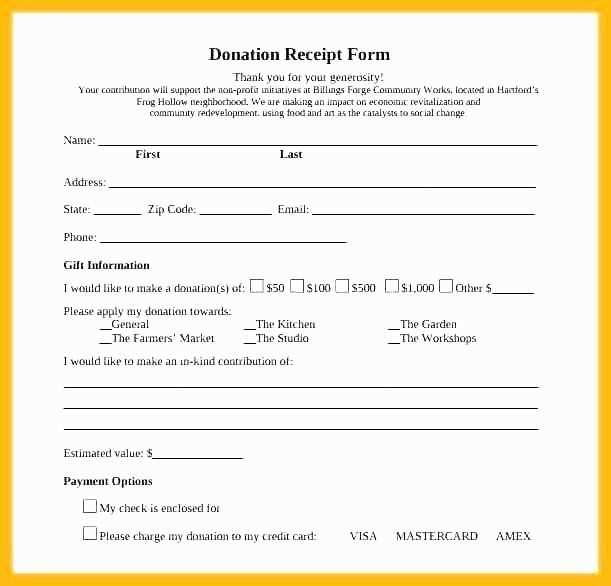

Itemized List of Products or Services: Include each purchased item or service, its quantity, unit price, and total amount. This transparency helps customers understand charges and reduces disputes.

Subtotal, Taxes, and Discounts: Break down the total cost, including any applicable taxes, fees, or discounts. This ensures compliance with tax regulations and maintains clear financial records.

Payment Method: Indicate whether the transaction was completed via cash, credit card, bank transfer, or another method. If applicable, provide partial payment details for future reference.

Return and Refund Policy: If your business offers returns or refunds, state the conditions directly on the receipt. This prevents misunderstandings and sets clear expectations.

Business Branding Elements: Add your logo, brand colors, and fonts to make the receipt visually consistent with your business identity. This reinforces brand recognition and professionalism.

Legal Compliance Information: Depending on your location, include any required disclaimers, tax identification numbers, or regulatory statements. This keeps your receipts legally valid.

Digital and Printed Copies: Offer customers both digital and printed versions. Digital receipts reduce paper waste and are easier to store, while printed copies cater to those who prefer traditional documentation.