Using a structured receipt paid template can significantly streamline your financial documentation. To ensure clarity and accuracy, start by including the essential details such as payment date, recipient information, and transaction description.

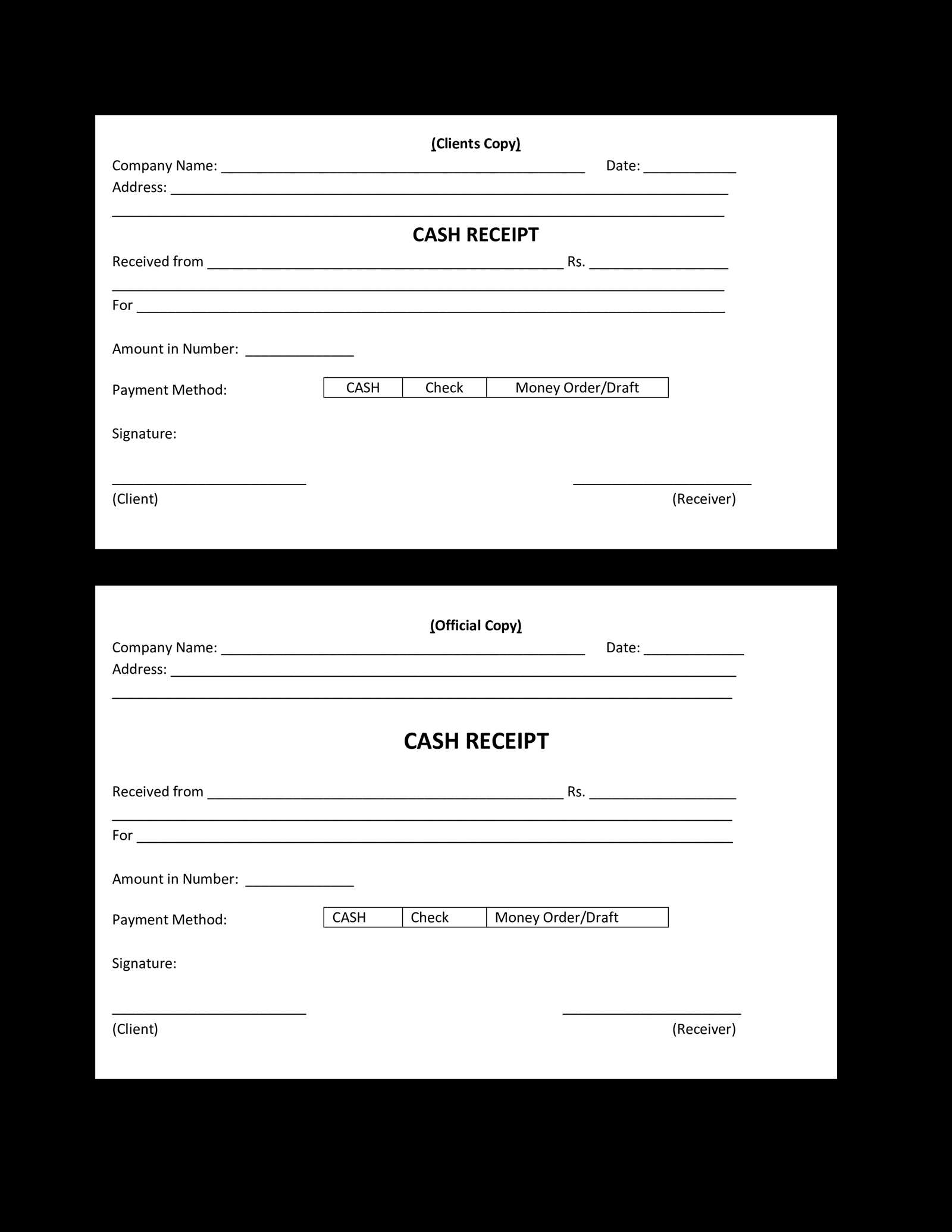

It’s important to clearly state the payment amount and any tax components, if applicable. Highlight these elements using bold text within the template to avoid ambiguity. Including payment methods such as credit card, bank transfer, or cash can also be helpful for tracking purposes.

Consider adding fields for additional notes or references that may be relevant to the transaction. These might include invoice numbers, project codes, or customer account IDs. By keeping your receipt template adaptable but structured, you’ll ensure smoother reporting and better organization of financial records.

Finally, remember that a well-prepared receipt template reflects professionalism and provides transparency for all parties involved. Review your template periodically to maintain its relevance and efficiency.

Receipt Paid Template: Practical Guide

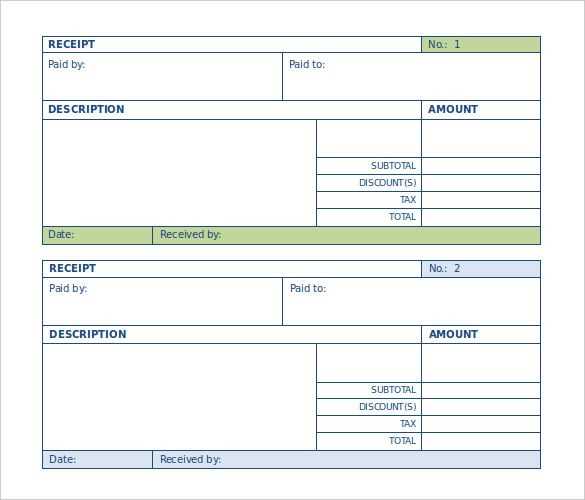

Always begin by including essential payment details such as the receipt number, payment date, and total amount paid. This ensures clarity for both parties and simplifies record-keeping.

Key Information to Include

List the payment method, whether it was completed via bank transfer, card payment, or cash. Specify any relevant transaction identifiers to make it easier to trace payments if needed.

Practical Formatting Tips

Use a clean layout with clearly defined sections for payer information, payment breakdown, and confirmation statement. Avoid clutter by keeping unnecessary graphics or excessive text out of the document.

By following these recommendations, your template will provide clarity and professionalism, making financial management smoother and more transparent.

How to Create a Clear Receipt Paid Template

Define the essential details to include. A clear receipt template should always feature key elements such as the payment date, unique receipt number, amount paid, payment method, and a concise description of the purchase or service.

Organize Information Logically

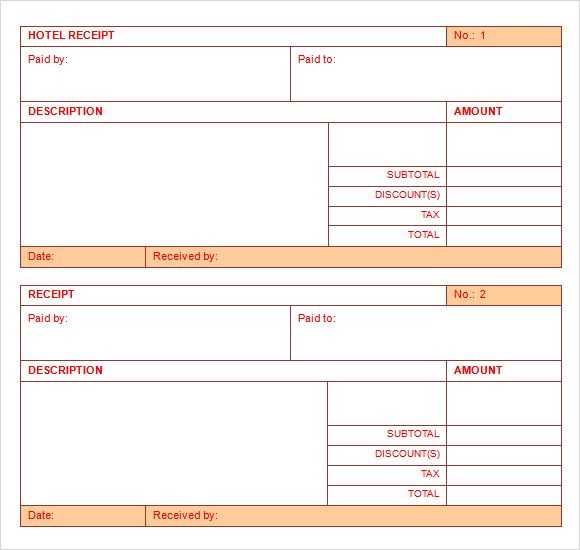

- Place the business name and contact information at the top for easy reference.

- Follow this with customer details, ensuring accurate identification of the payer.

- List itemized details of products or services, including individual prices and quantities.

- Conclude with payment confirmation, including the total amount and any taxes or discounts.

Ensure Professional Formatting

- Use simple, legible fonts and avoid cluttered layouts.

- Include clear headings and sections to separate different types of information.

- Provide space for additional notes or terms if necessary.

- Add a digital or physical signature area to validate the receipt if required.

Save the template in a reusable format such as PDF or Word. Keeping a standardized template simplifies future transactions and maintains consistency across all receipts issued.

Key Elements to Include in a Receipt Paid Template

Include the payment date to establish a clear record of when the transaction occurred. This helps both parties track financial activities efficiently.

Specify the full names and contact details of both the payer and the recipient. This information is crucial for accurate documentation and future reference.

Transaction Details and Payment Method

List the itemized products or services paid for, along with their corresponding amounts. Include taxes, discounts, and the total paid to maintain transparency.

Document the payment method, such as credit card, bank transfer, or cash, to avoid potential disputes regarding how the payment was made.

Confirmation and Unique Receipt Number

Assign a unique receipt number to each transaction. This simplifies future searches and auditing processes.

Finally, add a confirmation statement indicating that payment was received in full. A signature field or digital confirmation option reinforces authenticity.

Common Mistakes to Avoid When Using Templates

Skip overediting templates unnecessarily. Focus on customizing only essential sections, such as payment details and company branding, while maintaining a clear and professional layout. Excessive edits often disrupt readability.

Avoid neglecting accuracy checks. Verify that all calculations, dates, and amounts are correct before issuing a receipt. Inconsistent data can create disputes and undermine trust with recipients.

Failing to update outdated templates is another common error. Always ensure the template reflects current tax rates, legal requirements, and payment methods. Using old formats may result in compliance issues.

Don’t overlook user permissions when sharing editable templates. Limit access to prevent accidental changes and maintain document integrity.

Lastly, avoid generic naming conventions. Use clear file names that include the date and transaction reference to simplify future retrieval and recordkeeping.