Down Payment ReceiptAnswer in chat instead

Down Payment Home Lease: Template & Receipt Guide

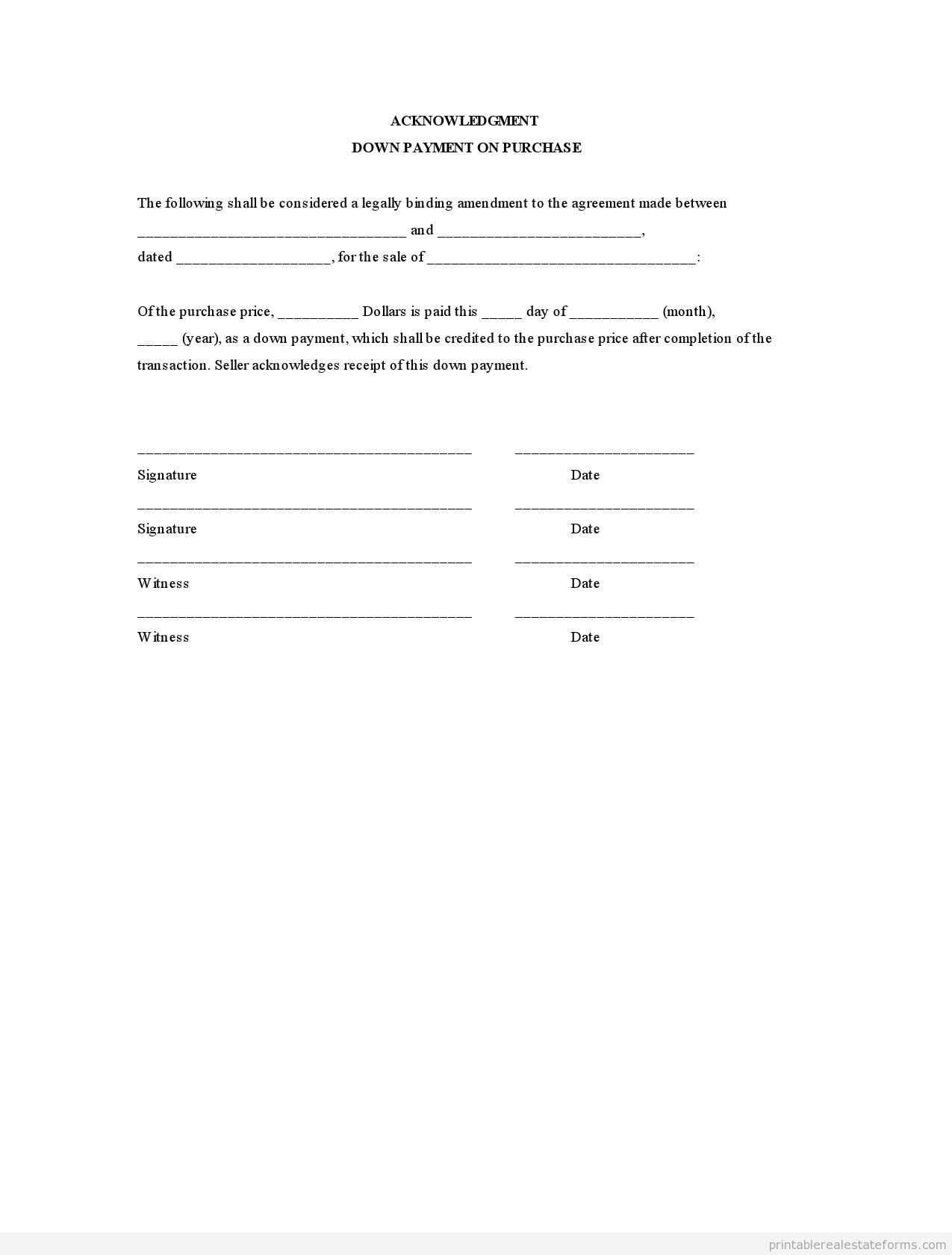

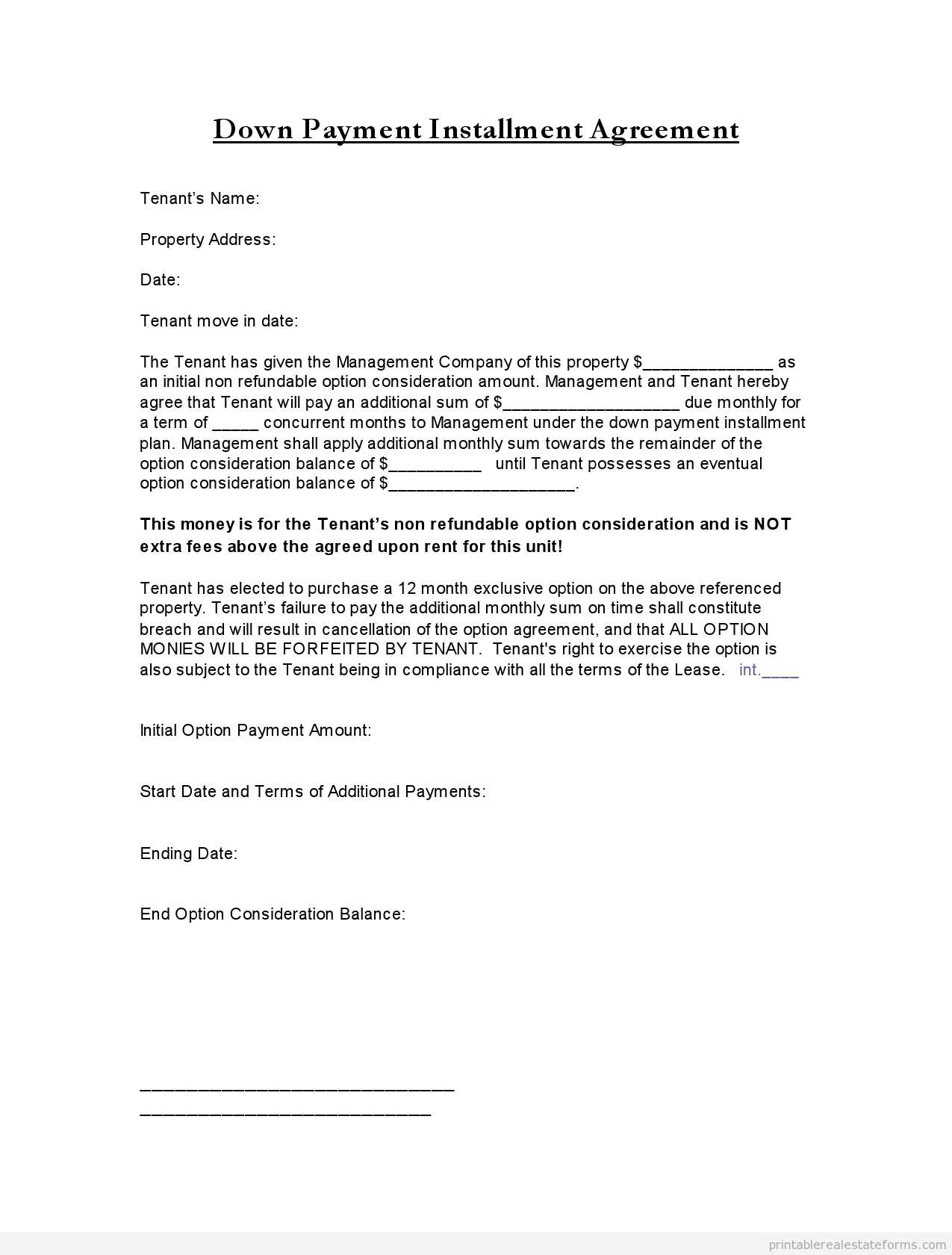

How to Structure a Down Payment Agreement for Leasing a Home

A lease down payment agreement must clearly define payment terms, responsibilities, and conditions for refundability. Specify the exact amount, due date, and acceptable payment methods. Include the landlord’s and tenant’s full names, property address, and a clause stating how the payment will be applied–whether deducted from future rent or held as security. If refundable, outline the conditions for reimbursement. Both parties should sign and date the document to ensure legal validity.

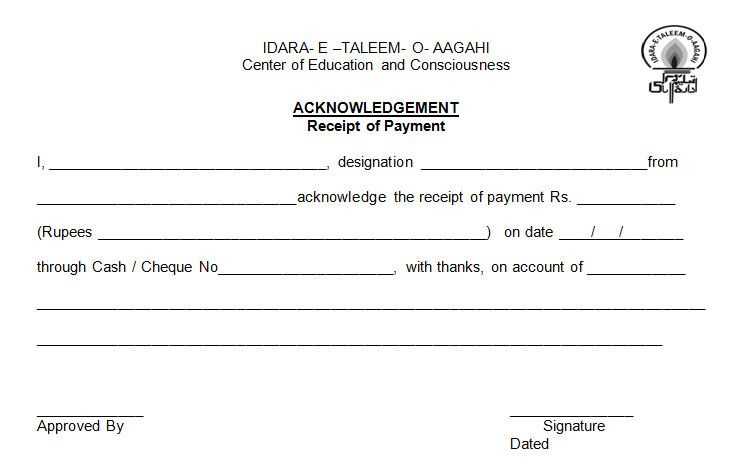

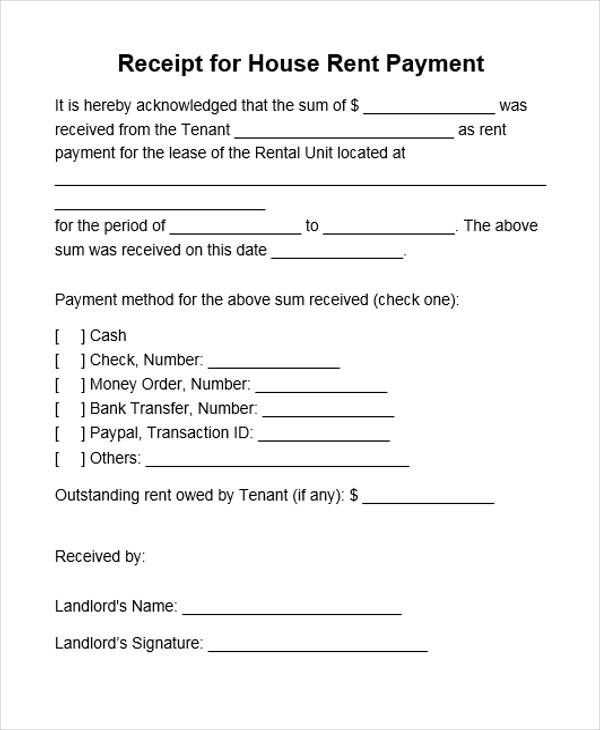

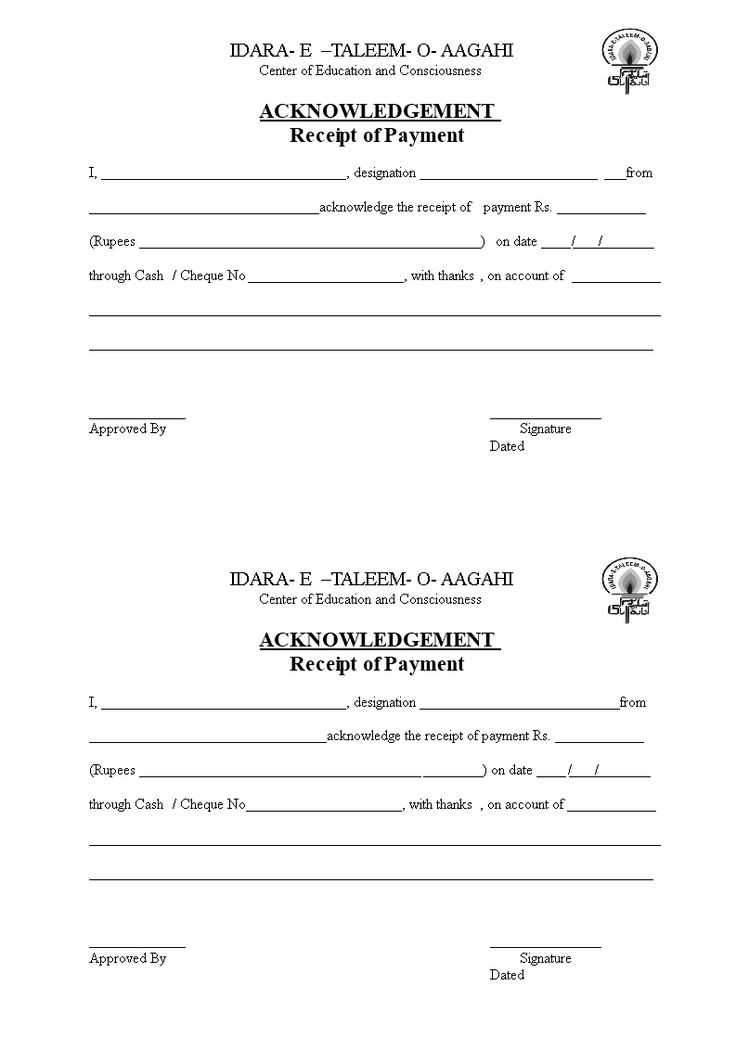

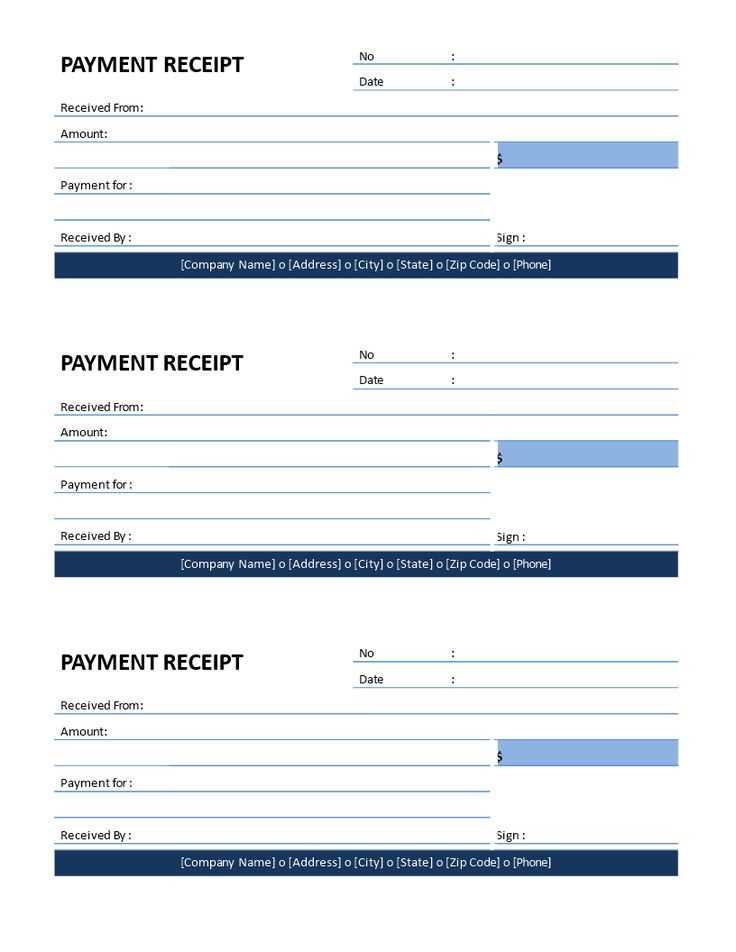

Key Elements to Include in a Payment Receipt

A proper receipt must confirm the amount paid, date of payment, tenant’s name, and property details. Include the payment method (cash, check, bank transfer) and reference number, if applicable. Clearly state whether the amount is part of the total rent or a separate deposit. The landlord or property manager should sign the receipt and provide a copy to the tenant for record-keeping.

Legal Considerations for Handling Lease Payments

Verify local rental laws to ensure compliance with regulations on down payments and security deposits. Some jurisdictions limit the amount a landlord can request upfront or require that deposits be held in separate accounts. Provide tenants with a written notice detailing where their deposit is stored if legally required. Keeping detailed records of all payments helps prevent disputes and ensures transparency in financial transactions.