If you operate a taxi or private hire service in the UK, providing a clear and accurate receipt is essential for customer satisfaction and record-keeping. A well-structured receipt should include key details such as the fare amount, journey date, pick-up and drop-off locations, and your business information. Using a standard template ensures consistency and professionalism.

A typical UK cab receipt should include the following details:

- Business Name and Contact Details: Include your trading name, phone number, and email address.

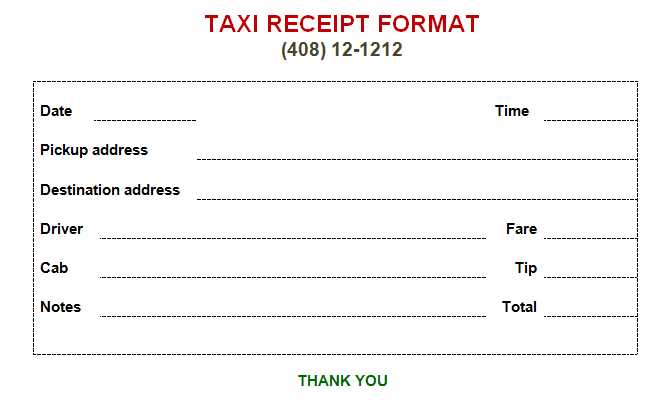

- Journey Information: Specify the date, time, starting point, and destination.

- Fare Breakdown: Show the base fare, additional charges (such as waiting time or extra passengers), and the total amount paid.

- Payment Method: Indicate whether the fare was paid in cash, by card, or through an app.

- Company Registration or License Number: If applicable, add your taxi license or VAT registration number.

Providing receipts in both digital and printed formats helps meet customer preferences. A digital receipt can be sent via email or messaging apps, while a paper copy ensures compliance with local regulations. Using a template with pre-filled sections reduces errors and saves time, allowing you to focus on providing a reliable service.

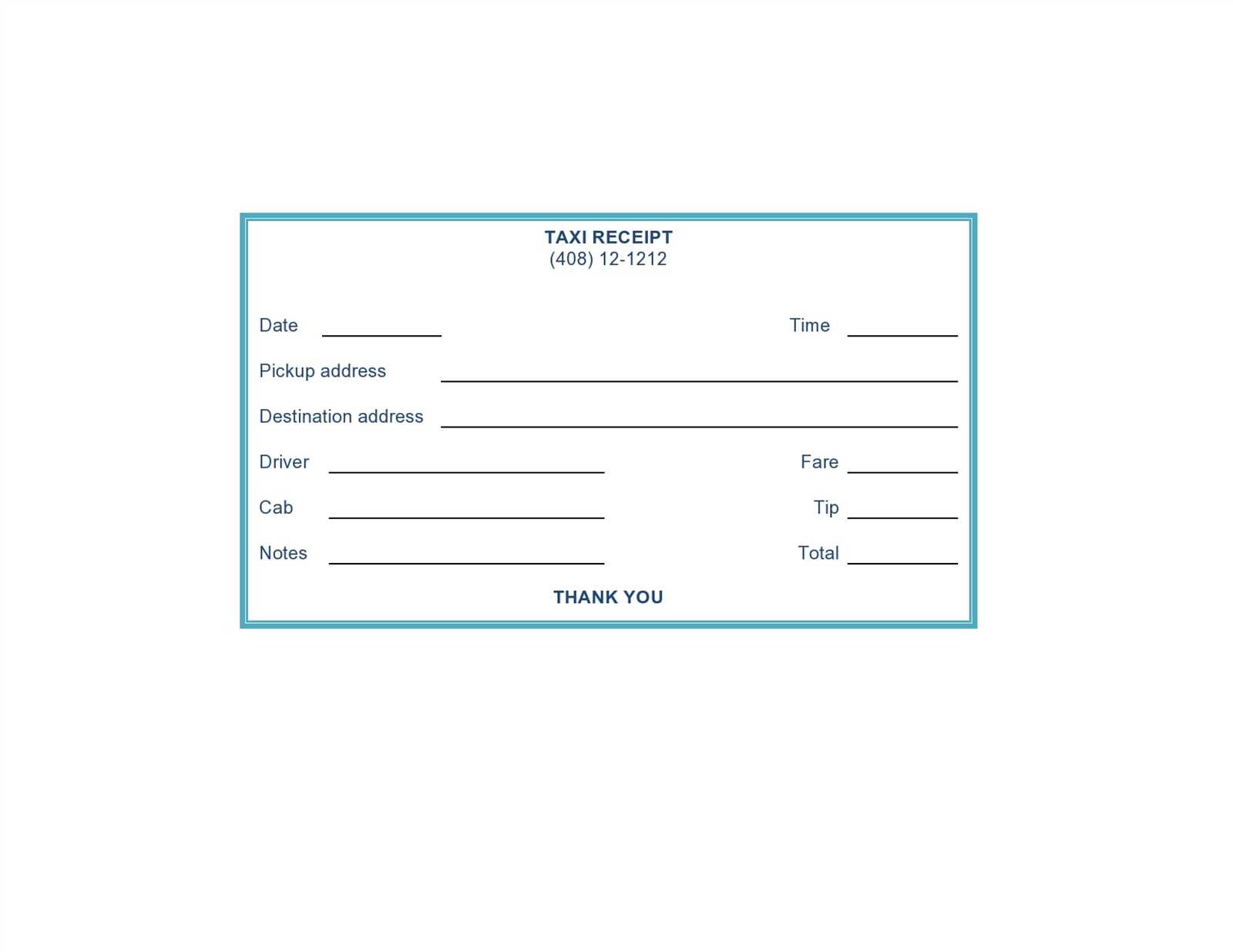

Cab Receipt Template UK

Ensure every cab receipt includes key details to meet UK tax and reimbursement requirements. A properly structured receipt prevents disputes and speeds up claims processing.

- Company Information: Include the taxi firm’s name, address, and contact details.

- Date & Time: Clearly state when the journey took place.

- Pickup & Drop-off Locations: Specify the exact start and end points.

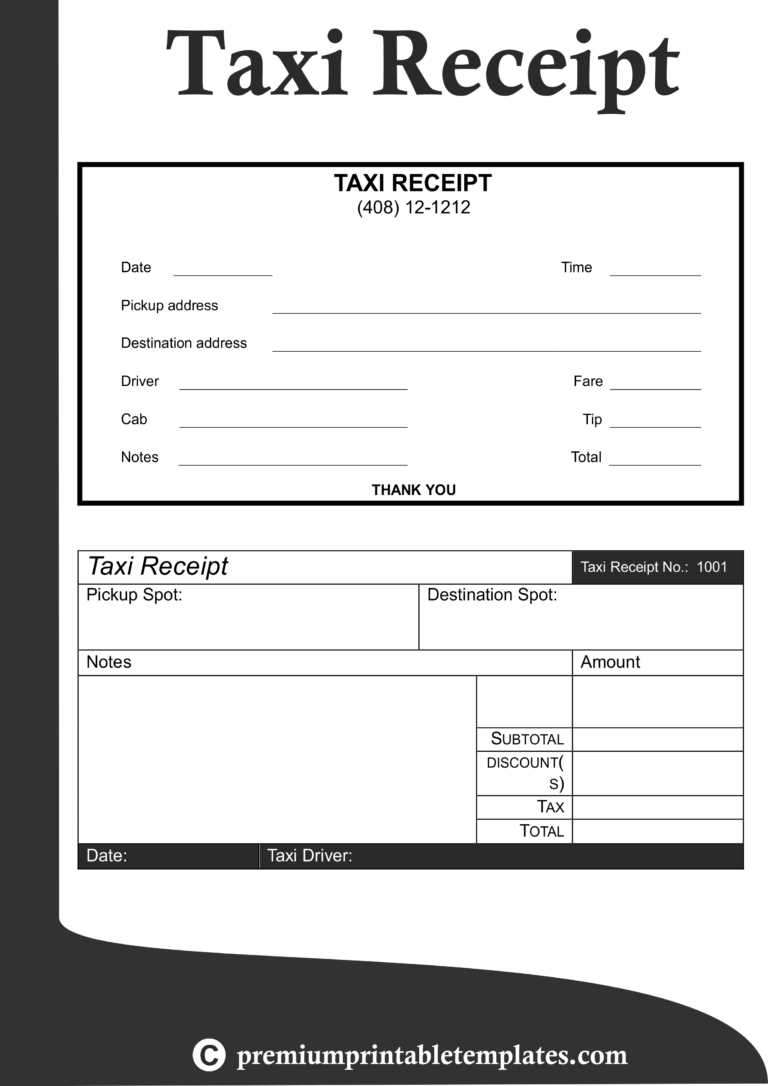

- Fare Breakdown: List the base fare, additional charges, and total amount paid.

- Payment Method: Indicate whether cash, card, or digital payment was used.

- VAT Information: If the operator is VAT-registered, include the VAT number and tax breakdown.

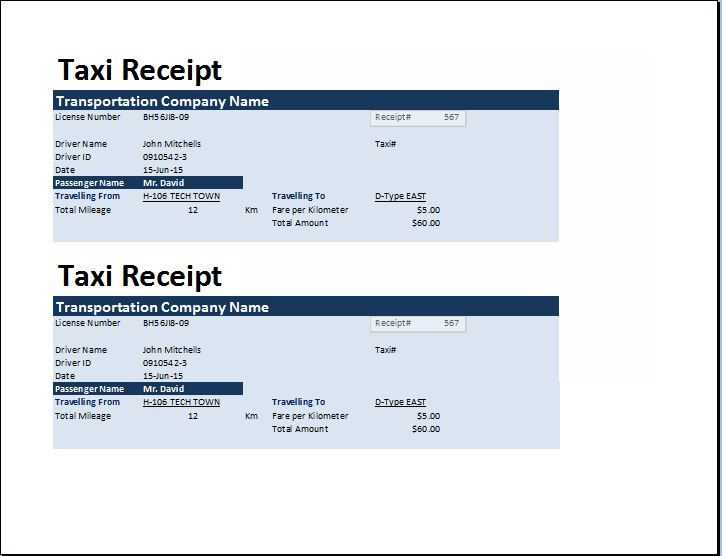

- Driver’s Details: Provide the driver’s name or ID for verification.

- Receipt Number: Assign a unique identifier for tracking and record-keeping.

Many businesses require digital copies, so offering a PDF or email option can be beneficial. If using a template, ensure it follows UK regulations to remain valid for expense claims.

Mandatory Information to Include on a UK Cab Receipt

Receipt Number: Every receipt should have a unique reference number for tracking and verification.

Date and Time: Clearly state when the journey took place. This helps with expense claims and dispute resolution.

Driver’s Details: Include the driver’s full name and badge number as issued by the licensing authority.

Vehicle Information: Provide the vehicle registration number and the licensing authority’s identification details.

Journey Details: Specify the pickup and drop-off locations to validate the route and fare.

Fare Breakdown: List the base fare, distance-based charges, waiting time, surcharges, and any additional fees. Transparency helps avoid disputes.

Total Amount Paid: Show the final amount paid, including VAT if applicable. If the transaction was cashless, mention the payment method.

Operator Details (if applicable): If booked through a company, include the firm’s name, address, and contact number.

Licensing Information: Display the licensing authority’s name to confirm the vehicle and driver are legally operating.

Contact for Queries: Provide a phone number or email for customer inquiries or complaints.

Legal Requirements and Compliance for Taxi Receipts in the UK

Every taxi receipt in the UK must include key details to comply with HMRC regulations and ensure transparency for both passengers and drivers. A valid receipt should contain:

- The driver’s name or the name of the taxi company

- Date and time of the journey

- Pickup and drop-off locations

- Fare amount, including any additional charges

- Payment method (cash, card, or other)

- VAT details if the driver or company is VAT-registered

For VAT-registered drivers or businesses, the receipt must display a VAT number and a breakdown of VAT, if applicable. Failure to provide compliant receipts can lead to disputes and potential fines. Digital receipts are accepted, but they must contain the same required information.

Passengers have the right to request a receipt for expense claims or tax purposes. To avoid issues, taxi companies should use standardized templates and digital solutions that automatically generate legally compliant receipts.

Customizing a Cab Receipt Template for Business and Personal Use

Adjust the receipt layout to match your needs by adding or removing fields. Businesses often require fields for VAT, company registration numbers, and expense categories, while personal use may only need basic fare details. Use a clear font to enhance readability.

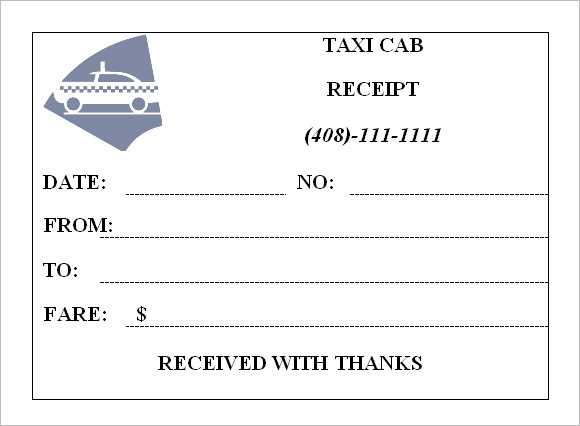

Adding Company Branding

Include a company logo and contact details to create a professional look. Position the logo at the top, ensuring it doesn’t interfere with important fields. Use a consistent color scheme that aligns with your brand identity.

Improving Data Accuracy

Enable automated date and time stamps to eliminate manual errors. For digital templates, use dropdown menus for vehicle types and payment methods to ensure consistency. If receipts are handwritten, pre-fill static fields like company details to save time.

For digital receipts, consider adding QR codes linking to trip details or customer support. This enhances record-keeping and provides easy access to trip information if needed later.