Make every receipt email clear and professional. A well-structured message reassures your client that their payment was processed successfully and provides them with a record for future reference. Use concise language, include key details, and maintain a polite tone.

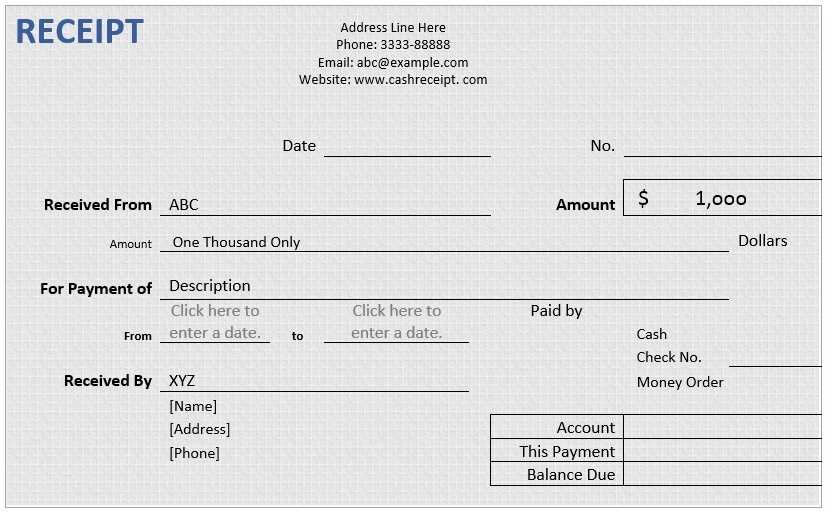

Always include the payment confirmation number, transaction date, and amount. These details help avoid confusion and reduce unnecessary follow-ups. If applicable, attach a PDF copy of the receipt for easy access.

Keep the subject line direct, such as “Payment Confirmation – [Your Business Name]” or “Receipt for Your Payment to [Company Name].” Avoid vague or promotional wording to prevent your email from being overlooked.

End the email with a brief thank-you message and contact information. If relevant, offer additional support or mention upcoming billing cycles. A professional closing leaves a positive impression and encourages future transactions.

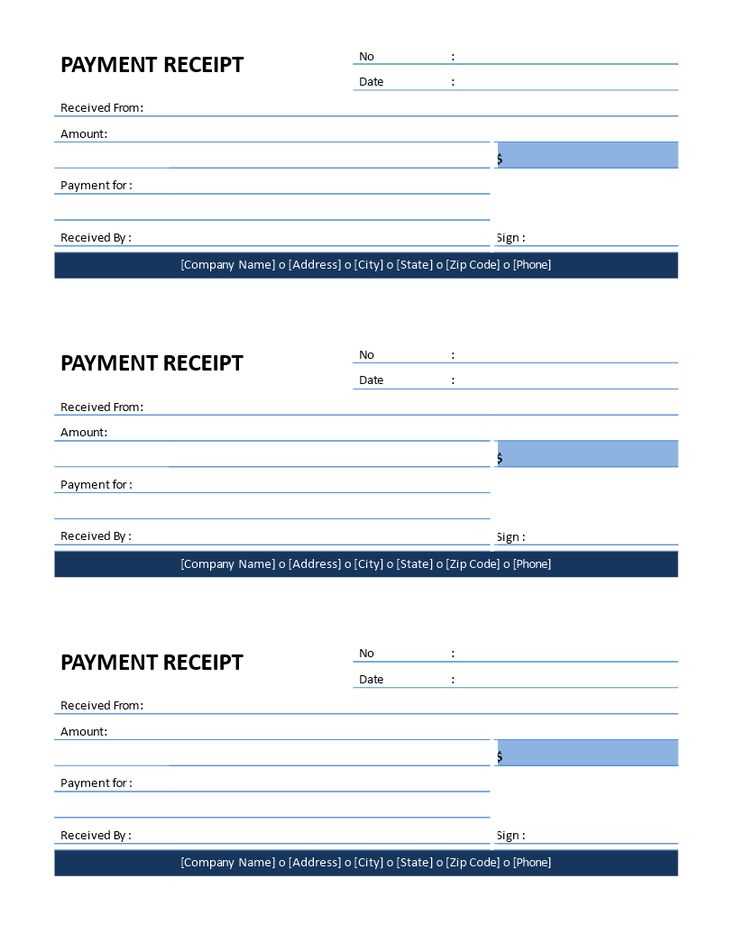

Client Payment Receipt Email Template

Ensure clarity by using a subject line like “Payment Received – Receipt Attached.” Keep it concise to confirm the transaction and provide essential details.

Begin with a friendly greeting, followed by a clear acknowledgment of the payment. State the amount, date, and transaction ID to avoid confusion. If applicable, mention the service or product purchased.

Attach the official receipt in PDF format for easy access. Reinforce trust by summarizing key details within the email body, such as the billing period or any upcoming charges.

Encourage further engagement by offering a contact option for any questions. A closing remark expressing appreciation strengthens client relationships and leaves a positive impression.

Structuring a Clear and Concise Payment Confirmation Message

Specify the transaction details immediately. Begin with a short sentence confirming the successful payment, followed by the amount, date, and transaction ID. This ensures clarity and eliminates guesswork.

Break information into logical sections. Use short paragraphs or bullet points for key details like:

- Amount Paid: $[Amount]

- Date: [MM/DD/YYYY]

- Payment Method: [Card/Bank Transfer/Other]

- Transaction ID: [Unique ID]

Provide next steps. If an invoice or receipt is attached, mention it explicitly. If further action is required, such as shipping updates or access to digital content, include clear instructions.

Maintain a friendly, professional tone. A simple thank-you sentence adds a personal touch without unnecessary fluff: “Thank you for your payment. Your order is being processed.”

Include contact details for support. A direct line for assistance reassures the recipient: “Need help? Reply to this email or contact us at [Support Email].”

End with a clear sign-off, such as “Best regards, [Your Company Name]”, to reinforce professionalism.

Key Details to Include for Transparency and Compliance

Payment Confirmation: Clearly state the amount received, the payment method, and the transaction date. This eliminates confusion and provides a solid reference for both parties.

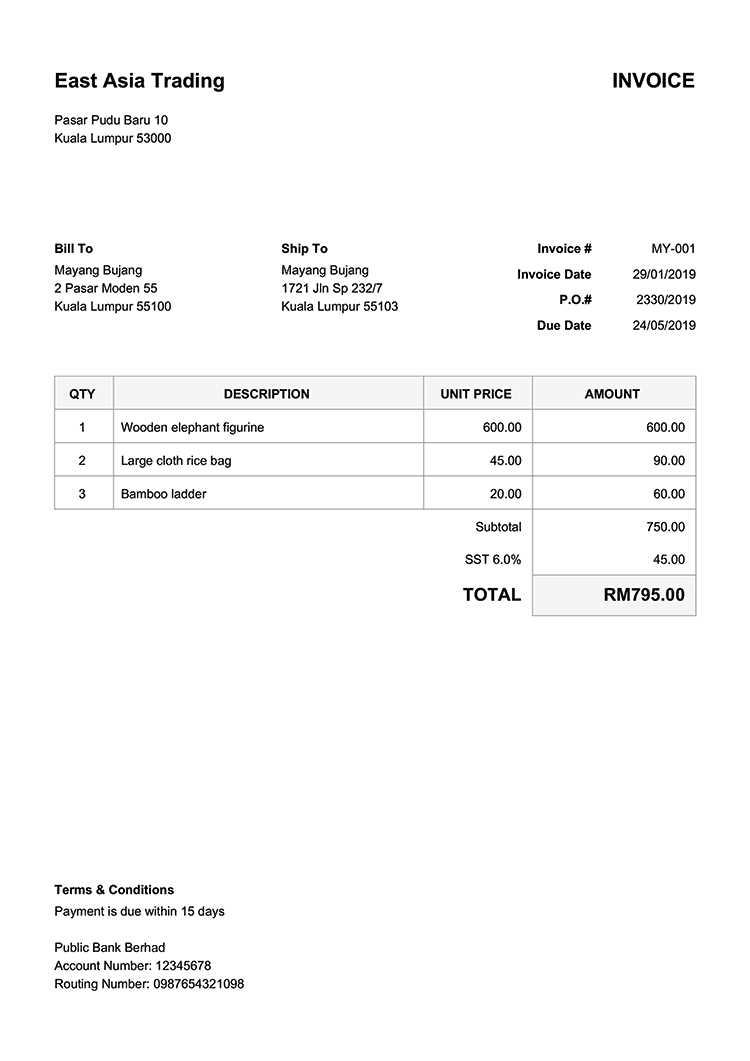

Invoice Reference and Breakdown

Include the corresponding invoice number and a detailed list of products or services covered by the payment. Itemizing charges prevents disputes and reinforces clarity.

Business and Customer Information

Provide the legal name, address, and tax identification number of your company. Ensure the recipient’s details match the original invoice to avoid processing delays.

Tax and Compliance Notes: If applicable, display the tax amount separately and mention any relevant compliance regulations. This is particularly important for cross-border transactions.

Next Steps: If further action is required, such as finalizing a contract or scheduling service delivery, state it clearly. A brief note on refund or dispute policies also adds reassurance.

Maintain a friendly yet professional tone, and ensure the email format is easy to scan. A concise summary at the end reinforces key details without overwhelming the recipient.

Customizing the Template for Different Payment Methods

Adjust the email structure based on the payment method to ensure clarity and relevance. Each method has unique details that should be reflected in the template.

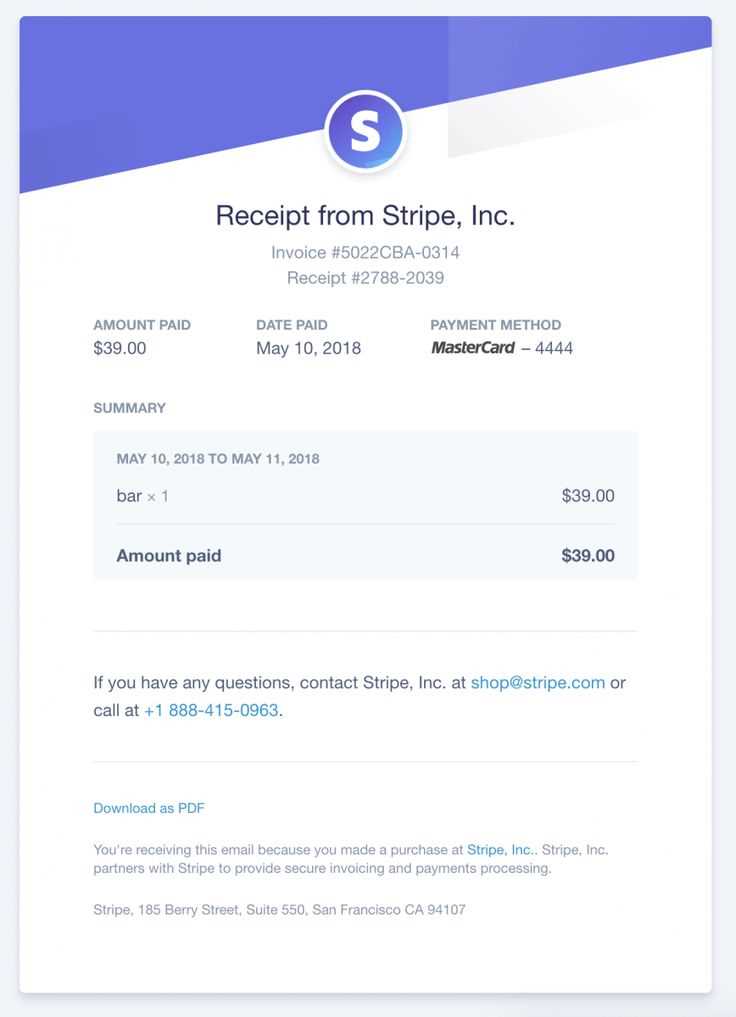

- Credit/Debit Cards: Include the last four digits of the card and a transaction ID. Specify the processing time if delays are possible.

- Bank Transfers: Confirm the sender’s name and reference number. Mention the expected processing time and any additional steps required for verification.

- PayPal: Provide a direct link to the transaction details. Indicate whether automatic payment confirmation is enabled.

- Cryptocurrency: Display the transaction hash and network used. Note potential delays due to network congestion.

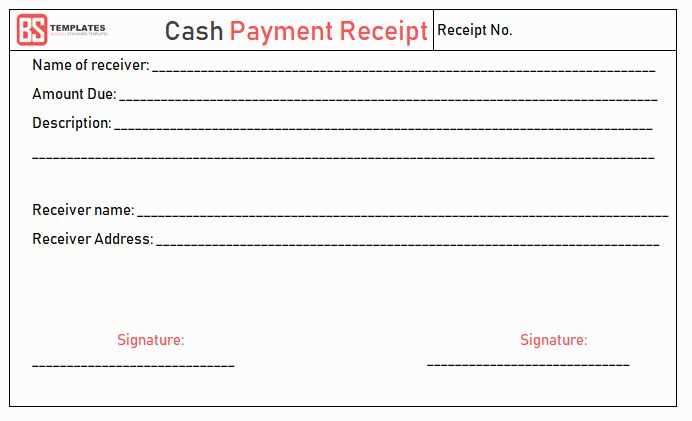

- Cash Payments: Confirm the amount received and the date of payment. Offer a digital copy of the receipt for record-keeping.

Use conditional placeholders in the template to insert specific payment details dynamically. For example:

<p>Payment Method: {{payment_method}}</p>

<p>Transaction ID: {{transaction_id}}</p>

Ensure that refund policies and support contacts are clearly stated. This minimizes confusion and enhances trust.