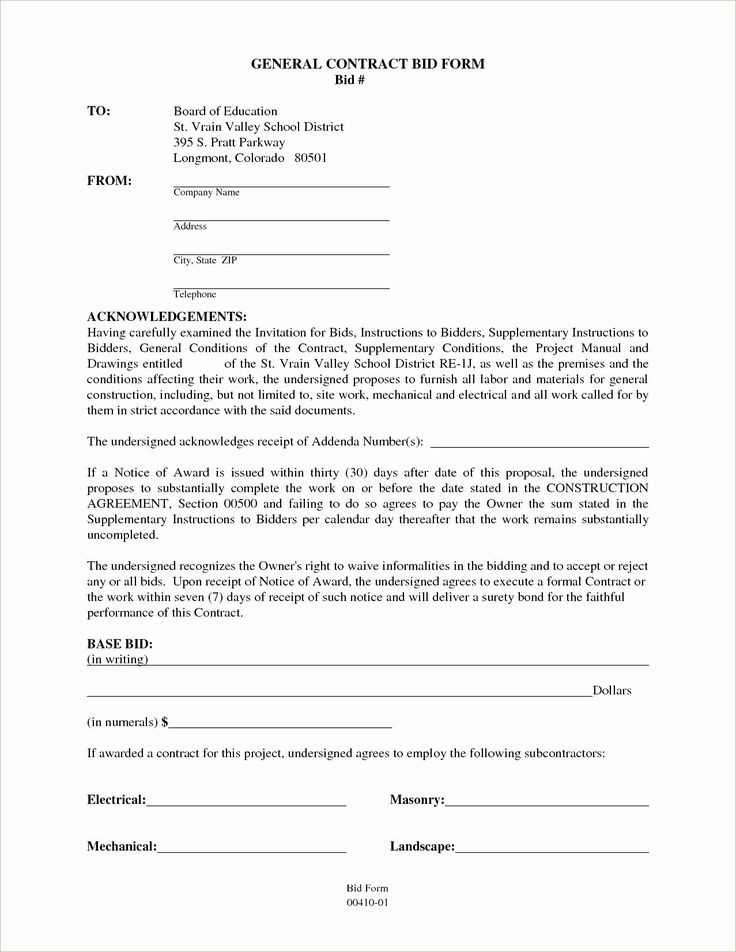

Save time and keep your records organized with a ready-to-use general contractor receipt template. Whether you’re handling renovations, new construction, or subcontracting work, a structured receipt ensures clear documentation of payments and project details. With a well-formatted receipt, you can provide clients with accurate proof of transactions while maintaining a professional image.

Every receipt should include key elements: contractor and client details, payment breakdown, project description, and confirmation of received funds. A well-structured template eliminates confusion and minimizes disputes by clearly outlining labor costs, materials, and taxes. By using a predefined format, you streamline financial tracking and ensure compliance with tax reporting requirements.

Instead of creating a receipt from scratch, download a customizable template that meets industry standards. Choose between printable PDFs, editable Word documents, or automated spreadsheets for seamless integration with your workflow. Tailor the format to match your business needs, adding custom fields such as payment methods, warranty details, or project milestones.

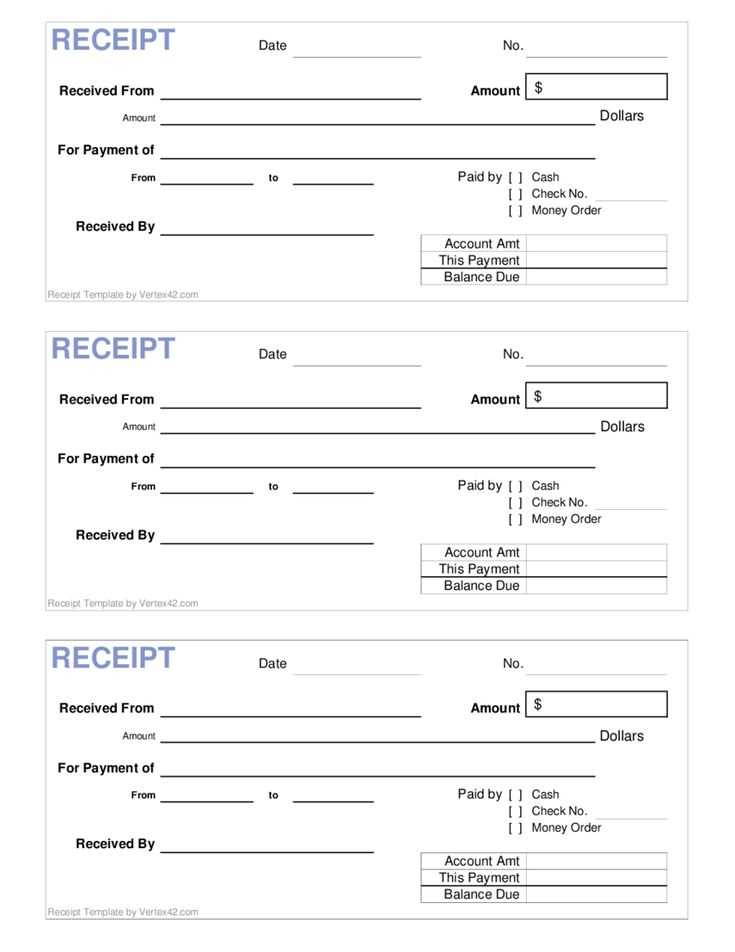

Free General Contractor Receipt Template

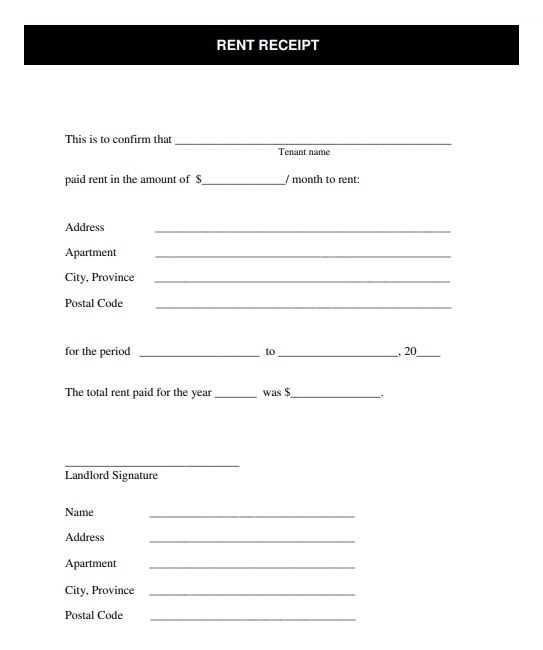

Use a structured receipt template to ensure clear records and avoid disputes. A well-organized receipt should include essential details:

- Contractor Information: Business name, contact details, and license number if applicable.

- Client Details: Name, address, and phone number.

- Receipt Number: A unique identifier for tracking payments.

- Date: The day the payment was received.

- Payment Method: Cash, check, credit card, or bank transfer.

- Work Description: Brief but specific details about the service provided.

- Amount Paid: The total sum received, including a breakdown if necessary.

- Balance Due (if any): Remaining amount if partial payment was made.

- Authorized Signature: Contractor’s or client’s confirmation of the transaction.

Use a digital or printable format for flexibility. PDFs ensure consistency, while editable spreadsheets allow adjustments. Keep copies for tax filing and potential client inquiries.

Key Elements to Include in a Contractor Receipt

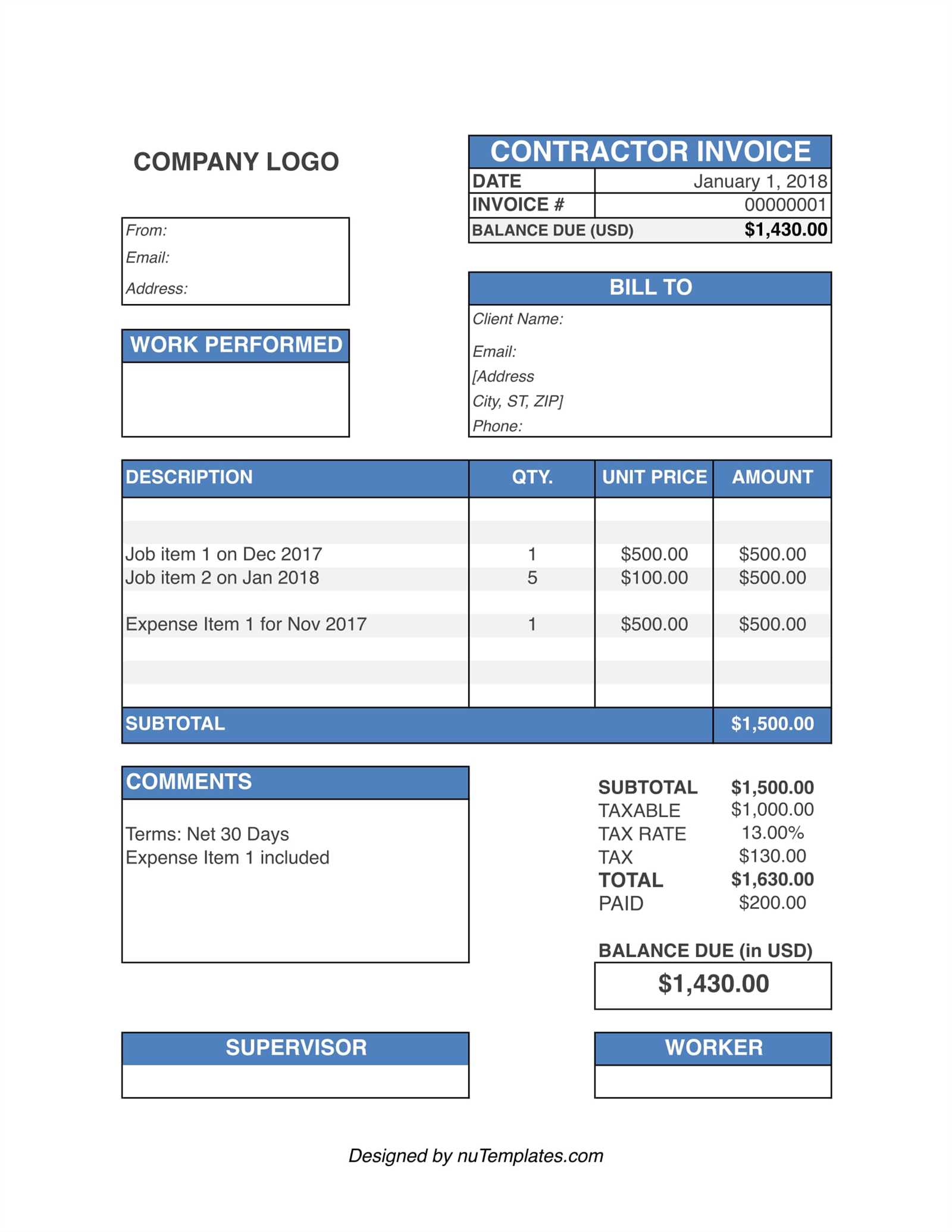

Include the contractor’s full name or business name, along with contact details such as phone number, email, and physical address. This ensures clear identification for both parties.

Client and Project Details

Clearly state the client’s name and contact information. Specify the project location and a brief description of the work performed. This helps avoid confusion about the services provided.

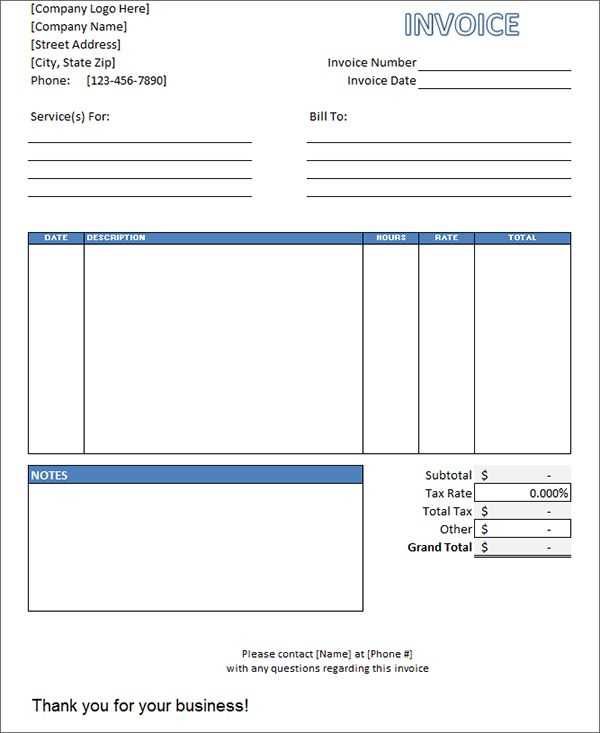

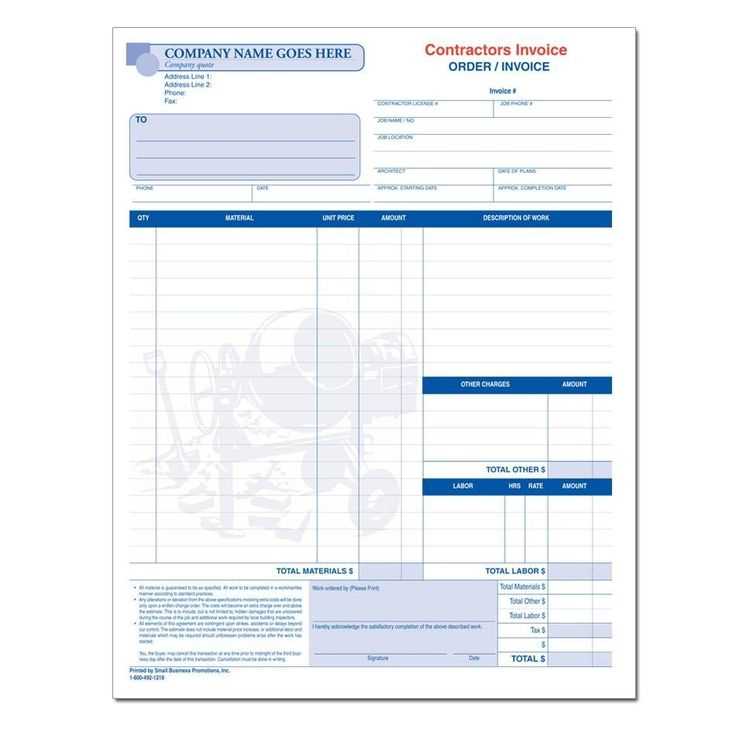

Itemized Breakdown and Payment Information

List each service or material with individual prices, including labor costs and any applicable taxes. Show the total amount due and the payment method used. If a partial payment was made, note the remaining balance.

Include the date of issuance and a unique receipt number for record-keeping. Adding a brief payment confirmation statement reinforces clarity and professionalism.

How to Customize a Receipt Template for Different Projects

Modify the receipt layout based on project specifics. For construction jobs, include material costs separately from labor. For consulting work, highlight hourly rates and billable hours. Tailor descriptions to match the service provided, ensuring clarity for both parties.

Adjust Tax and Payment Details

Different locations and industries have unique tax requirements. Add appropriate tax fields or exempt sections as needed. If a project involves milestones or phased payments, include installment details with due dates.

Incorporate Branding and Legal Terms

Add a company logo and adjust fonts or colors for a professional touch. Include legal disclaimers or warranties when applicable, ensuring compliance with local regulations. Clearly define refund policies or payment deadlines to avoid disputes.

Best Formats and File Types for Printable Contractor Receipts

Use PDF for the most reliable formatting and compatibility. This format ensures that layouts, fonts, and signatures remain intact on any device or printer. Many free tools allow easy conversion from Word or Excel to PDF.

For editable templates, DOCX works best. It allows quick modifications before saving the final version as a PDF. Contractors who need structured calculations should use XLSX, which supports automatic formulas for tax and total calculations.

Choose JPG or PNG for scanned receipts. These formats preserve details but don’t allow easy edits. If archiving digital copies, opt for a high-resolution scan to keep text legible.

For cloud-based access, consider Google Docs or Sheets. These formats let multiple users edit and print receipts from any location. When finalizing a document, export it to PDF for a polished, unchangeable copy.