When creating a template receipt for money, it’s important to include key information that ensures clarity and legal validity. A simple, well-organized structure can prevent confusion in case of audits or disputes.

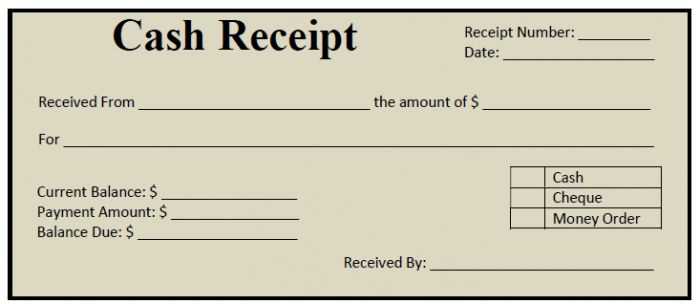

Start by including the payer’s name, as well as the receiver’s name. This establishes who is involved in the transaction. Then, clearly indicate the amount of money being received, using both numerical values and words for full transparency. Don’t forget to mention the payment method, whether it’s cash, check, bank transfer, or another form of payment.

Next, ensure the date of the transaction is recorded. This helps track the timing of payments and is especially important for tax purposes. Also, provide a description or purpose for the payment, so both parties understand the reason behind the transaction. It adds a layer of security for both the payer and the receiver.

Finally, make room for signatures, both from the payer and receiver. While not always legally required, it’s a good practice to include them as they add authenticity to the transaction. A template receipt of money can be tailored to suit specific situations, ensuring that all necessary details are properly documented.

Here’s the revised version:

To ensure clarity in the receipt of money, begin with a clear breakdown of the transaction amount. State both the gross sum and any applicable fees or deductions. This helps the receiver understand the exact payment they are receiving. Always include the method of payment, whether it’s via bank transfer, cash, or another method, to avoid any confusion.

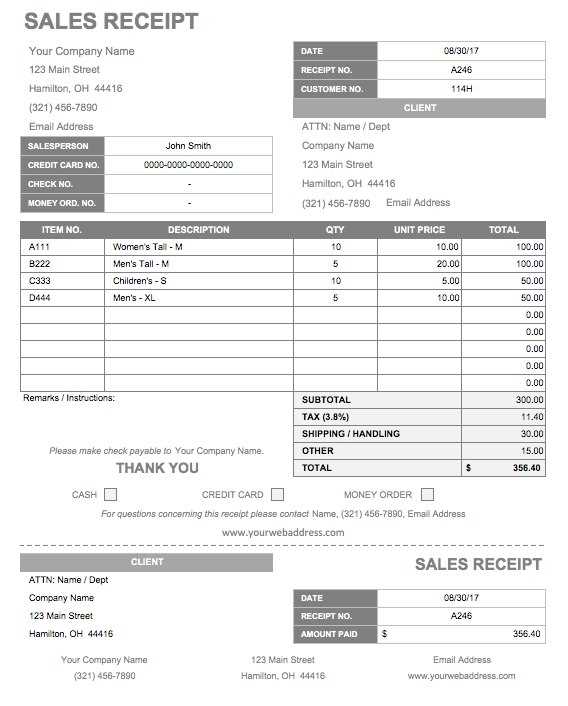

Clear Itemization

List individual items or services paid for, along with their respective costs. This provides transparency and builds trust. If applicable, include dates or references to prior agreements or invoices, ensuring everything is traceable.

Payment Confirmation

Include a statement confirming the receipt of the funds, along with any transaction or confirmation numbers. This serves as an official record for both parties. Make sure the receiver has all the details they need to verify the payment in case of future inquiries.

Template for Receipt of Payment

Design a payment receipt template with clarity and precision. Begin by including essential details such as the payer’s name, date of transaction, amount paid, and a brief description of the service or product provided. Incorporate space for both the payer and recipient to sign if necessary. Ensure that the document is easily readable and includes proper identification numbers, such as invoice or transaction numbers, to trace the payment.

How to Structure a Receipt Template for Legal Transactions

For legal transactions, structure the receipt to cover all potential requirements, including payment terms and conditions. Clearly state the amount and currency, and specify the method of payment used. Mention any taxes or additional fees that were applied. Include legal disclaimers if relevant, ensuring the document complies with local regulations. Specify both the date of payment and the effective date of any service or goods provided. This creates a legally binding record of the transaction.

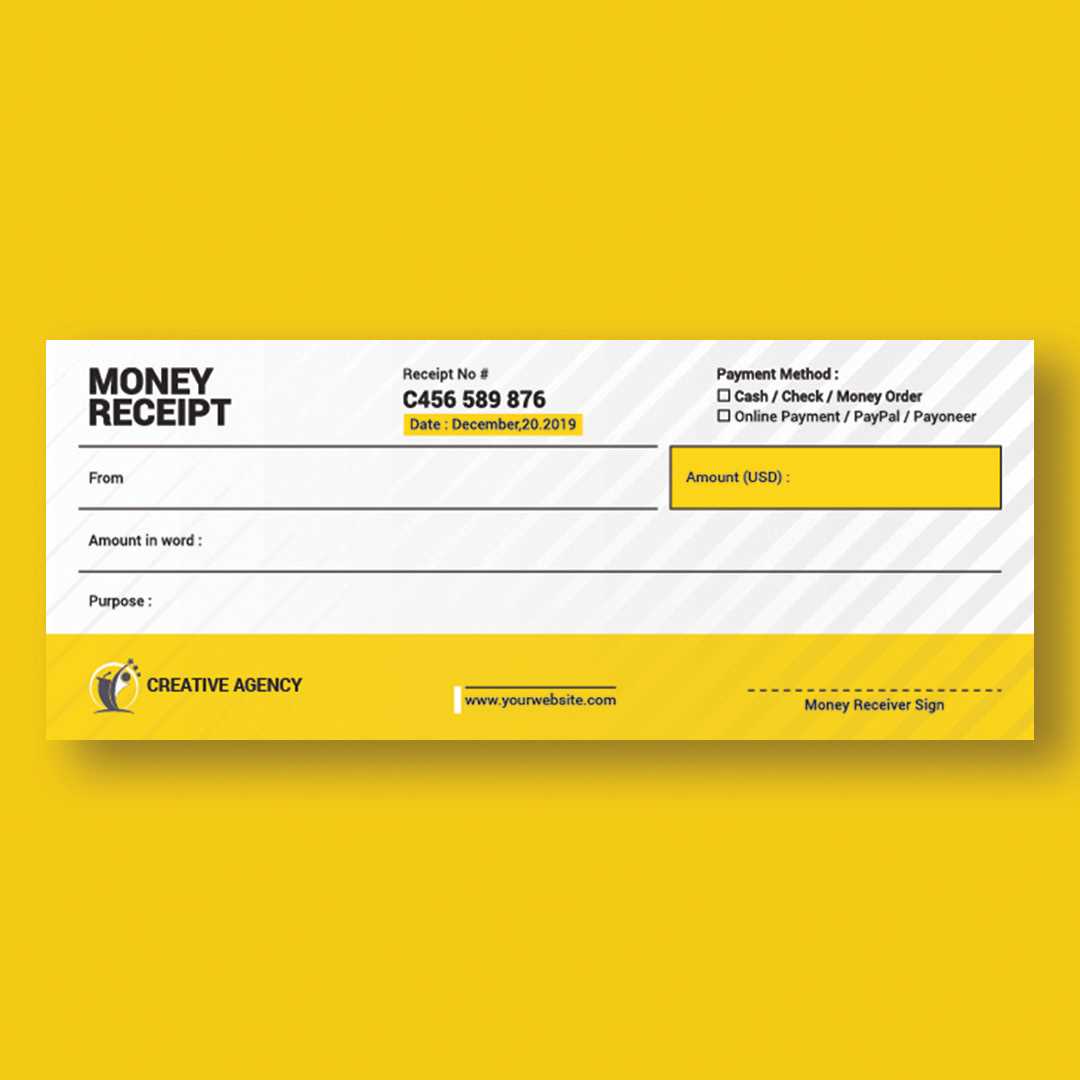

Customizing Templates for Various Payment Methods

Modify the receipt template to accommodate different payment methods. For cash payments, include space for the cashier to indicate the denomination or form of payment received. For digital payments, provide sections for transaction IDs and references to payment platforms, such as credit card or bank transfer details. Tailor the template to reflect specific instructions or confirmations for each payment method used, ensuring consistency in all cases.

Clarity and professionalism are key in every payment receipt template. The design should remain simple and straightforward, with organized sections that can be easily updated as needed. Avoid clutter, focusing on the most critical details. A well-structured template promotes trust and reduces the chances of confusion during or after a transaction.