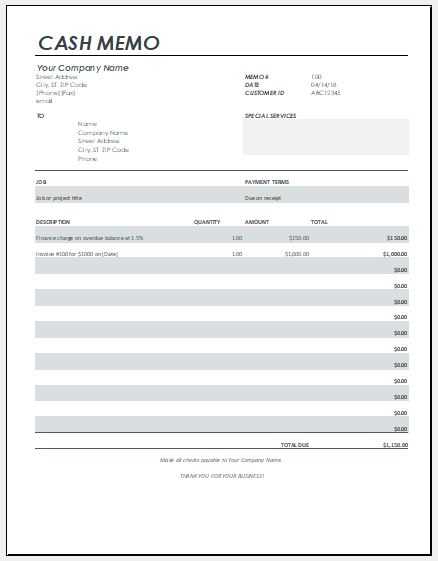

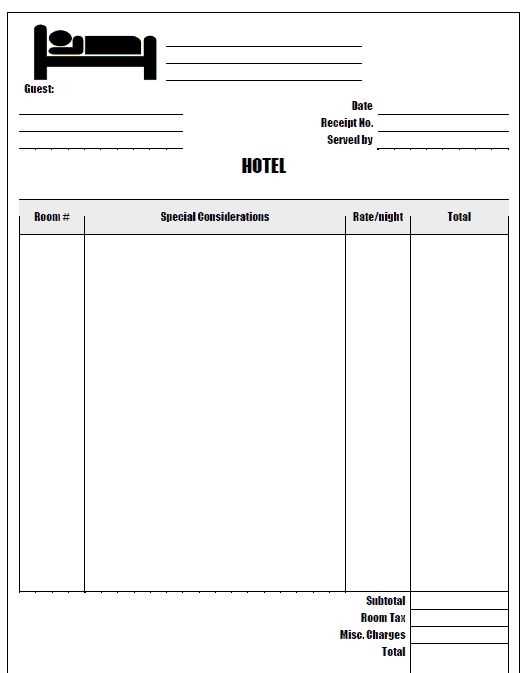

Use a clear structure for your receipt memos to ensure all critical details are captured. Start with the date of the transaction. This helps in tracking when each exchange occurred. Next, list the items or services provided with specific amounts. Keep the descriptions brief but precise for easy reference. Follow this by noting the total cost, which should include any applicable taxes or fees. Clearly distinguish between the subtotal and final price.

Include the payment method used, whether it’s cash, card, or digital transfer. This adds clarity on how the transaction was completed. It’s also helpful to add any invoice or reference number for tracking purposes. Make sure to provide the name of the business or service provider along with contact information in case further clarification is needed.

Lastly, consider adding a thank you message or a brief note about return policies. These small touches enhance the user experience and can help maintain positive business relationships. A well-organized receipt memo template saves time and keeps all necessary information easily accessible.

Here is the revised version with minimal repetition:

Keep the format clean and straightforward. Focus on providing key transaction details without overcomplicating the layout. Include the date, amount, and recipient name clearly. Add a brief description of the service or product for transparency, but avoid unnecessary elaboration. Place this information in a consistent, easy-to-read structure.

Use clear, bold headings to guide the reader’s eye, especially for critical details like payment methods or discounts. Ensure there is adequate space between sections for readability. Avoid repeating the same wording in different areas. If a specific term or phrase appears multiple times, rephrase it to maintain clarity without redundancy.

Conclude with any applicable notes in a concise manner. The goal is to provide a summary of the transaction without overwhelming the reader. Be sure to avoid jargon, making the memo approachable for all users. Lastly, if additional context is required, include it in a short, separate section to maintain flow.

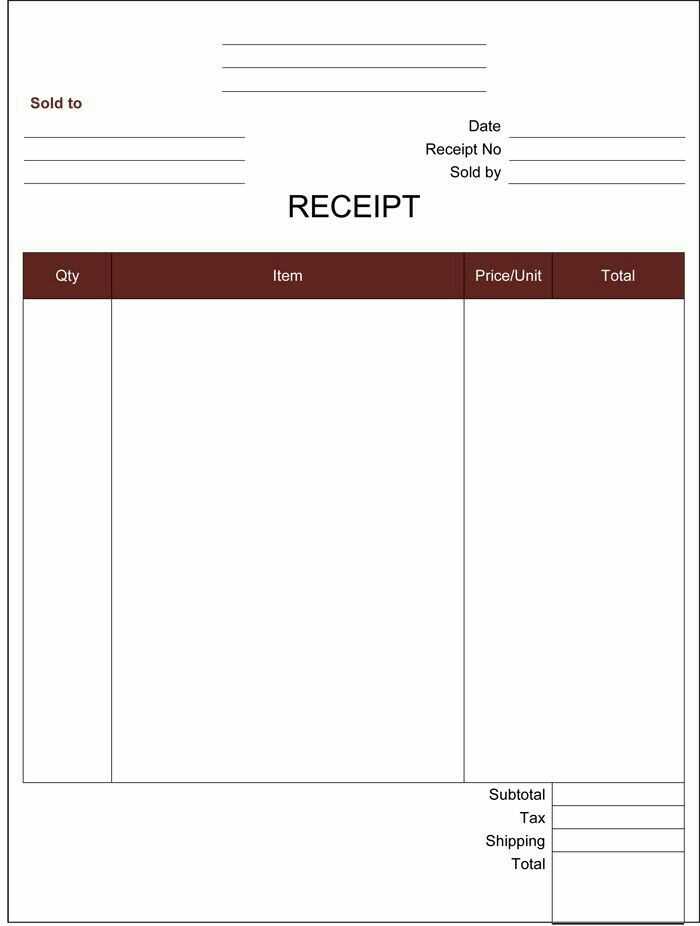

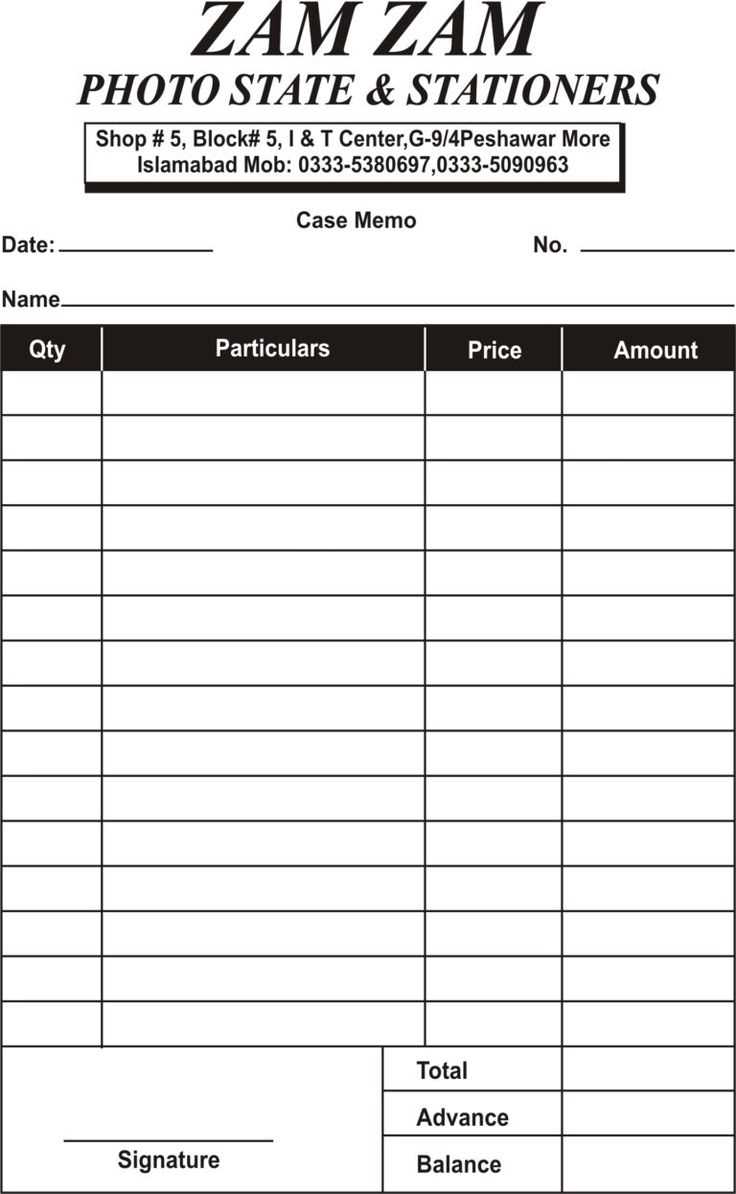

- Receipt Memo Template

A receipt memo template should include key details to ensure clarity. Include the transaction date, a description of the items or services provided, the amount paid, and payment method. Be sure to include the recipient’s name and contact details for future reference. Specify any discounts or taxes applied to the total amount.

For accuracy, each entry should be clearly labeled, and the template should be easy to update with minimal effort. It’s recommended to incorporate a section for both the issuer’s and recipient’s signatures, which adds an extra layer of verification to the document.

To ensure consistency, use a standard format that can be quickly adapted for multiple transactions. Ensure that there is space for additional notes if needed, especially for future reference or follow-up communication.

Begin with a clear layout that includes fields for the date, receipt number, item descriptions, quantity, price, and total amount. These fields are non-negotiable and must be visible for both the customer and the business. Use placeholders in each section, such as [Customer Name], [Transaction Amount], or [Date], to make it easy to fill out each time.

1. Add Customizable Fields

Include sections for additional notes or special instructions that can be tailored for each transaction. Fields like “Discount Applied,” “Tax,” or “Payment Method” can be helpful depending on the type of transaction. Keep these fields flexible to accommodate different situations, from refunds to bulk purchases.

2. Make it Printable and Editable

The receipt should be easy to print or send electronically. To make it even more adaptable, consider designing the template in a format that can be quickly filled out digitally. Using software like Word or Excel allows for efficient updates, and users can save time by reusing the template with minimal changes.

Ensure the template is well-organized and intuitive, with enough space for any additional details that might come up. A clean design makes it easy to modify, whether printing or emailing, while still maintaining professionalism in every transaction.

Use receipt memos to document transactions that might not involve traditional invoices or receipts, such as refunds, exchanges, or partial payments. This ensures clarity and accountability in your financial records. Always include clear information: the date, amount, reason for the transaction, and any additional notes. This will prevent confusion and streamline future reference when reconciling accounts.

Maintain Consistency in Formatting

Adopt a consistent format for your receipt memos across your business. This helps both you and your clients or customers to easily understand the details of any transaction. A clear and uniform layout also helps when organizing your records and enhances your professional image.

Store Memos Digitally

Save receipt memos in a digital format and back them up regularly. This reduces the risk of losing important documents and allows you to access them quickly when needed. Use cloud storage or a dedicated financial management system to organize these files by date or transaction type.

Ensure that every memo adheres to relevant legal and tax regulations by including accurate details and maintaining transparency. Start by clearly identifying the purpose and scope of the memo, ensuring it meets the specific legal requirements associated with its content. Avoid ambiguity, as precise language helps prevent any misinterpretation or future disputes.

Tax Implications

Verify that any financial information, such as amounts or transactions mentioned in the memo, complies with tax laws. This includes providing sufficient details for tax reporting purposes and ensuring any deductions or exemptions are correctly outlined. If applicable, include necessary references to tax codes or regulations that support the mentioned amounts.

Confidentiality and Privacy

Respect confidentiality rules by securing sensitive data. If the memo includes personal, financial, or proprietary information, implement protections that align with privacy laws. Secure handling of data is a key aspect of compliance, especially in industries where strict confidentiality is mandated.

Ensure clarity in your receipt memo by keeping a simple and organized structure. Start with the recipient’s name and contact information, followed by a brief description of the transaction.

- Transaction Date: Clearly list the date to avoid confusion with future memos.

- Amount: Specify the amount involved and break it down if necessary (e.g., taxes, discounts).

- Payment Method: Indicate whether the payment was made via cash, card, or other methods.

- Itemized List: If relevant, include the list of items or services with corresponding prices for transparency.

- Signature: Provide space for both the issuer and the recipient to sign, confirming the transaction.

Additional Recommendations

- Keep the font size readable and maintain proper spacing for ease of review.

- Ensure all fields are aligned for a neat and professional appearance.

This layout makes it easy for both parties to verify and reference key details quickly.