A well-structured salary receipt template in Excel simplifies payroll management, ensuring that each payment is documented correctly. This template helps businesses track salaries, deductions, and net pay without errors. Downloading or creating a template saves time and maintains consistency in financial records.

Excel offers flexibility with built-in formulas to automate calculations. A properly designed template includes fields for employee details, salary components, tax deductions, and payment methods. With dropdown menus and pre-set formulas, errors in payroll processing are minimized.

To create an Excel salary receipt template, use a structured table format. Add columns for basic salary, allowances, deductions, and net payable amount. Apply formulas to automate tax and benefits calculations. Conditional formatting highlights missing data, ensuring accuracy.

Using a ready-made template or customizing your own guarantees clear and professional salary receipts. This not only improves payroll accuracy but also ensures compliance with financial regulations.

Salary Receipt Template in Excel

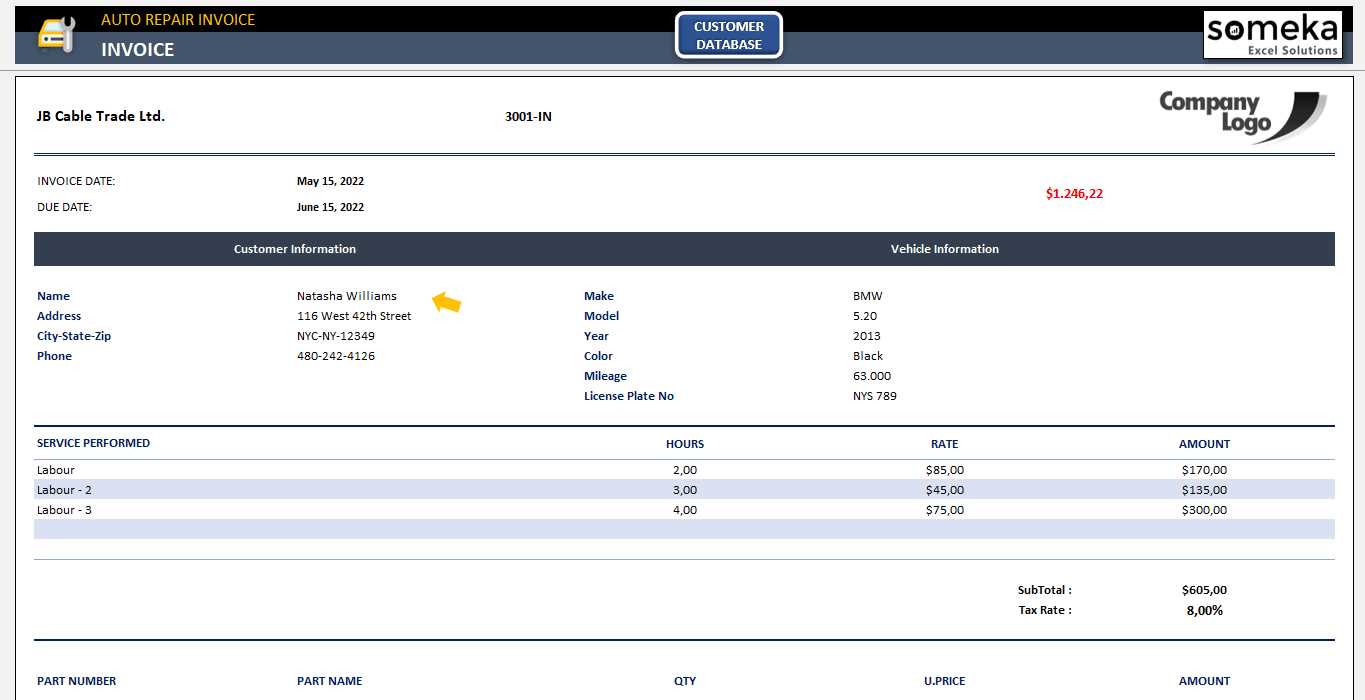

Download a ready-to-use salary receipt template in Excel to streamline payroll processing. This template includes automatic calculations for gross salary, deductions, and net pay, reducing manual work and errors.

Enter employee details, salary components, tax deductions, and any additional earnings in designated fields. The template updates totals automatically, ensuring accurate calculations.

Customize the layout by adding your company logo, modifying currency formats, or adjusting tax rates to match local regulations. Use conditional formatting to highlight overdue payments or discrepancies.

Save completed receipts as PDFs for easy sharing or print them directly. Keep records organized by maintaining a digital archive sorted by month or employee name.

How to Structure a Salary Receipt in Excel

Create a structured salary receipt by organizing key details into clearly defined sections. Use separate columns for employee information, salary components, and payment details to ensure clarity.

1. Define the Header Section

Include the company name, logo (if applicable), and contact details. Add the receipt title, such as “Salary Receipt – [Month/Year]”. Below this, insert fields for the employee’s name, ID, designation, and department.

2. Break Down Salary Components

Use distinct rows for each component:

- Basic Salary – The fixed amount before deductions.

- Allowances – House rent, travel, or medical allowances.

- Deductions – Taxes, insurance, or loan repayments.

- Net Salary – Final amount after deductions.

Format currency values with Excel’s Accounting or Currency format for consistency.

3. Include Payment and Approval Details

Specify the payment method (bank transfer, cash, or check) and the transaction reference number. Reserve space for the employer’s signature or digital approval.

To automate calculations, apply formulas:

- Calculate total earnings:

=SUM(B5:B8) - Calculate total deductions:

=SUM(C5:C7) - Compute net salary:

=B9-C9

Save the template for reuse and protect key fields to prevent accidental modifications.

Formulas and Functions for Automated Calculations

Use Excel formulas to automate salary receipt calculations and reduce errors. Start with =SUM() to total earnings and deductions. For example, =SUM(B2:B5) adds up all income components.

Tax and Deduction Calculations

Calculate tax with =IF() to apply different rates based on salary brackets. Example:

=IF(A2>5000, A2*0.2, A2*0.1)This applies a 20% tax if salary exceeds 5000; otherwise, 10%.

Use =VLOOKUP() to reference tax tables dynamically:

=VLOOKUP(A2, TaxTable, 2, TRUE)Net Salary Calculation

Subtract total deductions from gross salary with:

=B2-SUM(C2:E2)For date-based calculations, use =EOMONTH() to find the last day of a payroll period:

=EOMONTH(TODAY(), 0)Automate overtime pay with =IF() and =HOUR():

=IF(HOUR(B2)>8, (HOUR(B2)-8)*OvertimeRate, 0)These formulas streamline payroll management, ensuring accuracy and efficiency.

Customizing the Template for Different Business Needs

Adjusting a salary receipt template to fit specific business needs ensures clarity and compliance with internal policies. Start by modifying the structure to include only relevant data fields.

Adding or Removing Fields

- Freelancers and contractors: Include project-based payment details instead of fixed salary components.

- Small businesses: Remove complex tax breakdowns if payroll is managed externally.

- Corporate settings: Add sections for bonuses, overtime, and deductions for benefits.

Formatting for Readability

- Use conditional formatting: Highlight overdue payments or discrepancies automatically.

- Adjust currency and tax settings: Align with local regulations by modifying tax formulas.

- Standardize fonts and spacing: Ensure consistency with other company documents.

For automated processing, integrate formulas for gross and net salary calculations. If the template is shared digitally, enable data validation to prevent errors in manual entry.