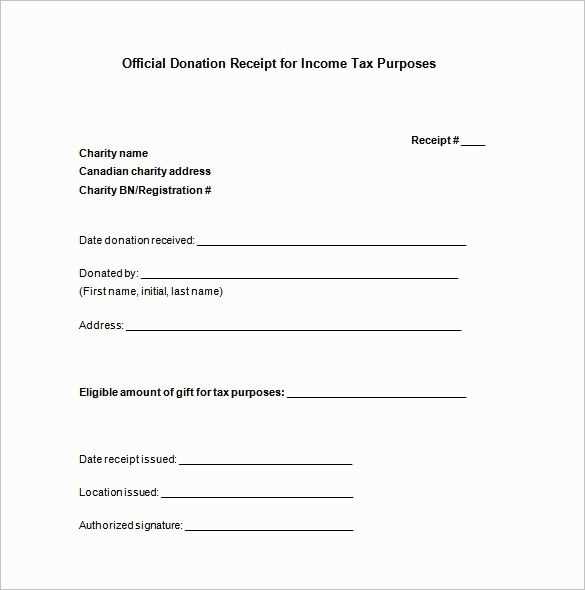

Use a structured donation receipt template to ensure compliance with Canadian tax regulations and provide clear documentation for donors. A well-formatted receipt includes essential details like the donor’s name, the amount contributed, and the issuing organization’s information.

The Canada Revenue Agency (CRA) requires specific elements for a donation receipt to be valid. These include the organization’s full legal name, registration number, date of donation, and a statement confirming that no goods or services were exchanged for the contribution. Missing any of these details could render the receipt ineligible for tax purposes.

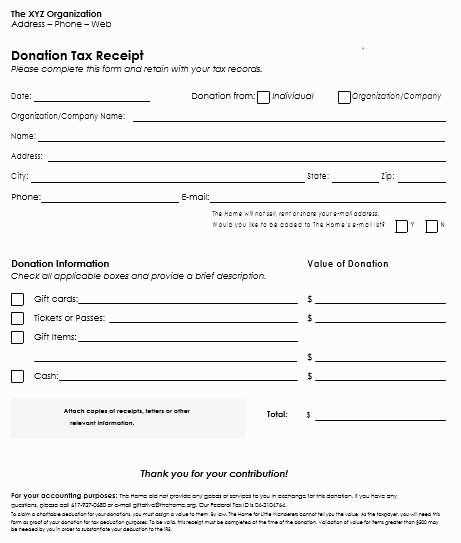

For added clarity, include a breakdown of donated assets, whether cash or non-cash contributions. If issuing digital receipts, ensure they are tamper-proof and accessible for record-keeping. A well-organized template not only meets legal standards but also strengthens donor confidence and encourages future contributions.

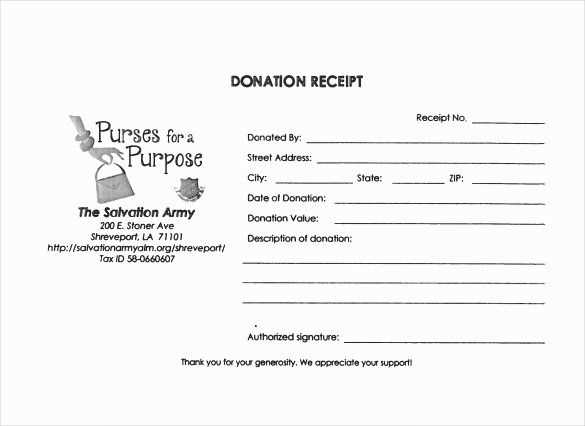

Donation Receipt Template Canada

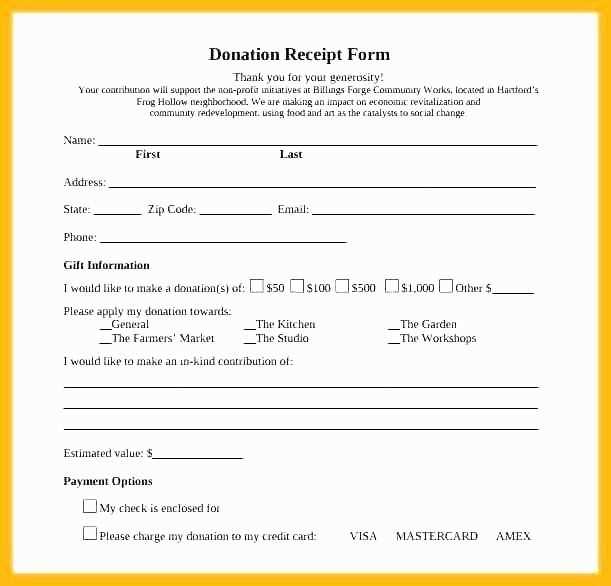

Provide a detailed breakdown of each donation, including donor’s full name, date of contribution, and total amount. For non-monetary gifts, include a clear description of the item and its fair market value.

Mandatory Information

Ensure the receipt contains the charity’s legal name, registration number, and contact details. Clearly state that the receipt is for income tax purposes and confirm no goods or services were exchanged, unless applicable.

Receipt Format

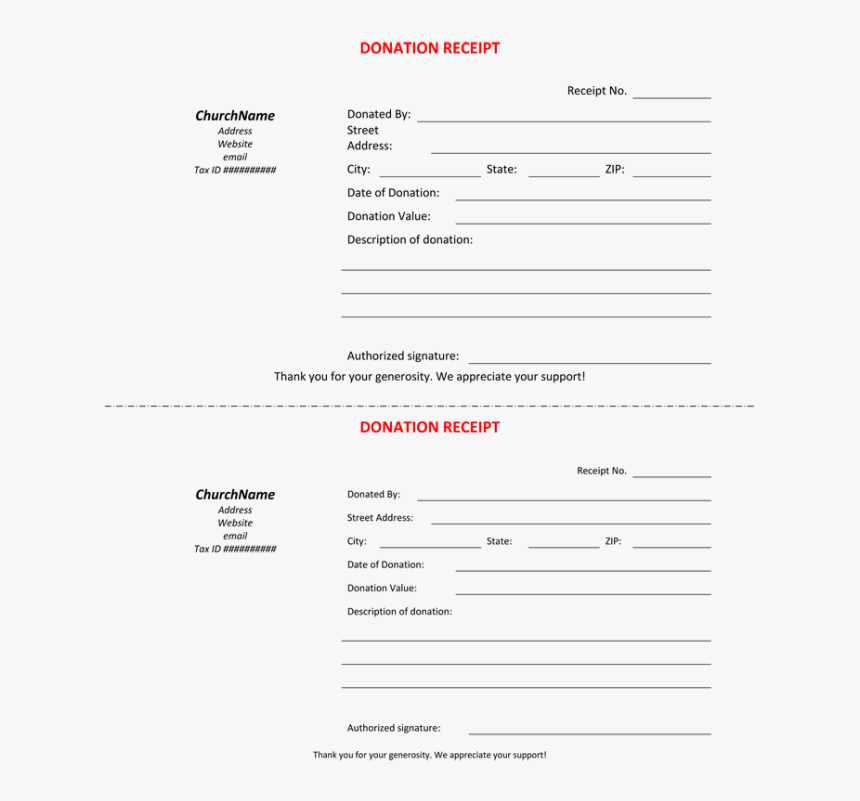

Use a structured format with all required details in a legible layout. Digital receipts are acceptable, but they must be securely stored for at least six years. For paper receipts, ensure they include a signature from an authorized representative.

Required Information for a Valid Donation Receipt

Ensure every donation receipt includes these key details to comply with Canadian tax regulations and provide donors with necessary documentation.

- Charity Name: Use the official registered name as listed with the Canada Revenue Agency (CRA).

- Registration Number: Include the unique CRA-assigned charity number.

- Receipt Serial Number: Assign a unique identifier for tracking purposes.

- Donor’s Name and Address: Record the full legal name and mailing address of the contributor.

- Donation Date: Specify the exact date the contribution was received.

- Amount Donated: For cash gifts, state the total amount given. For non-cash gifts, include a fair market value assessment.

- Description of Non-Cash Gifts: Clearly describe any donated items or securities and their appraised value.

- Official Statement: Include a declaration that the receipt is for an eligible donation and that no goods or services were provided in return, unless applicable.

- Authorized Signature: A representative of the charity must sign to validate the receipt.

- Date of Issue: Indicate when the receipt was created.

Incomplete or incorrect receipts may lead to tax deductions being denied. Always verify details before issuing receipts to maintain compliance.

Formatting Guidelines According to Canadian Tax Laws

A valid donation receipt must include the full legal name and address of the issuing organization as registered with the Canada Revenue Agency (CRA). This ensures donors can claim their charitable contributions without issues.

Mandatory Receipt Details

Each receipt must feature a unique serial number, the donation date, and the donor’s full name and address. Clearly state the amount given and specify whether the contribution was in cash or property. If property was donated, include a brief description and a fair market value assessment.

Signature and Compliance

A receipt is only valid if it contains the signature of an authorized representative of the organization. Electronic receipts must meet CRA authenticity standards, preventing unauthorized modifications. Failure to include these elements can result in rejected claims for tax deductions.

Common Errors and How to Avoid Them

Missing Key Information

Ensure every receipt includes the donor’s full name, donation amount, date of contribution, and charity’s legal name. Without these, the receipt may be invalid for tax purposes. Double-check that the registration number is correct and clearly visible.

Incorrect Wording

Use precise language to confirm that no goods or services were exchanged for the donation. If benefits were provided, list their estimated value separately. Avoid vague statements–Canada Revenue Agency (CRA) requires specific phrasing to ensure compliance.

Review each receipt before issuance. Small mistakes can lead to rejections during tax filing. Automate the process where possible to reduce errors and maintain consistency.