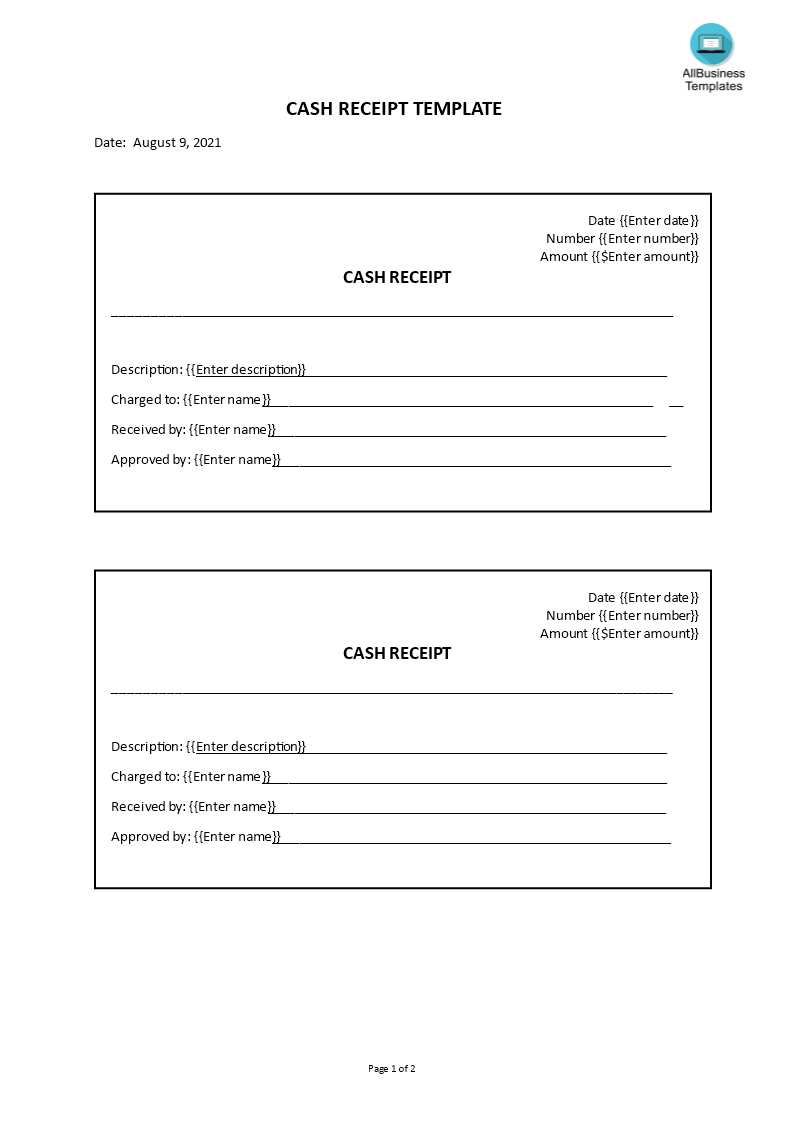

For businesses and individuals who handle cash transactions, a paid cash receipt template provides an efficient way to document and track payments. This template simplifies the process of confirming that payment has been made, offering clarity for both the payer and the recipient. A well-structured receipt ensures that all necessary details are recorded correctly and is a reliable record for accounting purposes.

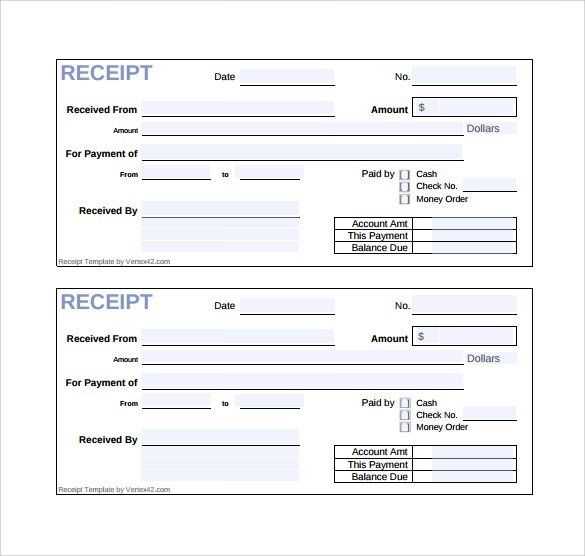

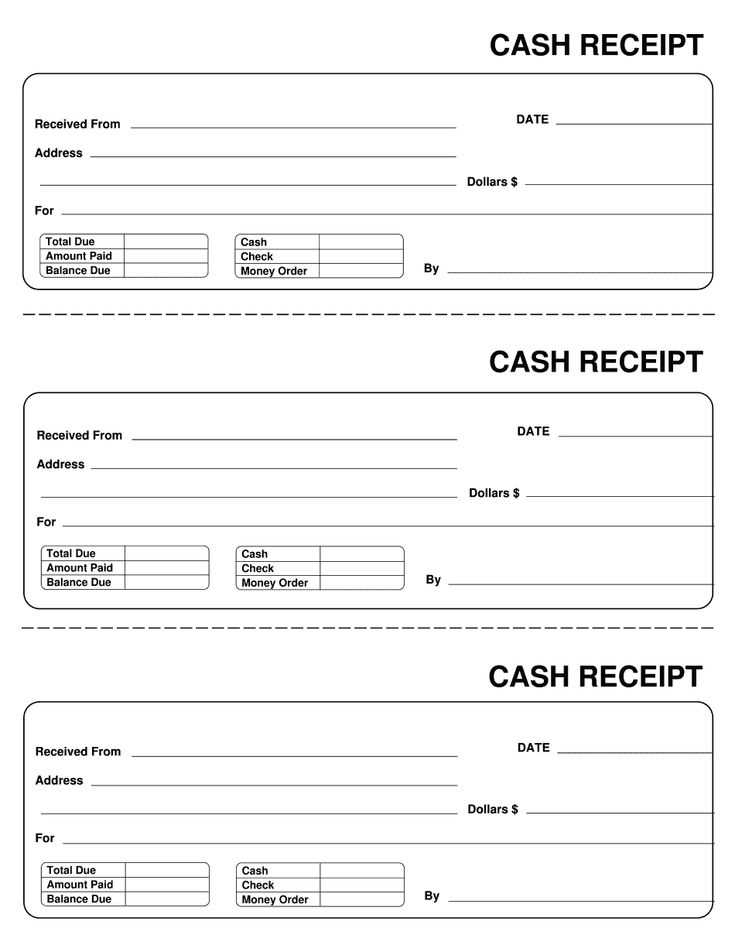

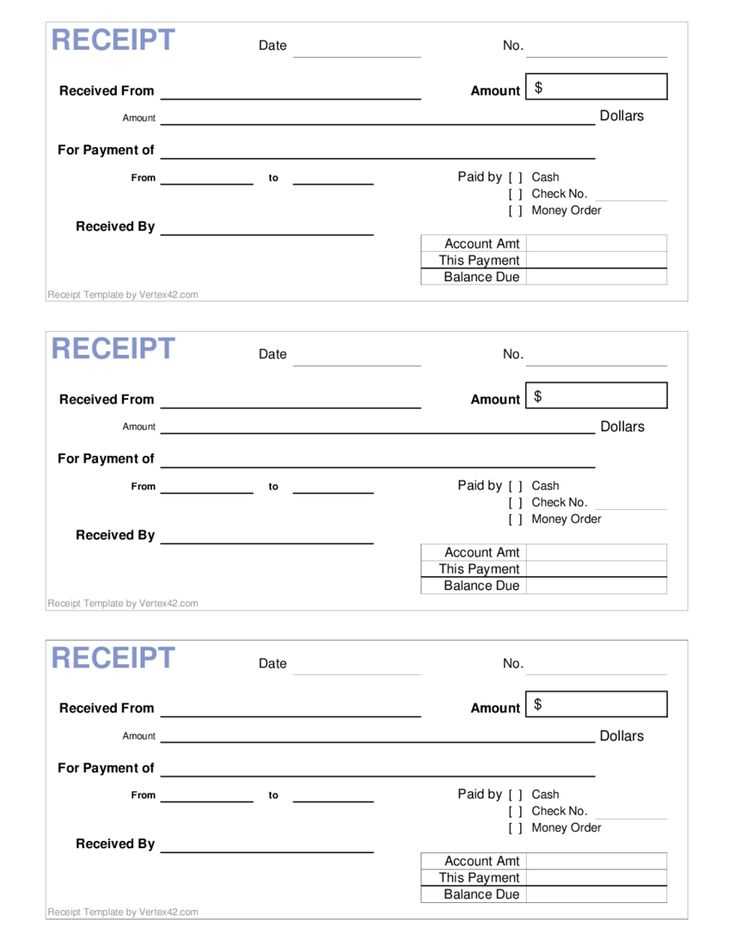

Each paid cash receipt should include key elements like the amount received, the date of the transaction, the payer’s details, and the purpose of the payment. Having these components clearly defined in your template minimizes confusion and keeps your financial records organized. Make sure to use a format that is easy to fill out and store, either in paper form or digitally, to ensure quick access whenever needed.

To create your own paid cash receipt, consider using a simple, user-friendly layout with sections for the payer’s name, the amount paid, the date, and any additional notes about the transaction. A well-organized template helps you avoid missing important information, which is essential for bookkeeping and future reference.

Here are the corrected lines where word repetitions have been eliminated:

Review the following examples to ensure clarity in your paid cash receipt template:

- Original: “The payment was received on the 10th of January, 10th of January 2025.”

Corrected: “The payment was received on January 10, 2025.”

- Original: “The payment amount of $500.00 is the amount of $500.00 received.”

Corrected: “The payment amount of $500.00 has been received.”

- Original: “The payment has been processed, and the transaction has been completed successfully.”

Corrected: “The payment has been processed and the transaction completed.”

- Original: “The client’s payment of $1000.00 was paid on January 5th, January 5th 2025.”

Corrected: “The client’s payment of $1000.00 was received on January 5, 2025.”

- Original: “We acknowledge the payment of $200.00 made by the client, which was made on February 1st, 2025.”

Corrected: “We acknowledge the payment of $200.00 made by the client on February 1, 2025.”

By reducing unnecessary repetitions, you enhance readability and clarity in your template. Each sentence is now concise and clear, ensuring a more professional tone for your documents.

- Paid Cash Receipt Template

A paid cash receipt template serves as an official acknowledgment for payments made in cash. This document is essential for both businesses and customers as it provides a clear, written record of the transaction. A well-structured receipt can help avoid disputes, maintain accurate financial records, and ensure transparency. Below are the key elements you should include when creating or using a paid cash receipt template.

Key Components

- Date: Always include the transaction date. This helps in tracking payment history and aligning with accounting records.

- Receipt Number: Assigning a unique number to each receipt creates a systematic record and makes tracking easier.

- Receiver’s Information: Include the name, address, and contact details of the entity or person receiving the payment.

- Payer’s Information: Specify the name and contact details of the individual or business making the payment.

- Amount Paid: Clearly state the exact amount received in words and numbers to avoid ambiguity.

- Payment Method: Although the receipt is for cash, if the payment was made in part with another method, mention it here.

- Description of Goods/Services: Provide a brief description of what the payment is for, ensuring clarity on the nature of the transaction.

- Signature: A signature from the recipient ensures authenticity, confirming the payment has been received in full.

Customization Tips

- Branding: Personalize the template with your company logo, name, and address to align with your brand identity.

- Legal Compliance: Check local regulations to ensure the template meets legal requirements, particularly in regard to tax information or additional disclaimers.

- Format: Use a clean and readable font. Ensure all information is clearly separated and easy to follow.

With these elements in place, your paid cash receipt will be both professional and functional. Customize it as needed to fit the specific requirements of your business or personal use. Keep it simple, accurate, and clear to ensure both parties are satisfied with the transaction documentation.

To create a paid receipt template, focus on including key details that will serve both your business and your customers. A receipt should be clear, concise, and contain all necessary transaction data. Follow these steps to design a straightforward and useful paid receipt template:

1. Header Section: Begin with your business name, address, phone number, and email. This establishes your identity and makes it easier for customers to contact you in case of inquiries.

2. Receipt Title: Clearly label the document as “Paid Receipt” or “Receipt of Payment” so that the customer knows what it represents.

3. Receipt Number: Assign a unique identification number to each receipt for easy tracking and reference. This helps both parties keep accurate records.

4. Date of Payment: Include the date the payment was received. This is important for both accounting and warranty purposes.

5. Transaction Details: List items or services purchased, along with their respective prices. Include quantities, unit prices, and total amounts to ensure transparency.

6. Total Amount Paid: Clearly indicate the total sum paid by the customer. If a partial payment was made, list the remaining balance.

7. Payment Method: Specify the method of payment used (e.g., cash, credit card, check). If applicable, provide transaction IDs or reference numbers for electronic payments.

8. Thank You Note: A short thank you message can enhance customer satisfaction and encourage repeat business.

9. Footer Section: Include any legal disclaimers or business policies, such as refund or exchange terms, if needed.

To make the template easily accessible, use a software tool like Microsoft Word or Google Docs to create a reusable document. Save it as a PDF for a professional finish or use an invoicing system to automate receipt generation.

| Field | Details |

|---|---|

| Business Name | Your Company Name |

| Receipt Title | Paid Receipt |

| Receipt Number | Unique Identifier |

| Date of Payment | Date Format (DD/MM/YYYY) |

| Transaction Details | Itemized List |

| Total Amount | Sum Paid |

| Payment Method | Cash/Credit Card/Other |

| Thank You Message | Optional |

| Footer Section | Legal Notes (if applicable) |

Tailor your receipt template based on the transaction type. For straightforward sales, include the date, amount, payer’s details, and a brief description. For services, add a section to specify the service provided, hours worked, rate, and applicable taxes.

For payments related to goods, list item descriptions, quantities, and prices. Include a subtotal before taxes for better clarity. For larger transactions, like bulk orders or contract payments, provide a breakdown of the payment schedule, showing installments or future balances due.

For loan payments, include the loan number, payment terms, and outstanding balance. If payments are recurring, add sections for the next due date and any changes in payment amounts. This makes tracking easier and keeps everything organized.

For refunds, highlight the original transaction details and the refund amount. Including the reason for the refund can add clarity and ensure all parties are on the same page.

Ensure your receipt template includes key details like the business name, date, transaction amount, and item description. If applicable, include tax information, such as the tax rate and total tax amount. This is important for compliance with local tax laws and regulations.

Tax Compliance

Verify that the tax rate and amount on the receipt align with the local tax laws. Different regions have varying tax rates, and it’s your responsibility to apply the correct ones. Keep records of these transactions in case of an audit or future reference.

Data Protection

Only collect and store necessary customer information. Avoid asking for sensitive data unless required by law. Ensure that any personal details are securely stored and comply with data privacy regulations like GDPR or CCPA.

By following these guidelines, you minimize legal risks and ensure your receipt template remains compliant with local regulations.

Modifications Made to Avoid Excess Repetition of “Paid” and “Receipt” While Retaining Core Meaning

To improve clarity and reduce redundancy, the wording has been refined without losing the essential message. Instead of using “Paid” and “Receipt” repeatedly, synonyms or alternative phrasing have been applied. This ensures that each statement remains concise and clear.

1. Streamlining Payment Descriptions

In the original template, the word “Paid” often appeared multiple times within a few lines. To avoid repetition, phrases like “payment confirmed” or “transaction completed” are used. These alternatives still convey the same meaning but in a more varied way.

2. Rewording Receipt-Related Terminology

The term “Receipt” has been substituted with “confirmation” or “proof of payment” in some sections. This ensures that the document remains professional and informative without unnecessary redundancy. The core idea of verifying the payment status is still clearly communicated.

These adjustments enhance readability and ensure that key details are easily understood, while minimizing repetitive language.