A holding deposit secures a rental property while the final tenancy agreement is prepared. When accepting a holding deposit, it is essential to provide a clear, written receipt outlining key details. This protects both the landlord and the prospective tenant, ensuring transparency and compliance with UK rental regulations.

The receipt should include the amount paid, the date, the property address, and the names of both parties. It must also specify whether the deposit is refundable and under what conditions. A well-structured template helps avoid disputes and keeps the process straightforward.

UK law limits holding deposits to one week’s rent. If the tenancy proceeds, the deposit is usually applied to the first rent payment or security deposit. If not, landlords must refund it unless the tenant provides false information or backs out. A receipt should state these terms clearly.

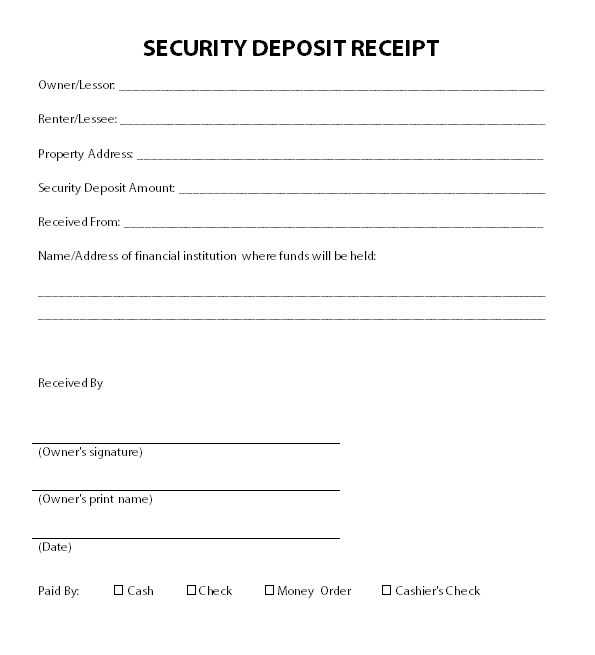

Using a standardized template ensures consistency and legal compliance. It also reassures tenants that their money is handled properly. Below is a simple format to follow when drafting a holding deposit receipt.

Holding Deposit Receipt Template UK

Provide a detailed receipt that includes the tenant’s full name, the property address, the amount paid, and the date of payment. Specify the payment method and reference number if applicable.

Clearly state the terms under which the deposit is refundable or non-refundable. Reference relevant UK legislation, such as the Tenant Fees Act 2019, to clarify legal obligations.

Include the landlord’s or letting agent’s name, contact details, and signature. Ensure both parties receive a signed copy for record-keeping.

Avoid vague wording–use precise terms to outline conditions, ensuring transparency and avoiding disputes.

Key Legal Requirements for a Holding Deposit Receipt

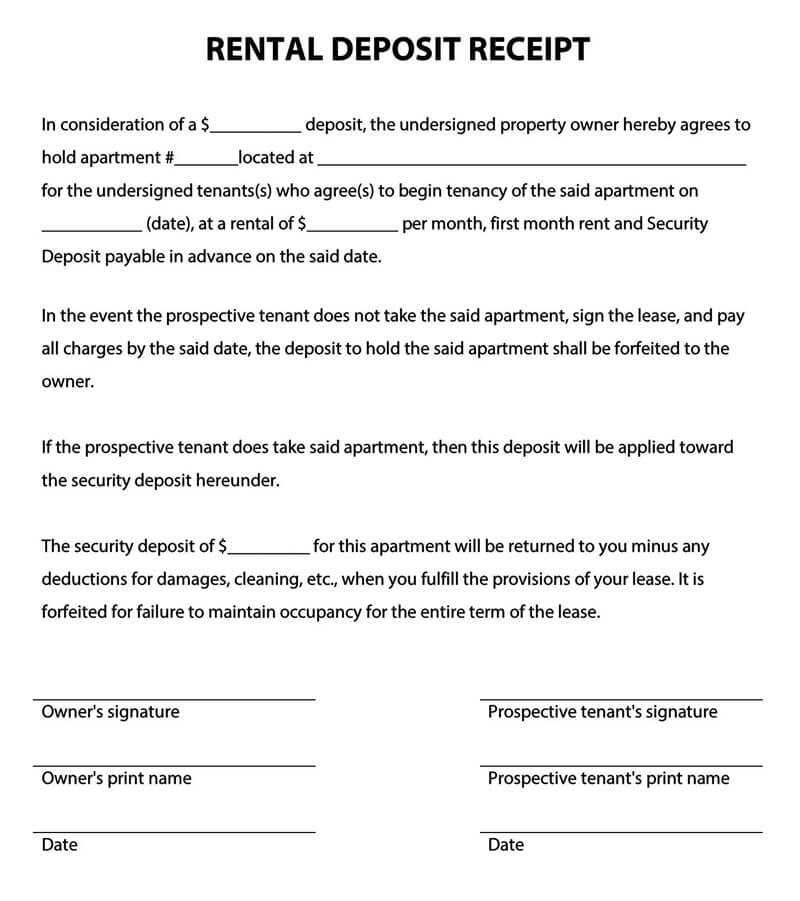

A holding deposit receipt must clearly state the amount paid, the date of payment, and the details of both parties. Without these elements, disputes can arise over terms and conditions.

Mandatory Information

Ensure the receipt includes the property address, the tenant’s full name, and the landlord or agent’s details. The document should outline the terms under which the deposit is retained or refunded.

Compliance with Regulations

In the UK, holding deposits are capped at one week’s rent. The receipt must specify whether the deposit will be deducted from the first rent payment or returned. If the landlord decides not to proceed, a full refund is usually required unless false information was provided by the tenant.

A well-structured receipt protects both parties and prevents misunderstandings. Always provide a signed copy to the tenant for reference.

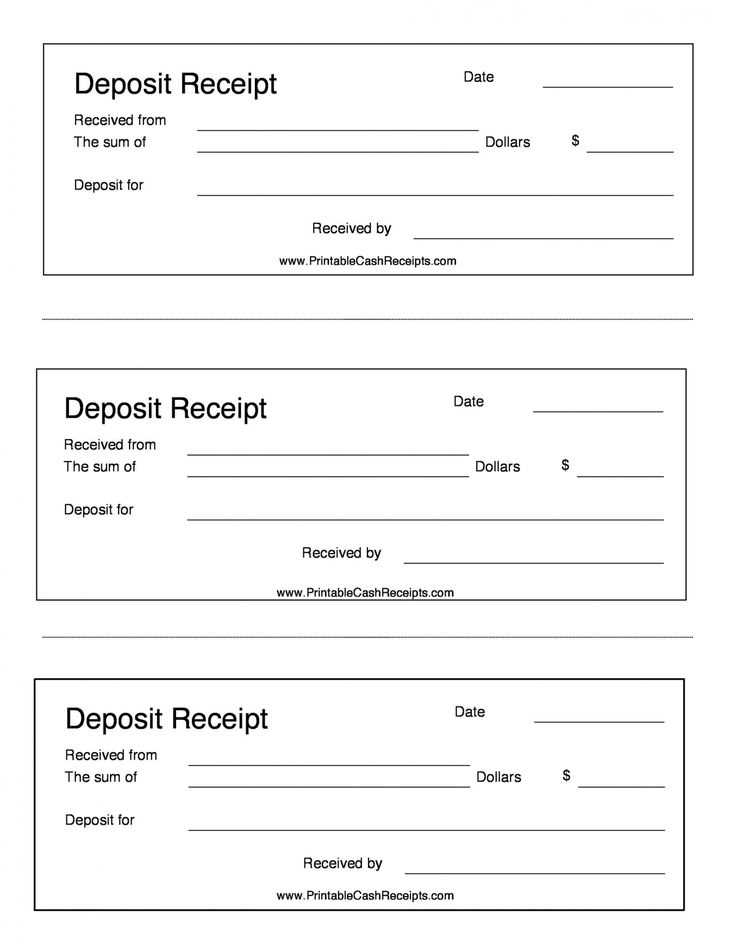

Essential Information to Include in the Template

Tenant and Landlord Details: Clearly list the full names and contact information of both parties. Include addresses to ensure all communication remains transparent.

Property Address: Specify the exact location of the rental unit. A complete address prevents disputes over which property the deposit applies to.

Deposit Amount and Payment Method

State the exact sum received, the currency, and the agreed payment method. If the deposit is paid via bank transfer, include a transaction reference for verification.

Terms of Refund and Forfeiture

Define the conditions under which the deposit is refunded or retained. Mention scenarios such as failure to sign the tenancy agreement or providing false information.

Signatures and Date: Require both parties to sign and date the document. Digital signatures are acceptable if agreed upon in writing.

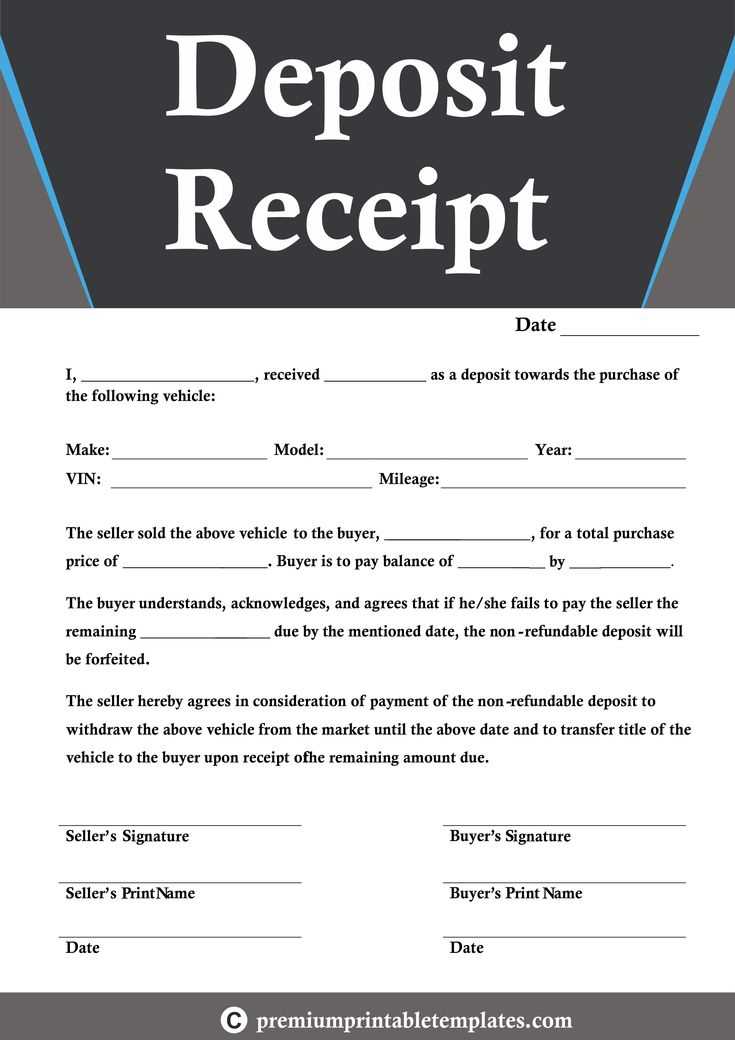

How to Customize the Receipt for Different Tenancy Agreements

Adjust the receipt layout based on the type of tenancy. Short-term lets often require a simpler format, while long-term agreements benefit from detailed breakdowns of payments and conditions.

Include Relevant Payment Details

- Specify the exact amount received and its purpose (e.g., holding deposit, security deposit).

- Mention the due date for any remaining balance, if applicable.

- For periodic tenancies, clarify whether payments will roll over to the next term.

Adapt Wording for Different Rental Structures

- Fixed-Term Leases: State the start and end dates, ensuring the deposit terms align with the contract duration.

- Rolling Contracts: Indicate how the deposit applies if the agreement continues beyond the initial term.

- Company Let Agreements: Include the business name and registered address for clarity.

Always check local regulations to confirm the wording aligns with legal requirements, particularly when handling deposits in protected schemes.