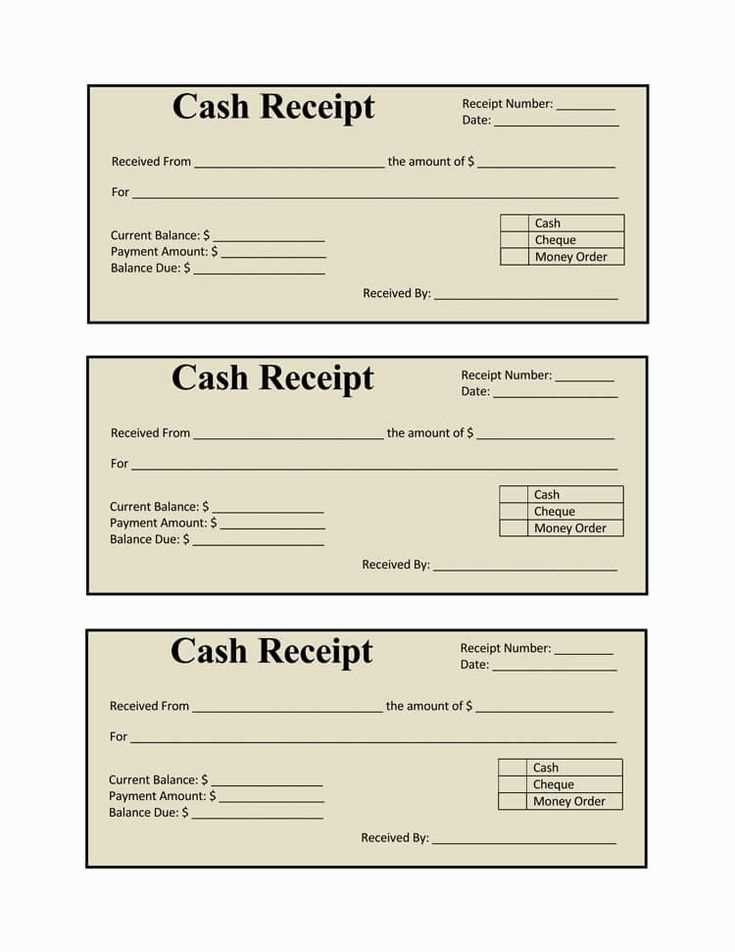

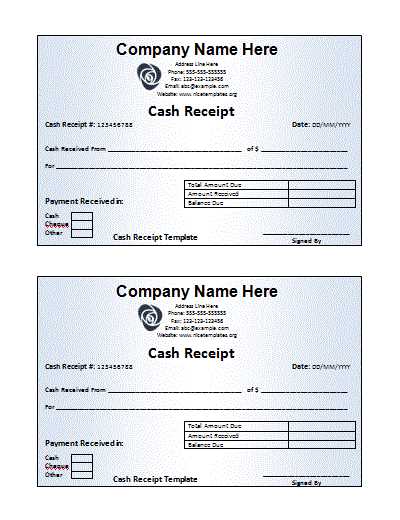

A well-structured cash receipt template helps businesses and individuals track payments with clarity. It should include key details such as the payer’s and recipient’s information, transaction date, amount received, and payment method. Adding a unique receipt number ensures better record-keeping.

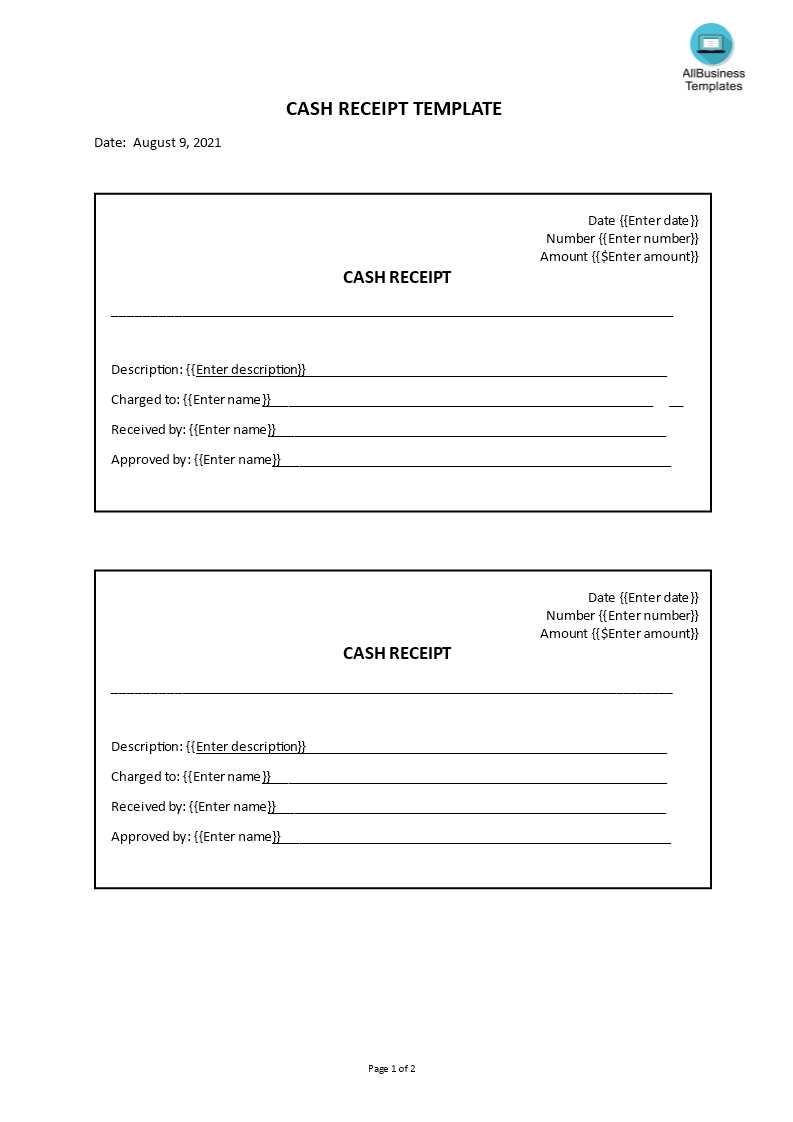

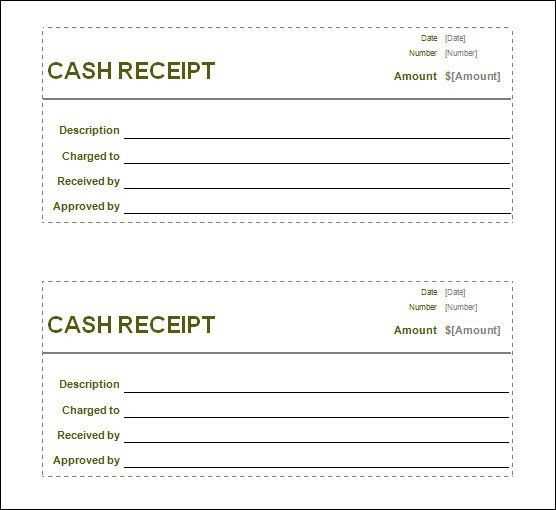

Use clear formatting to make receipts easy to read. Include labeled sections for each detail and consider adding a company logo or digital signature for authenticity. A structured layout improves accuracy and minimizes errors.

For digital receipts, PDFs offer a reliable format, while spreadsheets allow for customization. If creating receipts manually, pre-printed templates with fillable fields save time and maintain consistency.

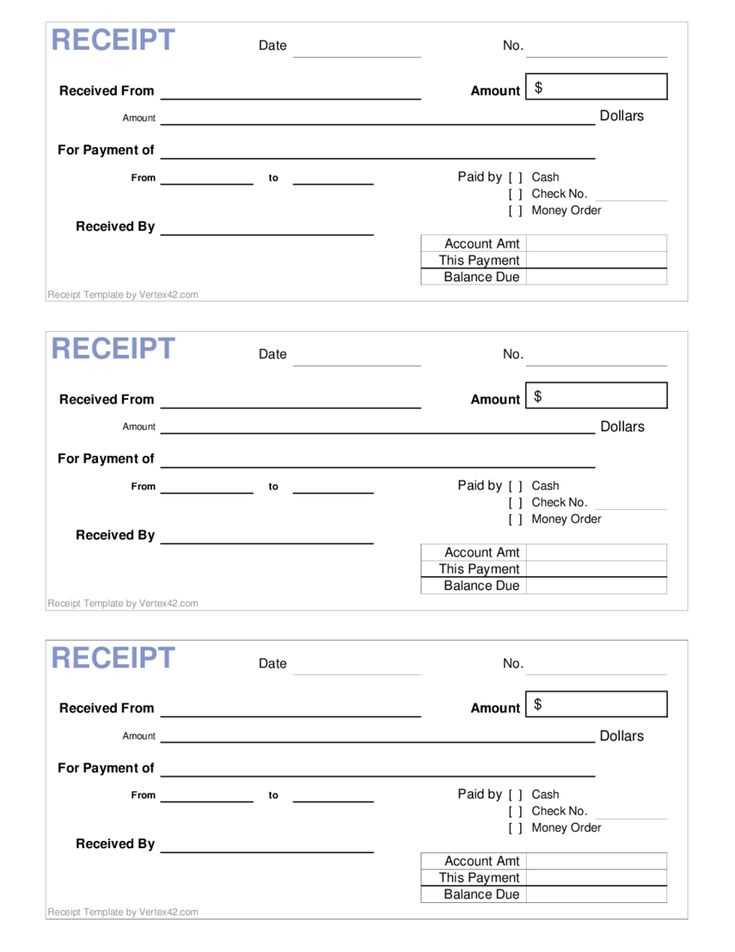

Cash Receipt Document Template

A structured cash receipt template helps track transactions and ensures clarity in financial records. Use a format that includes all key details while maintaining a professional appearance.

Essential Elements

- Date: The exact day the transaction occurs.

- Receipt Number: A unique identifier for easy reference.

- Payer Details: Name and contact information.

- Amount Received: Specify currency and total sum.

- Payment Method: Cash, check, or other forms.

- Description: Brief note on the reason for payment.

- Issuer Signature: Confirmation of transaction completion.

Formatting Tips

- Keep It Clear: Use a structured layout with aligned sections.

- Use Readable Fonts: Avoid overly stylized typefaces.

- Include Branding: Add a company logo or official stamp if applicable.

- Ensure Accuracy: Double-check all details before issuing.

A well-designed cash receipt template improves record-keeping, prevents disputes, and enhances financial transparency.

Key Elements of a Cash Receipt

Ensure every cash receipt includes the date of the transaction. This provides a clear record of when the payment was made and helps with financial tracking.

Payer and Payee Information

Include the name of the person or business making the payment and the recipient. This establishes transparency and accountability, especially in case of disputes.

Transaction Details

Clearly list the amount paid, the payment method, and a description of the goods or services provided. If applicable, include tax details and any discounts applied.

Assign a unique receipt number to simplify organization and referencing. A structured numbering system helps track payments efficiently.

Formatting and Layout Guidelines

Use a clean, legible font such as Arial or Times New Roman, size 12, to ensure readability. Align text to the left for a professional appearance, and maintain consistent spacing between sections to improve clarity.

Include a bold header at the top with the document title, followed by the date and receipt number. Organize information into clearly defined sections, such as payer details, itemized charges, and total amount, to facilitate quick reference.

Ensure sufficient white space around key details to enhance visual separation. Use bold or underlined text sparingly to highlight essential figures, such as the total sum or tax amount, without overwhelming the layout.

Structure tables with defined rows and columns for itemized lists. Keep column widths uniform to prevent text from shifting or becoming misaligned when printed or viewed on different devices.

Place signature lines and additional notes at the bottom with ample spacing to accommodate handwriting. Keep margins at least 0.5 inches to ensure all content remains visible when printed.

Common Mistakes and How to Avoid Them

Skipping essential details leads to disputes. Always include the date, total amount, payment method, and both parties’ names to ensure clarity.

Illegible handwriting creates confusion. Use a clear font if printing or write neatly if filling out by hand.

Omitting serial numbers or item descriptions makes verification difficult. List each item accurately to avoid misunderstandings.

Failing to issue copies leaves no record. Keep one for yourself and provide another to the payer.

Incorrect tax calculations result in compliance issues. Double-check all amounts before finalizing the receipt.

Using vague language causes misinterpretations. Be specific about what was paid for and any terms related to the transaction.

Ignoring formatting consistency reduces credibility. Align text properly, use the same font throughout, and maintain a professional layout.