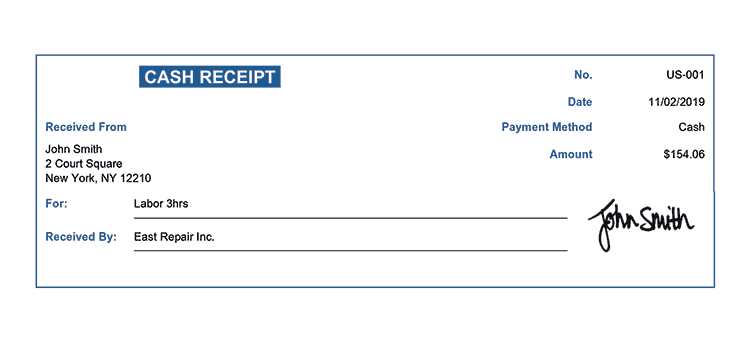

To create a receipt of payment, start by including key transaction details such as the date of payment, amount paid, and method of payment. This allows both parties to easily track the financial exchange. Each receipt should clearly identify the payer and payee, including names and contact information if necessary.

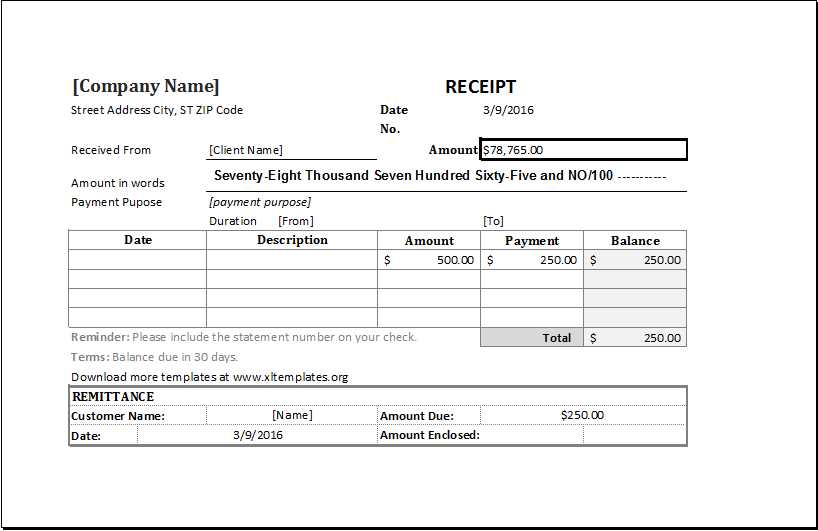

Receipt Structure: The basic structure of a receipt includes the receipt number, payment details, and a breakdown of services or goods purchased. If applicable, you should add a section for taxes or discounts, ensuring transparency in the amount due and paid.

Sample Receipt Template: Begin with a header that includes your business or personal details. Follow this with the transaction date, a unique receipt number, and an itemized list of purchased goods or services. Finally, note the total paid, including any taxes or discounts, and specify the payment method. Don’t forget to include a space for signatures or approval if needed.

Here’s the revised version without word repetition:

Begin by listing the payer’s name and the recipient’s details. Clearly indicate the amount received, followed by the method of payment. Include the transaction date and any reference number for clarity. Add a brief description of the goods or services paid for. Lastly, ensure that the document is signed by the recipient or authorized personnel, confirming the payment.

- Sample Template for a Payment Receipt

Here is a clear and concise template for a payment receipt. It covers all necessary details while keeping things straightforward.

- Receipt Number: Unique identifier for each transaction.

- Date of Payment: The exact date the payment was made.

- Amount Paid: The total sum received, including currency notation.

- Payment Method: Specify whether it was cash, card, bank transfer, etc.

- Sender Information: Name and contact details of the person making the payment.

- Receiver Information: Name and contact details of the party receiving the payment.

- Transaction Details: A brief description of the service or product exchanged.

- Signature: For verification, include space for both sender and receiver signatures.

Ensure all sections are filled out accurately to maintain transparency and avoid confusion. The template should be used for documenting and confirming payments of any type.

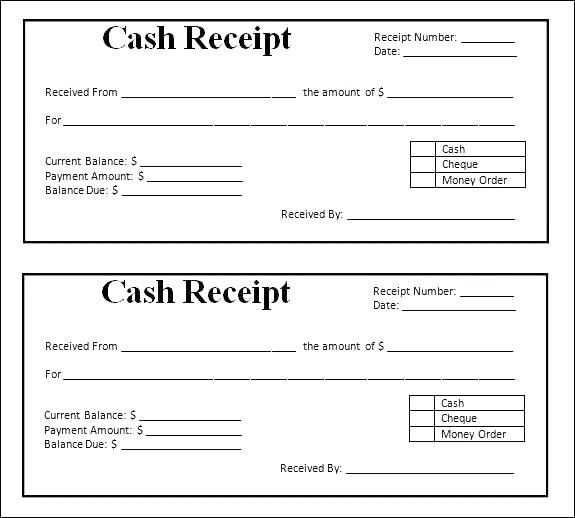

Include the following key details to ensure clarity and accuracy in a payment acknowledgment:

- Transaction Date: Clearly state the exact date the payment was received.

- Payment Amount: Specify the amount received in both numerical and written form for transparency.

- Payment Method: Indicate how the payment was made (e.g., credit card, bank transfer, check).

- Sender’s Information: Include the payer’s full name or business name and contact details.

- Recipient’s Information: List the name and contact details of the entity or person receiving the payment.

- Invoice or Reference Number: Mention any relevant invoice or reference number that links the payment to the specific transaction.

- Transaction ID: Provide any unique transaction ID for record-keeping purposes.

- Balance After Payment: If applicable, state the remaining balance after payment.

- Payment Description: A brief description or purpose of the payment can be helpful, especially in business transactions.

Keep the layout clean and straightforward. Use clear headings for key sections, such as “Payment Details,” “Transaction Date,” and “Amount Paid.” Ensure the font is legible, like Arial or Times New Roman, and the text is appropriately spaced to improve readability.

Align the information in a structured manner. Place the company or individual’s name and contact information at the top, followed by the date and invoice number. Ensure the payment amount is bolded or highlighted, making it easy for the recipient to spot quickly.

Use consistent formatting for numbers and dates. Stick to one format for currency (e.g., “$123.45”) and dates (e.g., “MM/DD/YYYY”). This reduces confusion and ensures the document appears polished.

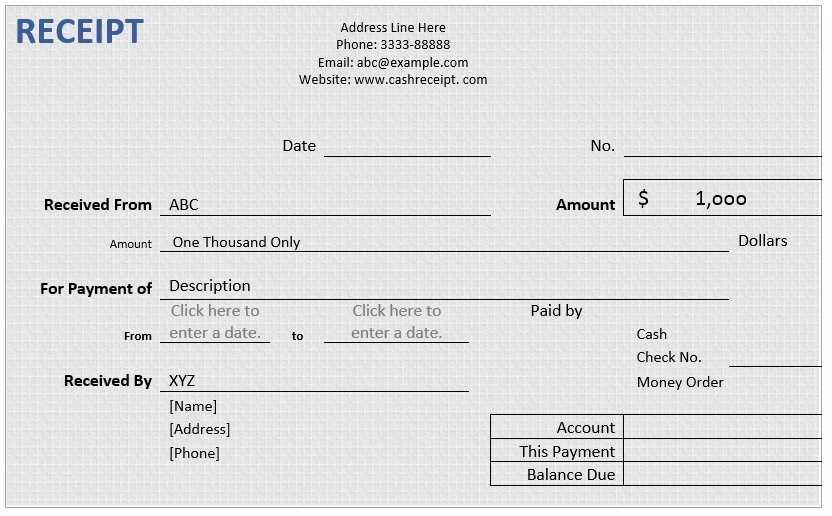

Consider incorporating a table to organize itemized charges, if applicable. Label each row clearly, listing the item description, quantity, rate, and total. This transparency builds trust and ensures accuracy in the payment process.

Leave enough white space around each section to avoid a cluttered appearance. This not only makes the document easier to read but also gives it a more professional and balanced look.

Include a section for payment instructions, such as the method of payment accepted (bank transfer, credit card, etc.) and any relevant reference numbers or account details. Make sure this section is easy to find and clearly marked.

Adjust the layout of your receipt template to suit your needs. Begin by modifying the header to include your business name, logo, and contact information. Ensure the design is clean and easy to read, avoiding unnecessary elements that could distract from the essential details.

Next, personalize the receipt fields. Customize areas like the receipt number, transaction date, items purchased, and total amount. Add any relevant tax information, payment method details, or order references that might be useful for both you and the customer.

Use a table to organize the items and their prices clearly. Below is an example of a basic receipt table structure:

| Item Description | Unit Price | Quantity | Total |

|---|---|---|---|

| Product A | $10.00 | 2 | $20.00 |

| Product B | $15.00 | 1 | $15.00 |

| Total | $35.00 | ||

Ensure that all text is legible and well-spaced. Adjust font sizes and colors where necessary, and make sure the template is mobile-friendly if it’s being sent digitally. Finally, save your customized template for future use and consider making it available in multiple formats for flexibility, such as PDF or HTML.

Providing Clear Payment Details

Include the payment amount, date, and any transaction reference number on the receipt. This ensures clarity for both the payer and recipient. Make sure to list the exact payment method used, such as cash, check, or bank transfer, alongside any relevant account details.

Include Both Party Information

Identify both the payer and the payee with full names and contact information. This helps avoid confusion in case of disputes and ensures that both parties can be easily reached if necessary. If applicable, include the company name or position for added clarity.