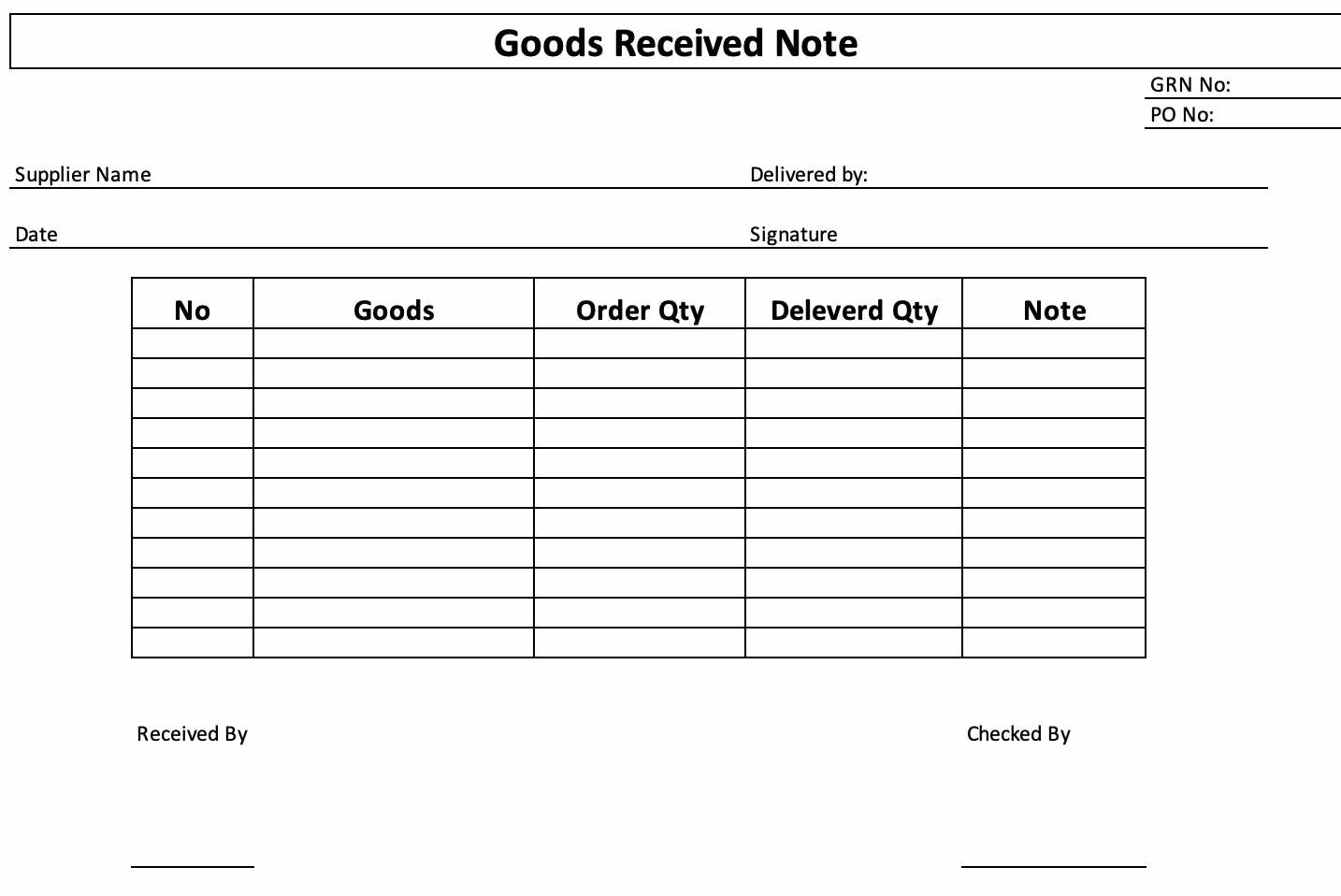

Creating a corporate distribution receipt template streamlines the tracking of goods and services within a business. The template should include fields for details such as recipient information, date, distribution method, items or services provided, quantities, and signatures. Be clear and concise in labeling each section to ensure accurate documentation.

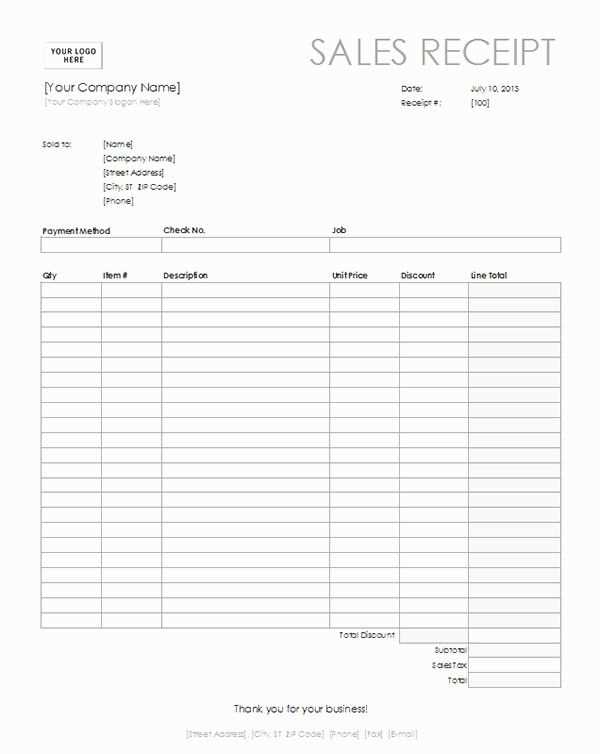

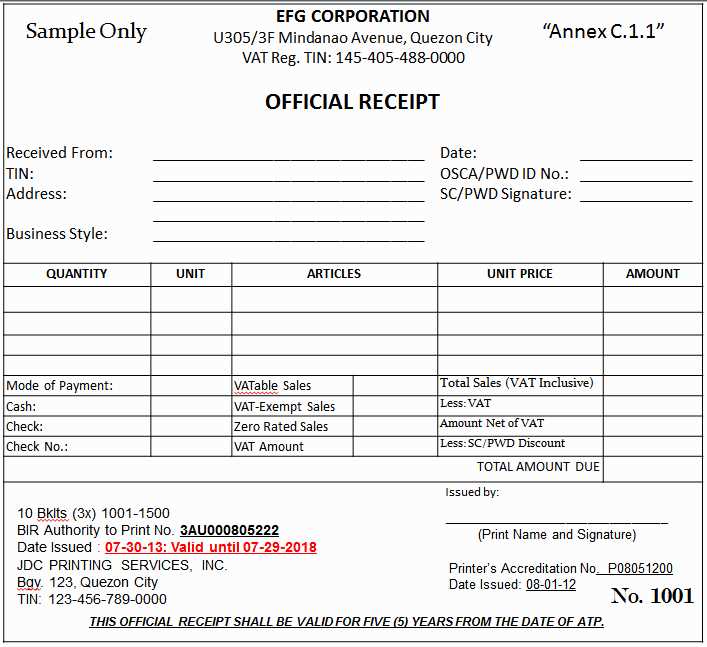

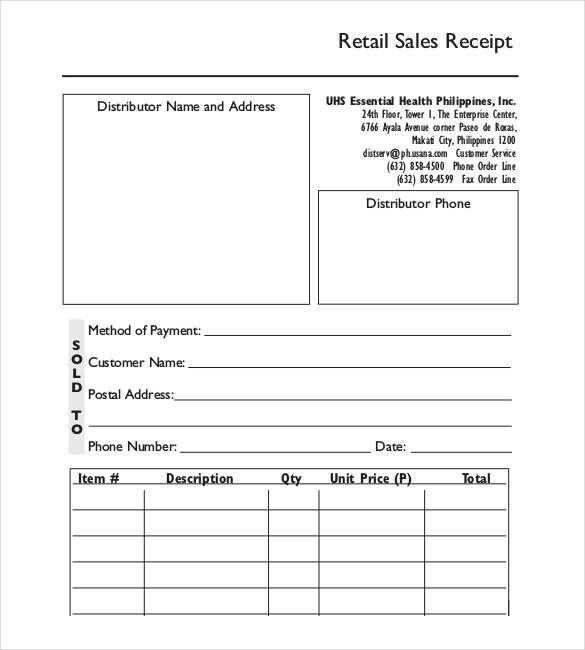

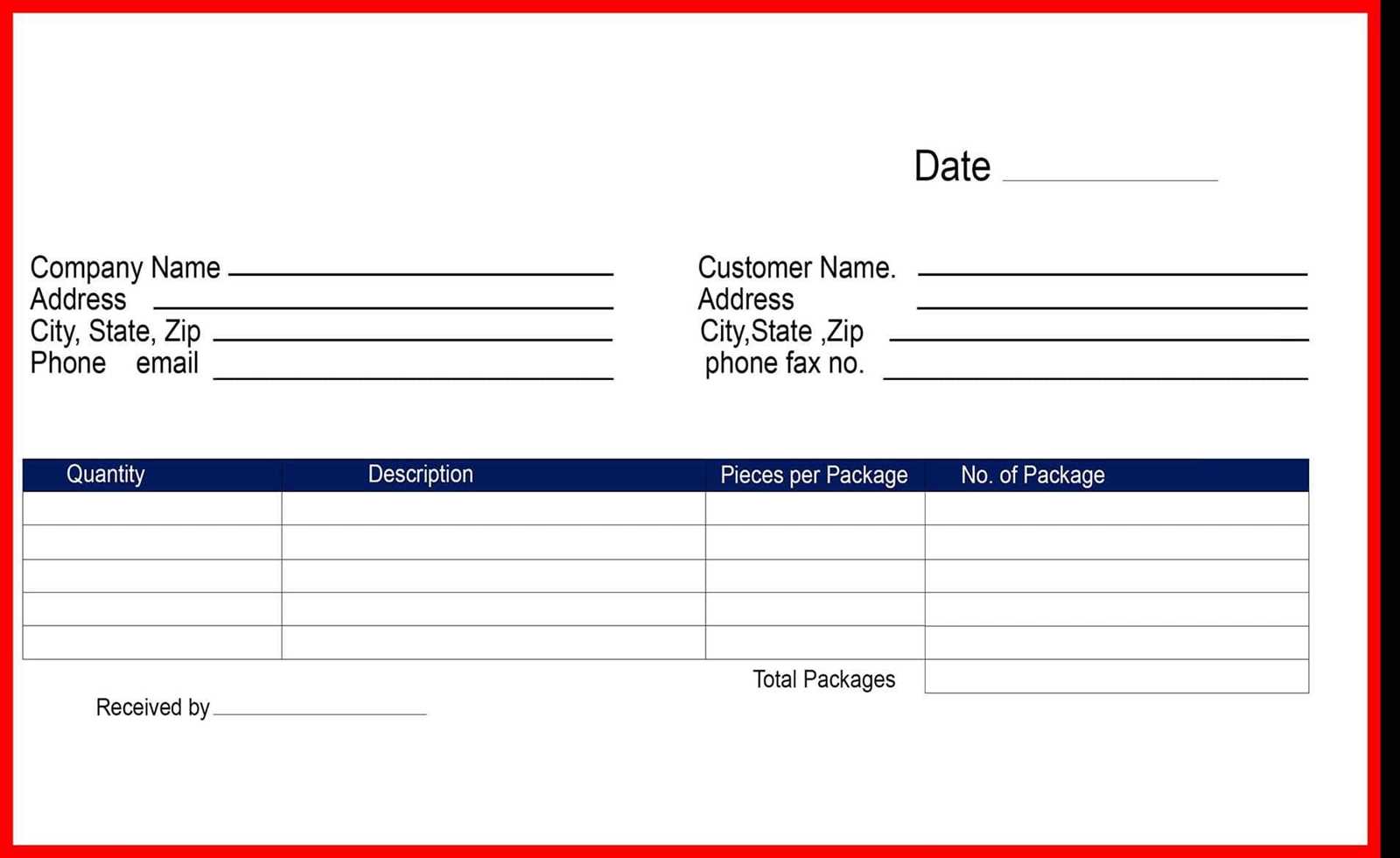

Start with an organized header section to capture essential data such as the company’s name, address, and contact information. Make sure the recipient’s name, company details, and any relevant references are clearly presented. This minimizes confusion and ensures both parties are on the same page regarding the distribution.

Next, use a table format to list the items or services provided, along with corresponding quantities and unit prices. This section serves as the core of the receipt, providing transparency and clarity. Include an area for any taxes, fees, or discounts applied, so the final total can be easily calculated.

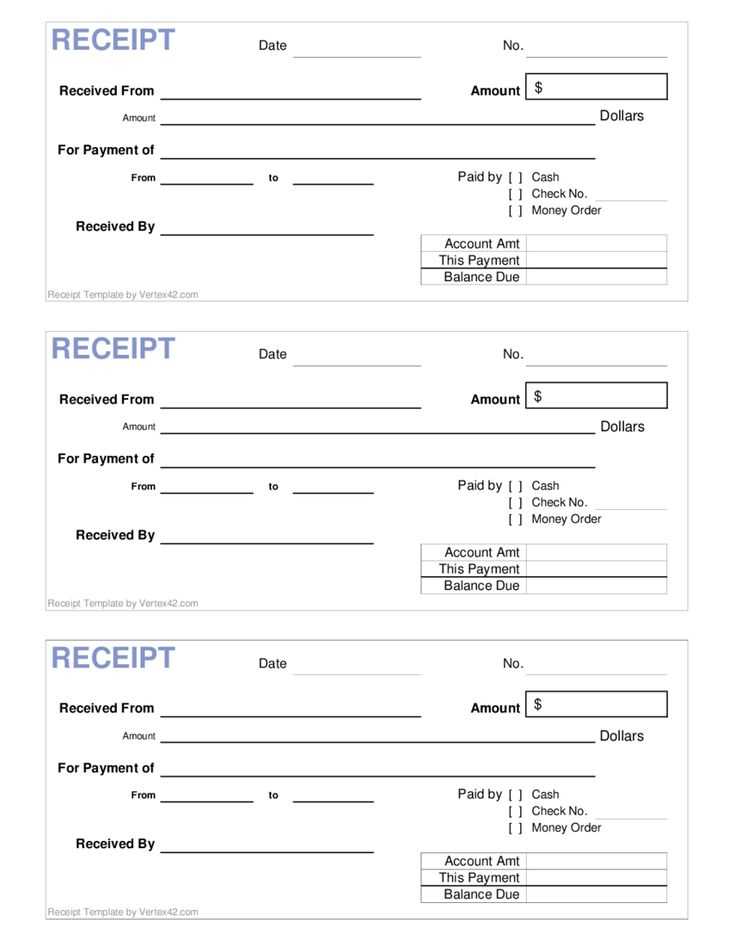

Lastly, provide spaces for signatures from both parties to confirm the distribution. This step guarantees that both the sender and the recipient acknowledge the transaction and agree on the details. Be sure to include a date field, marking the official record of the distribution.

Here is the revised version with duplicates removed:

For clarity and accuracy in your corporate distribution receipt, ensure that each field is clearly labeled. The sender’s details, including the full name, address, and contact number, should be easy to locate. The recipient’s information must be accurate to avoid any confusion during the distribution process.

Include a detailed breakdown of the items or services distributed, specifying quantities, descriptions, and any relevant serial or identification numbers. This ensures both parties can easily verify the contents.

The total amount or value of the distribution should be clearly stated, including any applicable taxes or fees. Double-check the calculations to maintain transparency.

Always use consistent date formatting to avoid misunderstandings. The date of distribution should be marked prominently at the top of the document.

Ensure your signature or authorization line is included to validate the transaction. If electronic signatures are used, make sure they comply with legal requirements for electronic documentation.

Lastly, if applicable, add any relevant terms and conditions or follow-up instructions to ensure smooth operations and future reference.

Corporate Distribution Receipt Template

A Corporate Distribution Receipt should capture all key details of a transaction or distribution between a corporation and an individual or entity. This document serves as both proof of receipt and a record for financial tracking. Make sure to include the following elements:

Key Information

Start by clearly identifying the company and recipient. Include the full legal name of the corporation and the name or company of the recipient. Add the date of the distribution, along with a unique receipt number for easy tracking. Specify the amount or value of the distribution and the payment method (e.g., cash, check, wire transfer).

Detailed Description

Provide a brief but clear description of the nature of the distribution, whether it is a dividend, payment, refund, or any other form of corporate distribution. Include any terms related to the distribution, such as conditions or relevant agreements between the parties involved.

Make sure to note any relevant tax implications and retain documentation that supports the amount distributed. This will help maintain accuracy during audits or financial assessments.

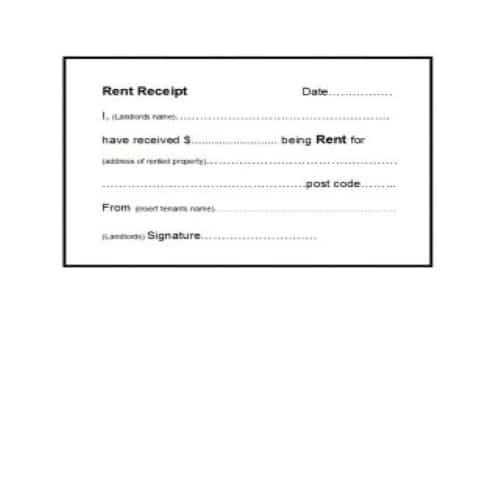

A receipt should capture all necessary details for both the buyer and seller. Start with clear identification of the business or service provider. Include the full name of the company, physical address, and contact details, such as a phone number or email address. It helps with recognition and future contact if needed.

Transaction Information

Each receipt must contain a precise record of the transaction. Include the following:

| Item/Service Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product Name | 1 | $20.00 | $20.00 |

| Product Name | 2 | $15.00 | $30.00 |

Include the date of the transaction and the method of payment (cash, credit, etc.). A unique receipt number is critical for record-keeping and verification.

Tax and Total Calculation

Clearly display any applicable taxes, including sales tax or VAT, with an easy-to-read breakdown. Show the subtotal before tax and the final total after tax to avoid confusion.

Begin with a clear header that identifies the document’s purpose. Include company details at the top, such as the name, address, and contact information, followed by the recipient’s details. Be sure to list the receipt number for easy reference. Organize sections logically: start with the date of the transaction, then list the items or services delivered, along with their quantities, prices, and totals. Include any applicable taxes or additional fees at the end of this section.

Breakdown of Key Information

Provide a clear, itemized list. For each item, specify the name, description, unit price, and total amount. If applicable, use clear separation between categories to avoid confusion. Calculate the subtotal for each section, followed by a final total. This helps both the sender and receiver easily track the transaction details.

Closing Details

Finish with the payment method, due dates, and any terms or conditions related to the receipt. Include a space for signatures if necessary, and ensure there’s an area for any additional notes or instructions. Clear formatting improves readability and ensures both parties have all necessary information in a concise format.

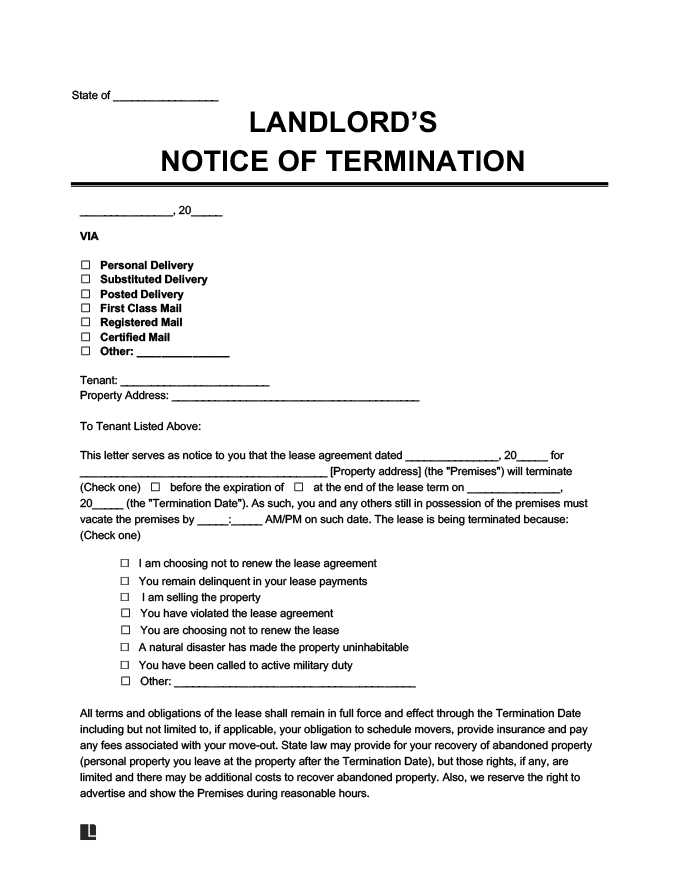

To ensure proper handling of corporate distribution receipts, it is necessary to address key compliance and legal requirements. Below are specific guidelines to follow:

- Verify all information complies with local tax laws, including accurate reporting of transaction details such as product types, quantities, and values.

- Ensure proper documentation for sales tax calculations. Always cross-check the sales tax rates according to the jurisdiction where the sale occurs.

- Maintain clear records that align with both internal accounting standards and external regulatory requirements, such as financial audits and government inspections.

- Consider the privacy of sensitive customer information. Secure the personal details included in receipts to avoid legal breaches under data protection laws like GDPR or CCPA.

- Abide by industry-specific regulations, especially in sectors like healthcare or finance, where additional legal rules apply to distribution receipts.

By following these steps, businesses can maintain legal compliance, minimize risks, and improve operational efficiency.

For a clear and efficient corporate distribution receipt, focus on the key details: transaction date, parties involved, quantity of items, and value. Ensure every item is clearly listed with precise descriptions to avoid misunderstandings.

Include Basic Details

Begin with the date of the transaction and the names or company details of the distributor and recipient. Include any relevant reference numbers or internal codes that could simplify tracking and reporting.

List Distributed Items Clearly

Each item should be clearly listed, with a brief description, quantity, and individual value. Group similar items together and provide the total for each group, followed by a grand total at the bottom of the receipt. If applicable, include tax or shipping charges separately for transparency.