How to Create a Clear and Professional Cash Expense Receipt

A well-structured cash expense receipt ensures accurate record-keeping and transparency in financial transactions. Follow these steps to create a receipt that includes all necessary details.

Key Elements to Include

- Date: The exact date of the transaction.

- Receipt Number: A unique identifier for tracking.

- Payer and Payee Details: Full name and contact information.

- Amount: The exact cash amount received.

- Purpose: A clear description of the expense.

- Payment Method: Indicate that cash was used.

- Authorized Signature: Signature of the recipient or issuer.

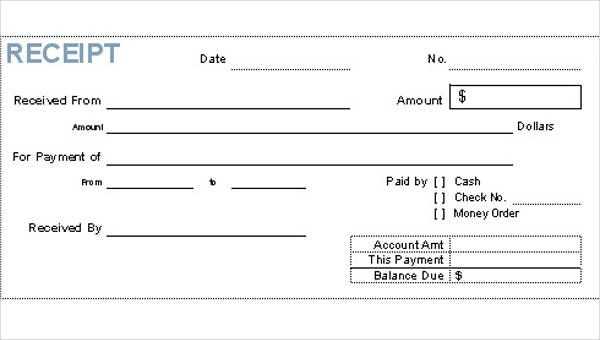

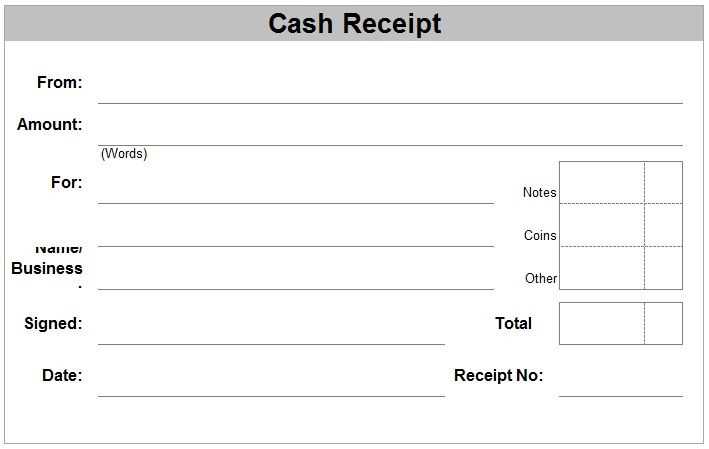

Simple Template Format

Use this structure for a quick and organized cash receipt:

Receipt No: [Unique Number] Date: [MM/DD/YYYY] Received from: [Payer’s Name] Amount: $[Amount] Purpose: [Expense Description] Received by: [Payee’s Name] Signature: ___________

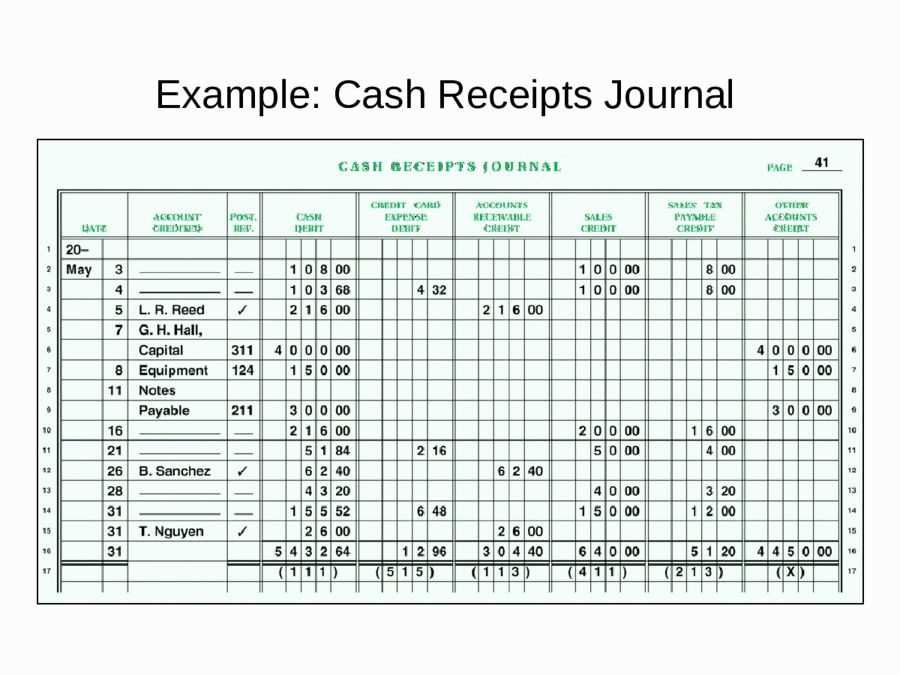

Best Practices for Using Cash Expense Receipts

Store all receipts safely for tax or reimbursement purposes. If issuing receipts frequently, consider using templates in Word or Excel to maintain consistency.

Cash Expense Receipt Template

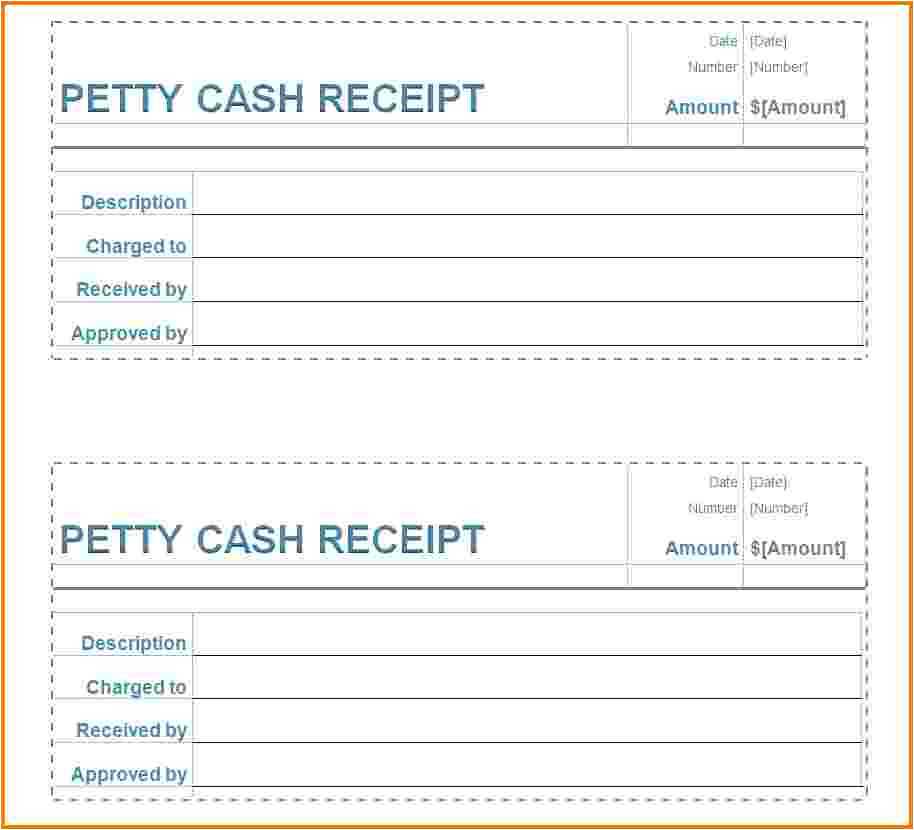

Key Elements to Include in Such a Receipt Template

A structured cash expense receipt should contain the date of the transaction, a unique receipt number, the amount paid, payment purpose, recipient details, and payer information. Add a signature or business stamp for verification. If the receipt is for tax or reimbursement purposes, include a breakdown of costs and applicable taxes.

How to Customize It for Different Business Needs

Adjust the template based on the business type. Retail businesses may include itemized purchases, while service providers should specify the nature of services rendered. For internal reimbursements, add an approval section. Using editable formats like Word or Excel ensures quick modifications.

Best Practices for Storing and Managing These Receipts

Keep both digital and physical copies for at least five years, depending on tax regulations. Use cloud storage or accounting software to organize records by date and category. Regularly back up digital receipts to prevent data loss.