Use a cash receipt journal template in Excel to simplify the process of tracking incoming payments. This template allows you to record various transactions efficiently, ensuring accurate bookkeeping. Whether you’re managing a small business or handling personal finances, an Excel template can save you time and reduce errors.

The layout of the template typically includes columns for the date of the transaction, the payer’s name, amount received, and payment method. You can easily customize it to fit your needs, adding categories like invoice number or payment references. Excel’s built-in features, such as formulas and conditional formatting, make it easy to calculate totals and highlight discrepancies.

Using this template streamlines the data entry process, helping you maintain clear financial records. It provides an organized overview of cash inflows, which is useful when generating financial statements or preparing tax filings. With Excel’s ability to track historical data, you can spot trends and make informed decisions about cash flow management.

Here are the corrected entries:

Ensure each entry in the journal is consistent and accurate. Double-check the amounts and dates to avoid any discrepancies. For clarity, make sure you follow the format of the previous rows, particularly in the date column, as errors there can cause confusion. Update the account codes if necessary and verify that each transaction aligns with the corresponding revenue or expense category.

Review the totals regularly to confirm all entries balance correctly. It’s a good practice to use formulas to automatically sum amounts in relevant columns, reducing manual error. Adjust the layout for readability, grouping similar types of receipts together. This helps maintain clarity when reviewing the journal later.

Finally, before finalizing the template, check that all reference numbers and transaction descriptions are consistent and correctly recorded. Use short and clear descriptions to avoid unnecessary confusion in the future. With these adjustments, your cash receipt journal template will function more efficiently.

- Cash Receipt Journal Template for Excel

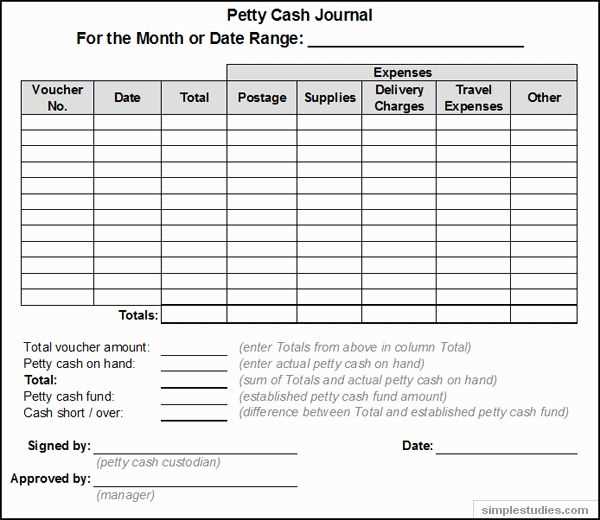

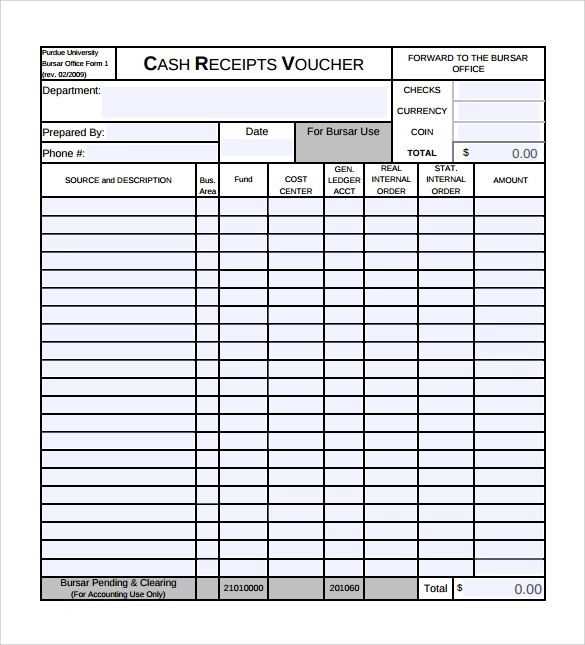

Creating a cash receipt journal template in Excel provides an easy way to track incoming payments. This tool helps businesses manage their finances accurately and keep records organized. To create a functional template, begin by setting up columns for the necessary details. Here’s a breakdown of what to include in your journal:

Key Columns for the Template

| Date | Description | Account | Receipt Number | Amount | Payment Method |

|---|---|---|---|---|---|

| 01/01/2025 | Payment for Invoice #123 | Cash | R12345 | $500 | Cash |

| 01/02/2025 | Payment for Invoice #124 | Bank Account | R12346 | $300 | Bank Transfer |

Each entry should include the date of the transaction, a brief description of the payment, the account it was deposited into, a unique receipt number, the payment amount, and the method used (cash, bank transfer, etc.). This format ensures clarity and consistency in tracking payments.

How to Use the Template

Once your template is set up, it’s important to enter each cash receipt as soon as the payment is made. Ensure that all the details are correctly recorded to avoid discrepancies during audits or financial reporting. The total amount column can be calculated automatically by summing the individual amounts for each transaction. Additionally, you can customize the template by adding filters or drop-down menus to streamline data entry and improve usability.

Begin by opening a new Excel sheet and labeling the columns to capture necessary details for each transaction. Columns should include: Date, Description, Amount, Payment Method, and Balance. These categories will help track all relevant cash receipt information clearly.

Step 1: Set up your columns

Label the first row of your Excel sheet with the following headings:

- Date: The date the cash was received.

- Description: A brief note about the receipt, such as the source or reason.

- Amount: The total amount of the receipt.

- Payment Method: Specify how the payment was made (e.g., cash, check, online transfer).

- Balance: Track the cumulative balance of received cash.

Step 2: Set up formulas for Balance Tracking

In the Balance column, create a formula to track the running total of receipts. For example, in the first cell under Balance, simply enter the amount in the corresponding row’s Amount column. For the next row, use a formula like =previous balance cell + current amount cell to keep an ongoing tally.

Now, as new transactions are added, Excel will automatically calculate and update the balance for you. Make sure to format the Amount and Balance columns as currency to ensure proper tracking.

Lastly, consider applying filters to the columns. This allows you to quickly sort by date, description, or payment method, making your journal much easier to use for reporting purposes.

Designing a useful journal template requires careful attention to specific details that help track cash receipts. The following features should be prioritized to ensure accuracy and clarity in financial tracking.

1. Date of Receipt

Include a dedicated column to record the date of each receipt. This ensures accurate tracking of cash flow over time and provides a clear chronological order of transactions.

2. Source of Cash Receipt

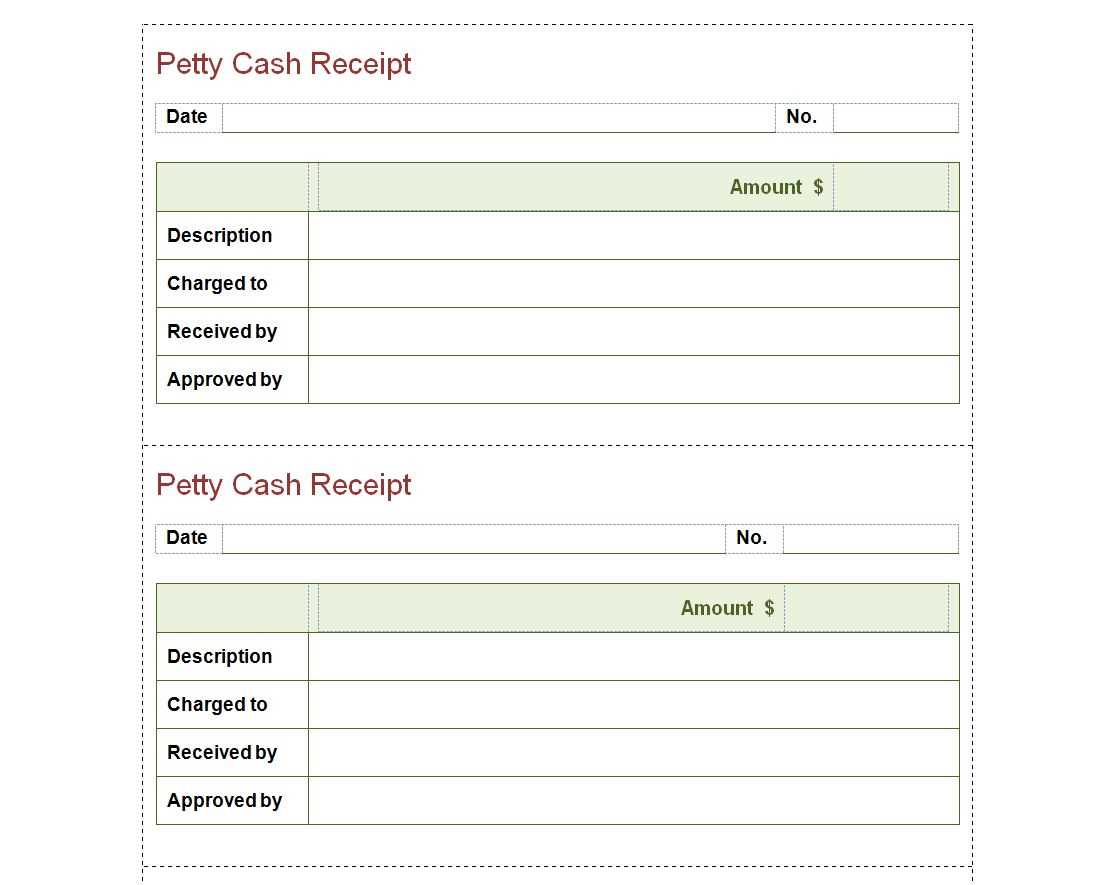

Include a field to specify the source of the cash, such as customer payments, loan repayments, or other forms of income. This helps identify the origin of each cash transaction.

3. Amount Received

A column should be provided for entering the exact amount of money received. This allows for easy reference and verification during financial reviews.

4. Method of Payment

Track how the cash was received (e.g., cash, check, bank transfer). This feature is critical for understanding how payments were made and assists in reconciling accounts.

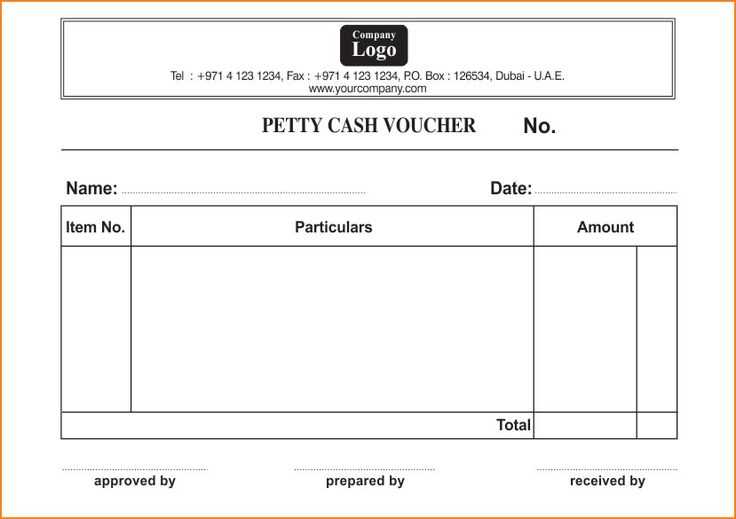

5. Reference Number or Invoice Number

Link the cash receipt to a specific invoice or reference number. This ensures that each transaction can be traced back to its corresponding document, improving accountability and transparency.

6. Description or Purpose

Provide a brief description of the reason for the receipt. This can include services rendered or products sold, ensuring clarity in the financial records.

7. Account to Credit

Clearly indicate which account should be credited with the received amount, whether it’s a sales revenue account or other types of income accounts. This helps in proper ledger posting.

8. Cashier or Person Handling Transaction

Assign responsibility by noting who processed the transaction. This helps identify who is responsible for the receipt and improves accountability within your business.

9. Balance after Receipt

Track the running balance after each receipt to maintain a clear overview of your available cash at any given time. This helps manage cash flow effectively.

- Columns for subtotal and total amounts for quick referencing.

- Options to categorize receipts (e.g., sales, deposits, loans) for easy financial analysis.

Incorporating these key features will ensure your cash receipt journal is organized, accurate, and easy to use for both everyday transactions and long-term financial planning.

Use Excel formulas and features like SUM, IF, and VLOOKUP to automate the calculations in your cash receipt journal. For example, the SUM function can quickly add up totals from different columns, saving time on manual calculations. You can use the IF function to apply conditional logic for automatic categorization based on receipt amounts or dates. This makes it easy to track receipts by category, such as sales or refunds.

For more advanced automation, set up pivot tables. They allow for instant summaries of your data by grouping receipts by date, amount, or other variables. This feature ensures that you can view and analyze trends in your cash flow without complex formulas.

For reporting, create templates using Excel’s built-in reporting features. Design customized reports using predefined layouts or create your own with specific fields. Link the data from your journal to these reports using cell references, so that when a new receipt is entered, the report updates automatically.

Lastly, use Excel’s Power Query to streamline data import from external sources, ensuring all receipts are recorded seamlessly. This eliminates the need for manual entry and guarantees up-to-date information in your reports without duplication or error. Set up reminders for regular data refreshes to maintain accuracy in your reports.

Set up an easy-to-use Cash Receipt Journal template in Excel by starting with basic columns for Date, Description, Amount, and Account. This structure will help track all incoming payments accurately. Customize it to fit your specific needs, such as adding fields for payment method or customer ID, depending on your business type.

Data Entry Tips

To keep your journal organized, enter payments as they occur. Each entry should include the date of receipt, a brief description of the payment source, and the amount. Make sure to separate payments by categories to provide clear insights into your revenue streams.

Formatting and Validation

Use Excel’s built-in data validation tools to ensure only valid entries are made. This can prevent errors like entering a letter in the amount column. Apply conditional formatting to highlight overdue payments or entries that need further review, making it easy to identify key issues at a glance.

Finally, ensure your journal is linked to a proper reconciliation process, where totals are checked against your bank account or cash flow statements for accuracy.