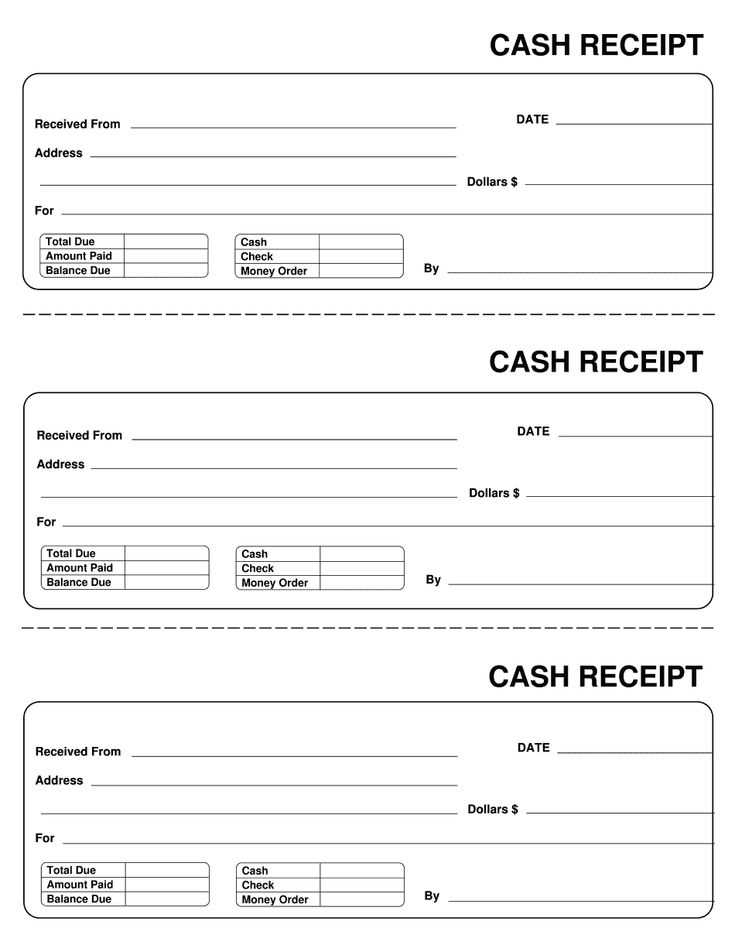

Creating a cash payment sales receipt is straightforward with a well-designed template. This document helps both the seller and the buyer keep track of transactions, ensuring clarity and transparency. A simple template should include the date of the transaction, the buyer’s name, the seller’s business details, the amount paid, and a breakdown of the items or services purchased.

Make sure your template is clear and precise. Each receipt should include sections for the transaction amount, tax (if applicable), and any discounts offered. This allows both parties to easily verify the details of the sale and prevents any potential misunderstandings later. The receipt should also have a unique transaction or receipt number for reference.

Don’t forget the payment method. For cash payments, indicate the total amount received and note that the payment was made in full in cash. You can also add a space for signatures to confirm that both parties are in agreement on the transaction.

Using a template saves time and ensures consistency across your sales. Choose a format that suits your business needs, whether it’s a basic text-based template or one with additional branding elements. Customizing your template is easy, and it can reflect the professionalism of your business while providing all necessary details for the buyer.

Here’s the corrected version:

Make sure your cash payment sales receipt template includes these key elements for clarity and accuracy. Start with the name of your business at the top, followed by the receipt number for tracking purposes. Below that, add the date of the transaction to avoid any confusion. Next, list the items or services sold, along with their corresponding prices and quantities. For each item, ensure the subtotal is clearly visible, with a line separating taxes if applicable.

Include the total amount paid, which should clearly reflect the sum of all items, taxes, and any discounts offered. Don’t forget to add the payment method–specifically noting that the payment was made in cash. Include a section for the customer to sign if needed. Finally, offer space for any additional notes, such as return policies or transaction reference numbers, to avoid misunderstandings down the line.

- Cash Payment Sales Receipt Template

A cash payment sales receipt should include key details like the transaction date, the seller’s and buyer’s information, itemized goods or services, total amount paid, and the payment method. Here’s a basic template you can use:

Basic Template Structure:

Receipt Number: [Unique identifier for the transaction]

Date of Purchase: [MM/DD/YYYY]

Seller’s Information:

Name: [Seller’s name]

Address: [Seller’s address]

Contact: [Phone number or email] Buyer’s Information: Name: [Buyer’s name] Address: [Buyer’s address]Items Purchased:[Description of item 1] – [Price][Description of item 2] – [Price][Itemized list continues…]Total Amount: $[Total cost of items]Amount Paid: $[Amount received in cash]Payment Method: CashSignature of Seller: ______________________Signature of Buyer: ______________________

Key Notes:

Each section of the template serves a specific purpose. Ensure you include both parties’ names and contact details, so there’s no confusion later. An itemized list of purchases allows both parties to see exactly what was bought, along with individual prices. It’s also wise to note the amount of cash received to avoid any discrepancies during the transaction. Always keep a copy for your records.

Designing a simple cash payment receipt template requires focusing on clarity and key transaction details. Follow these steps to create an efficient template.

1. Include Basic Business Information

Start with the name of your business, address, phone number, and email. This ensures that customers can easily contact you if needed. It’s also a good idea to include your business logo if possible, for a more professional touch.

2. Add the Receipt Number and Date

Each receipt should have a unique number to help with tracking. Include the transaction date, as this provides context for the payment.

3. Detail the Items or Services Sold

List the items or services the customer purchased along with their corresponding prices. If applicable, include any taxes or discounts applied. This will help the customer verify the details of the transaction.

| Item | Quantity | Price |

|---|---|---|

| Product A | 1 | $20.00 |

| Service B | 1 | $35.00 |

4. Specify the Payment Amount

Clearly display the total amount paid in cash. You can also note the payment method, such as “Cash” or “Paid in Full” to make it clear.

5. Include a Thank You Message

End the receipt with a simple “Thank you for your business” or similar message. It adds a personal touch and shows appreciation to the customer.

Ensure your sales receipt for cash payments includes the following key elements to avoid any confusion and maintain transparency:

Date of Transaction: Always record the exact date the payment was made. This helps both parties track purchases and serves as proof for any future reference.

Receipt Number: Assign a unique number to each receipt. This provides an easy way to reference specific transactions in the future.

Business Information: Include your business name, address, contact details, and tax identification number if applicable. This ensures the customer can contact you if needed.

Customer’s Information (Optional): If relevant, include the customer’s name or any specific identification that links them to the purchase. This can be useful for records or warranty claims.

Item Description: List the items purchased along with the quantity and unit price. This gives a clear breakdown of the transaction and prevents disputes later on.

Total Amount Paid: Clearly state the total sum paid in cash, including applicable taxes or discounts. Ensure there’s no ambiguity about the payment amount.

Payment Method: Specify “Cash” as the payment method. If there are any partial payments or change given, include these details to avoid confusion.

Signature (Optional): Although not always necessary, adding a space for the customer’s signature can provide additional verification of the transaction.

Return/Exchange Policy: If your business offers returns or exchanges, briefly state the policy on the receipt. This sets expectations for the customer and minimizes misunderstandings.

For tailored cash receipts, include transaction-specific details to enhance clarity. For example, if you’re processing a sale of goods, mention the item description, quantity, and price per unit. This will help the customer understand exactly what they’re paying for and how the total was calculated.

Incorporating Discounts and Taxes

If discounts apply, be sure to clearly state the discount amount or percentage next to the original price. Likewise, when tax is involved, include the tax rate and total amount to give the customer an accurate picture of the final payment.

Special Payment Methods

For transactions that involve multiple payment methods, such as a combination of cash and credit card, list the amounts paid through each method. This helps both you and the customer track payments accurately.

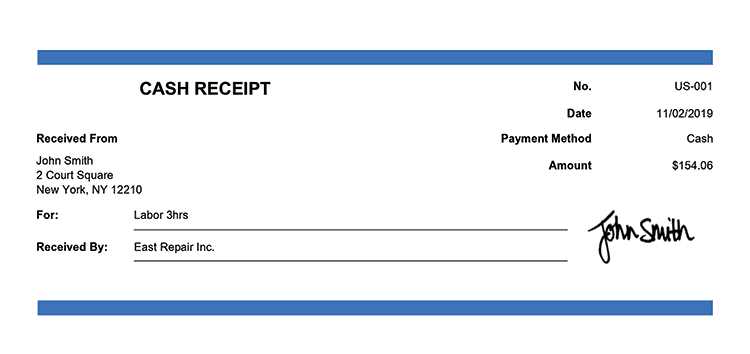

Cash Payment Sales Receipt Template

For a clean and professional look, organize your cash payment sales receipt template with these key elements:

- Date of Transaction: Always include the exact date of the transaction to keep a proper record.

- Seller Information: Display the seller’s name, address, and contact details to ensure the customer can reach out if needed.

- Buyer Information: Include the buyer’s name and contact details, especially for larger purchases or if tracking customer relations is required.

- Itemized List of Products or Services: Provide a detailed list of what the buyer paid for, including the quantity, description, and price of each item.

- Total Amount: Ensure that the total amount is clearly visible at the bottom, including any taxes or discounts applied.

- Payment Method: Specify “Cash” as the payment method and, if possible, include the exact amount of cash received.

- Receipt Number: Assign a unique receipt number to every transaction for easy tracking and future reference.

Template Example:

- Receipt #: 001234

- Date: 2025-02-11

- Seller: John’s Electronics, 123 Main St, Phone: 555-1234

- Buyer: Jane Doe, 456 Oak Rd, Phone: 555-5678

- Items Purchased:

- Smartphone, Model X – $500

- Screen Protector – $20

- Total: $520

- Payment Method: Cash

Use this structure to maintain a professional and clear record of cash transactions.