Nonprofit organizations must provide donors with a tax receipt that includes specific details required by the IRS for tax deduction purposes. Make sure the receipt clearly states the amount of the donation, the organization’s tax-exempt status, and any goods or services provided in exchange for the donation.

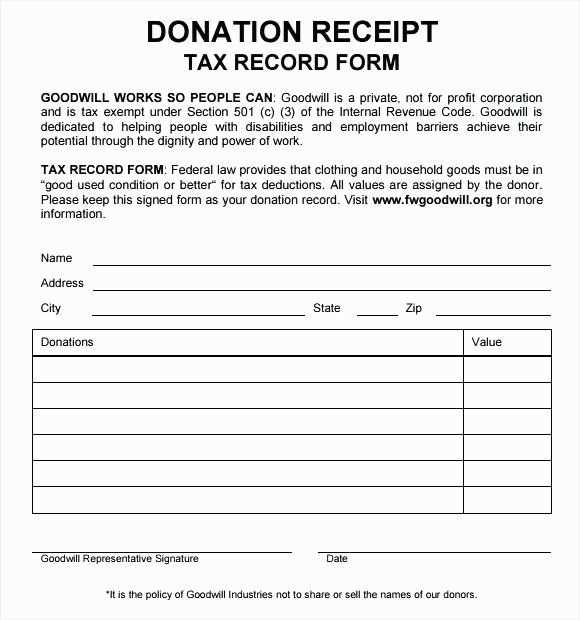

Start by including the organization’s name, address, and EIN (Employer Identification Number) at the top of the receipt. This makes it clear who issued the document. Be specific about the donation’s nature, whether it’s cash or goods, and include the exact value of the contribution. If any goods or services were provided, list them and provide an estimate of their value to avoid any confusion during tax filing.

Donor Details: Include the donor’s full name, address, and the date of the donation. This will help both the donor and the nonprofit in case of any future queries or audits. For non-cash donations, a description of the items donated is necessary along with their fair market value.

Reminder: It is recommended that you issue these receipts promptly after receiving donations. This ensures that donors have the necessary paperwork to claim their deductions when filing taxes.

Here is the corrected version:

For a nonprofit tax receipt, ensure the following details are included:

- Nonprofit’s Name: Clearly state the official name of your nonprofit organization.

- Donor’s Name: Include the donor’s full name or the name of the entity making the donation.

- Donation Amount: Specify the exact amount of the donation received. If it’s a non-cash donation, describe the donated item and its estimated value.

- Date of Donation: Include the precise date the donation was made.

- Nonprofit’s Tax ID Number: Provide the tax-exempt number assigned to your organization by the IRS.

- Statement of No Goods or Services: Mention if the donation was purely a gift without any goods or services exchanged.

Ensure the receipt is signed by an authorized representative of the organization. This should be done in a clear and legible manner.

Keep a copy of each receipt for your records and for the donor’s future reference during tax filing.

- Tax Receipt Template for Nonprofits

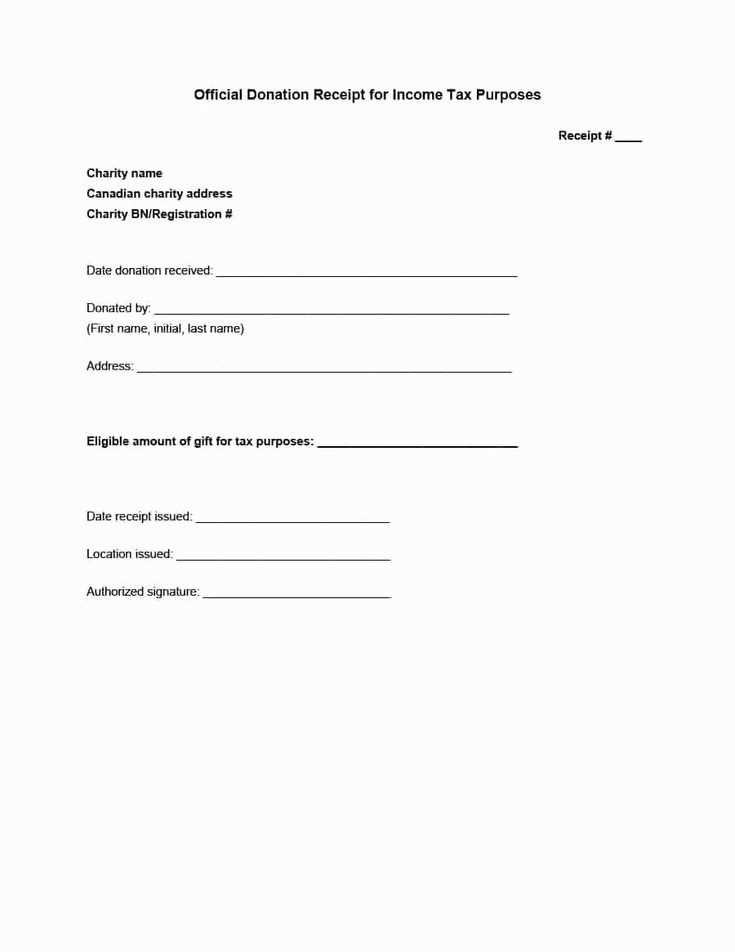

Nonprofits must provide donors with accurate tax receipts to claim deductions. A tax receipt template should include specific details to meet IRS requirements. Here’s what your template needs:

Key Information to Include

The receipt must clearly state the nonprofit’s name, address, and tax-exempt status. Include the donation amount or description of non-cash contributions, the date of the donation, and a statement that no goods or services were exchanged in return for the contribution. For non-cash donations, describe the item and its estimated value. This ensures compliance with IRS standards and gives the donor the information needed to claim their deduction.

Additional Considerations

If your nonprofit offers goods or services in exchange for donations, include the fair market value of those items. Also, remember to add a unique receipt number for tracking purposes. This makes it easier for both your organization and the donor to manage records.

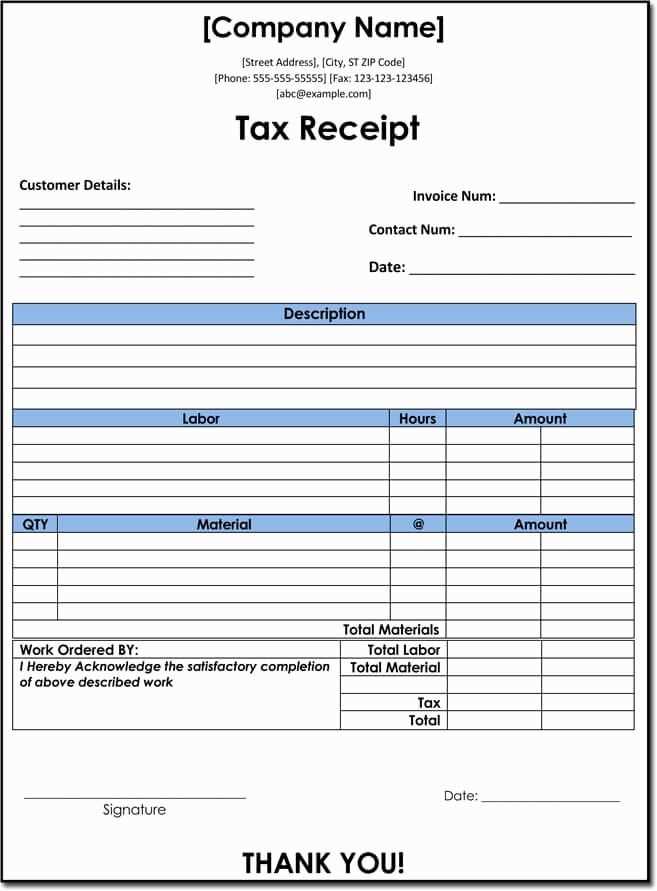

Clearly outlining the right details in your nonprofit’s tax receipt ensures accuracy and compliance. Include the following key components:

1. Donor Information

Begin with the name and address of the donor. If applicable, include their organization name and contact details. This personal information is crucial for both tax reporting and verification purposes.

2. Donation Details

Specify the donation date and the exact amount. For non-cash gifts, provide a description of the item(s) donated, including fair market value (FMV) if possible. The donation type (e.g., cash, check, or in-kind) should be listed as well.

3. Nonprofit Information

Include your nonprofit’s name, address, and tax-exempt status. Make sure the receipt clearly states your organization’s IRS determination letter and include your tax ID number (EIN) for identification purposes.

4. Statement of No Goods or Services Provided

For tax deduction purposes, confirm whether your organization provided any goods or services in exchange for the donation. If nothing was provided, include a simple statement like: “No goods or services were provided in exchange for this donation.”

5. Signature and Date

Ensure a representative from your nonprofit signs and dates the receipt. This validates the document and confirms it’s an official receipt for tax purposes.

6. Additional Notes for Non-Cash Donations

If the donation is non-cash and valued over $500, include a brief description of the item and its estimated fair market value. If it’s valued over $5,000, remind the donor that they must complete IRS Form 8283 for their filing.

| Receipt Element | Details |

|---|---|

| Donor Information | Name, address, and contact info |

| Donation Details | Date, amount, and item description (if applicable) |

| Nonprofit Information | Name, address, and tax ID (EIN) |

| Statement of No Goods or Services | Confirmation of no exchange for the donation |

| Signature and Date | Signature of nonprofit representative and date |

| Additional Notes for Non-Cash Donations | Fair market value and IRS Form 8283 requirement (if applicable) |

By including these elements, you can ensure your tax receipts meet IRS requirements and provide transparency for your donors.

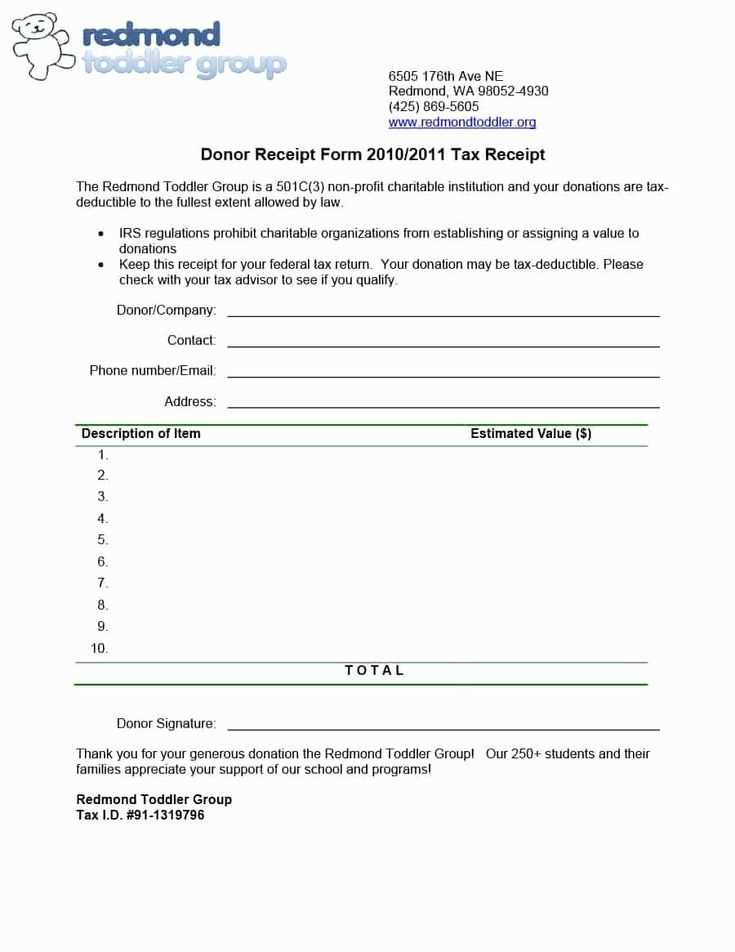

Customize your receipt template to include clear donor information, donation amounts, and date of contribution. Ensure that each receipt contains the donor’s full name, address, and donation specifics such as the amount and any restrictions or designations on the donation.

Ensure Consistency in Formatting

Maintain uniformity in the font, layout, and color scheme across all receipts. A consistent design ensures that donors easily recognize your organization’s branding and reduces the chance of confusion. Keep key details like donation amount, donor’s information, and donation date prominently displayed.

Include a Tax-Exempt Statement

Include a statement that your organization is tax-exempt and provide your IRS or relevant tax identification number. This assures donors that their contributions are eligible for tax deductions and provides them with the information they need when preparing their tax returns.

Make sure to add any additional information required by your local laws, such as the value of in-kind donations or any necessary disclaimers. Avoid unnecessary legal language but ensure clarity and transparency to build trust with donors.

Ensure that the donor’s information is clear and accurate. Double-check names, addresses, and amounts to prevent mistakes that could lead to confusion or delays during tax filing. Incorrect data can result in processing issues, which can frustrate both the donor and your team.

1. Forgetting to Include Required Legal Information

Always include the nonprofit’s legal name, address, and tax ID number (EIN). These are mandatory elements for any tax receipt. Not providing this information can render the receipt invalid for tax purposes.

2. Incorrect Donation Amount

Clearly distinguish between the donation amount and any non-deductible portions, such as goods or services received in exchange. If the donor receives something in return, like a ticket to an event, ensure you subtract the fair market value from the donation total.

3. Lack of Date and Donation Type

- Specify the exact date of the donation.

- Indicate whether the contribution is a cash donation or in-kind.

Failure to do so can lead to confusion for both the donor and the IRS during tax reporting.

4. Using Unclear Language

Avoid vague terms. Be specific about what the donor has given and the benefits received. Using unclear language can make the receipt difficult to interpret, which can raise red flags with tax authorities.

5. Inconsistent Formatting

Design the receipt with consistency in mind. Use uniform fonts, spacing, and headings. A cluttered or difficult-to-read receipt can make it harder for donors to find critical information. It may also look unprofessional.

6. Not Including a Thank You Message

Include a simple acknowledgment or thank-you note. It doesn’t need to be lengthy, but recognizing the donor’s contribution can enhance your relationship with them and encourage future donations.

7. Ignoring the IRS Guidelines

Stay updated on IRS rules regarding charitable donations. Failure to comply with these guidelines can result in your nonprofit facing penalties or your donors not being able to claim deductions.

Make sure your nonprofit tax receipt template clearly includes the following details:

- Donor Information: Include the full name, address, and contact details of the donor. This ensures clarity for both the donor and tax authorities.

- Donation Details: Specify the amount or description of the donated goods, as well as the date of donation. For goods, provide an approximate value.

- Nonprofit Information: Include your organization’s legal name, address, and tax-exempt number. This confirms the legitimacy of your organization for tax purposes.

- Statement of Goods or Services: Clearly state whether any goods or services were provided in exchange for the donation. If none were provided, note that the donor received no goods or services in exchange for the contribution.

- Signature: Ensure the document is signed by an authorized individual in your nonprofit to verify authenticity.

These details will help donors claim their charitable tax deductions and ensure compliance with tax regulations.