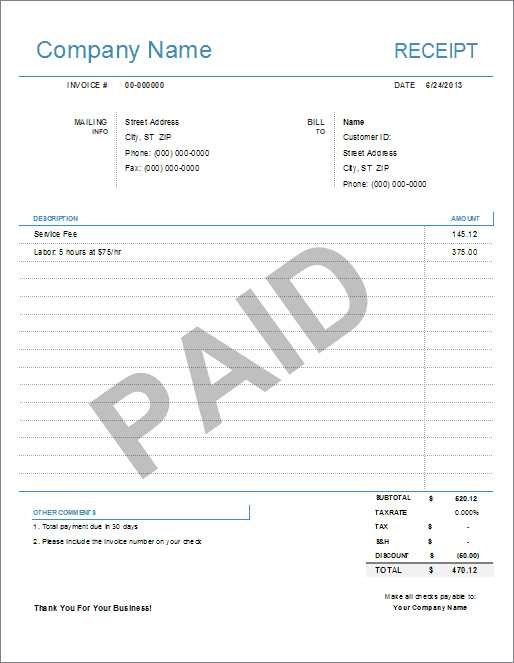

To create a clear and professional receipt for services rendered, begin by detailing the service provided, the date, and the amount charged. Use a simple layout that emphasizes the transaction details, making it easy for the client to understand the breakdown. Ensure that your business name, address, and contact information are prominently displayed at the top for easy reference.

List each service offered, along with its corresponding price. If applicable, include any applicable taxes or discounts, and provide a total sum at the bottom of the receipt. Keep the language straightforward to avoid confusion. Conclude with a thank you message or note expressing appreciation for the business.

By following these guidelines, you can generate a receipt that reflects professionalism and clarity, offering both you and the client a transparent record of the transaction.

Here are the corrected lines where repetitive words have been replaced while maintaining the meaning:

First, ensure the receipt clearly displays the service provided, along with the date, amount, and payment method.

Next, replace redundant terms such as “total amount due” and “payment required” with more concise phrases like “due balance” or “amount to pay.” This helps to avoid unnecessary repetition and enhances clarity.

Corrected Examples

Instead of writing “Please submit your total payment amount,” use “Please submit the total due.”

Instead of saying “service cost is the amount charged for the service rendered,” try “service charge is the fee for the service.”

- Print a Receipt for Services Rendered

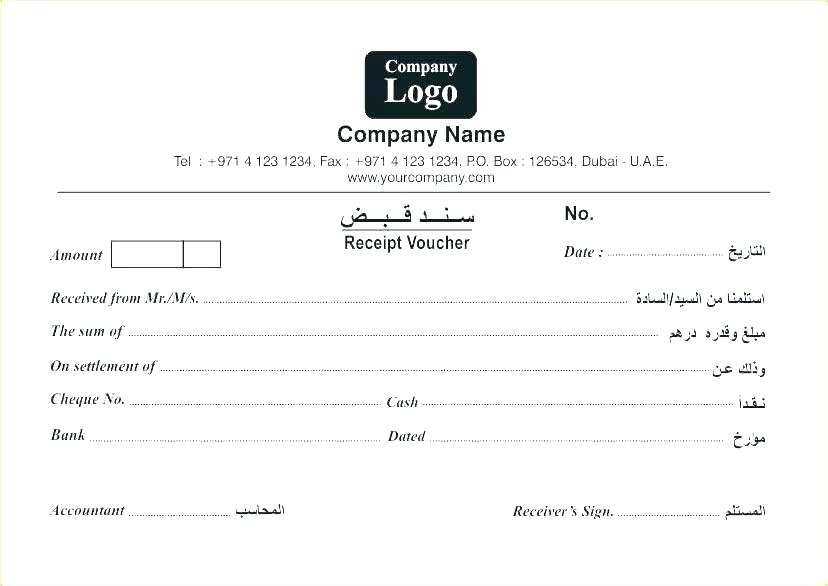

Start by including key details such as the service date, description, amount charged, and payment method. Clearly indicate the service provider’s name, contact information, and business details, if relevant. Mention the total sum paid and any applicable taxes or discounts. Ensure the receipt is easy to read and provides all necessary information for both parties to understand the transaction fully.

Details to Include

Include the date the service was provided and the date the receipt is issued. List the services rendered with brief descriptions, ensuring the amount for each service is clear. For payment records, specify the method used (cash, credit card, bank transfer) and any reference number or transaction ID associated with the payment.

Additional Notes

If applicable, mention any future follow-up services, warranties, or guarantees related to the transaction. Always double-check the details for accuracy before printing, ensuring that both service provider and recipient are in agreement with the terms outlined in the receipt.

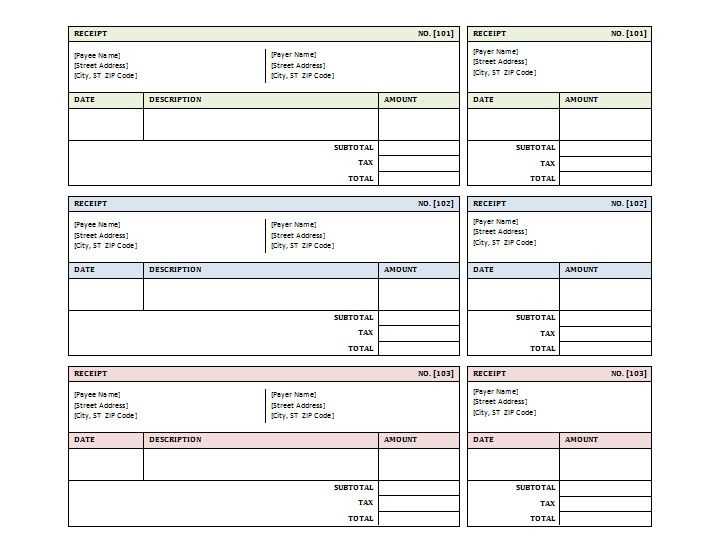

Decide whether a paper or digital receipt format works best for your business needs. If you have a physical store, printed receipts can create a tangible connection with customers. For businesses operating online, digital receipts are cost-effective and eco-friendly.

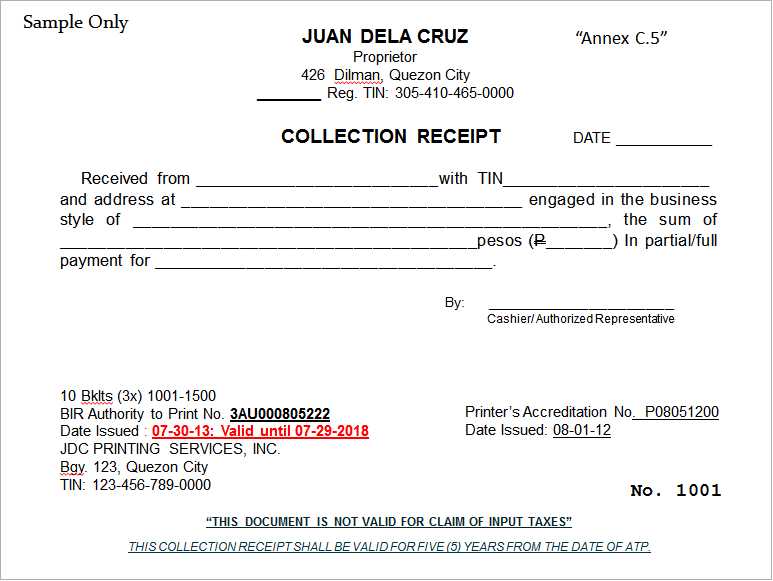

Consider Legal and Tax Requirements

Ensure your chosen format meets local tax laws and regulations. Some jurisdictions require specific data to be included on receipts, such as VAT numbers or company registration details. Always verify the compliance requirements before selecting a format.

Match Format with Customer Preferences

- Ask customers if they prefer digital or paper receipts.

- Provide both options when possible, to accommodate varying preferences.

- Consider integrating a receipt system that sends digital copies to customers upon purchase.

Balance Cost and Efficiency

While paper receipts come with printing costs, digital receipts require reliable software or email systems. Evaluate which format offers the best balance of efficiency and cost savings based on your business size and transaction volume.

Include clear, accurate information that reflects the services provided, such as the type, description, and duration of the service. Specify the pricing model (e.g., hourly, flat rate, or per task) to avoid confusion. Customize the format by adding unique identifiers, like transaction numbers or customer reference codes, for easy tracking. Tailor payment details to include the method used, whether cash, credit card, or digital payment, and ensure any discounts or taxes are clearly outlined. Make sure to personalize the document by adding your business logo or contact information to reinforce brand identity and professionalism.

To apply tax and discounts in your receipt template, you need to calculate them separately before including them in the final amount. First, determine the applicable tax rate and the discount percentage based on your service or product. Then, use the following approach:

Calculating Tax

Multiply the subtotal by the tax rate to find the amount of tax to be added. For example, if the subtotal is $100 and the tax rate is 8%, the tax will be $8.

Applying Discounts

If a discount is offered, calculate the discount amount by applying the discount percentage to the subtotal. For instance, with a 10% discount on a $100 subtotal, the discount would be $10.

| Item | Amount |

|---|---|

| Subtotal | $100 |

| Tax (8%) | $8 |

| Discount (10%) | -$10 |

| Total | $98 |

Finally, include both tax and discounts in the total section of your template to provide the client with a clear breakdown of the charges.

Clearly outline payment options to avoid confusion. Include specifics on whether customers can pay by credit card, bank transfer, or other methods like PayPal or cash. Indicate any online payment platforms supported to streamline the transaction process.

Payment Deadlines

Set clear payment deadlines to establish expectations. Mention if payment is due immediately after services are rendered or if a grace period is allowed. Provide consequences for late payments, such as late fees or service suspension, and specify how they will be enforced.

Refund and Cancellation Policies

State the terms for refunds and cancellations directly on the receipt. If refunds are possible, explain the process and any conditions that must be met. Be transparent about any non-refundable fees, such as for cancellation within a specified time frame.

Make sure all receipts follow legal requirements for data accuracy and privacy. Always include key information such as service details, transaction amounts, and dates. Avoid using personal or sensitive data unless it’s necessary and legally required.

- Verify that all service details are clear and precise. Include itemized breakdowns for transparency.

- Check that taxes and fees are correctly calculated and displayed, as per the applicable laws.

- Ensure the format is consistent with regional regulatory standards for receipts or invoices.

- Store copies of receipts securely to comply with data protection laws, limiting access to authorized personnel only.

- Regularly review legal requirements to adapt your receipts to changing laws and regulations.

Ensure your receipt includes clear details such as service description, date, and amount. Use a high-quality printer to prevent issues with legibility. Verify that your printer is set up correctly to handle receipt-sized paper for neat presentation. Consider offering both printed and electronic copies for convenience.

Distribute the receipt immediately after the transaction. Hand it to the customer in person or email it directly if they prefer a digital version. Keep records of receipts in a secure system for future reference. Provide an option for customers to request a copy if they misplace their receipt.

Tip: Always double-check for accuracy before printing. Mistakes in amounts or service descriptions can lead to confusion or disputes.

For a clean, user-friendly service receipt template, include these key elements:

- Service Description: Specify the service provided with clear, concise wording.

- Quantity and Rate: Include the number of items or hours and the agreed-upon rate.

- Total Amount: List the total cost, including taxes if applicable.

- Date of Service: Mention the exact date the service was performed.

- Client Information: Include the client’s name, address, and contact details.

- Payment Method: Indicate how the payment was made (e.g., credit card, cash, online).

- Thank You Note: A short note of appreciation can add a personal touch.

Formatting Tips

Make sure the text is easy to read by using a clean font and leaving enough space between sections. Ensure the receipt is in a format that’s easy for clients to print or save for reference.