Using an Excel template for pawn shop receipts simplifies tracking transactions and maintaining accurate records. It ensures each transaction is documented clearly and can be quickly retrieved for future reference.

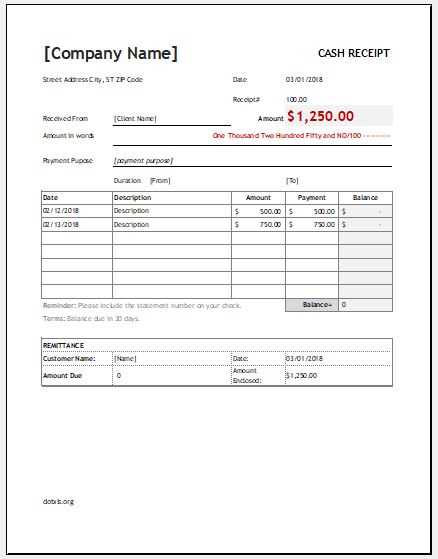

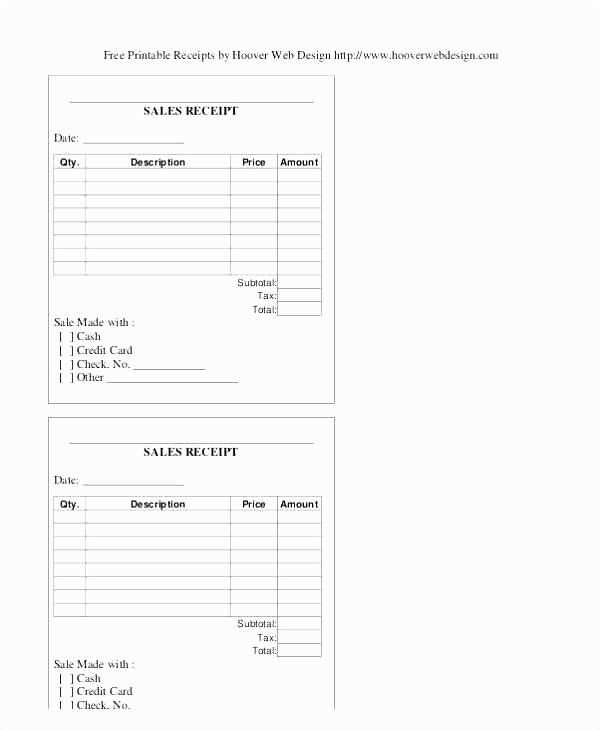

Start with basic fields: Include the customer’s name, item description, loan amount, interest rate, and due date. These fields form the foundation of the receipt and help organize key details for each loan.

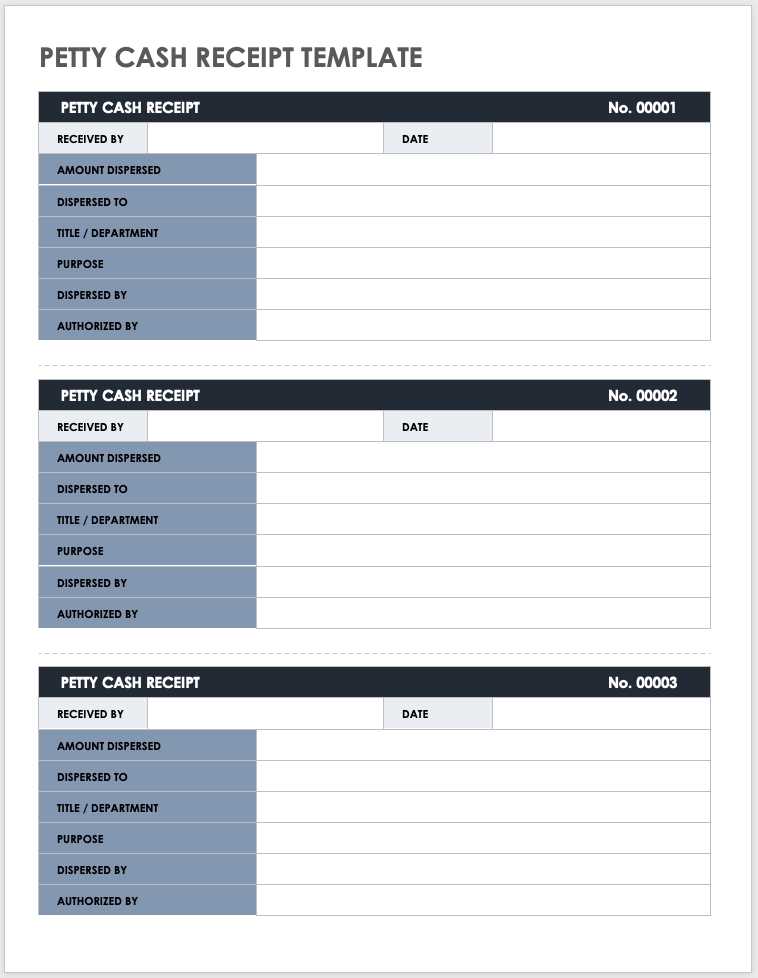

Include a tracking system: Adding a unique receipt number for each transaction ensures you can easily trace and verify any receipt. This is especially helpful when managing multiple customers and items at once.

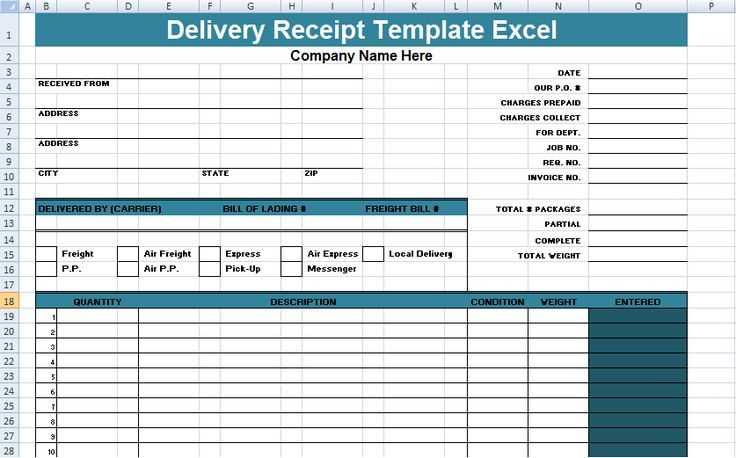

Formatting tips: Set clear column headers and use dropdown lists for categories like item condition or loan status to speed up data entry. Conditional formatting can help highlight overdue loans or important notes automatically.

Keep the template simple, but make sure it covers all necessary details for smooth operations and transparency in your business.

Creating a Custom Template for Pawn Transactions

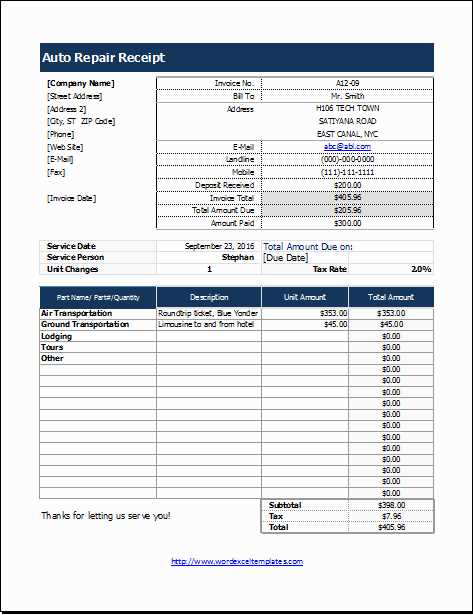

Begin by structuring your template to include clear fields for essential transaction details: pawn ticket number, customer information, item description, loan amount, interest rate, and due date. Ensure each field is easily identifiable for quick input.

In Excel, set up data validation rules for fields such as dates and loan amounts to prevent errors. For example, use date pickers for due dates to avoid manual input mistakes. Also, apply number formatting for loan amounts and interest rates to maintain consistency.

Consider adding a section for item appraisal. This can include columns for the appraiser’s name, date of evaluation, and condition notes. Using drop-down lists for item condition (e.g., new, good, fair, poor) can speed up the process and reduce human error.

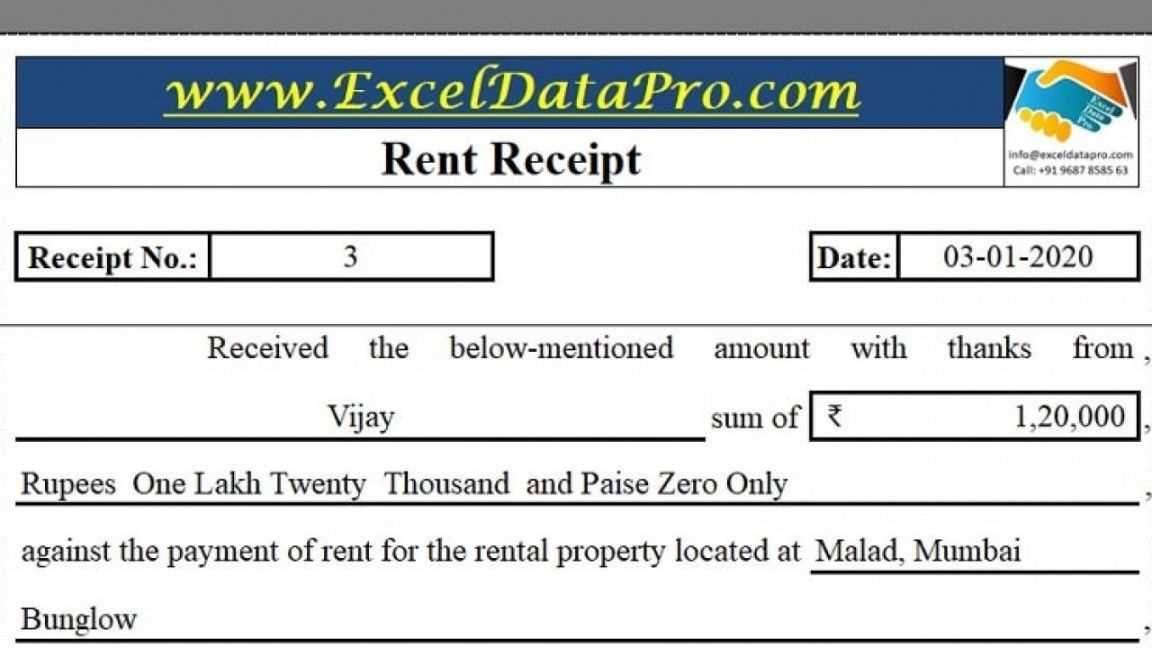

Include a calculation area for interest rates based on the loan amount and duration. Set up formulas that automatically calculate the interest and total repayment, ensuring accuracy. Use conditional formatting to highlight overdue loans or other critical data.

Finally, create a printable version of the template that fits neatly on a single page. This ensures the pawn shop can easily provide customers with a physical receipt that mirrors the data recorded in the system.

Key Elements to Include in a Pawn Receipt Template

Begin with the pawn shop’s name, address, and contact details. This information establishes the identity of the business and ensures easy communication with customers.

Include a unique receipt number for tracking purposes. This will help both the shop and the customer keep a reference for the transaction.

Item Description and Condition

Clearly describe the item being pawned, including its make, model, serial number, and any distinguishing features. Mention its current condition, noting any damages or wear. This helps to avoid future disputes about the item’s state.

Loan Amount and Terms

State the loan amount provided and the agreed-upon interest rate. Include the terms for repayment, including the due date and any fees associated with late payments. This section ensures transparency about the financial obligations of both parties.

Finally, provide space for both the pawn shop representative and the customer to sign and date the receipt, confirming the details of the transaction.

Automating Calculations and Tracking in Excel

To automate calculations and tracking in Excel, use built-in functions like SUM, AVERAGE, and IF statements. These tools allow for quick data processing and decision-making. For example, the SUM function can automatically total amounts in your columns, removing the need for manual updates. Combine this with conditional formatting to highlight key data points, like overdue items or high-value transactions.

Creating Dynamic Totals and Reports

Implement dynamic totals by linking data across multiple sheets. With the use of cell references and the SUMIF function, you can calculate totals based on specific criteria, such as pawned items by category or transaction dates. This feature saves time, especially when managing large datasets. Additionally, pivot tables can be used to summarize and organize information, creating easy-to-read reports for quick analysis.

Tracking Due Dates and Payments

Tracking due dates and payments is made simple by using date functions like TODAY and DATEDIF. By setting up a column for due dates and using a conditional formula, you can automatically flag overdue items. Use the IF function to calculate remaining payments based on the initial loan amount, interest rate, and payment history. This setup ensures accurate tracking without constant manual updates.