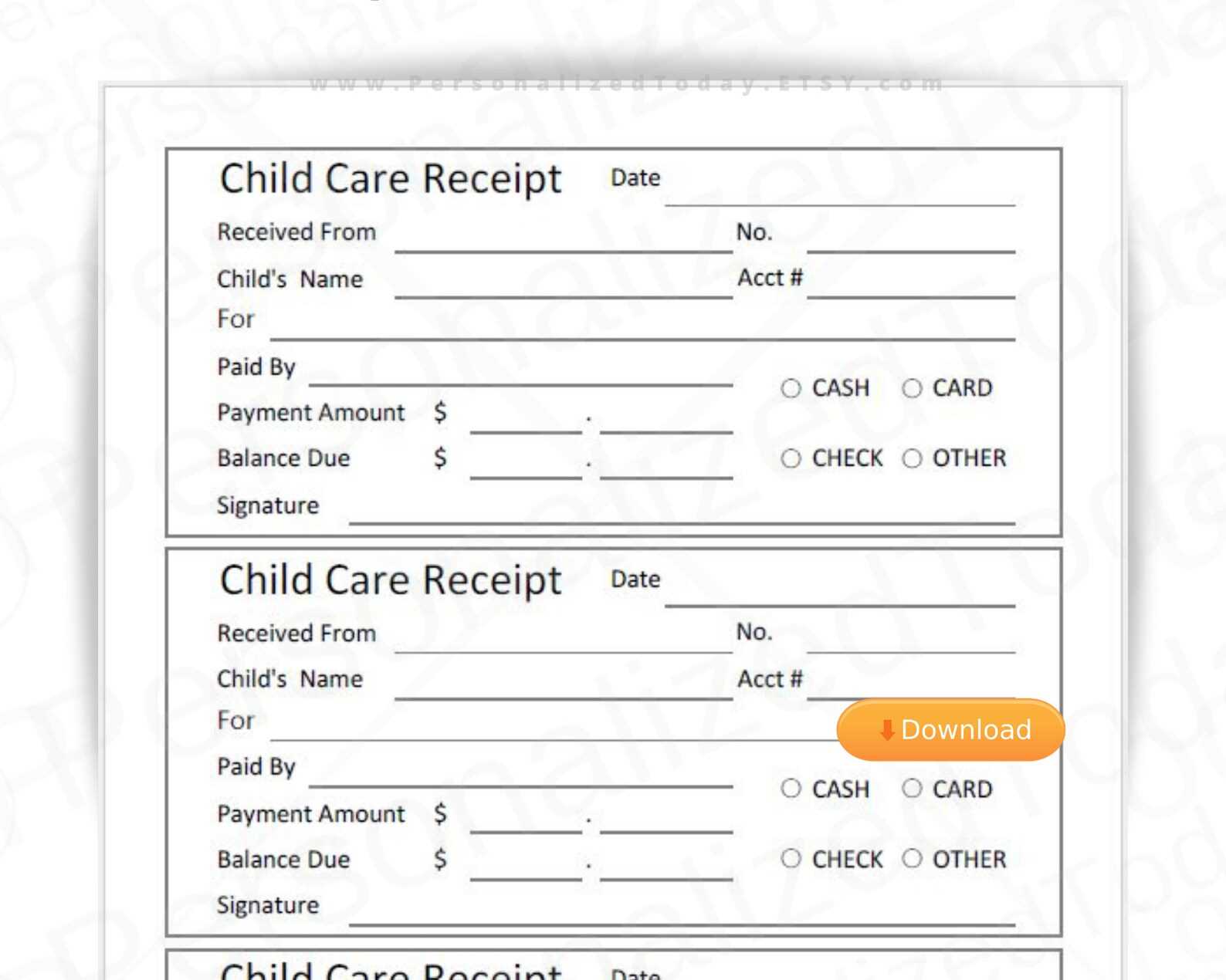

If you need a child care receipt template in Canada, using a proper format will save you time and ensure accuracy when filing taxes or applying for benefits. A well-organized receipt helps you track expenses, qualify for tax credits, and provide proof of payment to the government or other authorities.

The template should include key details such as the provider’s name, address, and contact information. Make sure to include the child’s name, the period of care (e.g., dates), and the total amount paid for services rendered. These details are crucial when submitting your claim for child care tax benefits or deductions.

By including the provider’s signature or a digital equivalent, you add authenticity to the receipt, making it easier for tax authorities to verify the claim. Keeping a record of receipts ensures that you don’t miss out on eligible financial assistance and helps you maintain transparency in all transactions.

Here’s the corrected text:

When preparing a child care receipt in Canada, include the following key details:

1. Provider Information

Clearly list the name, address, and phone number of the child care provider. If they are a registered business, include the registration number as well.

2. Payment Details

Specify the exact amount paid, including the breakdown of any additional charges such as late fees. The date of the payment should also be mentioned.

Include the method of payment (e.g., cash, cheque, e-transfer), and always ensure the receipt is signed by the provider to confirm the transaction.

3. Tax Information

If applicable, make sure to indicate whether GST/HST was charged. If it was, the provider’s tax number must be included. This is important for tax deductions or credits you may claim.

Having a clear and accurate child care receipt is vital when applying for government benefits, such as the Child Care Expense Deduction. Keep these receipts organized for reference during tax filing.

- Child Care Receipt Template Canada

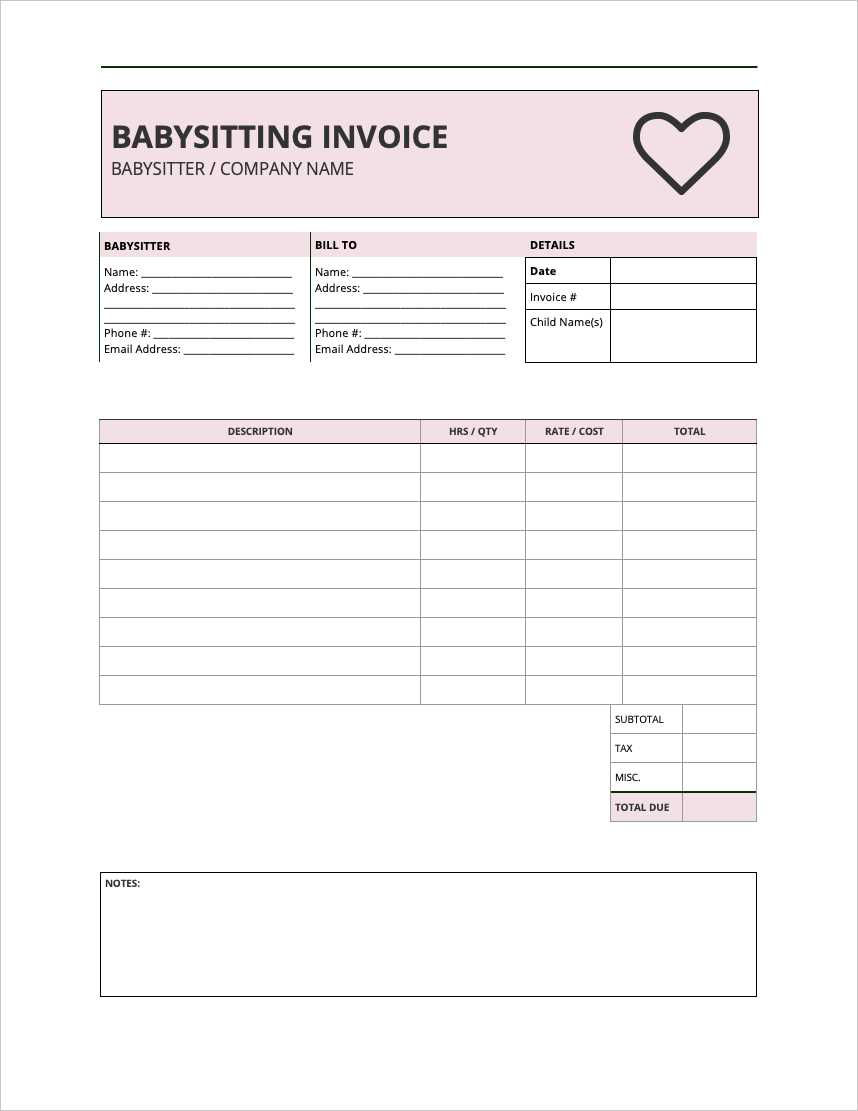

A Child Care Receipt Template in Canada should include specific details to ensure it meets tax requirements. Start with the name and address of the child care provider. Include the business registration number, if applicable. The receipt should list the dates the services were provided and the total amount paid for the care, including taxes if applicable. Specify the child’s name and the type of care provided (e.g., daycare, after-school care, etc.). If the care was paid by installments, note the payment dates and amounts for each.

Ensure that the receipt is clear and legible. Providers should offer receipts for every payment, and parents should keep them for tax deductions or credits. If the provider is registered, they should provide a CRA (Canada Revenue Agency) number. This is important for verifying the legitimacy of the claim during tax filing.

For parents, using the correct receipt template ensures they are able to claim child care expenses on their tax return, reducing taxable income and possibly increasing refunds. The Canada Child Benefit (CCB) may also be impacted by these claims, so it’s wise to keep accurate records throughout the year.

To ensure your receipt for child care services is legally compliant in Canada, include the following key details:

- Provider’s Information: The receipt should contain the child care provider’s full name or business name, address, and contact number.

- Child Care Service Dates: Clearly state the start and end dates for which the services were provided. This helps to specify the billing period.

- Description of Services: Outline the type of child care services offered (e.g., full-time, part-time, or drop-in care). Include the number of hours or days of care provided.

- Amount Paid: Specify the exact amount paid for the child care services, including any applicable taxes (e.g., GST/HST). The total amount should be clearly separated from any deposit or advance payments.

- Payment Method: Indicate how the payment was made (e.g., cash, cheque, or electronic transfer). This adds clarity and helps in case of disputes.

- Receipt Number: Use a unique receipt number to help track and reference the transaction for both the provider and the client.

- Tax Information: If the provider is registered for GST/HST, include the GST/HST number. This is important for both tax reporting and possible claims for child care expenses under the Canadian tax system.

Make sure the receipt is signed or stamped by the child care provider. The signature adds authenticity and ensures the document is officially recognized. Keep a copy for your records as receipts are necessary for claiming child care expenses on tax returns or for other official purposes.

Provide the full name of the child care provider at the top of the receipt. This identifies who delivered the service and ensures there are no confusion about the source of the care. Include the business name, if applicable, and the provider’s address, phone number, and email.

Next, clearly state the recipient’s name–either the parent or guardian who paid for the service. It’s important to confirm the payer for proper record-keeping.

List the dates of service in detail. This includes the specific days the care was provided, with start and end times where relevant. This ensures both parties agree on the care period and helps with potential future reference or tax filings.

Specify the total amount paid for child care services, breaking it down if necessary (e.g., hourly rate, daily rate, or package deal). This breakdown helps ensure transparency and can be useful for both parties during tax season.

Include the payment method used (e.g., cash, credit card, or cheque). This confirms how the transaction was completed and adds a layer of clarity to your records.

Lastly, add a unique receipt number. This provides a reference for both parties in case of any disputes or future inquiries regarding the transaction.

Child care expenses are eligible for tax deductions in Canada, allowing parents to reduce their taxable income. To claim these expenses, ensure that the child care receipt meets specific criteria, such as containing the provider’s information, the amount paid, and the dates of service. Keep all receipts organized and accurate, as the Canada Revenue Agency (CRA) requires detailed documentation for verification.

Tax Benefits for Child Care Expenses

Parents can claim up to $8,000 per child under seven years old, and $5,000 per child aged seven to 16, depending on the province of residence. These amounts apply to a wide range of child care services, including daycares, nannies, and after-school programs. Make sure to cross-check the eligible services in your region to maximize your tax benefit.

Common Mistakes to Avoid

Avoid submitting receipts that lack required details, such as the provider’s name, the address, or the taxpayer’s identification number. Additionally, claiming expenses for unqualified services like extracurricular activities or overnight stays will result in denied claims. Review the CRA’s guidelines for clear instructions on eligible and ineligible expenses.

| Age Group | Maximum Deduction |

|---|---|

| Under 7 years | $8,000 |

| 7–16 years | $5,000 |

Customizing a child care receipt template for different provinces in Canada requires understanding local tax rules and reporting requirements. Each province may have unique specifications for what needs to be included in a receipt.

1. Include Provincial Tax Information

Some provinces, like Ontario and British Columbia, require a clear indication of the Harmonized Sales Tax (HST) or Provincial Sales Tax (PST) applied to the services. Be sure to list the applicable tax rate in the receipt, as well as the amount of tax charged on the total fee. For example, in Ontario, HST is 13%, while in BC it’s 5% GST and 7% PST.

2. Provide Clear Payment Breakdown

Provinces like Quebec have specific requirements for including detailed payment breakdowns. Your receipt should clearly show the child care service charges, any applicable discounts, and the total amount paid. Additionally, for Quebec, ensure that you mention whether the payment qualifies for any provincial child care tax credits.

Be sure to adjust the template based on each province’s unique rules, and include any local credits or subsidies available to parents. This ensures your receipt meets all provincial requirements and aids parents in claiming potential tax benefits.

Accuracy is key when issuing child care receipts. Ensure the following to avoid common mistakes:

- Incorrect Information: Double-check the caregiver’s name, address, and tax identification number. Mistakes in these fields can lead to complications when claiming the credit.

- Missing Dates: Each receipt should clearly indicate the start and end dates of the child care services provided. Omitting or misplacing these dates can make the receipt invalid for tax purposes.

- Vague Descriptions: Always specify the type of care provided (e.g., full-time, part-time, after-school) and the number of hours worked. A general statement like “child care services” isn’t detailed enough.

- Failure to Include Payment Amounts: Clearly itemize the fees charged for services. This should include the total amount for each service period and any additional fees (e.g., registration fees, late pick-up fees).

- Not Providing a Signed Receipt: A receipt without the caregiver’s signature is incomplete. Ensure that the caregiver signs the receipt to confirm the validity of the transaction.

- Incorrect Tax Information: If the caregiver is registered for GST/HST, make sure the appropriate tax amount is reflected on the receipt. Missing tax details may lead to the rejection of claims.

- Failure to Issue a Receipt for Every Payment: Provide a receipt for every payment made. This helps create a clear record for both you and the caregiver and can prevent confusion during tax season.

Avoid these mistakes, and you’ll streamline the process for both yourself and the caregiver while staying compliant with Canadian tax regulations.

Where to Find Pre-Made Templates for Child Care Receipts for Canadian Parents

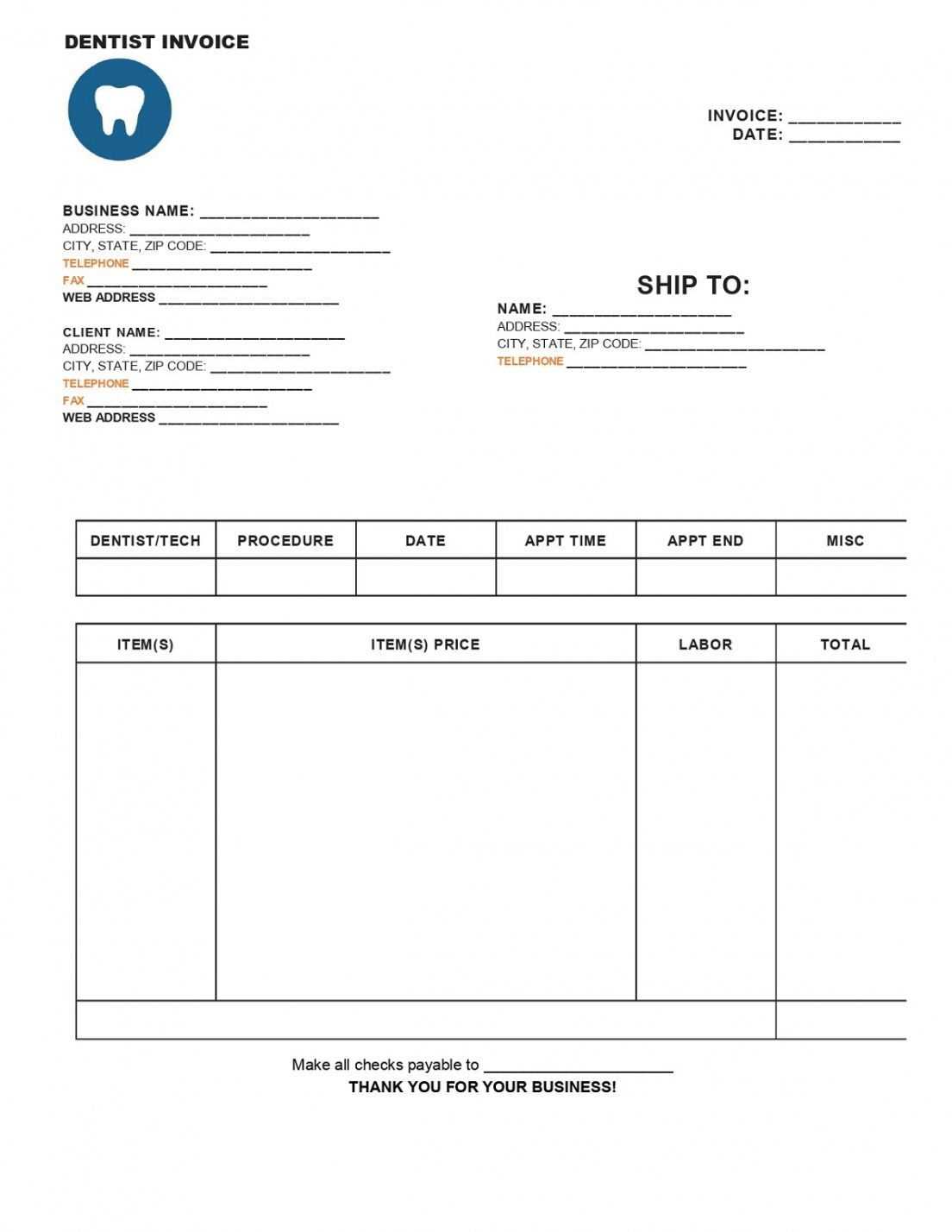

Parents in Canada looking for pre-made child care receipt templates can find reliable options online through several platforms. Websites like Canada.ca offer downloadable templates that meet the required standards for tax purposes. These templates include all necessary details such as the child’s name, care provider’s information, and payment amounts. They are ready to use and often come with clear instructions for customization.

Government Websites and Online Resources

The official Canadian government website offers templates designed specifically for child care expenses. These templates follow the necessary legal format and include all required fields to ensure proper documentation for tax claims. Additionally, many provincial websites provide tailored templates that reflect local tax regulations, making it easier for parents to find one that suits their needs.

Third-Party Websites and Tools

Several third-party websites specialize in providing customizable child care receipt templates. These websites often offer free or affordable options that can be downloaded and adjusted to suit specific circumstances. Some popular platforms like Vertex42 and TemplateLab offer various templates, including Excel and PDF formats, that meet Canadian standards for tax receipts.

By using these pre-made templates, Canadian parents can ensure that their receipts are tax-compliant and organized, helping streamline the process when claiming child care expenses during tax season.

Child Care Receipt Template: Key Elements and Variations

When creating a child care receipt, it’s important to include all necessary details while keeping the language varied. The term “Child Care Receipt” should only appear where absolutely needed, allowing for the use of synonyms or alternative phrases to maintain clarity and flow.

Key Information to Include

A child care receipt should clearly state the services provided, including the name of the provider, the dates of care, and the total amount paid. Avoid repetitive wording by referring to the “care services” or “child care” as needed, but ensure the information is clear. For instance, instead of repeating “Child Care Receipt,” you can simply mention “the receipt” or “payment record” when referring to it in other parts of the document.

Formatting and Structure

Keep the format simple and organized, highlighting the provider’s name, address, and contact details. The date range of care should be specified, along with the total payment amount. Replacing “Child Care Receipt” with “invoice” or “payment confirmation” in various sections helps avoid unnecessary repetition without losing meaning.

In the final lines, a statement like “This document confirms the payment for child care services” can conclude the receipt effectively, reiterating the key purpose without redundancy. Using such variations keeps the document professional while remaining easy to read.