For clear financial tracking, a Statement of Cash Receipts and Disbursements template offers a straightforward method for recording incoming and outgoing funds. This format allows you to categorize cash transactions efficiently, ensuring transparency and better management of cash flow.

Start with a structured format: The template should begin with sections for the date, cash receipts (e.g., revenue from sales, loans, or investments), and disbursements (e.g., payments for operating costs or loan repayments). Organizing the data in this way provides a clear snapshot of cash movements over a specific period.

Include detailed columns: Create separate columns for each type of transaction to avoid confusion. For example, one column for “cash receipts,” one for “cash disbursements,” and another for the balance. This breakdown makes it easier to track both positive and negative cash flow, helping to pinpoint any discrepancies quickly.

Ensure accuracy: Regularly update the template with accurate data, noting each transaction as it occurs. This practice minimizes errors and provides reliable figures for decision-making. Adjusting the template as needed ensures that it stays aligned with your financial reporting requirements.

Here’s a revised version of the sentences with reduced repetition while maintaining the meaning:

To create a clearer statement of cash receipts and disbursements, focus on consolidating similar transactions. Group cash inflows by categories such as sales revenue, loans, or interest income. Similarly, for disbursements, organize them into categories like operating expenses, loan repayments, and capital expenditures. This will reduce redundancy and improve the document’s clarity.

Focus on Clear Categorization

Instead of listing each transaction individually, categorize receipts and disbursements. For example, under “Operating Income,” combine all revenue-related transactions into one line. Similarly, group “Payments” by type, such as utilities, rent, or salaries. This structure simplifies your statement while retaining accuracy.

Keep Descriptions Brief

Use concise language to describe each category, limiting unnecessary detail. Instead of elaborating on every single item, provide a summary that includes the key points. This keeps your statement focused and reduces repetition.

- Detailed Guide on Cash Receipts and Disbursement Templates

Begin by designing your template with clear sections for tracking incoming and outgoing cash. The structure should allow you to list every transaction, specify the amount, and include the date of receipt or disbursement.

Key Sections to Include

- Receipts – Record all incoming cash, including sales, loans, or any other sources. Ensure each entry has a corresponding date and a description.

- Disbursements – List all cash outflows such as bills, salaries, or any payments made. Provide the amount, date, and purpose for transparency.

- Balance – Include a section to calculate the ending balance after each transaction, ensuring accuracy in cash tracking.

Formatting Tips

- Column Organization – Use columns for Date, Description, Amount (Receipts and Disbursements), and Running Balance.

- Clear Categorization – Group receipts and disbursements into categories for better visibility, such as Operating, Financing, and Investing activities.

- Consistency – Ensure every entry is consistent in format. This helps in easy reading and reduces errors when reviewing the data.

Use this template to monitor cash flow effectively. With proper tracking, you can make informed financial decisions and maintain control over your cash position.

To structure a basic template for tracking cash inflows and outflows, focus on clarity and simplicity. Organize the template into columns for date, description, inflow amount, and outflow amount. Include a row for the balance to track the net cash flow at any given time.

| Date | Description | Inflow Amount | Outflow Amount | Balance |

|---|---|---|---|---|

| MM/DD/YYYY | Example Income | $XXXX.XX | $0.00 | $XXXX.XX |

| MM/DD/YYYY | Example Expense | $0.00 | $XXXX.XX | $XXXX.XX |

Input each transaction as it occurs, ensuring that all inflows and outflows are accounted for in the corresponding rows. The balance should automatically update based on the amounts entered for each transaction.

A well-structured cash flow statement template includes the following components to ensure clarity and accuracy:

- Operating Activities: This section covers all cash transactions related to core business activities such as cash receipts from customers and cash payments to suppliers and employees.

- Investing Activities: Include cash flows from buying or selling long-term assets like equipment, property, and investments.

- Financing Activities: Cash flows related to borrowing and repaying loans, issuing or repurchasing stock, and dividend payments should be listed here.

- Net Change in Cash: Calculate the difference between cash inflows and outflows during the reporting period, indicating the overall change in cash available.

- Cash at the Beginning and End of the Period: Clearly state the opening and closing cash balance, which provides a clear view of liquidity at both points in time.

Each of these elements should be clearly separated in the template for better readability and understanding of cash flow activities.

| Section | Description |

|---|---|

| Operating Activities | Cash received from customers and cash payments to suppliers and employees. |

| Investing Activities | Cash flows from the acquisition and sale of long-term assets and investments. |

| Financing Activities | Cash inflows and outflows from borrowing, stock issuance, and dividends. |

| Net Change in Cash | The overall increase or decrease in cash over the period. |

| Cash at the Beginning and End | The cash balance at the start and end of the reporting period. |

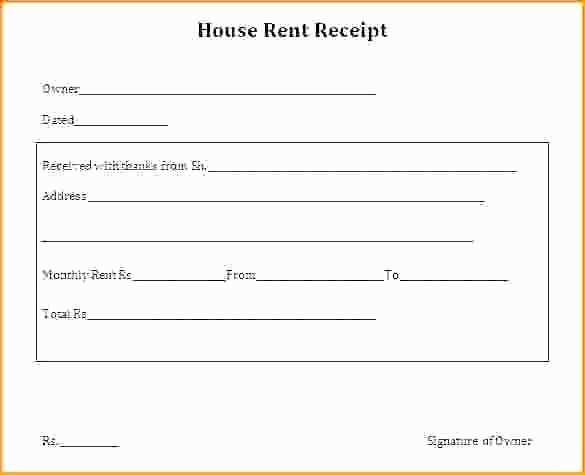

Ensure each receipt is logged immediately after it is received. This minimizes the chances of forgetting or misplacing the information later. Use a standard template for consistency in how you record each entry, making sure to include the date, amount, and the source of the funds.

Track the Source of Each Receipt

Clearly identify the source of each payment, whether it’s a customer, client, or another business. This helps create a detailed record for easy reference and can be crucial for audits or future reconciliation. Double-check the source details if they are unclear at first.

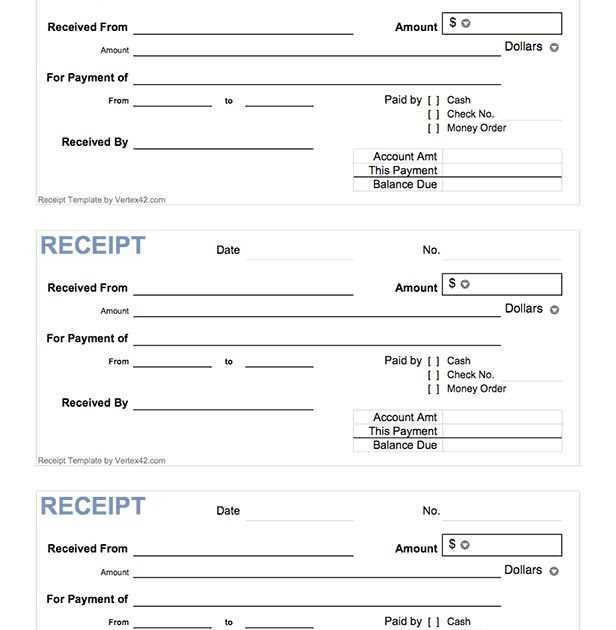

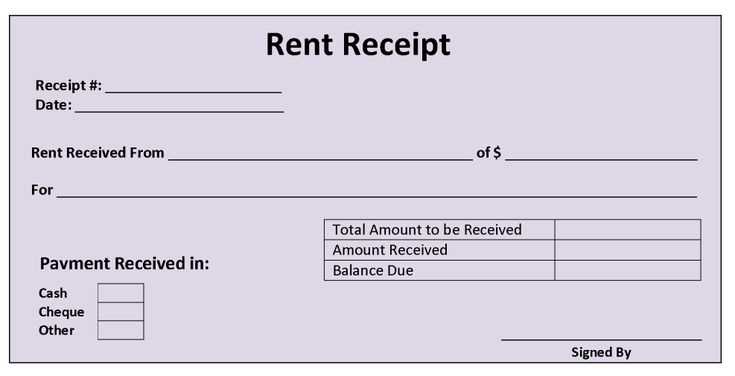

Include Payment Methods and Reference Numbers

Always note the payment method, whether cash, check, or digital transfer, as well as any reference numbers associated with the transaction. This adds an extra layer of verification and makes it easier to trace or follow up on any discrepancies later.

Accurate disbursement tracking starts with consistent record-keeping. Each disbursement must be recorded in detail, including the date, amount, payee, purpose, and payment method. This ensures transparency and simplifies audits and financial reviews.

Use Clear Categories and Codes

Classify disbursements into specific categories (e.g., operating expenses, payroll, vendor payments) and assign codes for each type. This enables faster identification and comparison of expenses, making it easier to spot any discrepancies or trends.

Implement Regular Reconciliation

Reconcile disbursements with bank statements regularly. This helps identify any discrepancies quickly and ensures that all payments are accurately accounted for in your records. Regular checks reduce errors and prevent potential issues during year-end closing.

The beginning and ending balances in a statement of cash receipts and disbursements are key for tracking the flow of cash over a period. They represent the starting and ending points of cash on hand, providing a snapshot of the financial health at both ends of the period. The beginning balance reflects the cash available at the start, which should match the ending balance from the previous period. The ending balance is the amount of cash left after accounting for all receipts and disbursements during the period. It’s crucial to ensure the ending balance reconciles with the starting balance for the next reporting period, confirming accuracy in cash flow tracking.

By clearly understanding these balances, discrepancies in cash movements can be identified. Any significant differences between the expected beginning balance and actual beginning balance may point to errors or unreported transactions from the prior period. Similarly, the ending balance provides insights into whether the cash management strategy was successful during the period or if adjustments are necessary moving forward. This simple yet effective tracking helps maintain financial clarity and accountability in cash flow management.

Accurate record-keeping is key to maintaining financial transparency. Here’s a breakdown of common mistakes to steer clear of while using the receipts and disbursements template:

1. Incorrect Categorization of Transactions

Ensure that all transactions are categorized correctly. Mixing receipts with disbursements or inaccurately labeling expense categories can lead to confusion and inaccurate reporting. Always double-check that each entry aligns with its respective category.

2. Forgetting to Record Small Transactions

Small transactions often get overlooked, but they add up. Ensure every transaction, no matter how minor, is entered into the template. Skipping these can result in discrepancies in your financial records.

3. Missing Supporting Documentation

Each entry should be backed by supporting documentation, such as receipts or invoices. Without these, it’s challenging to validate the accuracy of the entries. Make sure to attach or reference these documents when updating the template.

4. Not Regularly Updating the Template

Updating the template only at the end of the month or quarter can result in missed or forgotten transactions. Regularly update the records to keep your financial data accurate and up to date.

5. Inconsistent Data Entry

Consistency is vital when inputting data. Stick to a standard format for dates, transaction descriptions, and amounts. Inconsistencies can cause confusion and errors in financial analysis.

6. Failing to Reconcile Discrepancies

Always reconcile any discrepancies between your receipts and disbursements. If a mismatch occurs, investigate immediately to identify the source of the issue and correct it before it affects your financial accuracy.

By avoiding these mistakes, you can maintain a reliable and accurate statement of receipts and disbursements. Ensure all entries are precise and up-to-date to reflect true financial standing.

Use a consistent structure for your cash receipts and disbursements statement to ensure clarity and accuracy. Organize the template into clear sections, highlighting cash inflows and outflows. This method ensures that all financial data is easy to follow and understand.

- List receipts by source: Categorize income streams such as sales, loans, or capital contributions. Include the amount and date for each entry.

- Detail disbursements: Break down payments by purpose, such as rent, utilities, payroll, or loan repayments. Each entry should be accompanied by the payment amount and date.

- Track net change: Subtract total disbursements from total receipts to determine the net change in cash. This figure provides an overview of the financial position during the period.

- Periodical updates: Ensure the statement is updated regularly to reflect current financial data. This helps track trends and project future cash flows.

- Keep it simple: Avoid unnecessary complexity. Use clear and concise categories that anyone reviewing the statement can easily understand.