Use this free printable cash receipt template to track all your transactions with ease. Whether you’re managing a small business or just keeping personal records, this simple, yet functional template helps ensure accurate documentation for every cash exchange.

Download the template in your preferred format and start using it right away. It is designed to include all necessary fields like the transaction date, payer’s name, amount, and payment method. No additional tools are required–just print and fill it out as needed.

If you’re looking to create a clear and professional-looking receipt quickly, this template will do the job. You can adjust the layout to fit your specific needs, ensuring all key information is clearly displayed and easy to read. No hassle, no extra steps–just print and go.

Keep records organized with this straightforward tool. By tracking cash transactions properly, you can maintain transparency and avoid potential confusion down the line. Whether for personal use or business purposes, having a well-documented receipt ensures peace of mind and clarity in your financial dealings.

How to Customize a Free Cash Receipt Template for Your Business

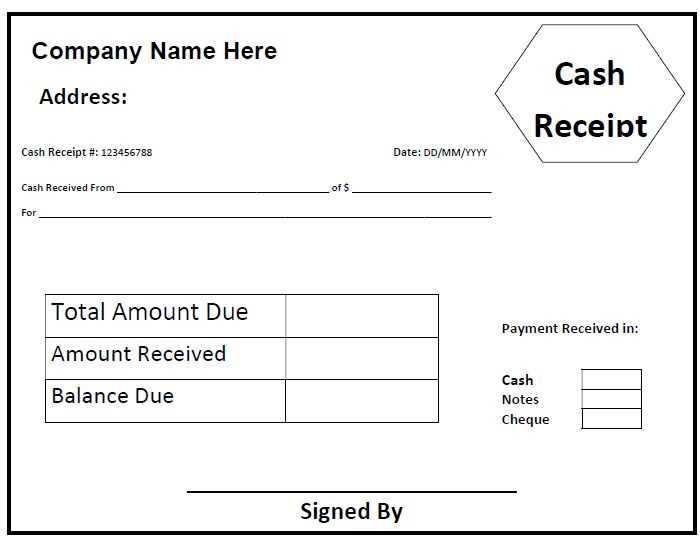

Begin by opening the receipt template in your preferred word processor or spreadsheet software. Modify the header section with your business name, address, phone number, and email for easy customer contact. This adds a personal touch and makes the receipt more professional.

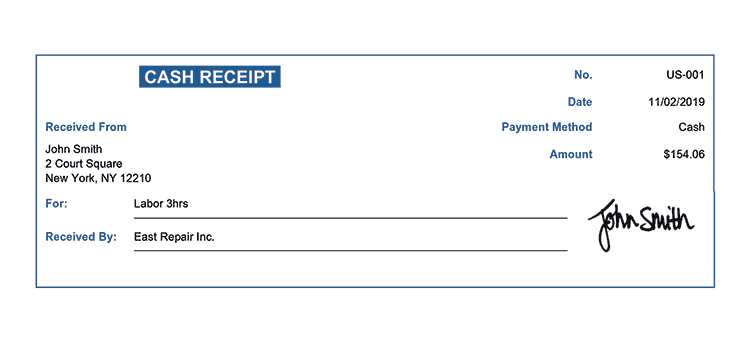

Next, customize the transaction details. Update the item or service descriptions, and ensure the quantity, price, and total match the transaction. You can also add tax rates if needed, depending on your local tax laws. Clearly label each section to avoid confusion.

Include a payment method field. Customize it to reflect the methods your business accepts, such as cash, credit card, or check. If applicable, add a reference number or transaction ID for tracking purposes.

If you require specific terms or policies on your receipts, create a section at the bottom. This could include return policies, warranties, or service agreements that customers may need to know.

Finally, adjust the design. Change fonts and colors to match your branding. You can also add your company logo or a watermark for added customization. Ensure the layout is clean and easy to read, keeping the receipt functional and visually appealing.

Step-by-Step Guide to Printing and Using a Receipt Template

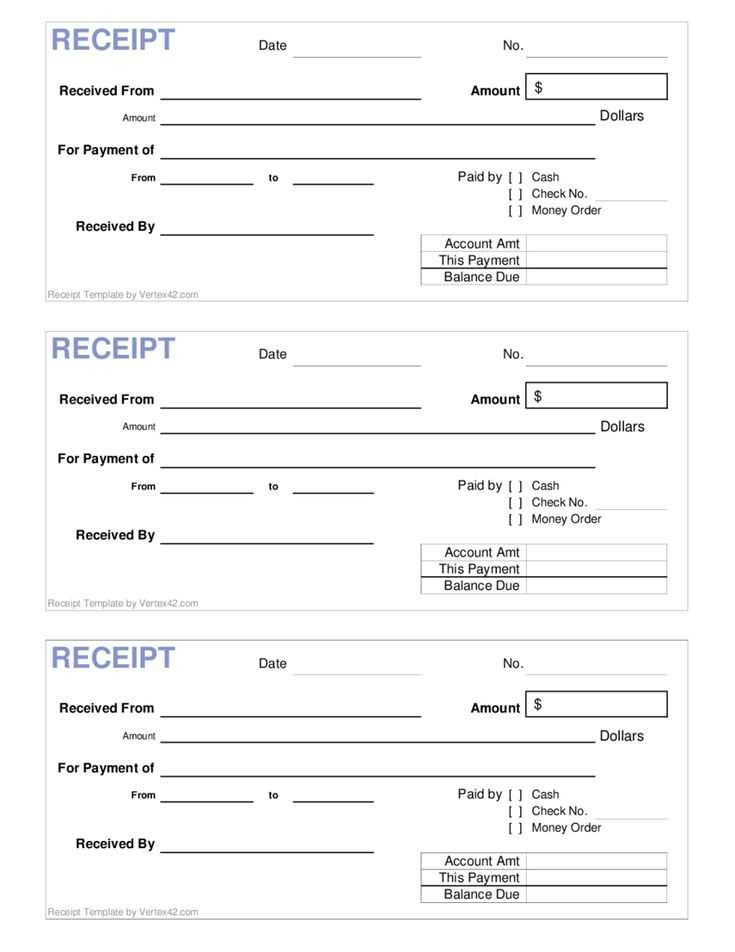

Choose a receipt template that suits your needs. Download it from a trusted website that offers free templates. Look for formats like PDF or Word for easy editing and printing.

Open the downloaded file using the appropriate software. If it’s a Word document, you’ll need Microsoft Word or a compatible word processor. For PDFs, use a PDF reader like Adobe Acrobat.

Personalize the template by filling in the required details. Include your business name, contact information, transaction date, item descriptions, and prices. Double-check all entered data for accuracy.

Save your edited receipt to prevent losing your changes. Name the file appropriately for easy reference later.

Print the receipt by selecting the ‘Print’ option in your software. Choose your printer settings, such as paper size and quality. Ensure that your printer is connected and has enough ink or toner for a clear print.

If you plan to store receipts digitally, save them as PDF files. This ensures that they can be easily accessed and shared when needed.

Common Mistakes to Avoid When Creating Cash Receipts

Double-check the information before finalizing the receipt. Missing or incorrect details like the date, amount, or payment method can lead to confusion. Always verify the transaction data to ensure accuracy, especially if using pre-made templates.

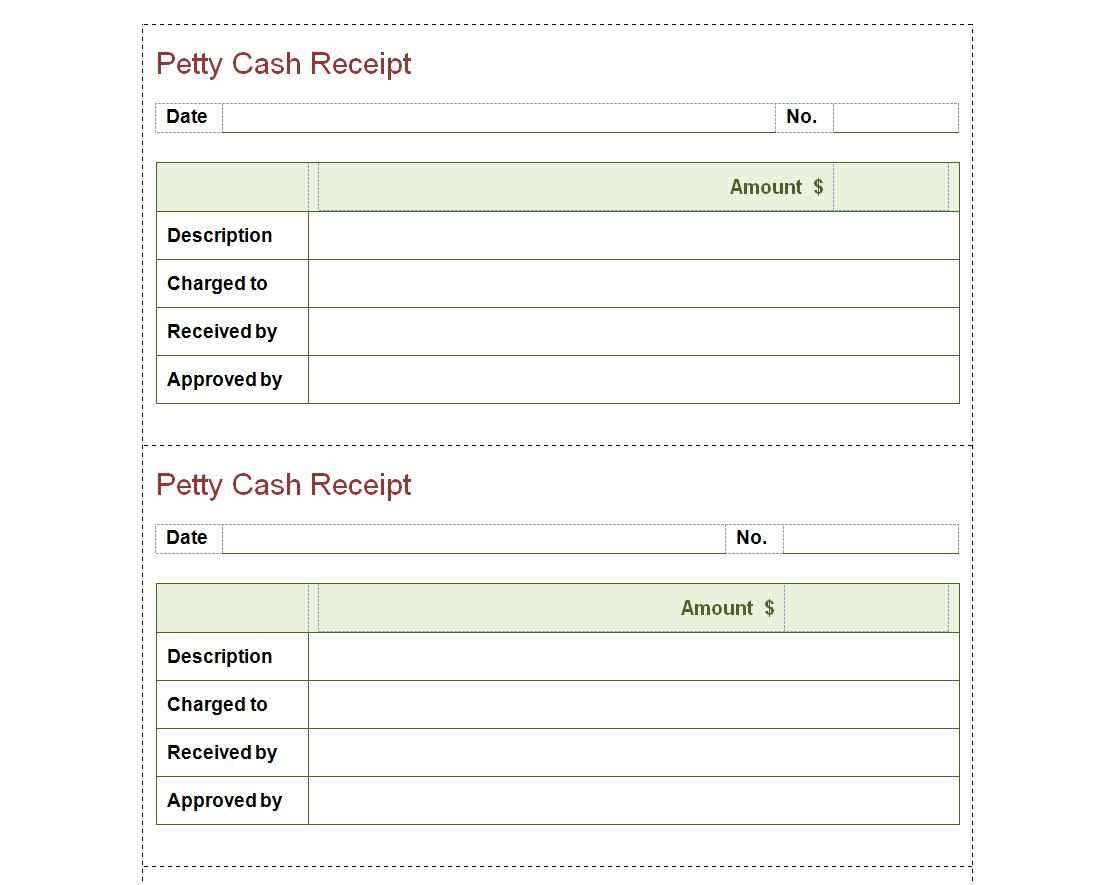

1. Forgetting the Unique Receipt Number

Every receipt should have a unique identifier. Failing to include a number or using the same number for multiple receipts can cause trouble for both tracking and future reference. It also makes record-keeping harder.

2. Skipping Payment Method Information

Always specify the payment method used (cash, card, check, etc.). Without this, it’s difficult to reconcile payments and trace transactions later. Even small details like the last four digits of a credit card number can be helpful for verification.

Be clear about the items or services provided. Listing unclear descriptions or leaving out crucial details can cause confusion if the receipt is questioned later. Use precise, unambiguous descriptions of products or services sold, with quantities and prices, to avoid misunderstandings.

Neglecting the business information is another mistake. Make sure the receipt includes your business name, address, phone number, and tax ID number if applicable. This ensures your receipt meets legal requirements and provides the customer with a way to contact you if needed.

Lastly, don’t forget about proper formatting. A cluttered, hard-to-read receipt will not only irritate the customer but also make record-keeping more difficult. Organize the information in a clean, structured way with proper spacing and alignment for clarity.