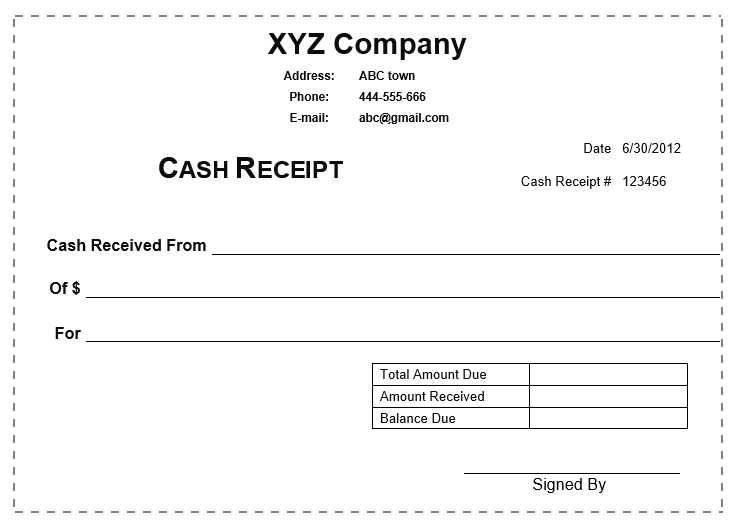

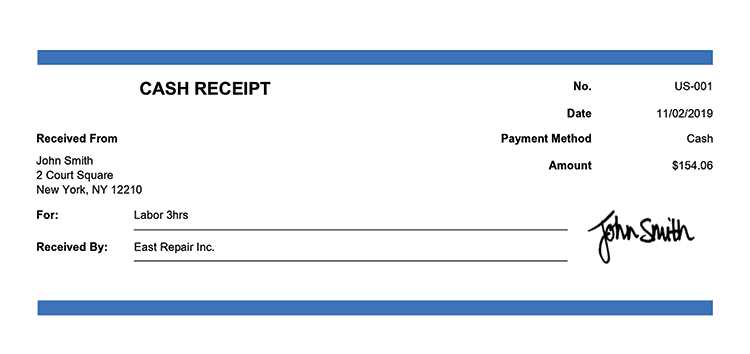

For accurate financial tracking in construction projects, a cash receipt template can simplify the process of documenting payments. Ensure all relevant details are included: the payer’s name, the amount, the date of payment, and the project description. This basic structure helps maintain transparency between contractors and clients.

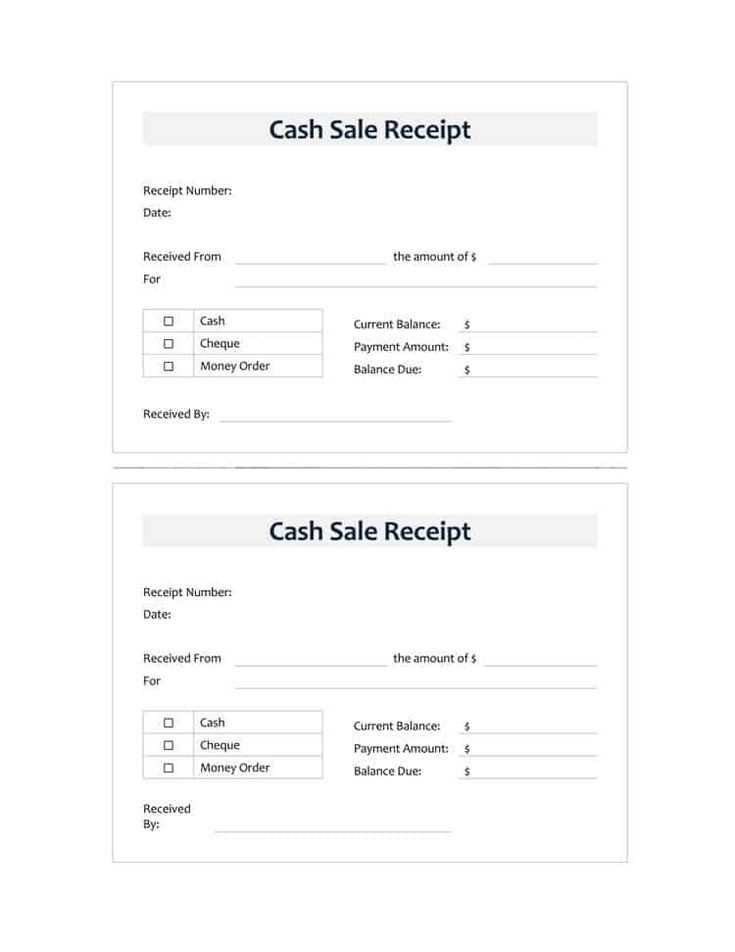

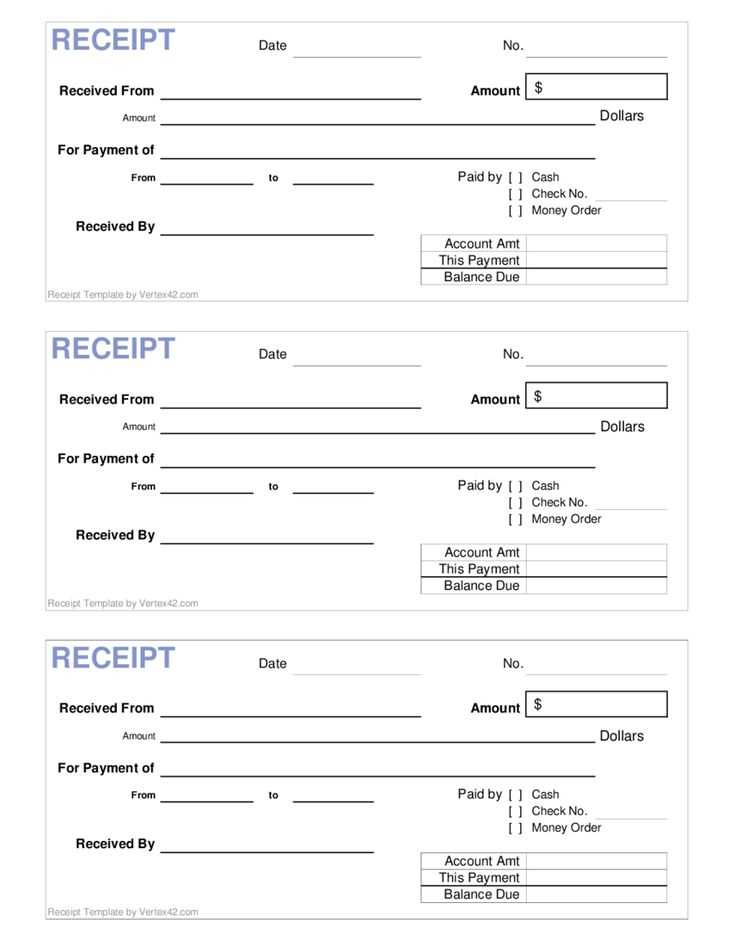

Include payment method information, such as cash, check, or electronic transfer, to track the flow of funds effectively. It’s important to have a clear breakdown of any additional fees or adjustments made. A detailed receipt keeps both parties informed and avoids misunderstandings.

For those managing multiple projects, consider creating a template that includes space for project-specific notes, helping to organize receipts by job. Using a template ensures consistency across all records and reduces the chance of errors. This method is especially useful for contractors handling multiple transactions on different job sites.

Cash Receipt Template Construction Work

A cash receipt template for construction work should include key details to ensure both clarity and legality. Start with the basic fields like the contractor’s name, the recipient’s name, and the payment amount. Specify whether the payment is for labor, materials, or both. This helps avoid confusion in case of disputes or audits.

Key Components

- Date of payment: Clearly indicate when the payment was received.

- Payment method: Include whether payment was made via cash, check, or bank transfer.

- Description of work: Provide a brief description of the work completed, referencing the specific job or contract.

- Amount: List the exact amount paid and ensure it’s clearly broken down if the payment covers multiple aspects.

- Receipt number: Assign a unique number to each receipt for tracking purposes.

- Signature: Both the contractor and recipient should sign to confirm the transaction.

Additional Considerations

- Invoice reference: Link the receipt to an invoice number for easier tracking and reconciliation.

- Tax information: If applicable, include tax details or an indication of whether the amount is tax-inclusive or exclusive.

- Address details: Both the contractor and recipient’s addresses should be clearly noted for reference.

Use this template consistently for all payments, ensuring all fields are filled out correctly and accurately. This will provide clear documentation for both parties and maintain a reliable record of transactions.

Creating a Template for Labor and Materials Tracking

Set up a simple table to track labor and material costs. Break it down into columns for each aspect: date, labor hours, hourly rate, material type, material quantity, and total cost. Include a column for additional notes to clarify any special circumstances or variations.

For labor, list worker names or IDs, ensuring that each entry corresponds to specific tasks or days. Multiply the number of hours worked by the hourly rate to calculate the total cost. In the materials section, specify the item type, quantity used, and the price per unit to track material expenses accurately.

Use separate rows for each workday or material delivery to maintain clarity. At the end of each entry, calculate the total labor and materials cost for that entry. For added transparency, create a summary section at the bottom that shows the total cost for both labor and materials over a specific period.

Regularly update the template to capture ongoing changes, ensuring accurate records throughout the project’s duration. This system helps quickly identify discrepancies or overages, keeping the project on budget and on schedule.

Integrating Payment Methods into Receipt Templates

Include a dedicated section for payment methods to keep the receipt clear. Specify the payment type used for the transaction, such as cash, card, or digital wallet. Label this section clearly with “Payment Method” or a similar heading to ensure easy identification.

For cash payments, state the exact amount received and, if applicable, note the change given. For card payments, show the last four digits of the card number to identify the payment method without exposing sensitive data. For online or mobile payments, include a reference number or transaction ID for tracking purposes.

Ensure the format is uniform for all payment methods to avoid confusion. Keep it concise and straightforward–only include information that’s necessary for both the customer and the business to reference later.

By integrating payment methods into your receipt template, you provide a transparent record that can be helpful for both parties in case of questions or disputes.

Compliance Considerations in Construction Receipts

Ensure all construction receipts include accurate details, such as the contractor’s full name, business address, and contact information. This data confirms the legitimacy of the transaction and supports auditing processes. Itemize each service or material used, specifying quantities, rates, and total costs. This transparency helps prevent misunderstandings and disputes.

Verify that tax information is properly stated, with applicable tax rates included. Construction projects often involve various tax categories, and failing to list taxes separately can lead to legal issues. Use clear item descriptions and reference contracts or estimates to match amounts with agreed-upon terms. This minimizes confusion and aligns with regulatory requirements.

Adhere to local regulations regarding payment terms. Clearly indicate due dates and any late payment penalties. Timely payments and clear deadlines help avoid legal complications. Consider keeping receipts for a minimum period as required by law to stay compliant with record retention policies.

Lastly, double-check that payment methods and any advances or prepayments are listed correctly. This detail avoids ambiguity in financial reporting and ensures that all transactions align with contractual agreements.