Use a clear and straightforward template for your online donation receipts to maintain transparency and trust with your donors. A well-structured receipt provides all necessary details, ensuring your donors have proof of their contribution for tax purposes and personal records.

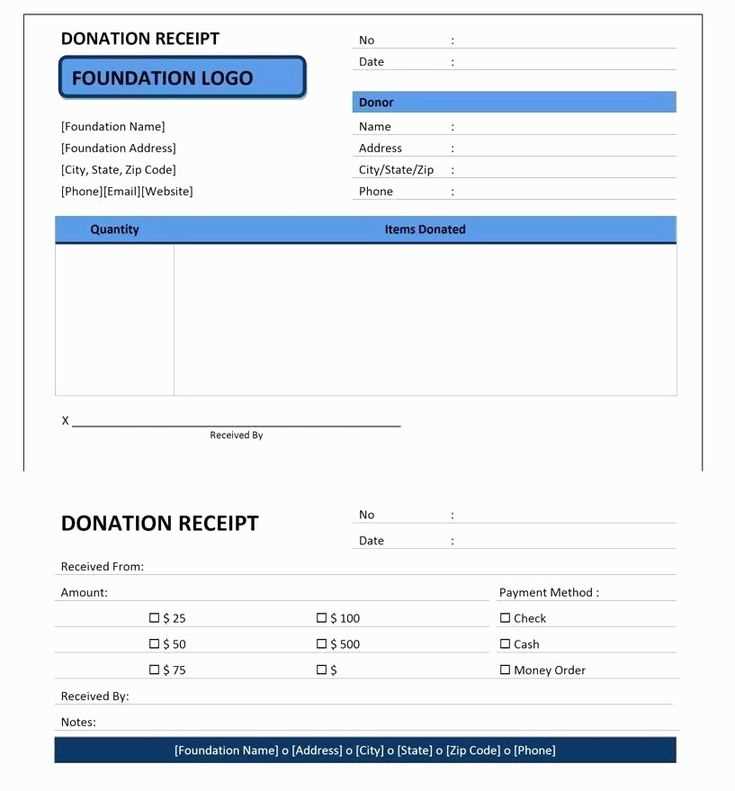

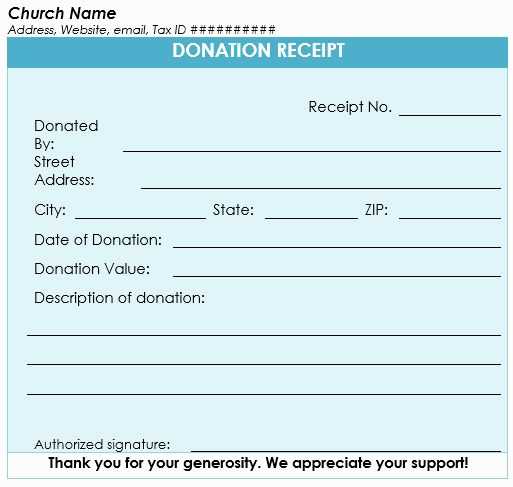

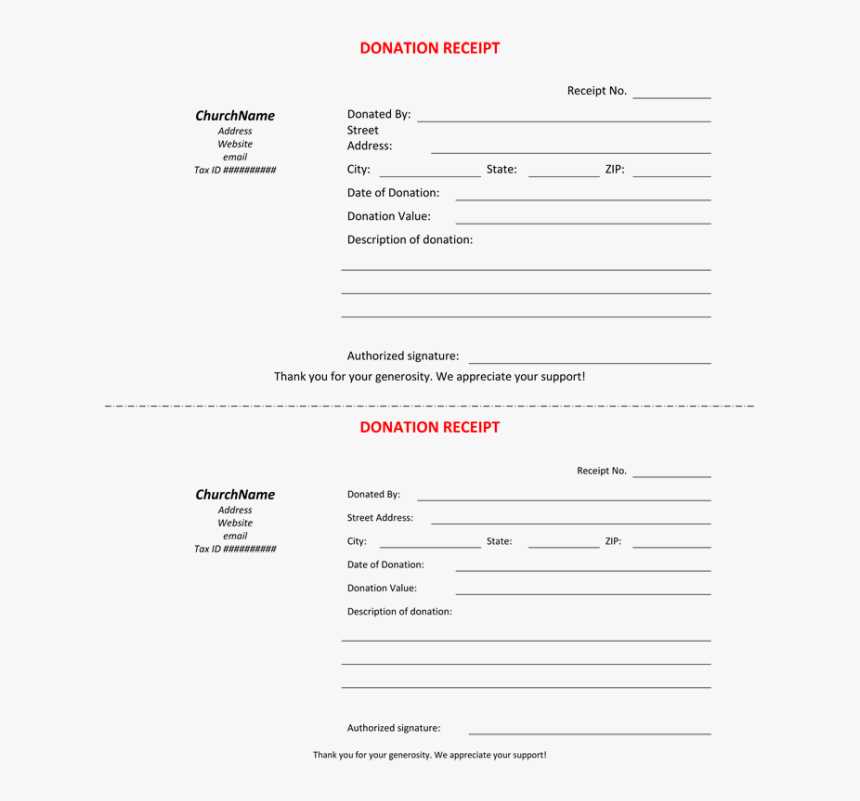

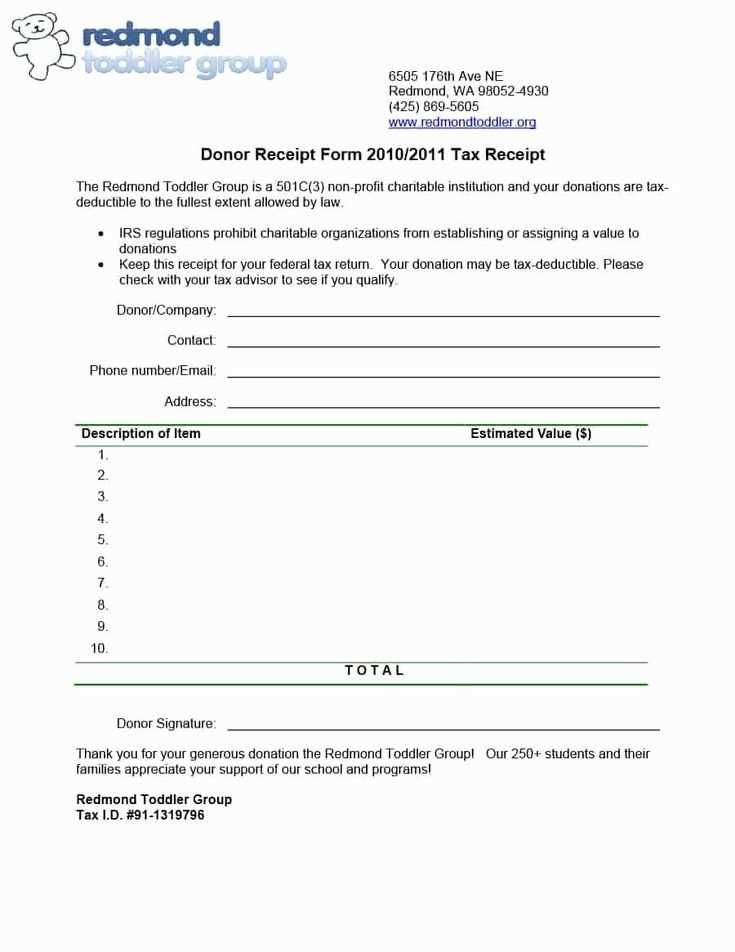

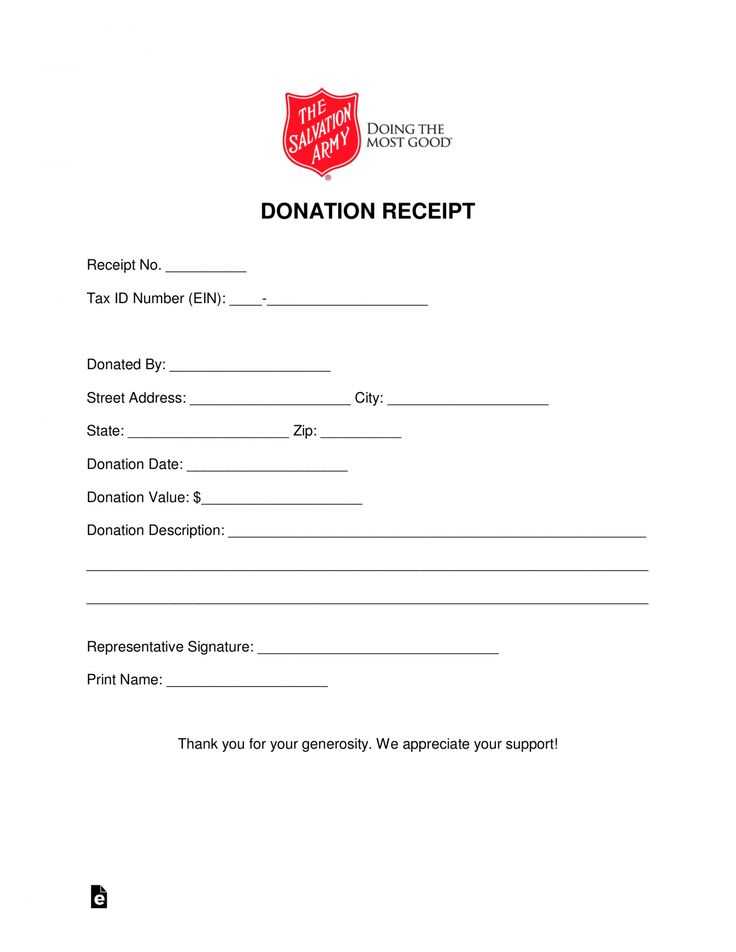

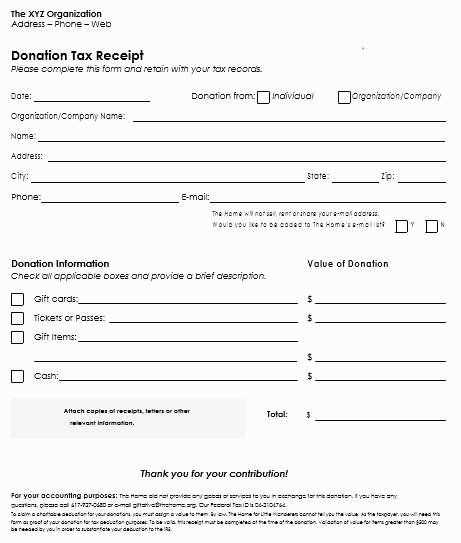

Ensure the template includes the donor’s name, donation amount, date, and the nonprofit organization’s details. Clearly state whether the donation is tax-deductible, as this information is crucial for the donor’s tax filings. Adding a brief thank you message can also enhance the donor’s experience, showing appreciation for their support.

Avoid unnecessary complexity in the design. Keep the format simple, with clear sections and easy-to-read fonts. You can personalize the receipt with your organization’s logo and contact information for a professional touch. Make sure the donation receipt is easy to find and accessible after a donation is made, either by email or through an online account.

Here’s the revised version with reduced repetition:

The online donation receipt should be clear and straightforward. Each element must be precise to ensure the donor can easily verify the transaction.

Key Components to Include:

| Component | Description |

|---|---|

| Donor Information | Name, address, and email address of the donor |

| Donation Amount | Specify the exact amount donated, including currency |

| Charity Details | Include the full name, registration number, and contact information of the charity |

| Date of Donation | Clearly mention the exact date the donation was made |

| Tax Information | If applicable, provide tax-exempt status or other related info |

| Transaction Reference | Provide a unique transaction ID for tracking purposes |

A well-structured receipt not only helps maintain trust but also ensures tax-related queries can be handled without delays.

Best Practices:

Keep the layout simple and organized. Avoid overloading the receipt with excessive details. Highlight key information to ensure quick reference for the donor.

- Online Donation Receipt Template

When creating an online donation receipt template, ensure it contains key details: donor information, donation amount, date, and the charity’s tax-exempt status. This makes it easier for donors to track their contributions and for the organization to maintain accurate records. A well-structured receipt reinforces trust and ensures compliance with tax regulations.

Key Elements to Include

Include the donor’s name and address to personalize the receipt. The donation amount should be clearly displayed, as well as the date of the contribution. For online donations, include the transaction ID or reference number for verification. If the donation was for a specific cause or campaign, mention that too.

Tax-Exempt Status and Legal Information

Donors will expect the receipt to confirm that the organization is tax-exempt. This should be included along with any other legal information, such as the charity’s registration number. Make sure to specify that no goods or services were exchanged in return for the donation, as this is necessary for tax deduction purposes.

Providing clear and organized receipts will make the donation process more transparent for both parties and streamline record-keeping for the organization.

Begin by including the donor’s name and contact information. Specify the date of the donation and the amount given. If the donation is a monetary gift, state the amount. For items donated, list a description, quantity, and estimated value.

Include Organization Details

Clearly display your organization’s name, address, and tax identification number. This ensures the receipt is valid for tax purposes. Add your contact information, including an email and phone number, for any follow-up queries.

Donation Type and Purpose

State whether the donation was cash, goods, or services. If applicable, mention the specific purpose of the donation, such as a fundraising campaign or charity event. This provides clarity for both the donor and your organization.

Conclude the receipt with a thank you note to the donor, showing appreciation for their support. Ensure the document is clear and easy to read, formatted in a simple, professional manner.

A donation receipt must contain clear, specific details to be valid. At a minimum, include the donor’s name, the donation amount, and the date of the contribution. If the donation is non-monetary, describe the item or service donated and its estimated value. The receipt should state that the donor did not receive anything in return, ensuring it complies with tax regulations.

Include the organization’s name, address, and tax-exempt status, if applicable. This information confirms the legitimacy of the entity receiving the donation. If the donation is a monetary one, specify the exact amount, and for non-cash contributions, include the fair market value. If the donor received any goods or services in exchange, you must outline these and provide an estimate of their value to accurately calculate the tax-deductible portion of the donation.

Finally, ensure the receipt includes a clear statement indicating that no goods or services were provided in exchange for the contribution, if true. This statement is key for the donor’s tax purposes and for maintaining compliance with local laws.

Customize your online donation receipt template by tailoring it to the platform’s specific formatting tools. For example, when using payment gateways like PayPal or Stripe, adjust the template fields to match the donation details you collect–such as donation amount, donor name, and transaction ID. Make sure the receipt automatically includes these elements in a clean, easily readable layout.

If your platform supports custom fields, incorporate any additional data that may be relevant, like the donor’s contact information or campaign-specific identifiers. This way, each receipt can include unique references or thank-you notes, which can enhance the donor’s experience and improve record-keeping.

For platforms that allow HTML and CSS customization, use styling options to match your organization’s branding. Adjust fonts, colors, and logos to maintain consistency across communications. Ensure that the layout adapts well to both mobile and desktop views. Test across devices to guarantee a smooth display.

When using platforms with limited customization (like GoFundMe or Kickstarter), focus on the content rather than design. Be clear and concise with the information provided, and keep the donation receipt informative while avoiding unnecessary details that could confuse the donor.

Lastly, integrate automated email functions to send the receipt promptly after a donation is made. Customize the email subject and body text to reflect your tone and engagement style, ensuring it feels personal and genuine for the donor.

Donation Receipt Template Tips

- Use clear headers to specify donor details and donation information.

- Include the donation amount, date, and payment method for full transparency.

- Make sure to provide your organization’s name, address, and contact info for future reference.

- Incorporate a thank-you message to personalize the receipt and express gratitude.

- Design the receipt with an organized layout for easy reading and understanding.

This approach avoids unnecessary repetition of the word “online” while maintaining the clarity and structure of the sentences.