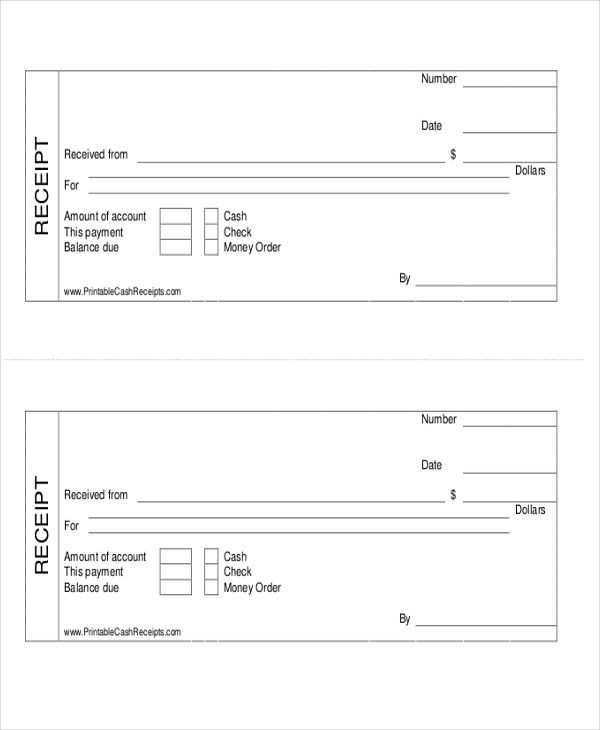

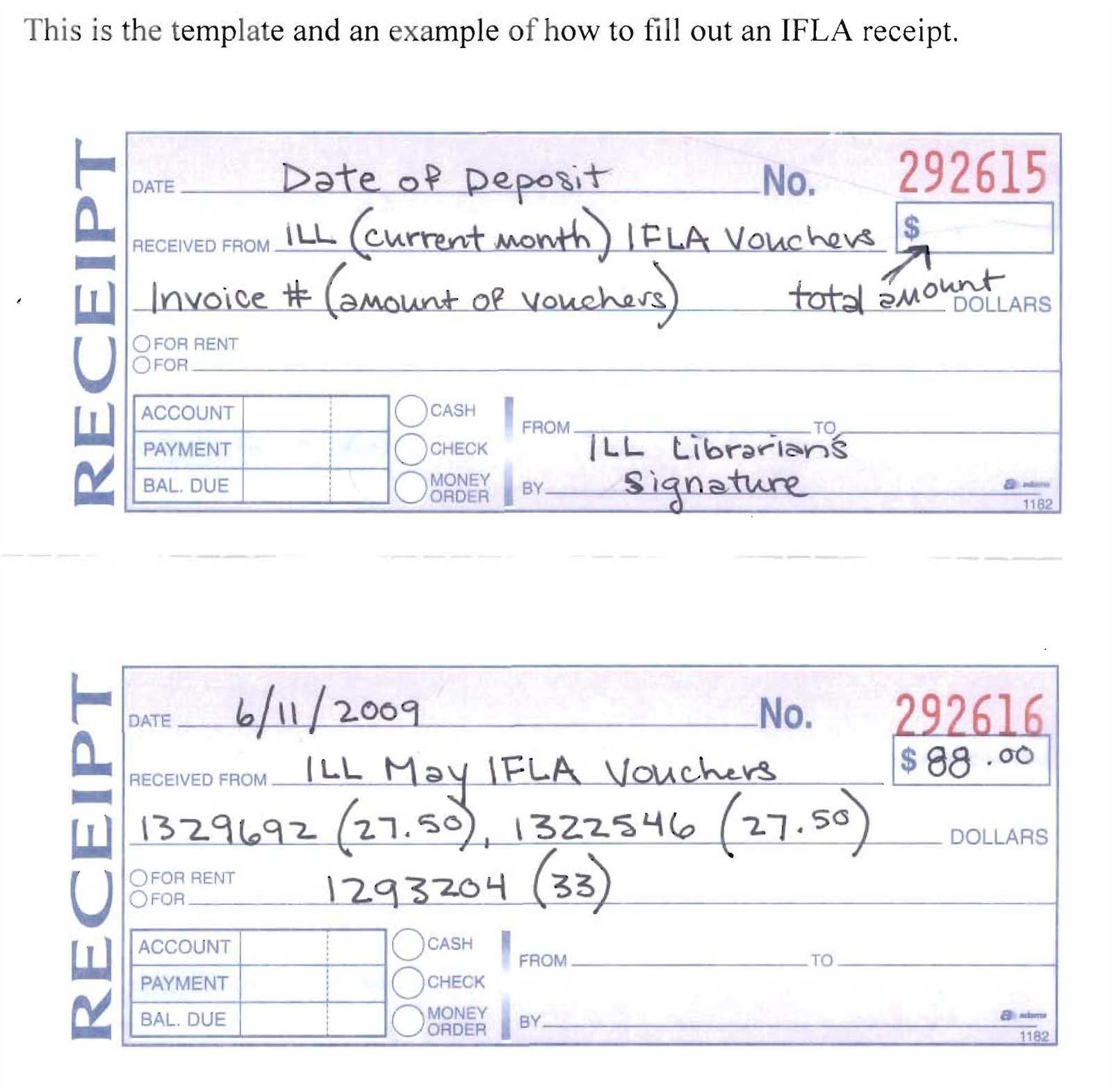

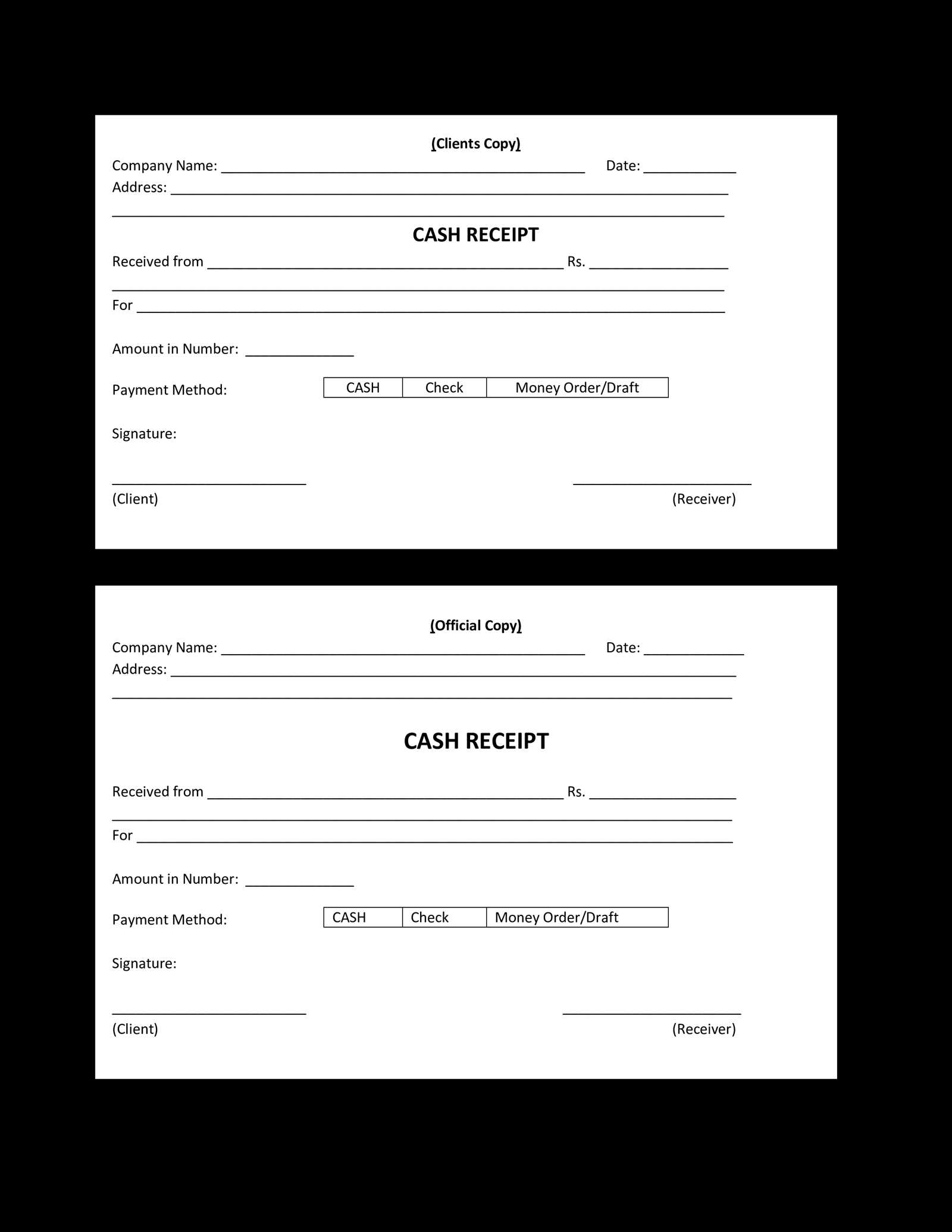

Start by filling in the basic details such as date, payee name, and amount received. These fields are the foundation of the receipt, ensuring both the payer and recipient are clearly identified. Use accurate amounts to avoid any confusion later on.

Next, fill in the payment method section, whether it’s a check, cash, or electronic transfer. This adds transparency and helps track how the payment was made. It’s important to include any relevant check numbers or transaction IDs when applicable.

Include a description of the transaction to give context. For example, note whether the payment is for services rendered, a loan repayment, or any other purpose. This will clarify the reason behind the payment.

Lastly, don’t forget to include the signatures of both the payer and the recipient. Signatures authenticate the document and confirm that both parties agree to the terms of the transaction.

Here is the corrected version:

Ensure all fields are filled out clearly and accurately. For a complete check receipt, include the date, payee name, amount, and check number. If you’re filling out a template, make sure to double-check the details of the transaction.

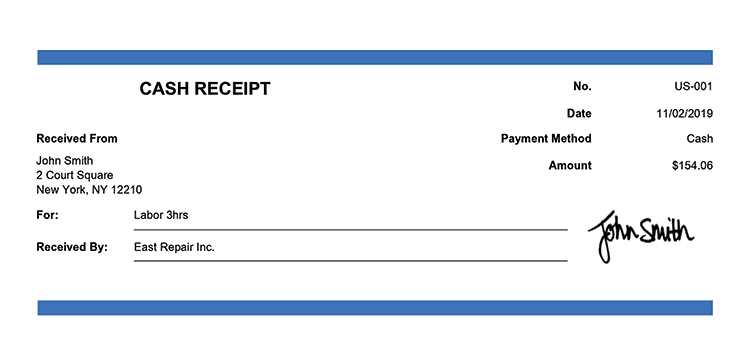

Start with the payer’s information at the top. Include the company name or personal details, followed by the address, ensuring the text is legible. Fill in the amount in words and numerals; these should match exactly. For additional clarity, use a clear format when listing the purpose or reason for the check.

The signature should be written in full, with the correct designation or title next to the name, if applicable. Make sure the check number is placed in the top right corner for easy reference. Lastly, confirm the bank details are correctly stated to avoid any errors in processing the check.

- Money Check Receipt Template Filled

When filling out a money check receipt template, accuracy is key. Follow these steps to ensure the receipt is completed properly:

- Date: Always enter the current date at the top of the receipt to indicate when the transaction occurred.

- Payee Name: Fill in the full legal name of the person or entity receiving the payment.

- Amount Paid: Clearly state the amount being paid. Use both numbers and words to prevent confusion.

- Payment Method: Indicate the payment method (check, cash, or electronic). If a check is used, include the check number.

- Purpose of Payment: Specify the reason for the payment. This helps to clarify the transaction.

- Signature: The payee should sign the receipt to confirm receipt of funds. This step adds credibility to the document.

- Contact Information: Include the contact details of the person or business issuing the receipt for future reference.

Once completed, double-check all fields for correctness. A well-filled receipt minimizes misunderstandings and is a reliable record for both parties.

To begin, ensure you have the correct check receipt template that matches the transaction type. Fill in the date at the top section accurately. Double-check this against your records to prevent any confusion later.

Next, input the payer’s name. This is crucial to ensure proper documentation of the transaction. Be precise and clear with the spelling. If the payment comes from a company, write the company name clearly.

Fill in the amount received. Ensure this matches the total amount on the check or cash being recorded. It’s helpful to write the amount in both numeric and written forms to eliminate any ambiguity.

In the “received from” field, enter the full name or business name of the individual or entity providing the payment. This is where you track who issued the payment. Avoid abbreviations or shorthand to ensure clarity.

Record the payment method. Indicate whether the payment was made by check, cash, or another form. If the payment was made via check, include the check number for future reference.

Write the purpose or reason for the payment. This helps both parties understand the context of the transaction. Be as specific as possible, mentioning the service or product related to the payment.

If there are any additional fields, such as a reference number or account details, be sure to fill those in as well. Accuracy in these sections helps when referencing this receipt in the future.

Finally, don’t forget to sign the receipt. Your signature authenticates the document and confirms the transaction details. If necessary, include your contact information for verification purposes.

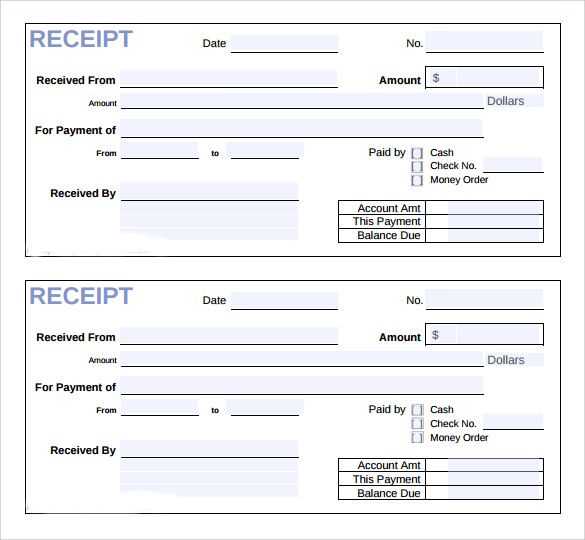

Focus on the following key fields while filling out a money check receipt template to ensure proper record-keeping and clarity:

1. Date of Transaction

Accurately enter the date when the payment was received. This ensures the record is timely and helps track financial transactions over time.

2. Name of Payer

Clearly list the name of the individual or company making the payment. This helps identify the source of the funds and avoids confusion during future reference.

3. Amount Received

Write down the exact amount of money received. Include both the numeric and written form of the amount to prevent errors.

4. Payment Method

Specify whether the payment was made by check, cash, or another method. This is important for distinguishing payment types and tracking the flow of funds.

5. Purpose of Payment

State the reason or purpose for the payment. This helps categorize the transaction and clarifies the reason for the exchange, which can be useful for both parties in the future.

6. Signature

Include a space for both the payer’s and receiver’s signatures. This adds legitimacy to the receipt and serves as confirmation that the transaction was completed.

7. Receipt Number

Assign a unique receipt number for each transaction. This can assist in organizing and tracking payments more efficiently, especially for business records.

8. Contact Information

List contact details such as phone number or email for follow-up communication if needed.

| Field | Description |

|---|---|

| Date of Transaction | Exact date the payment was received |

| Name of Payer | Full name or company name of the person making the payment |

| Amount Received | The total amount received, written both numerically and in words |

| Payment Method | Method used to make the payment (e.g., check, cash, online transfer) |

| Purpose of Payment | Reason or service for which payment was made |

| Signature | Space for the signatures of both the payer and the receiver |

| Receipt Number | Unique identifier assigned to each receipt for easy tracking |

| Contact Information | Phone number or email of the payer or receiver for further correspondence |

Double-check the recipient’s name for accuracy. Spelling errors can lead to confusion and delays in processing payments. Ensure that all characters are correctly entered, including middle names or initials if applicable.

Incorrect Date Entries

Always verify the date you enter on the receipt. Incorrect or missing dates can lead to legal issues or create difficulties in tracking payments. Make sure the date matches the actual transaction date.

Failing to Specify the Payment Amount Clearly

When entering the payment amount, write it out both numerically and in words. This reduces the risk of misinterpretation, especially when dealing with large sums or currency units that could be confusing.

Check the amount twice before finalizing. Mistakes in entering the figure or decimal point can cause discrepancies in your financial records.

Always leave space for additional notes if needed. This ensures all necessary information is included, such as payment method or transaction reference, to avoid confusion in future audits or inquiries.

Fill out the money check receipt template accurately to ensure proper documentation of your transactions. Start by clearly writing the date of the transaction and the name of the payer. Ensure that the payer’s information, such as their address or contact details, is included if required. The amount of money should be written both in figures and in words to prevent any discrepancies.

Include the purpose of the payment in a concise description. This could be for goods, services, or any other reason. If applicable, list the check number and any reference numbers to track the payment. Lastly, provide your signature to verify that the transaction is legitimate and complete.

Review the filled-out template to ensure all fields are correctly completed before issuing the receipt. Double-check the total amount and the date to avoid any mistakes that may cause confusion later. Having accurate and clear documentation helps maintain organized financial records and ensures both parties are on the same page.