For accurate record-keeping or reimbursement purposes, a well-structured taxi receipt from Washington DC is crucial. This template serves as a useful tool to ensure you capture all the necessary details of your taxi ride, such as date, time, fare breakdown, and service provider information. It helps you avoid any confusion or discrepancies that may arise when filing expenses or addressing queries from your transportation provider.

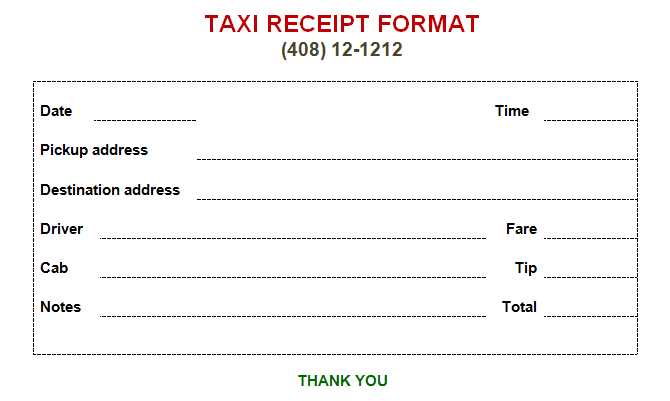

Ensure you include: the exact pick-up and drop-off locations, the total fare, including tips, and any applicable taxes. A taxi receipt should also display the cab number, driver’s name, and the unique identifier for the trip. Customizing this template to match your needs is straightforward, and having this format ready will save you time on each ride.

Remember to keep a copy of the receipt for your records, especially if you’re claiming travel expenses or simply need a reminder of the costs incurred. Using a clear, consistent template simplifies the process, ensuring transparency and accountability in any situation where a taxi receipt is required.

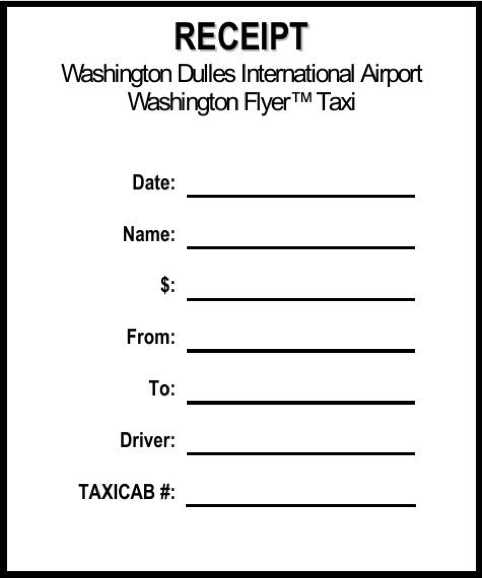

Washington DC Taxi Receipt Template

For a clear and accurate taxi receipt in Washington DC, ensure the following details are included:

The receipt should contain the taxi company’s name, including the contact number and address. It’s important to list the date and time of the ride, as well as the taxi’s unique identification number or vehicle details.

Clearly indicate the fare breakdown, showing the base fare, any additional charges (such as tolls or surcharges), and the total amount paid. Include the driver’s name and license number for identification. A tip section should also be visible if applicable, along with the method of payment used (cash, credit card, etc.).

Make sure the receipt is legible and printed clearly, allowing easy reference for future use or expense reporting. Ensure the format adheres to Washington DC’s regulatory standards for taxi services.

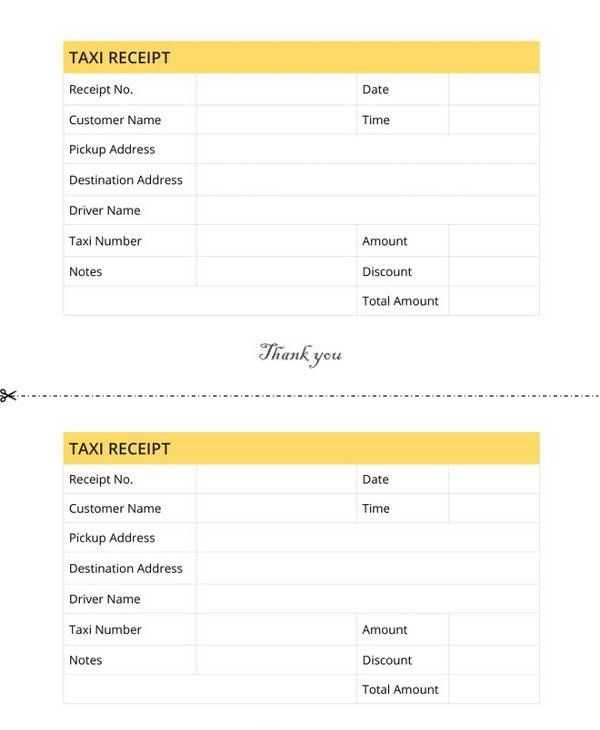

Key Information to Include in a Taxi Receipt

Make sure the receipt contains the following key details to ensure clarity and accuracy:

- Taxi Company Name and Logo: Clearly display the company’s name and logo for identification.

- Driver’s Name and ID Number: Include the driver’s name and unique ID for accountability.

- Pickup and Drop-off Locations: Specify the exact addresses of where the ride began and ended.

- Time and Date: Show the date and time of the trip, indicating both the start and end times.

- Fare Breakdown: List the cost of the trip, including base fare, additional charges (e.g., tolls, waiting time), and taxes.

- Payment Method: Indicate whether the payment was made by cash, card, or another method.

Additional Information to Consider

- Receipt Number: Include a unique number for tracking purposes.

- Vehicle Information: Record the taxi’s license plate number or vehicle ID for verification.

- Contact Information: Provide a phone number or email for customer service inquiries.

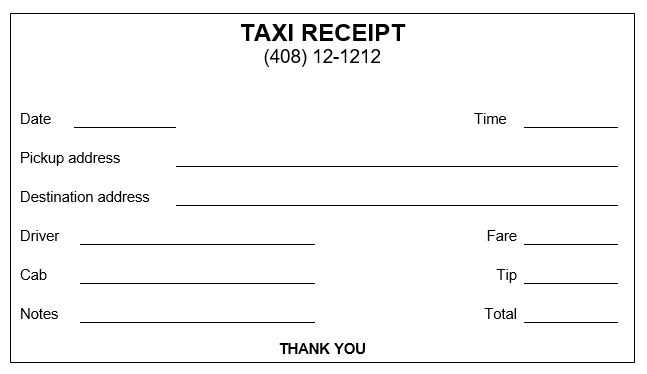

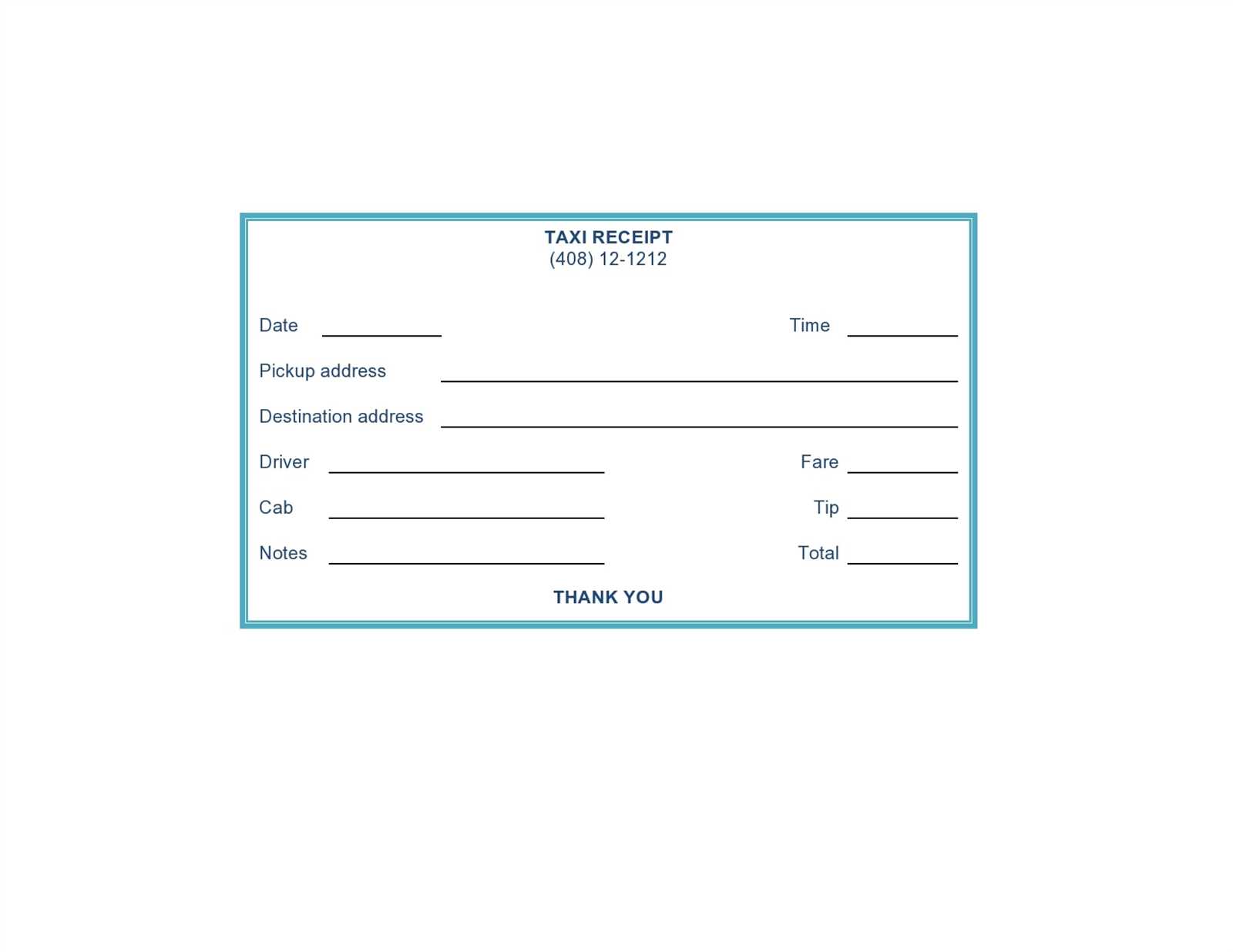

How to Customize the Template for Personal Use

Adjust the template fields to match your personal information. Replace placeholders like the taxi company’s name, fare amounts, and payment details with accurate data. Include your own contact information, such as email and phone number, to make the receipt personalized.

Edit Date and Time

Modify the date and time fields to match the specific ride. You can either manually enter these details or use dynamic fields that automatically update when you generate the receipt. Ensure that the date format is consistent with your local preferences.

Customize the Layout

If you need the receipt to fit specific branding, adjust the font, color scheme, and logo placement. Consider adding a header with your name or organization if you want to create a more formal document. You can also change the overall design to reflect your personal style or needs.

Legal Requirements and Tax Implications for Receipts

Receipts for taxi services in Washington, DC must include specific details to comply with local regulations. These details typically include the date, time, fare breakdown, and driver information. The taxi company name and contact details are also required. Additionally, any discounts, tips, or additional charges must be clearly indicated.

From a tax perspective, businesses offering taxi services must retain copies of receipts for at least three years, in line with IRS requirements. This ensures that the records can be verified if needed for audits or other tax-related matters. Drivers and companies should be aware that unreported income from tips and fares can result in fines or other penalties. Clear documentation is key to maintaining compliance and avoiding tax issues.

When it comes to the passenger, maintaining receipts is vital for claiming potential deductions on business trips. In many cases, having a detailed receipt can substantiate travel expenses during tax filing. Passengers are advised to keep their receipts for at least the same three-year period for potential auditing or personal record-keeping.