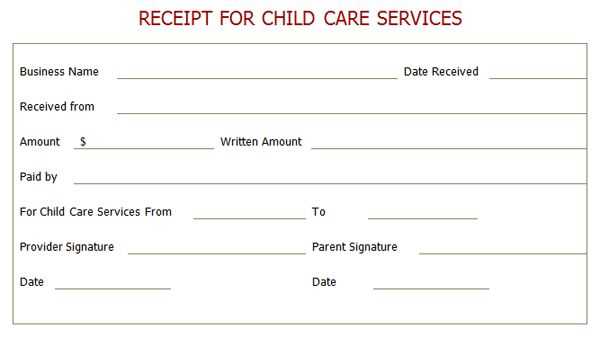

To streamline the process of documenting dependent care expenses, use a template that clearly outlines the details of services rendered. Ensure the receipt includes the provider’s name, the care recipient’s name, the dates services were provided, and the total amount paid. This format guarantees transparency and avoids confusion when submitting claims or tax documentation.

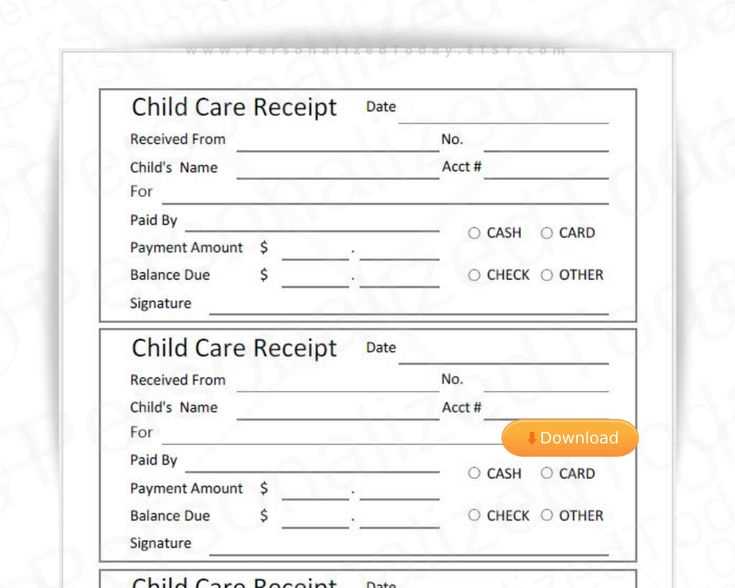

Be sure to specify the type of care provided, whether it’s daycare, after-school care, or assistance for an adult dependent. This will help both parties understand the scope of services and prevent any misunderstandings. A well-organized receipt aids in accurate record-keeping, which is crucial when it’s time to file for reimbursements or deductions.

Additionally, include the provider’s contact information and any necessary licensing details to confirm the legitimacy of the service. If the care was provided over multiple sessions, list each session separately with corresponding costs. This approach will simplify future audits and clarify any questions that may arise about the expenses incurred.

Dependent Care Receipt Template Guide

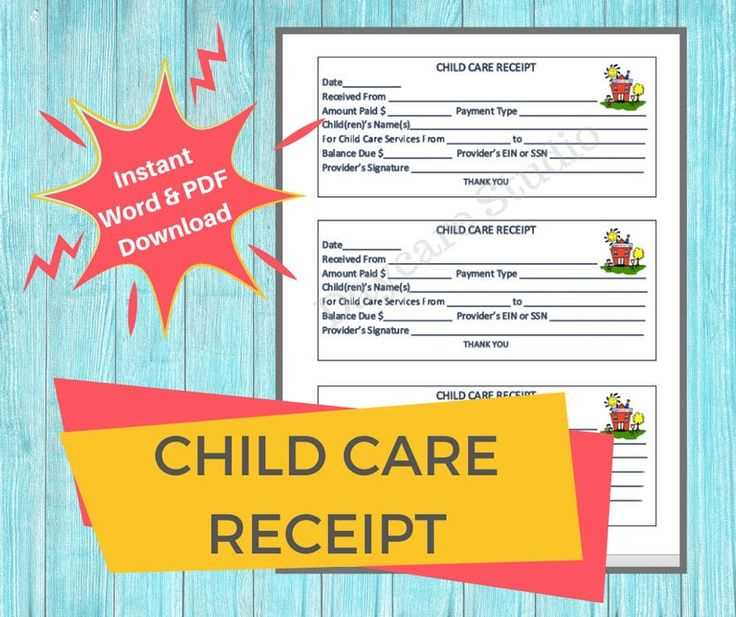

To create a clear and accurate dependent care receipt, ensure the following key details are included:

- Provider’s Information: Name, address, and contact details of the care provider.

- Recipient’s Information: The name of the person receiving care, typically the dependent (child or elderly family member).

- Care Dates: Specify the start and end dates of the care services provided. Be precise about the hours as well.

- Care Services Provided: List the exact services rendered (e.g., daycare, nanny, elder care) with corresponding charges for each type of service.

- Total Amount Charged: Clearly indicate the total payment made, breaking down by service if necessary.

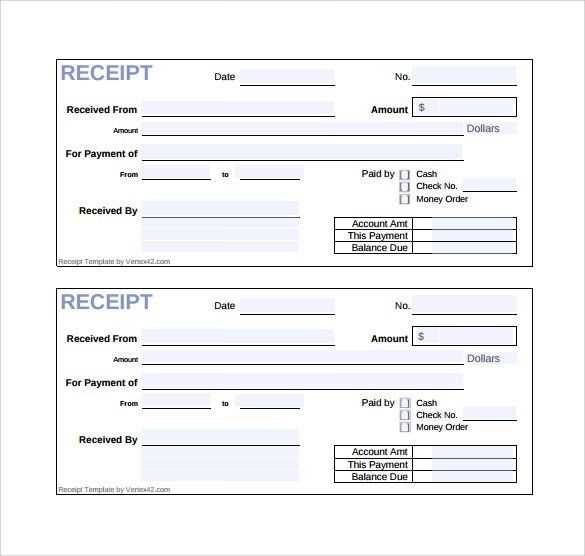

- Payment Method: Note whether payment was made via check, credit card, or cash.

Additional Considerations

In cases where the dependent care service was provided by a non-professional, like a relative, include the following:

- Relationship to the dependent.

- Affidavit or signed statement verifying the care provided.

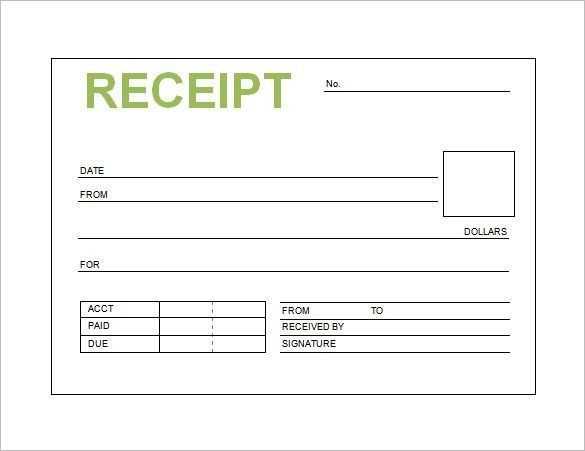

Formatting Tips

Make the receipt easy to read by using a consistent font and clear layout. Always provide an itemized list of services and charges, and ensure all required signatures are included for verification purposes. Keep the receipt for your records and for tax reporting purposes.

How to Create a Legally Compliant Receipt

Include the date of service or payment at the top of the receipt. Clearly state the provider’s name, address, and contact information. Ensure that the name and address of the person receiving the service or payment are also present.

Specify the nature of the service provided, such as caregiving or assistance, and itemize any specific tasks completed. List the amount charged for each service or task, as well as the total payment made. If applicable, include any taxes, fees, or discounts separately for clarity.

Include a statement that confirms the receipt of payment, such as “Paid in full” or “Payment received.” This confirmation serves as evidence of the transaction and prevents future disputes.

For legal compliance, incorporate your tax identification number (TIN) or business identification number, depending on your jurisdiction. This is particularly necessary for tax reporting and ensures transparency in financial dealings.

Ensure the format is clear and easy to read, using proper spacing between sections. Avoid clutter and unnecessary details that could confuse the recipient. Save a copy for your records and provide one to the recipient.

Key Information to Include in the Template

Begin with the recipient’s full name and contact details. Ensure that the address, phone number, and email are clearly visible for easy reference. Include the provider’s name, their business details, and the specific type of care provided, whether it’s childcare, eldercare, or another service.

Service Dates and Duration

Specify the dates for which the care was provided. This should include both start and end dates, as well as the total number of hours or days of service rendered. A breakdown of hourly or daily rates will help clarify the cost structure for the recipient.

Cost Breakdown

Clearly list the total amount owed, itemized by service type and duration. If applicable, include any taxes or additional charges. This transparency ensures both parties have a clear understanding of the financial aspect of the agreement.

Common Mistakes to Avoid When Issuing Receipts

Always double-check the recipient’s name and address before issuing a receipt. Incorrect or incomplete information can lead to confusion or issues with future audits. Verify that the name matches the person who made the payment to avoid discrepancies.

Ensure the payment amount is correct and matches the corresponding invoice or agreement. Double-entry errors can create confusion and may lead to disputes later. If discounts or taxes apply, clearly state these adjustments on the receipt to avoid ambiguity.

List a clear breakdown of services or goods provided. Vague descriptions without specifics can create misunderstandings and make it difficult to trace payments. Include item names, quantities, and unit prices for transparency.

Record the payment method accurately. Whether it’s cash, credit, or check, ensure the method is clearly stated to avoid future confusion. If the payment is partial, indicate the remaining balance to keep track of what’s been paid and what’s owed.

Don’t skip issuing a receipt for every transaction. Even if the payment is small, it’s critical to provide documentation. Not issuing receipts for minor transactions can lead to questions or problems if the customer needs proof of payment later.

Review the date and transaction details carefully before finalizing the receipt. An incorrect date can complicate refund or exchange processes, while wrong details on the transaction might lead to disputes or delays in record keeping.

Don’t forget to include your business’s contact information. Providing a phone number or email ensures customers can reach you if they have any questions or concerns about the receipt.