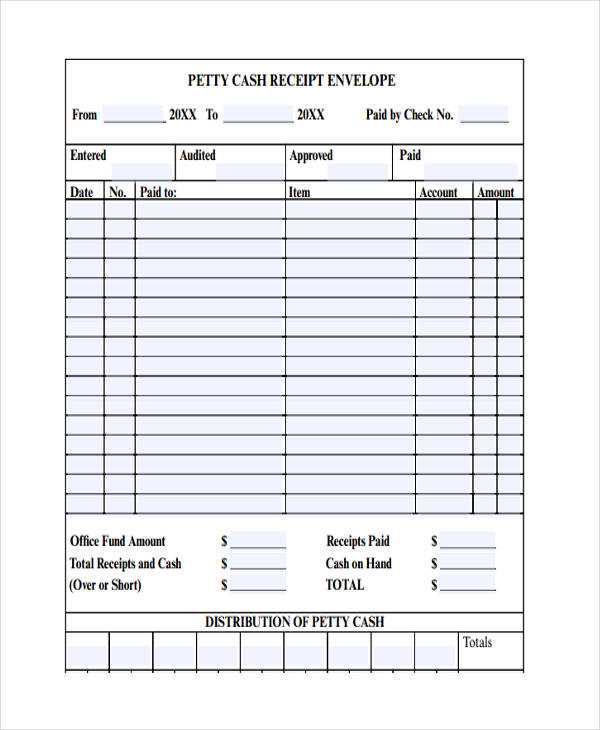

Use a structured template to streamline the process of tracking cash receipts. This ensures clarity and consistency in your records, reducing errors and making audits smoother. Start by organizing key details such as the transaction date, amount received, and the source of funds. A prelist should include fields for the payment method, whether cash or another form, and the corresponding account to credit.

Ensure your template allows for easy identification of discrepancies by including columns for notes or reasons for adjustments. This way, any changes to the original transaction can be clearly documented and referenced. Add a section for signatures or approvals to confirm the accuracy of the entries, keeping your documentation process transparent and verifiable.

A well-designed prelist serves not only as a tracking tool but also as a safeguard against financial discrepancies. With consistent use, it helps identify patterns and areas for improvement in cash flow management. Make sure the template fits your organization’s specific needs, whether for daily, weekly, or monthly records.

Cash Receipts Prelist Template Guide

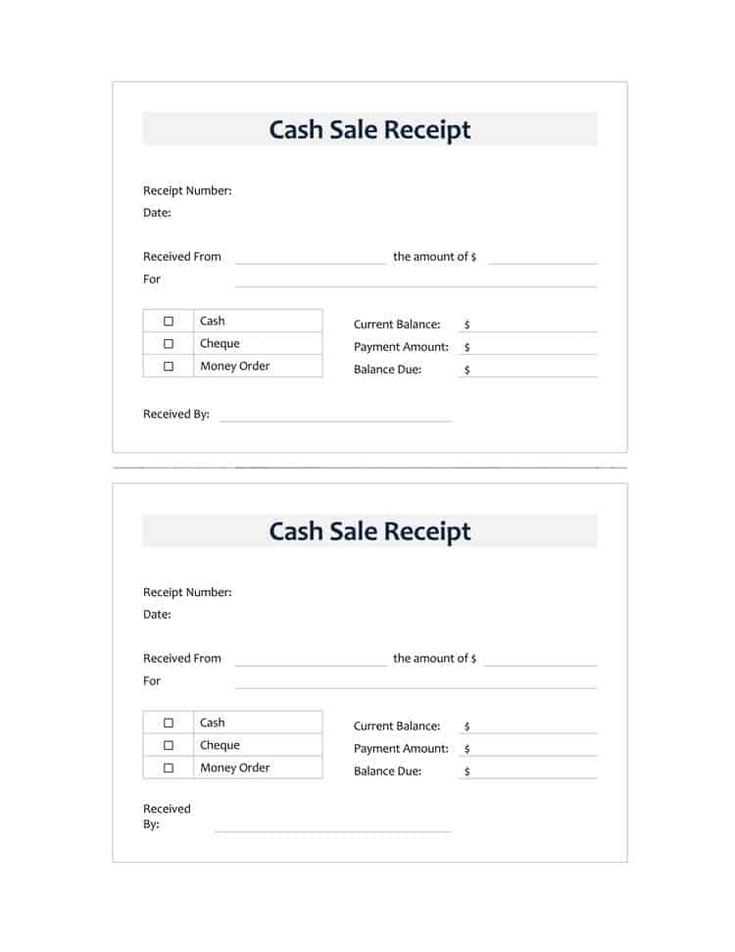

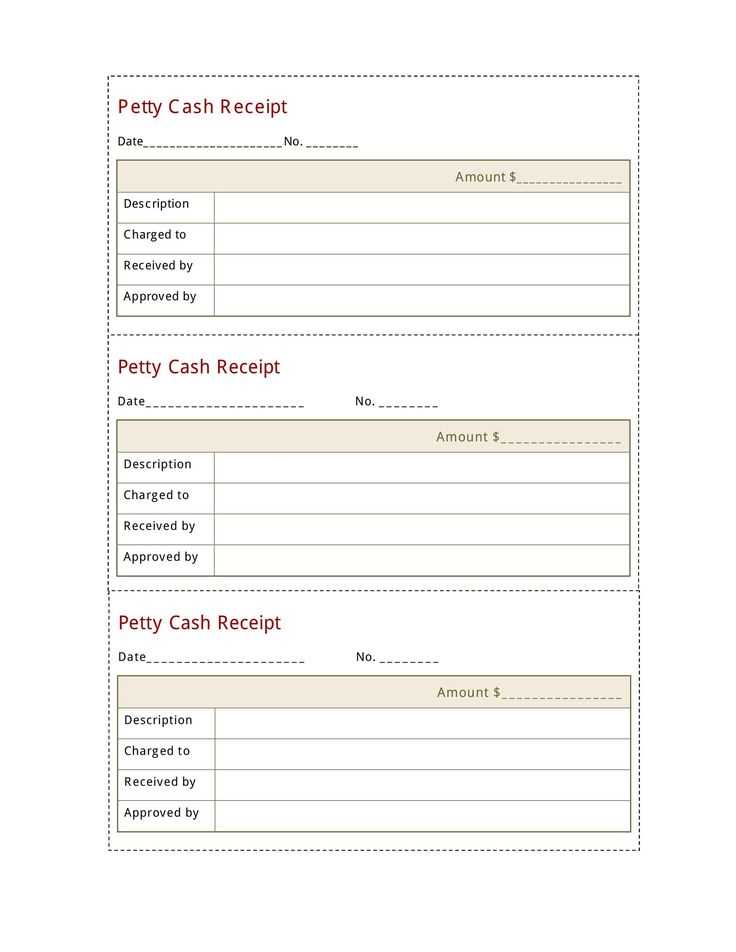

To create a reliable cash receipts prelist, begin by setting up columns for key data points like transaction date, payer name, payment amount, and payment method. Ensure each entry is clear and organized to track payments accurately.

Key Components to Include

Make sure the template covers these basic fields:

- Date: Record the exact date of each transaction.

- Payer Name: Include the full name or company name.

- Amount Received: Enter the exact payment amount for each entry.

- Payment Method: Specify whether the payment was made by check, credit card, cash, or other method.

- Transaction Reference: Add a reference number or invoice ID for tracking purposes.

Formatting Tips

Use simple, easy-to-read formatting. Align text consistently and avoid clutter. Consider color coding to quickly identify incomplete entries or discrepancies. A well-organized template ensures clarity when reviewing or auditing records later.

Finally, adjust the template for your specific needs, whether it’s for a small business or larger enterprise. Keep it simple but detailed enough to prevent confusion during reconciliation or reporting.

Creating a Detailed Cash Receipts Prelist

Begin by organizing your prelist to capture all relevant payment details. This includes listing each cash receipt with a unique reference number, date of receipt, payer’s name, and the exact amount paid. This ensures clarity and prevents errors in your record-keeping.

Key Elements to Include

Include the following columns in your prelist: Receipt Number, Date, Payer’s Name, Amount, Payment Method (e.g., cash, check, bank transfer), and Purpose (e.g., invoice number or donation). This structure helps streamline tracking and verification.

Double-Check Accuracy

Verify each entry before finalizing the prelist. Cross-check amounts with bank deposits or cash registers, and confirm payer details are correctly listed. Mistakes in recording can lead to discrepancies during audits or reconciliation.

Formatting and Customizing the Template for Your Business

Begin by adjusting the header and footer sections to reflect your business branding. Include your logo, company name, and contact details. This establishes consistency across all your financial documents.

Set up fields that capture all necessary transaction details. Include columns for payment methods, transaction numbers, amounts, and dates. Organize these fields in a clean, easy-to-read format to avoid confusion.

Consider customizing the template for different transaction types. If you accept multiple payment methods, include separate columns for cash, credit, and other forms of payment. This helps to quickly distinguish between payment methods at a glance.

Use a consistent font and clear typography. Stick to simple, professional fonts like Arial or Helvetica, and ensure the text is large enough to read comfortably. Maintain a balanced layout with proper spacing between each section.

If your business requires tax calculations, add a field for tax percentages. This can automatically calculate the tax based on the subtotal, reducing manual errors and saving time.

For easier tracking, you can add a notes section. This can be helpful for providing additional details such as discounts, special instructions, or other relevant information.

- Ensure all numerical fields are formatted to match your local currency.

- Include a section for transaction references if your business deals with invoices or receipts that require unique identifiers.

- Use color coding sparingly to highlight key information like totals or unpaid balances.

Lastly, save your customized template in a reusable format, such as Excel or Google Sheets, which allows for easy updates and data analysis. This also ensures your receipts are easy to generate quickly and consistently.

Common Pitfalls and How to Avoid Them

Ensure accurate data entry. Double-check each entry for spelling errors, incorrect amounts, or misplaced figures. Mistakes in the cash receipts prelist can lead to confusion during reconciliation and impact financial reports. Always cross-reference amounts with supporting documents.

Stay consistent with formatting. Inconsistent use of fields such as date, receipt numbers, or customer names can cause errors down the line. Stick to a uniform format throughout the entire prelist template to make it easier for others to process and review the data.

Don’t skip the validation process. Implement a validation step before finalizing the list. Check for missing or incomplete information, such as unrecorded cash payments or absent customer details. This will save time when reviewing and ensure that no data is overlooked.

Avoid overcomplicating the template. Keep the prelist template simple and focused. Including unnecessary fields can make the document harder to navigate, increasing the chances of errors. Stick to the essentials for efficient use and quick updates.

Prevent manual entry errors. Minimize manual data entry by automating parts of the process. Use formulas or pre-set drop-down menus to avoid human error, and leverage accounting software that integrates with your prelist template for better accuracy.