A car loan payment receipt template provides a structured format to confirm payments made towards your car loan. This template ensures you have a clear record of all transactions, helping you track your balance and stay organized. Make sure the receipt includes crucial details such as the amount paid, the date, and the remaining balance to keep your financial records accurate.

When creating a receipt, ensure it highlights the payment method used, whether it’s a bank transfer, credit card, or cheque. This ensures transparency and can help resolve any disputes or errors that may arise later. Including your loan account number on the receipt is key for easy reference.

For convenience, customize the template to reflect your personal information and loan specifics. You can also add an acknowledgment statement from the lender confirming the payment. This simple yet effective approach guarantees both parties have an official record for their reference.

Here’s the corrected version:

Ensure the payment receipt template includes the loan details, including the loan number, payment amount, due date, and the remaining balance. Clearly state the date the payment was made and any adjustments made to the loan balance. Confirm whether any additional fees were applied or if the payment was partial. This helps maintain transparency and avoids future misunderstandings.

Key Details to Include:

1. Loan number or reference ID for easy tracking.

2. Full payment amount with breakdown if necessary.

3. Date of payment and due date to clarify the transaction period.

4. Updated loan balance after the payment.

5. Any fees or charges applied with an explanation.

This format ensures clear documentation for both the lender and borrower, minimizing confusion and promoting smooth transactions moving forward.

- Car Loan Payment Receipt Template

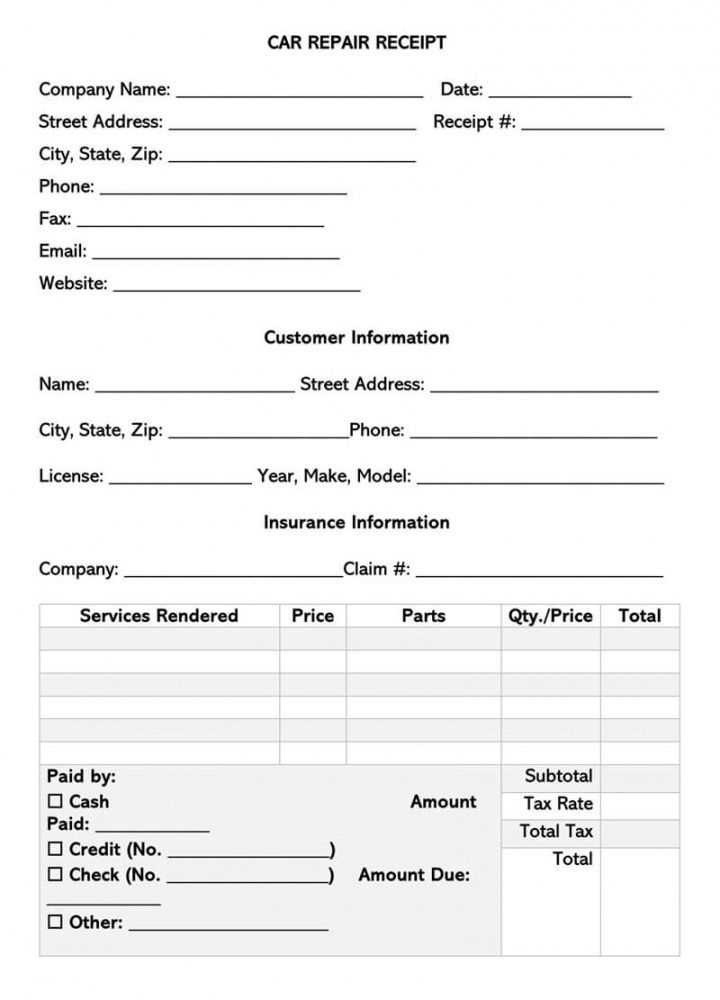

When creating a car loan payment receipt template, make sure it includes key information such as the borrower’s name, payment amount, date, and loan details. The receipt should clearly indicate the amount applied to the principal and interest. Here’s a recommended layout:

Receipt Information

- Borrower’s Name: Include the full name of the borrower.

- Loan Amount: State the original loan amount and any remaining balance.

- Payment Amount: Specify how much was paid during the transaction.

- Date of Payment: Include the exact date of payment.

- Payment Method: Mention if the payment was made by check, bank transfer, or another method.

Important Notes

Ensure that the receipt is signed by both parties to confirm the payment was received. Provide space for additional comments or clarifications, such as if the payment was partial or if it covers multiple installments. This helps avoid confusion and establishes clear communication between the borrower and the lender.

Begin by including the date of payment and the total amount received. This establishes a clear record of the transaction. Include the full name of the payer along with any reference number or invoice ID for clarity. Mention the method of payment, whether cash, check, or electronic transfer, to provide further detail. End the acknowledgment with a statement confirming the payment has been processed, ensuring the payer knows the transaction is complete. Finally, sign the receipt or provide contact details for any follow-up inquiries.

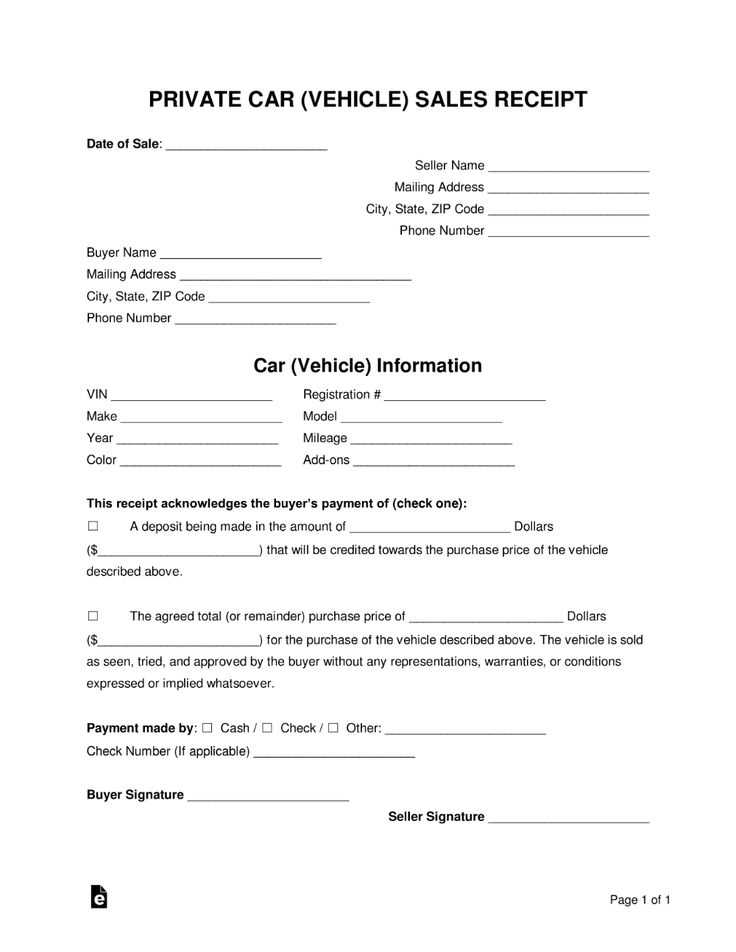

Include the following key details to ensure the document is clear and legally binding:

| Element | Description |

|---|---|

| Borrower and Lender Information | Clearly list the names, addresses, and contact details of both parties involved in the agreement. |

| Loan Amount | Specify the total loan amount being financed and any down payment, if applicable. |

| Interest Rate | Indicate the annual percentage rate (APR) or any other agreed-upon interest terms. |

| Payment Schedule | Define the frequency (monthly, weekly, etc.) and exact due dates for each installment. |

| Late Fees | Clearly outline penalties for missed or late payments, including amounts or percentages. |

| Collateral | If applicable, describe any assets securing the loan, such as the vehicle itself. |

| Signatures | Both parties must sign and date the document to confirm agreement to the terms. |

Make sure all terms are outlined in a straightforward manner, avoiding ambiguity to prevent misunderstandings later.

For a car loan payment receipt, selecting the proper format is key to ensuring clarity and ease of use. Stick with formats that allow both digital and physical access, so recipients can easily save, print, or share the document. PDFs and Word documents are ideal choices for their versatility and readability across various devices.

Why PDF is the Best Choice

- Universally accessible: Most devices can open PDFs without needing additional software.

- Fixed formatting: The layout and design remain consistent across all devices and platforms.

- Security: Password protection and encryption options keep your document secure.

When to Use Word Documents

- Editable: Use this format if you anticipate the need for changes or customizations.

- Easy for collaboration: Word documents allow for easy editing, making them ideal for teams or when multiple people need to review the receipt.

In general, PDFs are the go-to format for finalized documents like car loan payment receipts. Choose Word documents when you need flexibility or collaboration options.

Record partial payments clearly and accurately. Always indicate the amount paid, the outstanding balance, and the date of the payment. Use a dedicated section in your document to note these details, ensuring transparency for both parties involved.

Clearly Mark the Paid Amount

In the payment receipt, specify the partial payment made by the borrower. Label it as “Partial Payment” along with the exact amount. This prevents any confusion about the payment status and helps keep track of the remaining balance.

Update the Remaining Balance

After noting the partial payment, update the outstanding amount. This ensures that both parties are aware of the current debt and the remaining balance due. It’s best practice to add this figure next to the “Remaining Balance” section, so it’s easy to spot.

For each subsequent partial payment, repeat this process, updating both the date and amount accordingly. This method keeps the documentation clear and organized, helping avoid misunderstandings in the future.

Always double-check the details on the payment receipt, especially the amount paid, the date, and the loan balance. This ensures no discrepancies between your records and the lender’s. If any issues arise, promptly contact the lender for clarification.

Verify Loan Payment Amount

Review the payment amount listed against your scheduled payment. Ensure there are no overpayments or underpayments recorded. In case of additional charges or changes, confirm with your lender that the charges are valid and authorized.

Check Payment Date and Loan Balance

Confirm that the date listed matches your payment and that the remaining balance reflects the correct amount after the payment. This will help prevent confusion and ensure that any future payments are accurately processed and recorded.

If you’ve lost your car loan payment receipt, act quickly to avoid further complications. Here’s a clear approach to resolve the issue:

1. Contact Your Lender

Reach out to your lender right away. Inform them about the missing receipt and request a replacement. Most institutions can issue a duplicate or provide you with transaction details upon request.

2. Review Your Records

Check your email, bank statements, or online account for any proof of payment. Often, lenders send electronic receipts or updates that can serve as temporary documentation until a new one is issued.

3. Request a Copy of the Loan History

- Ask your lender for a loan history report, which shows all payments made, including dates and amounts.

- This can serve as proof of payment while you wait for the official receipt replacement.

4. Keep Detailed Notes

- Write down the specifics of the transaction, such as the payment date, amount, and any reference number.

- Use this information to track your payments and avoid future issues.

For creating a car loan payment receipt, ensure that all necessary details are included to maintain clarity and accuracy. Start with the full name of the borrower, loan amount, and the date of the payment. Specify the payment method, whether it’s by check, bank transfer, or cash. Include a reference number for the transaction for easy tracking.

Loan Information: Clearly state the loan balance before the payment, the amount paid, and any remaining balance. Mention the loan’s interest rate and the duration for which the loan has been active.

Payment Details: List the specific payment amount, breaking down principal and interest if applicable. It’s important to specify the due date of the payment and indicate whether this payment was on time or late, including any fees if they apply.

Confirmation: Provide a signature line or a confirmation code to validate the receipt. Ensure that the receipt is easy to understand for both parties, making it an efficient tool for tracking payments.