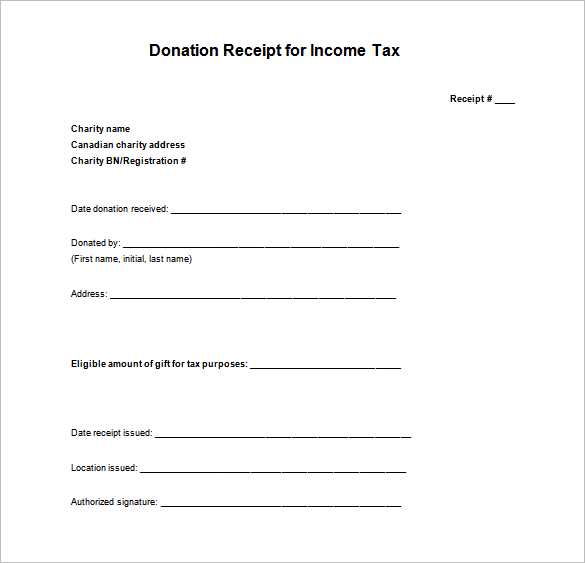

To create a tax receipt in Canada, begin by ensuring it includes all the necessary details required by the Canada Revenue Agency (CRA). The receipt must contain the issuer’s name, address, and business number. Additionally, the recipient’s information and the date of the donation are vital for proper documentation. Don’t forget to clearly indicate the amount donated, whether in cash, goods, or services.

Make sure to specify whether the donation is eligible for tax credits or deductions, particularly if it’s a charitable contribution. If applicable, include the registration number of the charity to confirm its status under CRA guidelines. Including a thank you note or acknowledgment may add a personal touch, though it’s not a requirement for tax purposes.

By using a template that ensures these details are covered, you can streamline the process and ensure compliance with Canadian tax laws. This approach will not only make filing taxes easier but also help donors keep accurate records for their claims.

Here’s a detailed plan for the informational article on the topic “Tax Receipt Template Canada” in HTML format with

Tax receipts in Canada must meet certain requirements to ensure they are valid for tax deduction purposes. The template should include specific details to ensure compliance with Canadian tax laws. Below is a detailed breakdown of the elements that should be included in the template.

Key Elements of a Tax Receipt Template

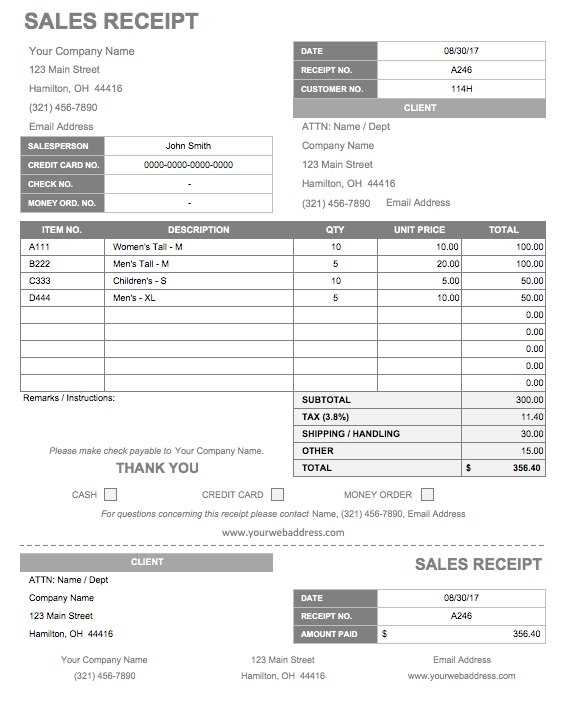

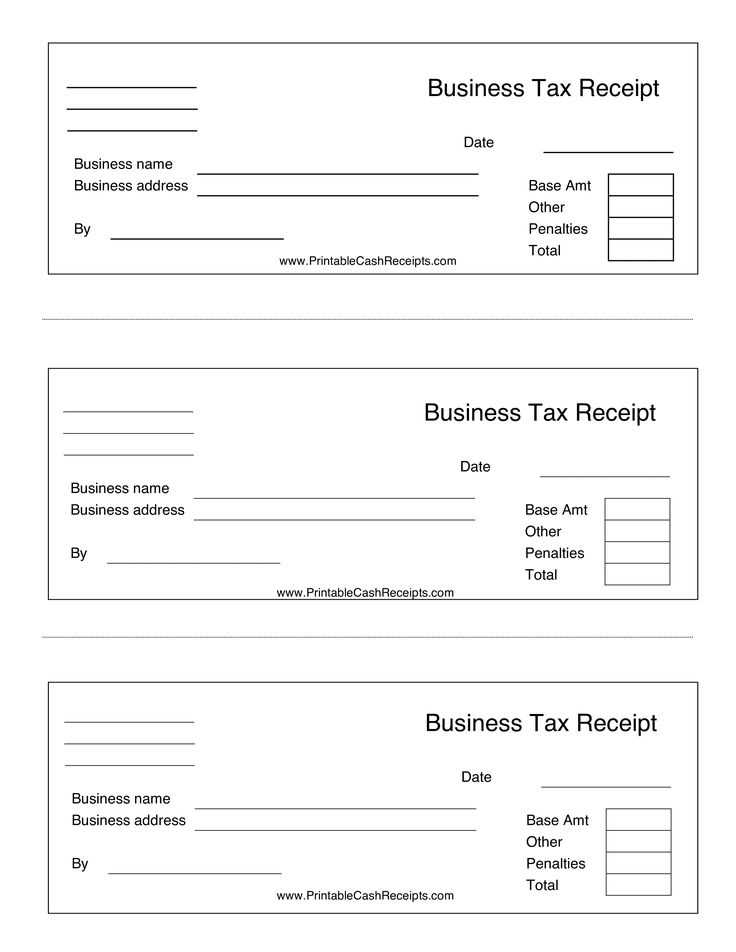

The tax receipt template should have the following information:

- Organization Name and Address: The name of the charitable organization or business issuing the receipt and their contact information.

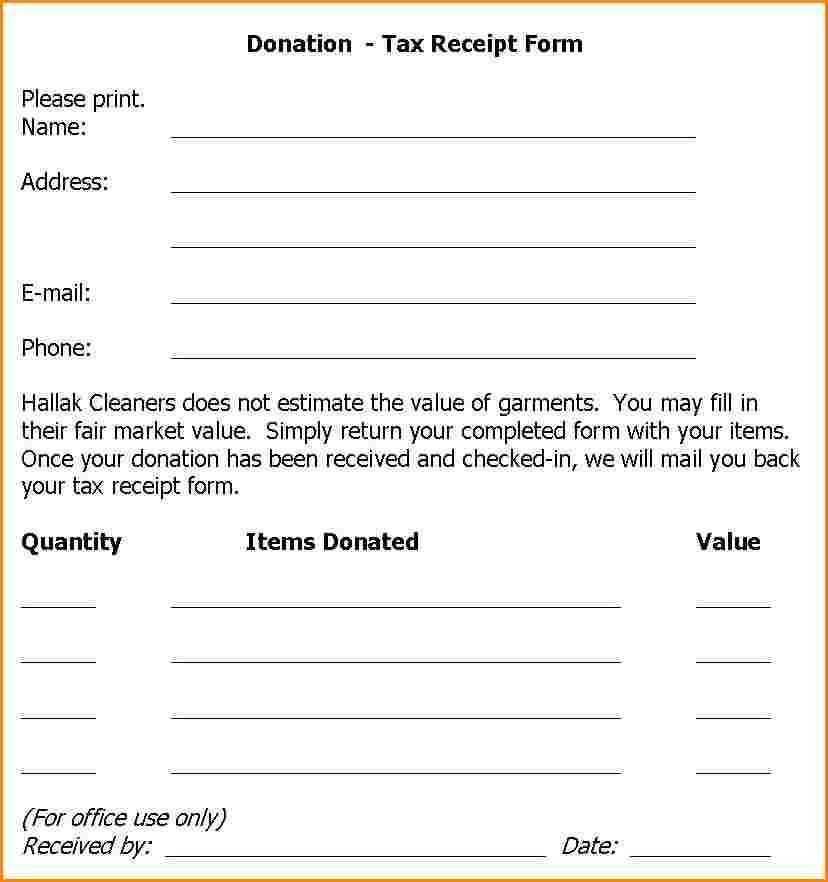

- Donor Information: The name, address, and contact details of the individual or entity making the donation.

- Date of Donation: The exact date the donation was received.

- Amount Donated: The total amount of the donation, including a breakdown if applicable (e.g., cash, goods, services).

- Description of Donated Goods or Services: A clear description of what was donated (if applicable), including the condition of items for goods donations.

- Charity Number or Business Number: The organization’s charity registration number issued by the Canada Revenue Agency (CRA), if applicable.

- Receipt Number: A unique number to track and verify the transaction.

- Signature: The signature of the authorized individual from the organization issuing the receipt.

Formatting the Tax Receipt

The receipt should be easy to read and professional in appearance. Ensure that the text is clearly structured, with distinct sections for each required piece of information. Use bold or italics for emphasis where necessary, and keep the font size consistent throughout the document.

How to Customize the Template

Customizing the tax receipt template is simple once the basic layout is in place. Add any relevant legal disclaimers, specific terms, or notes to clarify donation types or special conditions. Ensure the template is compatible with both paper and electronic formats to facilitate easy distribution to donors.

Conclusion

Creating a tax receipt template for Canada requires careful attention to detail to meet legal standards. Use this plan to ensure your template is both accurate and compliant, providing donors with the necessary documentation for tax purposes.

How to Create a Simple Tax Receipt for Canadian Businesses

To create a simple tax receipt for Canadian businesses, follow these steps:

1. Include Business Information

Start by adding your business name, address, and contact details at the top of the receipt. Make sure the business name matches your official registration to avoid confusion.

2. List the Purchaser’s Details

Include the name, address, and contact information of the purchaser, if necessary. For most receipts, this is optional unless you need to track customer purchases for tax purposes.

3. Specify the Transaction Details

Clearly state the date of the transaction and the goods or services provided. List each item with a description and the amount charged, including applicable taxes.

4. Include the Tax Amount

Break down the tax rate applied to the purchase. Include the GST/HST rate, and make sure the tax amount is clearly visible. For example, if the sale is subject to GST, list the GST amount separately from the subtotal.

5. Provide a Unique Receipt Number

Each receipt should have a unique number for record-keeping and auditing purposes. This ensures proper tracking and helps avoid any confusion for both the business and customer.

6. Sign or Stamp the Receipt

A simple signature or a company stamp at the bottom validates the receipt. This confirms that the transaction was processed and ensures that it can be used for tax purposes.

7. Provide Payment Method Information

Note the payment method used (e.g., cash, credit card, cheque) for transparency and clarity.

8. Keep Copies

Make sure to keep a copy of the receipt for your records. It may be required for tax filing or in case of an audit.

Key Information to Include in a Canadian Tax Receipt

Make sure the tax receipt contains the following information:

- Business Name and Address: Clearly state the full name of the business issuing the receipt along with its physical address.

- Receipt Number: Include a unique identification number to track the receipt and facilitate easy reference for both parties.

- Date of the Transaction: The date the transaction took place must be recorded for proper tax filing and record keeping.

- Amount Paid: Indicate the total amount paid, including any taxes or additional fees. This ensures transparency in the transaction.

- Tax Information: Provide a breakdown of applicable taxes (e.g., GST/HST) and the total tax paid.

- Detailed Description of Goods or Services: List the items or services provided along with their prices. This helps the recipient verify the purchase details.

- Payment Method: Specify how the payment was made (e.g., cash, credit card, cheque).

- GST/HST Registration Number (if applicable): Include the business’s GST/HST number if the business is registered for collecting these taxes.

- Contact Information: Include the phone number or email address for any follow-up questions or concerns.

By including these details, you ensure that the tax receipt complies with Canadian regulations and provides clear documentation for both the payer and payee.

Common Mistakes to Avoid When Issuing Tax Receipts in Canada

Ensure the receipt includes the correct legal name and contact information of the issuing organization. Missing or incorrect details could lead to complications during the filing process. Double-check that the name matches the one registered with the Canada Revenue Agency (CRA).

Do not forget to include the donation date and amount. This is essential for the recipient to claim tax credits. Inaccurate or missing amounts may cause the CRA to disallow the claim.

Accurate Charitable Status

Make sure the organization is registered as a charity with the CRA. Issuing receipts without proper registration can lead to penalties or the rejection of receipts. Always verify the charity’s status before processing donations.

Proper Receipt Format

Use the CRA’s prescribed format for receipts, ensuring all required fields are included. Failing to follow the correct format can result in delays or rejection. Check the CRA’s guidelines regularly to avoid errors.