For businesses handling cash transactions, a clear and concise cash receipt confirmation is necessary. This template serves as an official record, ensuring both parties acknowledge the transfer of funds. Whether you’re a small business owner or part of a larger organization, using a consistent template helps maintain transparency and simplifies accounting procedures.

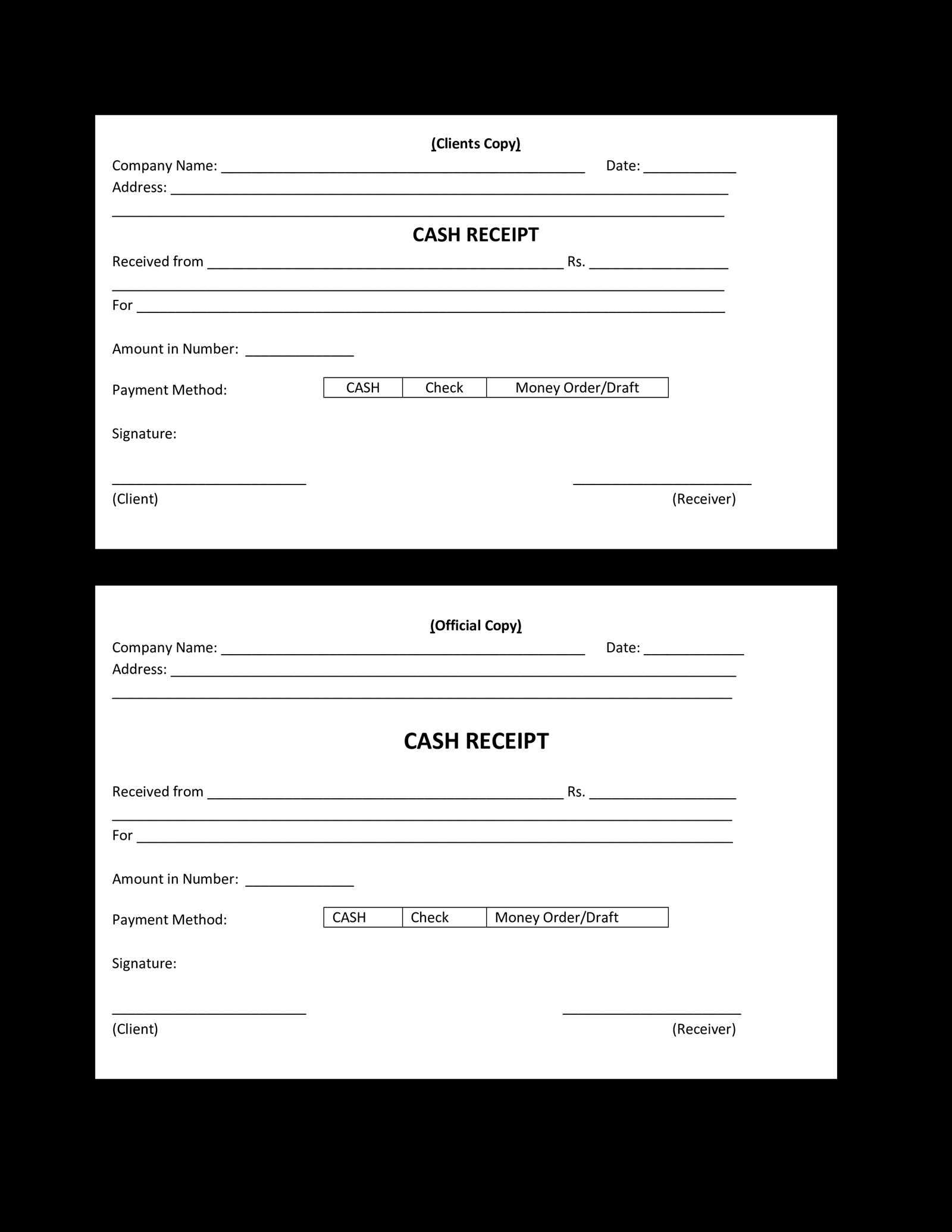

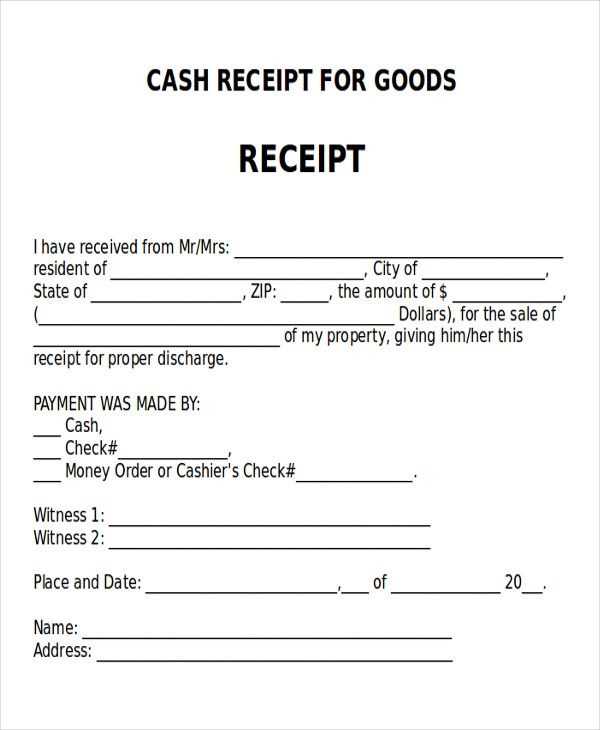

Start by including the transaction date and the names of the payer and payee. Specify the exact amount received and, if applicable, break down any specific fees or charges. It’s important to state the payment method (cash, check, etc.) for future reference. Always include a receipt number or reference ID to help track the transaction in your financial records.

Make the template easy to read and standardize the format across all receipts. This creates consistency, reduces errors, and saves time for both your team and customers. A well-structured confirmation is key to keeping your records accurate and preventing disputes in case of discrepancies.

Finally, make sure to include space for both parties to sign. The payer’s signature validates the receipt, while the payee’s signature acknowledges the funds have been handed over. Keeping these receipts organized will provide legal protection and make your financial operations run more smoothly.

Here’s the revised version:

Ensure that your receipt template is simple and direct. Include a clear statement confirming the amount received, the date, and the method of payment. For example, use this structure:

“This is to acknowledge the receipt of [Amount] on [Date] via [Payment Method].”

Make sure to add any relevant transaction details like invoice number or customer information to help identify the payment. Avoid unnecessary jargon or too much text to keep it easy to read and understand.

Consider adding a space for signatures or digital confirmations if needed, especially for physical transactions. Double-check that your receipt includes all the information required for record-keeping and future reference.

- Cash Receipt Confirmation Template: Practical Guide

To create a straightforward and clear Cash Receipt Confirmation Template, focus on providing all necessary details in a concise and structured format. Include key elements like the payer’s information, amount received, payment method, and date of the transaction. Ensure the document clearly states that the payment has been received in full, and use easy-to-read language for clarity.

Key Elements to Include

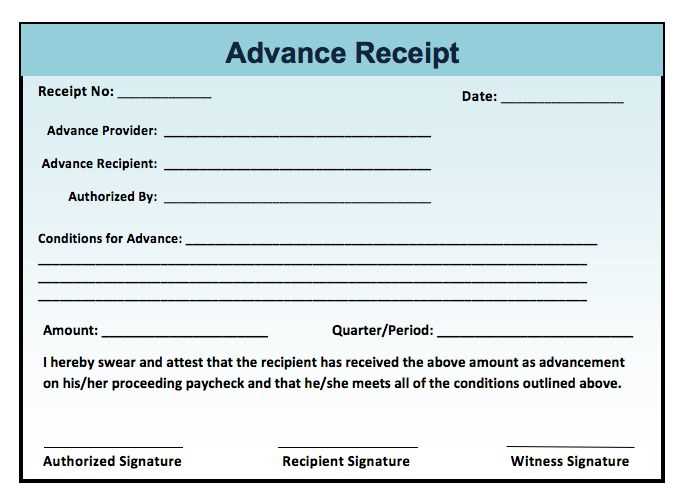

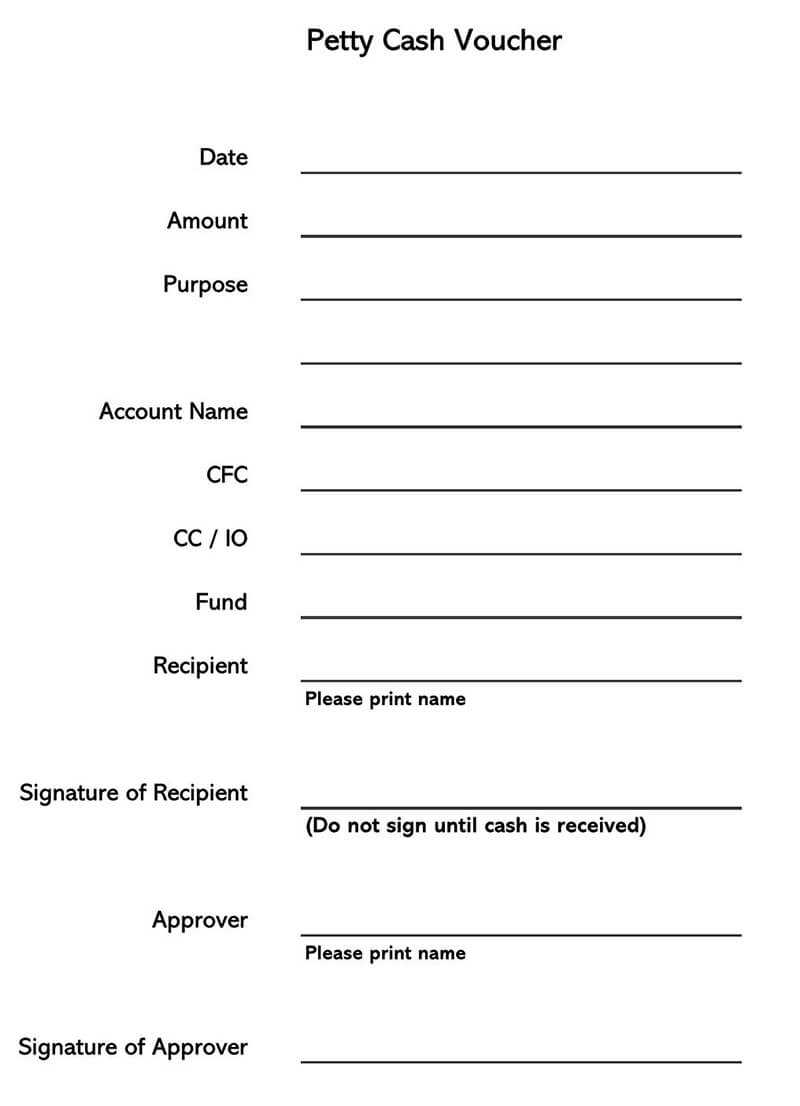

The template should start with a header that includes the title “Cash Receipt Confirmation” and space for a unique reference number. Below, provide fields for the date of receipt and the payer’s name or company. Include a breakdown of the amount received, specifying the currency and any applicable taxes or fees. Don’t forget to mention the payment method (e.g., cash, check, bank transfer) and the purpose of the payment. Finally, leave space for signatures of both the payer and the recipient to confirm the transaction.

Tips for Creating a User-Friendly Template

Keep the template clean and organized by using clear sections and bullet points to separate the different pieces of information. Limit the amount of text to avoid overwhelming the user. You may also add a note at the end to explain how to contact the organization in case of any questions or disputes about the receipt.

Cash receipt confirmation serves as a formal record that a transaction has occurred, ensuring both parties have proof of the payment. This confirmation is particularly valuable in mitigating disputes. When you issue or receive a cash receipt confirmation, you establish clarity in the exchange, making it easier to reference in case of future issues.

This confirmation not only safeguards against potential financial errors but also strengthens your financial tracking system. By confirming the receipt of cash promptly, you help prevent misunderstandings that could arise from lack of documentation. This simple step maintains transparency in transactions and supports proper accounting practices.

When managing cash transactions, confirmation adds an extra layer of security. It is a reliable method for verifying that funds have been received and that the agreed amount matches what was paid. This reduces the risk of miscommunication, enabling both parties to stay aligned on the transaction details.

Having a receipt confirmation in hand also facilitates quicker financial audits and tax reporting. It streamlines the process of proving income or expenses, should the need arise. Cash receipt confirmation supports your financial documentation, making the review process smoother and less prone to errors.

Key Elements to Include in a Cash Receipt Template

A well-structured cash receipt template helps ensure both clarity and accuracy in financial transactions. Below are key components that should always be included in a cash receipt document:

| Element | Description |

|---|---|

| Receipt Number | A unique identifier for each transaction, making it easy to track and reference future inquiries or audits. |

| Date | Indicates the exact date when the payment was received, crucial for financial records and reporting. |

| Amount Received | The total sum of money received, clearly stating the denomination (e.g., dollars, euros, etc.). |

| Payment Method | Specify how the payment was made, whether in cash, check, or electronic transfer. This helps distinguish between different types of transactions. |

| Paid By | Details of the payer, including the name and contact information, if applicable. This ensures the transaction is linked to the correct individual or organization. |

| Received By | The name of the person or entity who received the payment. This provides accountability and transparency in the process. |

| Transaction Description | A brief explanation of the reason for the payment, whether for a service, product, or other purpose. This provides context for the transaction. |

| Signature | Having the payer and receiver sign the receipt, where applicable, helps confirm the authenticity and acknowledgment of the transaction. |

By including these elements, you create a clear and professional cash receipt template that helps maintain proper documentation and reduces the risk of misunderstandings. Make sure each element is accurate and consistent for smooth financial management.

Design a receipt confirmation that is concise and visually easy to read. A well-structured format ensures the recipient quickly understands the transaction details without confusion.

1. Choose a Clean Layout

Use a simple layout with clear headings and organized sections. Create visual hierarchy by separating important elements, like payment details and confirmation messages, into distinct blocks. Keep the font legible and opt for white space to reduce clutter.

2. Include Key Information

- Transaction Details: List the amount received, date, and payment method.

- Recipient Information: Display the name and contact details of the party receiving the payment.

- Confirmation Number: Provide a unique reference code to help both parties track the transaction.

Make sure that these pieces of information stand out and are easy to locate for the recipient’s convenience.

3. Add a Personal Touch

Consider including a friendly message or a thank you note. A short, positive statement can help create a more professional yet approachable tone. This makes the confirmation feel less like an automated process and more like a personalized interaction.

4. Ensure Mobile-Friendly Design

With more users accessing confirmations on mobile devices, ensure the template is responsive. Text should remain legible on all screen sizes, and buttons or links should be easy to click on smaller displays.

One common mistake is failing to include all necessary transaction details. Ensure that the receipt lists the exact amount received, the payment method, and any transaction reference number. Omitting this can lead to confusion or disputes later.

Another mistake is unclear or missing signatures. Make sure to provide space for both the payer’s and recipient’s signatures to confirm the transaction has been agreed upon by both parties.

Some people forget to include the date of the transaction. Always include the precise date and time of the payment to avoid ambiguity.

Using ambiguous language can also cause problems. Make sure that the receipt clearly specifies what the payment is for, as vague descriptions can create misunderstandings.

Neglecting the confirmation of the receipt’s issuance is another issue. Marking the document as “Paid” or “Received” shows that the transaction has been fully processed and removes any doubt about the status.

Finally, not offering a clear way to contact for queries is another mistake. Including a contact email or phone number on the receipt allows for prompt resolution of any issues that may arise after the payment.

To tailor your cash receipt confirmation template for various transactions, adjust the template’s content based on the type of payment being processed. For cash transactions, include fields like the exact amount paid in cash and the change given, if applicable. This ensures the transaction is transparent and accurate.

For Credit or Debit Card Transactions

When confirming payments via credit or debit cards, include the last four digits of the card number (for security reasons) and the transaction authorization code. You may also want to specify whether the payment was approved or declined to avoid confusion.

For Online Payments

For digital payments through services like PayPal or bank transfers, ensure the template highlights the payment reference number, method, and confirmation status. This provides a clear record of the transaction and reassures the payer.

Additionally, customize the template to include specific notes relevant to the transaction, such as discounts, promotional codes, or tax exemptions, for a personalized touch. Tailoring each template for the transaction type enhances clarity and reduces the chances of disputes.

Organize confirmation receipts in a centralized folder or cloud storage system with clear naming conventions for easy retrieval. For instance, include the transaction date, recipient’s name, and a brief description of the transaction in the file name. This structure enables quick searching without opening each file.

Label physical copies with corresponding details and store them in a labeled file cabinet, where each section corresponds to specific categories or months. Make sure the receipts are stored in protective sleeves to prevent damage over time.

For electronic confirmations, employ a document management system that allows for tagging or categorization. Use metadata to add relevant information, like the transaction type or vendor name, which simplifies filtering and tracking later. Set up periodic backups to ensure the data remains safe.

Keep a separate log or database where you can record key details about each confirmation, such as the confirmation number, amount, and payment method. This log can act as a quick reference guide, reducing the time needed to find the actual receipts.

For ongoing tracking, use a spreadsheet or dedicated software where you can log receipt dates, amounts, and categories. You can also add a status column to indicate if the confirmation has been processed or needs further action. Set reminders to review and update this list regularly.

Make sure your cash receipt confirmation template is clear and detailed. It should include all relevant transaction information to avoid confusion.

- Include the payment amount in both numbers and words to ensure clarity.

- List the payment method, such as cash, card, or bank transfer.

- Provide the date and time of the transaction to record when the payment was made.

- Include the payer’s name or organization, as well as any identifying information related to the transaction.

- Provide a unique transaction reference number for easy tracking.

- If applicable, list any items or services paid for to avoid discrepancies.

- Clearly state that the payment has been received and confirm the amount is correct.

- Ensure the signature or stamp space is available for authorized personnel to sign.

Organize the information in a simple, easy-to-read format. Use clear headings and sections for quick reference. Keep it concise but thorough enough to serve as proof of payment.