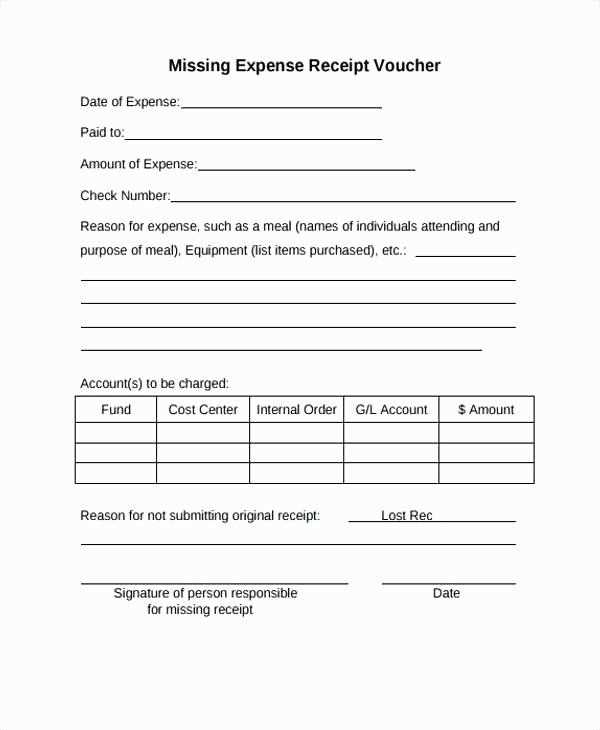

Keep a detailed record of expenses, even if a receipt is missing. Use a missing receipt template to ensure proper documentation for accounting purposes. This template acts as a formal record, capturing key information like the transaction date, vendor, amount, and purpose of the expense. Filling out the missing receipt form helps maintain compliance with financial reporting standards and prevents discrepancies during audits.

Fill in all required fields, including a brief description of the transaction and the reason why the receipt could not be obtained. Attach any other supporting documents, such as bank statements or credit card records, to verify the expense. Be consistent in providing accurate details to avoid delays or issues with reimbursement requests or tax filing.

Integrating the missing receipt template into your accounting workflow can streamline expense management. It minimizes gaps in your records and ensures transparency in financial processes, contributing to smooth business operations and reliable accounting practices.

Here’s the corrected version:

Start by including the missing details, such as the date of the transaction, the amount, and a brief description of the purchase. Ensure that the format is clear and easy to understand. Include the names of both the buyer and the seller to avoid confusion. If applicable, add the payment method used to complete the transaction.

In the event that a digital receipt is unavailable, provide any available evidence like bank statements, order confirmations, or email receipts. It’s essential to ensure the template reflects these missing details correctly to maintain accurate accounting records.

Don’t forget to list any taxes or additional charges that were applied during the transaction. The more transparent and detailed the template is, the less chance there will be for errors during the reconciliation process. This will help ensure that your accounting records remain organized and accurate.

- Missing Receipt Template for Accounting

When a receipt is missing, it’s crucial to document the transaction properly for accounting records. A missing receipt template can serve as a formal record of the expense and ensure compliance with financial reporting. Here’s a basic structure to follow:

Template Structure

| Field | Description |

|---|---|

| Date | Enter the date of the transaction or purchase. |

| Vendor | Name of the business or individual where the purchase was made. |

| Amount | Total cost of the transaction, including taxes. |

| Payment Method | Specify how the payment was made (e.g., credit card, cash, check). |

| Description | Provide details of the purchased goods or services. |

| Reason for Missing Receipt | Briefly explain why the receipt is unavailable. |

| Approval | Signature of the individual authorizing the missing receipt entry. |

Ensure that the missing receipt template is signed and supported by any other available documentation, such as bank statements or order confirmations. This helps validate the claim and ensures the expense is properly accounted for.

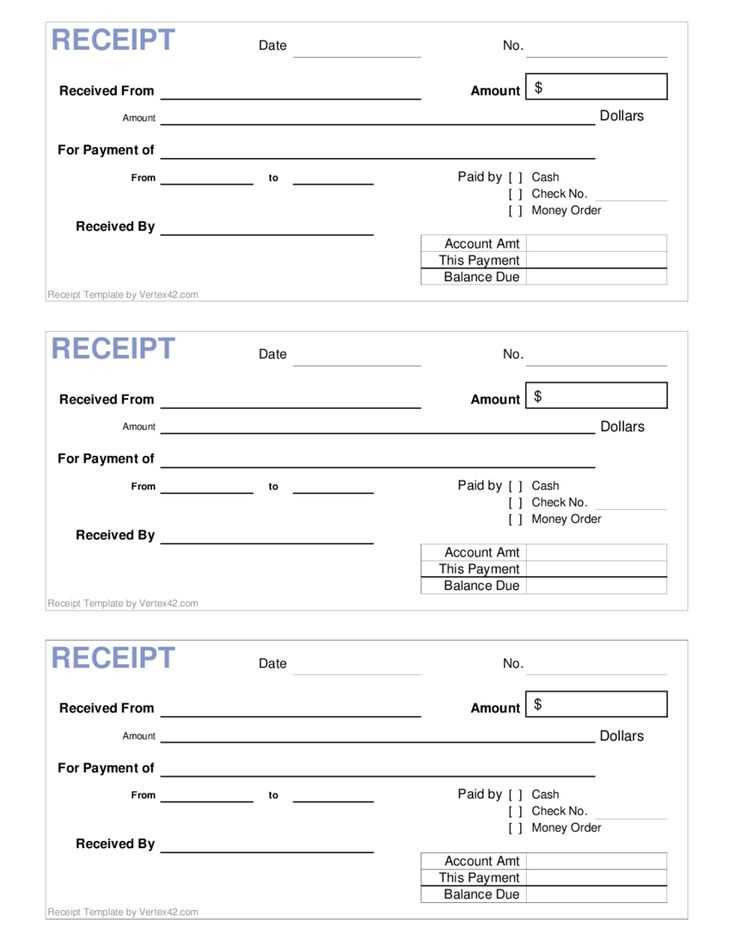

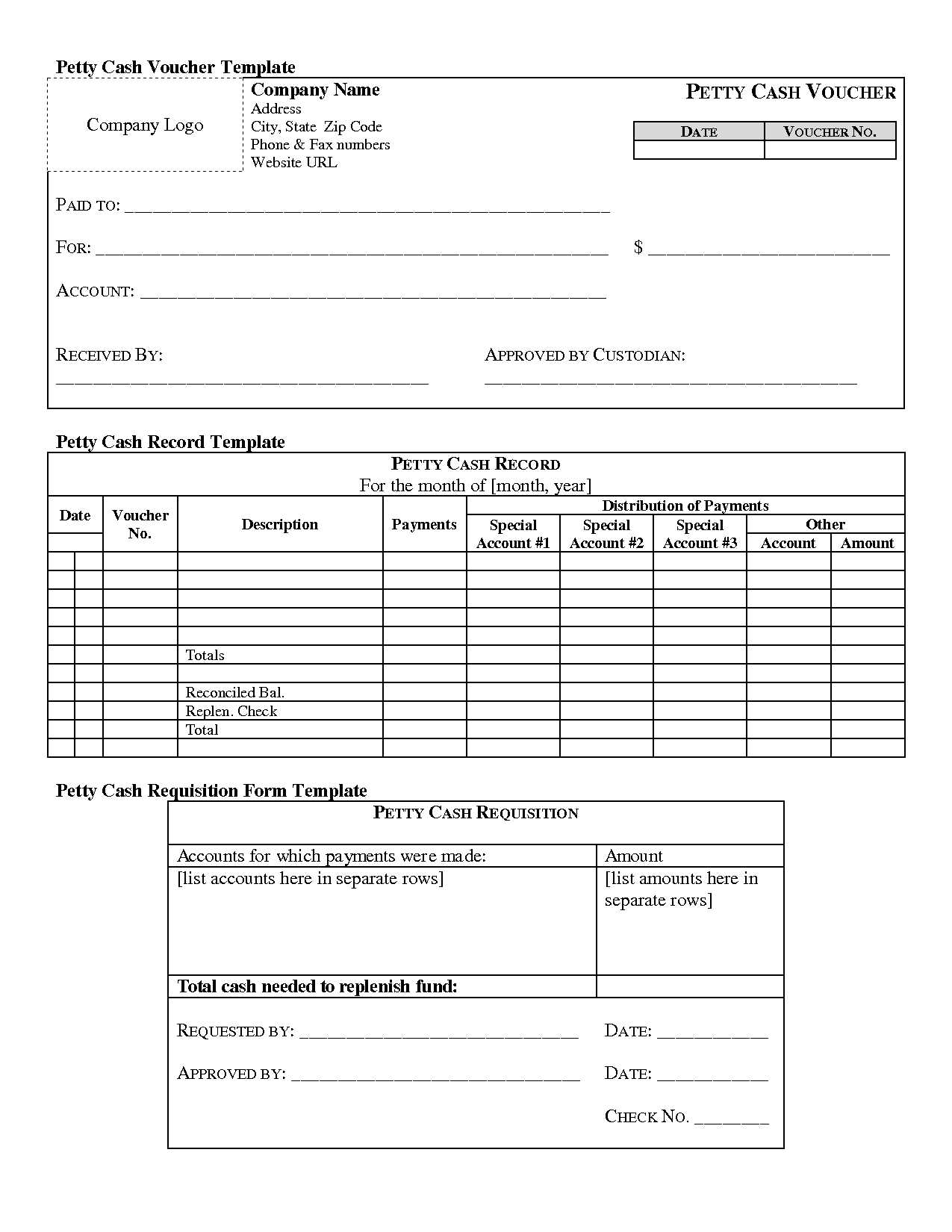

Design a clear, structured template to track missing receipts efficiently. The template should include fields for key transaction details such as date, amount, vendor, payment method, and reason for missing the receipt. Make sure the form has space for the signature of the individual who approves the transaction without the receipt.

- Date: Specify the date of the transaction. This helps in locating the related payment in your records.

- Amount: List the exact amount of the transaction.

- Vendor: Mention the name of the vendor or service provider involved in the transaction.

- Payment Method: Note whether the payment was made by cash, credit card, check, etc.

- Reason for Missing Receipt: Provide a brief explanation for why the receipt is unavailable, such as lost, misplaced, or not provided.

- Approval: Include a field for the responsible person to sign, confirming the transaction’s legitimacy.

To streamline your process, include a reference to the corresponding financial entry in the accounting system. This ensures easy cross-checking between records and the missing receipt form.

- Reference Number: Link the entry with an internal reference number for quick cross-referencing.

- Department/Employee Responsible: Mention the person or department responsible for the transaction.

Store the completed forms in a designated folder or digital system, where they can be easily accessed when necessary. This method helps maintain transparency and compliance in your financial records.

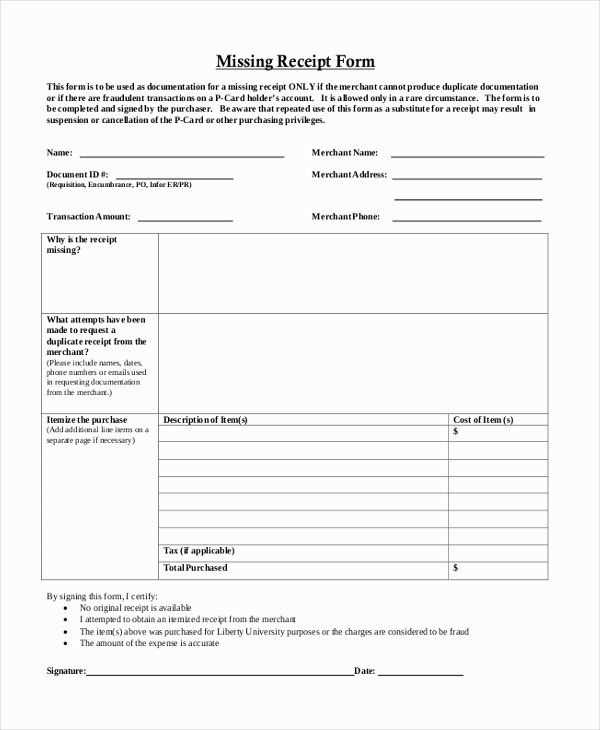

If you cannot locate a receipt during an audit, follow these steps to address the situation:

1. Gather Alternative Documentation

- Check bank or credit card statements for transaction details.

- Retrieve any email confirmations or online invoices from the vendor.

- Look for any internal records that may provide context, such as purchase orders or delivery receipts.

2. Communicate with the Vendor

- Contact the vendor directly to request a duplicate receipt or transaction summary.

- If possible, obtain a written statement from the vendor confirming the transaction.

In cases where alternative records are unavailable, provide a clear explanation for the missing receipt, including the efforts made to locate or recover it. This transparency will help auditors assess the situation appropriately.

Missing documentation in accounting can trigger significant legal and tax consequences. Without proper receipts or records, businesses risk non-compliance with tax regulations, leading to fines or penalties. The lack of supporting documentation makes it harder to substantiate deductions during an audit, potentially increasing tax liabilities.

Tax authorities may disallow claims for expenses that cannot be verified, reducing available deductions and increasing taxable income. This could result in higher taxes owed. Additionally, failure to keep required records may expose the business to audits or investigations, causing further disruptions.

Beyond tax issues, legal repercussions may arise if documentation is deliberately withheld or falsified. This could lead to charges of fraud or other financial crimes, which carry severe penalties including fines or imprisonment. To avoid these issues, businesses must implement effective systems for tracking and storing financial records and receipts.

Creating a Missing Receipt Template for Accounting

A missing receipt template can simplify your accounting process by ensuring all necessary details are properly documented. Create a clean, easy-to-fill template that captures all relevant information for the transaction, making it easier to track and verify expenses.

Key Components to Include

Include the following fields in your template:

- Date of the Transaction: Clearly state the date when the expense occurred.

- Amount: Specify the total amount of the transaction.

- Vendor or Service Provider: Identify the business or individual the payment was made to.

- Purpose of the Expense: Briefly explain the reason for the expenditure.

- Method of Payment: Indicate whether the transaction was made by cash, credit card, or any other method.

- Confirmation of Receipt: Request the signature of the individual verifying the absence of the original receipt.

Filling Out the Template

Ensure that all fields are filled out accurately. If the receipt is truly missing, provide any supplementary information that may help verify the expense, such as bank statements or credit card transaction details. This can support your claim and maintain financial transparency.