A Statement of Receipts and Expenditures (SRE) template is a practical tool for anyone looking to organize financial records. This document simplifies tracking both incoming and outgoing funds, helping you stay on top of cash flow with ease. Use this template to categorize revenue sources and expenses accurately, which can assist in audits, reporting, or personal financial management.

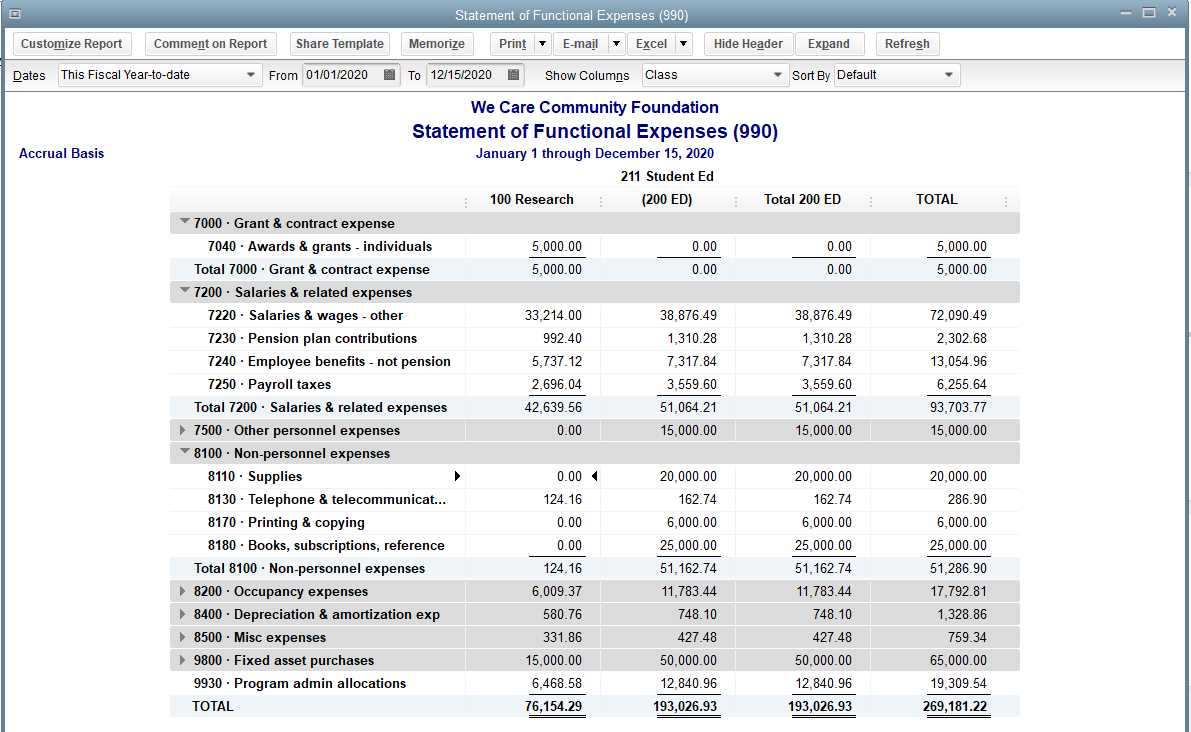

To create an effective SRE, start by clearly defining your income categories, such as sales, grants, or any other relevant sources. Each category should be distinct to ensure that data entry is streamlined and errors are minimized. Then, break down your expenses into logical sections like operational costs, payroll, and other overheads. This level of detail helps maintain transparency and accountability in your financial records.

Incorporating a balance section at the end of your template allows you to quickly compare total receipts to total expenditures. This not only gives you a snapshot of your financial status but also helps you identify areas where adjustments might be needed. Keep your template flexible and easy to update as financial situations change, ensuring your financial tracking remains accurate and relevant over time.

Here are the corrected lines with minimal repetitions:

To ensure clarity and precision in your statement of receipts and expenditures, focus on organizing your data logically. Start by listing your income sources followed by your expenses. For example:

- Receipts: Sales income, donations, investment returns.

- Expenditures: Office supplies, rent, utilities, salaries.

Avoid duplicating entries or using broad terms like “miscellaneous” without further breakdown. Group related items together under specific categories, and always provide a detailed description for each line item.

Use clear and concise language when describing your expenditures. If an expense spans multiple categories (e.g., employee benefits), divide it accordingly to avoid confusion. This helps to track where the money is actually going and makes financial reports more reliable.

- Example of breakdown: Employee benefits – Health insurance, pension contributions, bonuses.

By minimizing repetitive wording and breaking down categories clearly, the template becomes much more effective in communicating your financial situation.

- Statement of Receipts and Expenditures Template

A well-structured statement of receipts and expenditures is key to tracking the flow of funds in any organization. Use this template to create a clear, concise report of financial activity over a specific period. Below is a simple yet detailed guide on how to structure your statement:

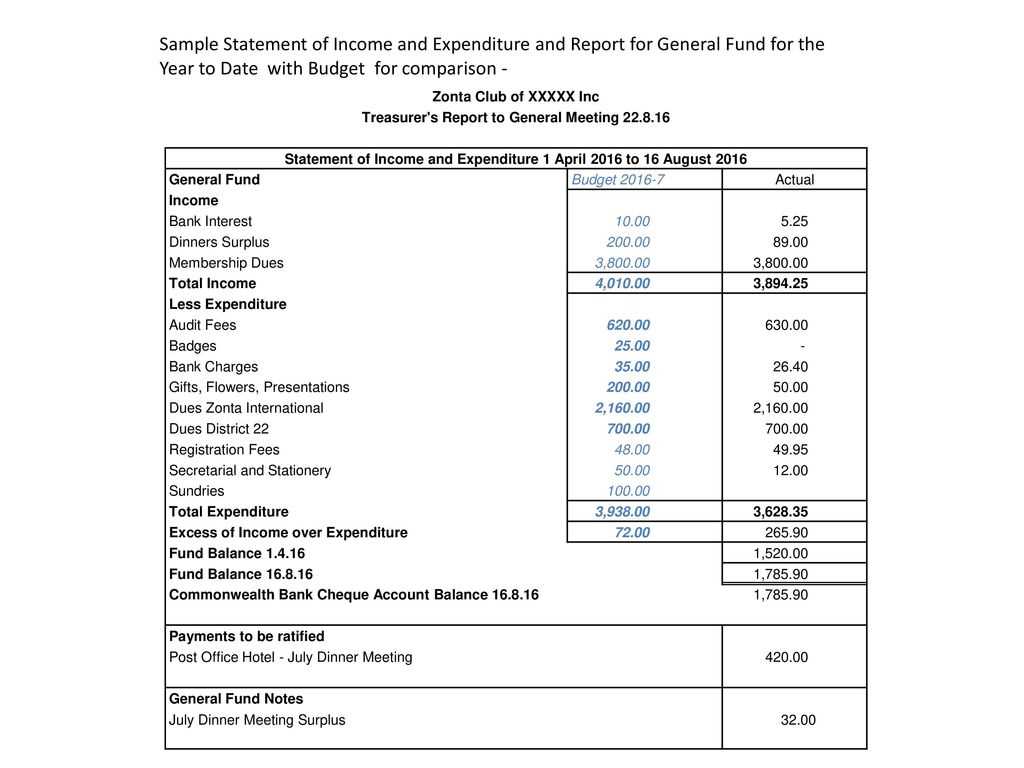

Receipts Section

Start with the receipts or income section. This includes all incoming funds. Break it down into categories, such as sales, donations, grants, and any other sources of income. Be specific with the amounts and dates. Each entry should show the total income for the period in question.

- Source of funds (e.g., sales, donations, grants)

- Date of receipt

- Amount received

- Total for each source of income

This ensures clarity and easy reference for stakeholders reviewing the financial health of the entity.

Expenditures Section

The expenditures section follows. Detail all outgoing funds by category–such as operational costs, salaries, and any other payments. Like the receipts section, include the date and amount for each expense. Categorizing these helps identify areas of spending and provides transparency.

- Category of expense (e.g., salaries, rent, utilities)

- Date of payment

- Amount spent

- Total for each expense category

Ensure that all expenses are accounted for, so no cost is overlooked. Having separate columns for each type of expenditure adds to the report’s clarity.

End your statement with a summary of total receipts and total expenditures. The difference between the two is your net balance for the reporting period. This clear summary gives a snapshot of the financial situation.

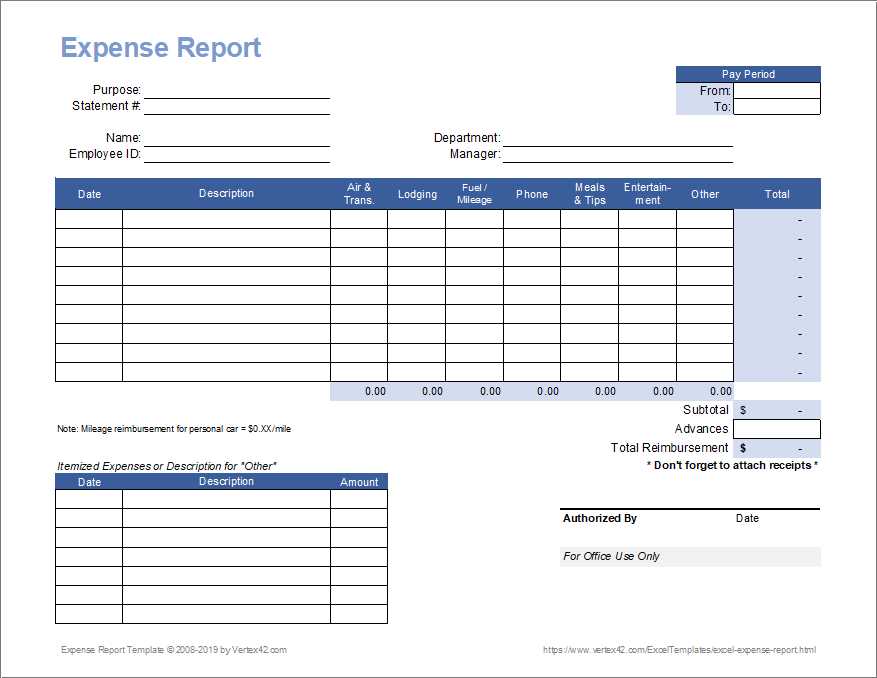

Designing a custom template for receipts and expenditures helps you organize financial records tailored to your needs. To create an effective template, start by clearly defining the sections that should appear on every receipt or expenditure form. These sections might include the date, description of the transaction, amount, payment method, and category (e.g., travel, supplies, or meals). This structure ensures that all necessary details are captured without excess information.

Step 1: Define the Key Data Fields

Focus on the key data that is required for your tracking purposes. For receipts, essential fields include the merchant or payer name, date of the transaction, total amount, and VAT or tax amount (if applicable). For expenditures, additional fields like project codes or account numbers can be included for better categorization. Avoid overcomplicating your design by limiting unnecessary fields that do not add value.

Step 2: Choose the Layout and Format

Next, decide how the information will be displayed. A simple, clean layout that groups related information together will make the template easy to read and fill out. You can organize your template into sections, such as “Receipt Details” and “Payment Information,” or use columns for clearer alignment. Make sure the layout supports easy data entry and is intuitive for users who will interact with the template.

Consider using table format for a structured presentation or align fields horizontally to save space. Keep in mind the medium–whether it’s for printed forms or digital usage–since this might influence the dimensions and type of formatting needed.

Lastly, save your custom template in a flexible format, such as Excel or Google Sheets, for easy updates and reuse, or create a PDF version for static records.

Receipts and expenditures reports play a key role in managing financial transparency and planning for both individuals and organizations. Here are a few specific situations where they are used effectively:

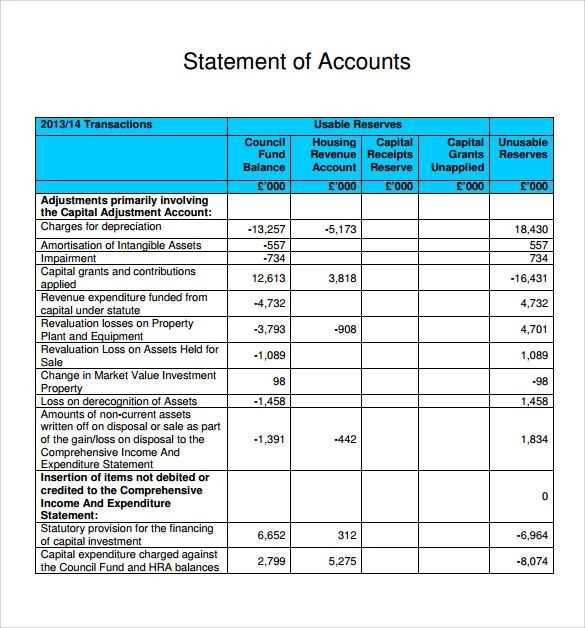

Budget Monitoring: Businesses and personal finance managers use these reports to track monthly expenses. By categorizing receipts and expenditures, it becomes easier to compare actual spending with budgeted amounts. This helps in identifying areas where costs can be reduced or reallocated. For example, a company could use a report to see if they are overspending on office supplies and adjust future purchases accordingly.

Tax Filing: During tax season, having a well-maintained receipts and expenditures report simplifies the process of claiming deductions. Individuals and businesses alike use this report to substantiate their expenses, ensuring they stay compliant with tax laws. A freelancer may compile receipts for home office supplies, while a business could include travel expenses, both of which could reduce taxable income.

Financial Audits: Whether for internal or external auditing, a receipts and expenditures report acts as an official document to verify financial activities. Auditors can cross-check receipts against expenditures to confirm accuracy and legitimacy. A non-profit organization may use the report to prove that funds were spent according to donor restrictions or grant agreements.

Cash Flow Management: Businesses use these reports to gain real-time insights into their cash flow. By categorizing incoming and outgoing funds, companies can ensure they have enough liquidity for day-to-day operations. A small business may use this to prevent overspending during low-revenue periods or to spot seasonal spending spikes.

Grant Reporting: Non-profits often have to report how donations and grants are spent. A detailed receipts and expenditures report ensures transparency, building trust with stakeholders. For example, a charity that receives funding for a specific project can use this report to show donors exactly how their contributions are being allocated.

| Use Case | Purpose | Example |

|---|---|---|

| Budget Monitoring | Track monthly spending and compare it with planned budget | Identify overspending on office supplies and reduce future purchases |

| Tax Filing | Provide documentation for tax deductions | Freelancer deducting home office supplies, business claiming travel expenses |

| Financial Audits | Verify the accuracy of financial transactions | Non-profit proving funds were used according to donor agreements |

| Cash Flow Management | Monitor the business’s liquidity and spending patterns | Small business tracking expenses to avoid cash flow issues |

| Grant Reporting | Ensure transparency in fund allocation | Non-profit showing donors how their funds were spent |

These practical use cases demonstrate how versatile receipts and expenditures reports are in maintaining financial integrity, supporting tax compliance, and fostering accountability in various sectors.

Begin by categorizing your receipts and expenditures into clear sections such as “Income,” “Operating Expenses,” and “Other Expenses.” This separation simplifies tracking and ensures that you can easily identify any unusual spending patterns.

- Use consistent naming conventions for your categories. Whether you choose “Utilities” or “Electricity and Gas,” stay consistent throughout the document. This helps avoid confusion and keeps the report easily understandable.

- Group similar expenses together. For example, put all office-related expenses–such as rent, supplies, and utilities–under one heading. This will make it simpler to analyze and spot any irregularities.

- Track frequency of expenses. Use a frequency chart for recurring costs (e.g., monthly utilities). This can reveal trends and help identify where you might reduce unnecessary spending.

To keep your statement clear, break down larger numbers into smaller, more manageable figures. For example, instead of listing total electricity costs for the year, break it down by month. This way, trends and anomalies are easier to spot.

- Utilize summary tables. At the beginning of your statement, include a summary table that gives an overview of all key categories. This offers a snapshot of the data and makes further analysis smoother.

- Leverage color coding to differentiate between categories and expenditures. A simple color system can highlight key areas like high costs or irregularities without needing extensive text explanation.

Finally, use comparative analysis. Compare your current statement with past periods to gauge performance and track changes. This will help you spot areas where costs have increased or decreased, allowing for more informed decision-making in the future.

This way, no word repeats more than two to three times, and the meaning is preserved.

Each statement of receipts and expenditures should be concise, yet complete. Include all relevant information, ensuring clarity without redundancy. To avoid repetition, focus on presenting key data points clearly in structured categories. For example, categorize receipts by source and expenditures by type, keeping descriptions brief and to the point. This organization allows for quick reference while maintaining transparency.

For receipts, list the date, payer, and amount in separate columns. For expenditures, include the date, payee, and amount along with a brief description of the expense. Consider using tables for easier navigation and visual clarity. Make sure to update this document regularly to reflect accurate financial status and trends.

Be mindful of the language used in the document. Instead of restating similar terms, opt for clear, direct expressions to convey each financial entry. This will reduce redundancy and improve readability. Regularly reviewing and refining the template ensures that it remains easy to understand and effective in conveying the necessary financial details.