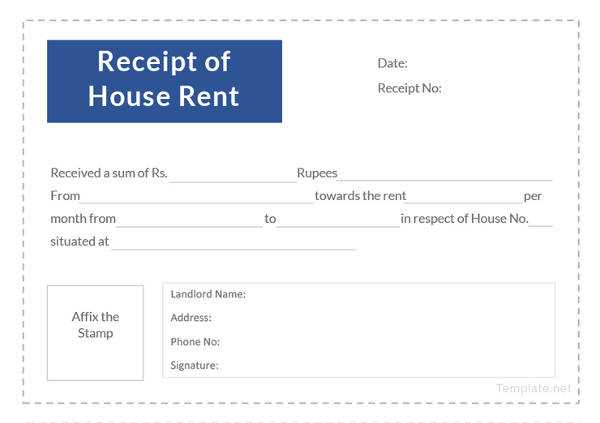

Using a well-structured receipt template in the UK helps maintain professionalism and clarity in transactions. It ensures both parties involved have a clear record of the exchange, minimizing potential disputes. A simple template that includes key elements such as date, amount, and description of goods or services ensures all necessary details are covered.

When creating your receipt, make sure to include your business name and contact details, as well as the recipient’s information. A receipt template with these fields not only provides transparency but also serves as an important reference for tax purposes and financial tracking.

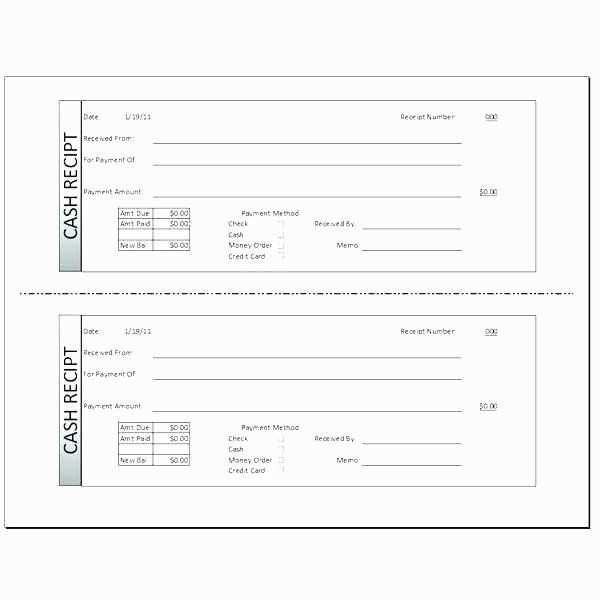

It’s crucial to include the payment method used for the transaction, as this gives a clear record of how the payment was made–whether it was cash, card, or another method. This level of detail helps in maintaining accurate financial records and makes it easier to track payments.

By utilizing a standardized receipt template, you ensure that both you and your customers are on the same page with every transaction. It also saves time, allowing you to quickly generate and issue receipts while keeping your business operations smooth and organized.

Here are the corrected lines:

The template should clearly display the key details of the receipt such as the company name, address, and contact details at the top. Make sure these are aligned properly with enough spacing to ensure easy readability.

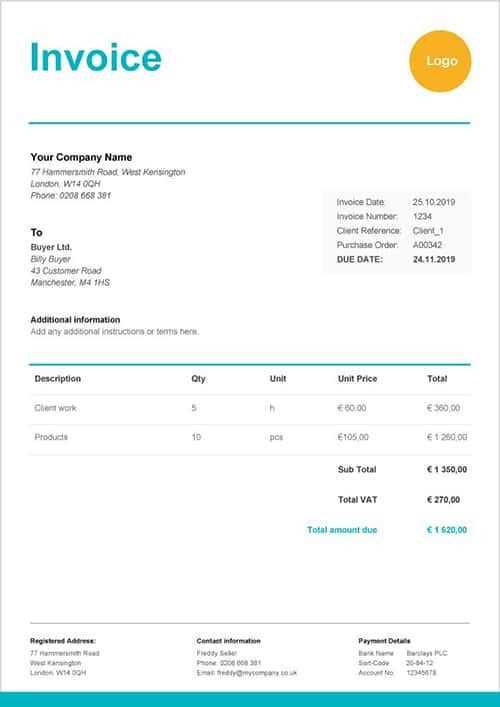

Correct placement of amounts

Amounts should be formatted consistently throughout. Ensure the total amount is bold and slightly larger than other figures. The line for VAT should be placed below the subtotal, without cluttering the overall design.

Clear date and transaction reference

The date of the transaction and reference number should be placed in the upper right corner. Use a clear font and avoid overcrowding this section with unnecessary details.

It’s important to structure the receipt in a way that makes each piece of information easy to locate, especially for any potential returns or inquiries. Avoid unnecessary repetition of information in different sections of the receipt.

- Receipt Template UK

A well-structured receipt template ensures clear and accurate documentation of transactions in the UK. Below is a list of key elements to include in your template to comply with UK standards:

- Business Information: Include the business name, address, phone number, and email. Make sure the business’s VAT registration number is visible if applicable.

- Customer Details: Include the customer’s name and contact information if needed. This may not be required for smaller transactions, but it’s essential for larger purchases or services.

- Receipt Number: A unique reference number for each receipt is important for record-keeping and future reference.

- Date of Purchase: Clearly state the date when the transaction took place. This helps with tracking and organizing financial records.

- Itemized List of Products/Services: Include a breakdown of each item or service purchased, including descriptions and prices. This transparency helps in case of returns or queries.

- Total Amount: Clearly show the total cost, including taxes, shipping, or any applicable fees. If VAT is charged, include the breakdown of VAT rates and amounts.

- Payment Method: Indicate whether the payment was made via cash, card, bank transfer, or other methods. This ensures clarity in case of discrepancies.

Additional Tips

- Compliance with VAT Rules: If your business is VAT-registered, ensure that the receipt includes the VAT rate and the VAT amount for each item or service.

- Digital vs. Paper Receipts: Consider offering digital receipts for convenience. If going digital, ensure they contain all required details in a clear format.

- Return Policy: Including your return and refund policy can reduce confusion in case a customer needs to return an item.

By including these components, your receipt template will provide clarity and meet UK transaction requirements effectively.

To ensure your receipt is legally compliant in the UK, include these key elements:

- Business Name and Address: Clearly state the business name, registered address, and contact details.

- Unique Receipt Number: Each receipt should have a distinct number for record-keeping and traceability.

- Transaction Date: Include the exact date when the transaction occurred.

- Description of Goods or Services: Provide a clear breakdown of the items or services sold, including quantities and prices.

- Total Amount: State the total amount paid, including any applicable taxes such as VAT.

- VAT Details (if applicable): If VAT is charged, include the rate and amount of VAT.

- Payment Method: Indicate how the payment was made (e.g., cash, credit card, bank transfer).

- Refund Policy (optional): Mention your refund or return policy, if applicable, especially for goods sold.

Including these details ensures your receipt complies with UK tax and business regulations, providing transparency and legal clarity for both parties.

Include the following key elements in your receipt template to ensure clarity and compliance with UK regulations:

| Element | Description |

|---|---|

| Business Name and Address | Clearly state your business name, legal trading name (if different), and full address. If you operate from a registered office, include that address as well. |

| VAT Number | If registered for VAT, list your VAT number. This is a legal requirement for VAT-registered businesses. |

| Receipt Number | Assign a unique receipt number for every transaction. This helps track and manage your sales records efficiently. |

| Date of Purchase | Indicate the exact date of the transaction. For returns or exchanges, this is vital for reference. |

| Item Description | Detail each item or service sold, including quantity, unit price, and any applicable discounts or promotions. |

| Total Amount Paid | Show the total price, including VAT if applicable. This should be clearly highlighted, especially in case of refunds or exchanges. |

| Payment Method | Specify how the payment was made (e.g., cash, credit card, debit card, etc.) for transparent record keeping. |

| VAT Breakdown (if applicable) | If your business is VAT-registered, include the VAT rate applied to each item or service and the total VAT charged. |

| Terms and Conditions | Include any relevant return, refund, or exchange policies to clarify customer rights and prevent misunderstandings. |

These details help maintain accurate records, comply with UK tax laws, and provide a professional experience for your customers.

For designing receipt templates in the UK, you can choose from various free and paid tools, depending on your needs and budget. Here’s a breakdown of some of the best options available:

- Canva (Free & Paid): Ideal for beginners and professionals alike, Canva offers a wide range of customizable templates. The free version is packed with basic features, while the Pro version unlocks advanced options, such as custom fonts and unlimited storage.

- Template.net (Paid): This platform provides high-quality, customizable templates tailored to different UK business needs, including receipts. A subscription gives you access to numerous business document templates.

- Invoice Generator (Free): If you’re looking for something quick and easy, Invoice Generator offers a free and simple tool to create receipt templates. It’s particularly useful for freelancers and small businesses in the UK.

- Microsoft Word (Free with Office 365): Microsoft Word offers a variety of templates that can be easily adapted for receipts. Although it’s more basic compared to other platforms, its ease of use makes it a solid option for many users.

- Zoho Invoice (Free & Paid): Zoho’s free plan covers basic invoicing needs, including receipt templates. The paid versions offer additional customization and integration with other business tools.

- Google Docs (Free): With its extensive library of templates, Google Docs is another great free tool for creating receipt templates. Plus, it’s easy to share and collaborate with others.

These tools cover a range of features, from simple templates to more advanced design capabilities, so you can find the right fit based on your specific needs. Whether you’re a small business owner or an independent contractor in the UK, these platforms will help streamline your process for generating receipts quickly and efficiently.

Remove Redundancy in Document Formatting

Focus on clarity by eliminating unnecessary repetition. Replace repetitive words with synonyms or rephrase sentences to avoid redundancy. For instance, if you’ve already stated “invoice format,” you don’t need to keep using “template” throughout. This makes your content more concise and easier to follow.

Use Context to Avoid Repetition

Each section of your document should be distinct in its purpose. If a term has been defined early on, you can simply refer to it by a relevant description without reintroducing the same word. For example, after mentioning a “receipt layout,” simply refer to the “design” or “structure” in subsequent references. This keeps the flow intact without overuse of the same vocabulary.

Streamline Sentences for Readability

Long sentences often lead to repetition. Break them down into shorter, more direct statements. A clean and organized structure improves comprehension, keeping the reader engaged while avoiding unnecessary redundancy in your writing.