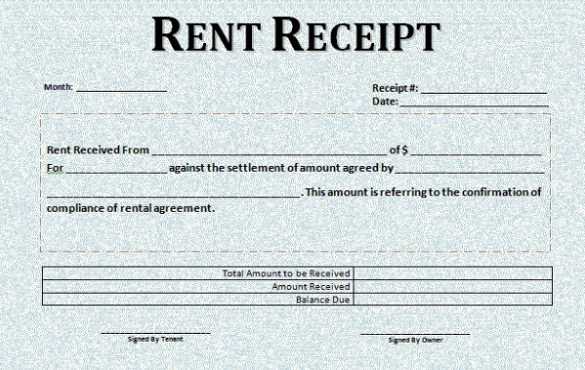

If you’re a landlord or property manager, providing a clear rent receipt is a simple yet effective way to keep both parties on track. A single rent receipt template allows you to document payments, ensuring transparency and a record of transactions. It’s a straightforward tool that can be customized for each payment made, providing peace of mind to both tenant and landlord.

Start by including the tenant’s name, address of the rental property, and the date of payment. These details make the receipt specific and trackable. The amount paid should also be clearly stated, along with the payment method used (cash, check, or bank transfer). This not only helps in case of disputes but also serves as a reliable reference for future transactions.

Make sure to also include any additional notes such as late fees, prepaid rent, or adjustments made. These elements help clarify the terms of the payment and prevent any misunderstandings. A well-designed template can save you time and avoid confusion, offering a professional appearance for your rental business while ensuring all financial exchanges are documented correctly.

Here is the revised version:

Make sure the rent receipt template includes the full name of both the tenant and landlord at the top. These details ensure that the document is linked to the correct individuals. The date of the transaction should follow immediately, so it’s clear when the payment was made.

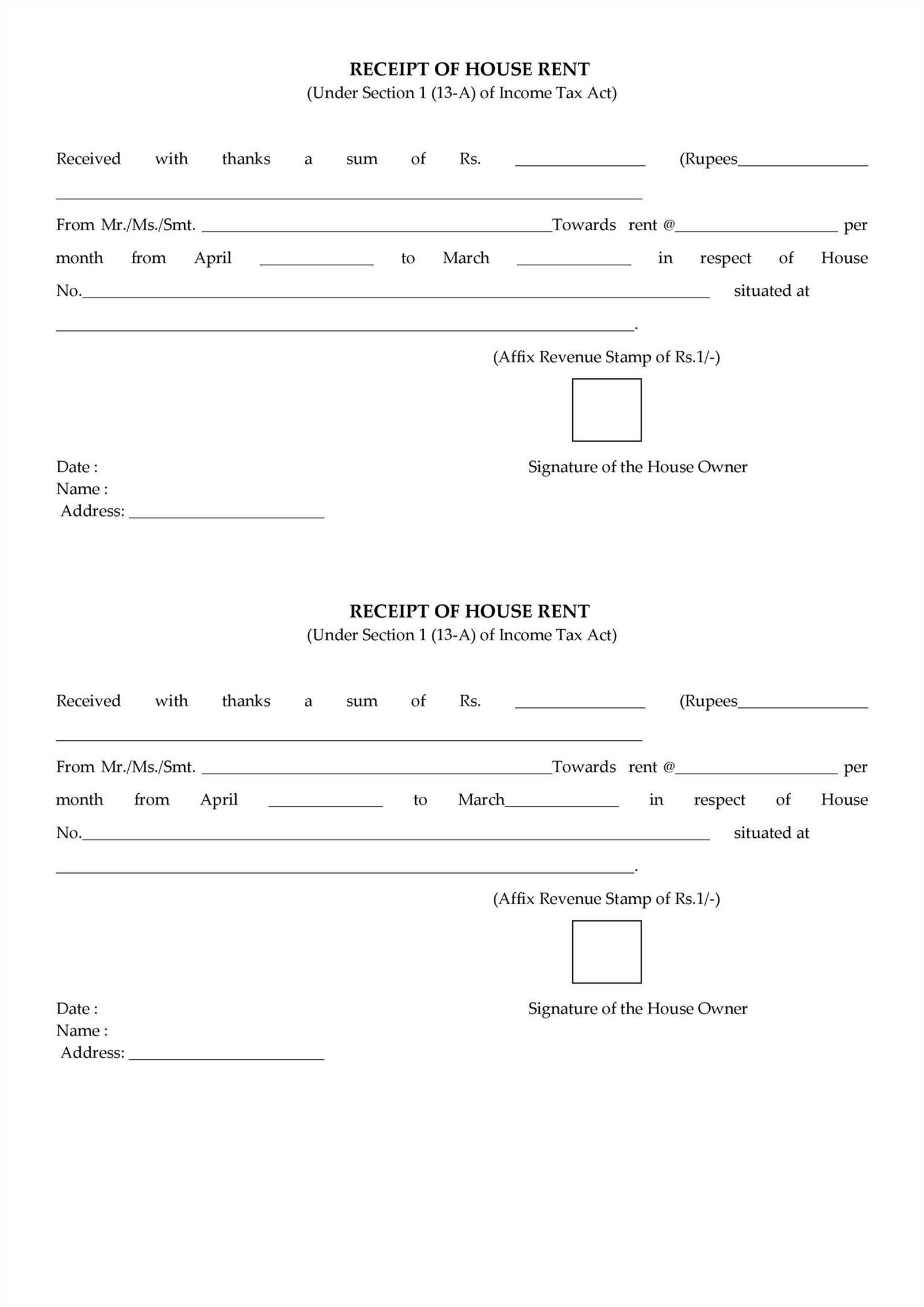

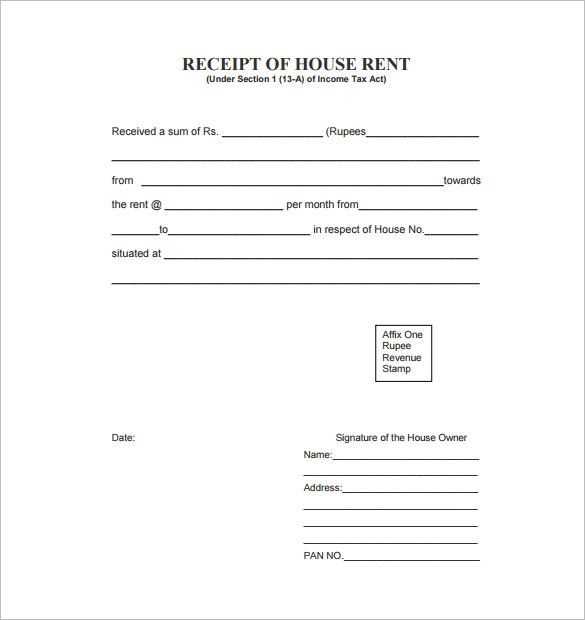

Next, specify the rent amount. Clearly state the payment amount in both numerical and written form to avoid any confusion. Include the rental period covered by the payment as well as the address of the rented property.

Don’t forget to mention the payment method used–whether it was cash, check, or electronic transfer. This will provide transparency on how the rent was settled.

Finally, ensure the signature of the landlord (or an authorized representative) is included at the bottom, confirming the payment. This adds authenticity to the receipt and protects both parties in case of disputes.

- Single Rent Receipt Template: Practical Guide

To create a rent receipt, ensure all key details are included. This guarantees both tenant and landlord have a clear record of the transaction.

Start with the date of payment. Clearly mention the date when the rent was received. This is a critical point for both parties for future reference.

Next, include the tenant’s name. Ensure you spell it correctly and provide any necessary identification details like an apartment number or address if applicable. This avoids confusion, especially when there are multiple tenants in the same property.

The landlord’s details should also appear. This could include the landlord’s name or the name of the property management company, depending on the arrangement. If a company is involved, add their registered address for transparency.

Specify the amount of rent received. Break it down if applicable, especially if partial payments or deposits are involved. Be clear on whether the rent includes utilities or if they are separate.

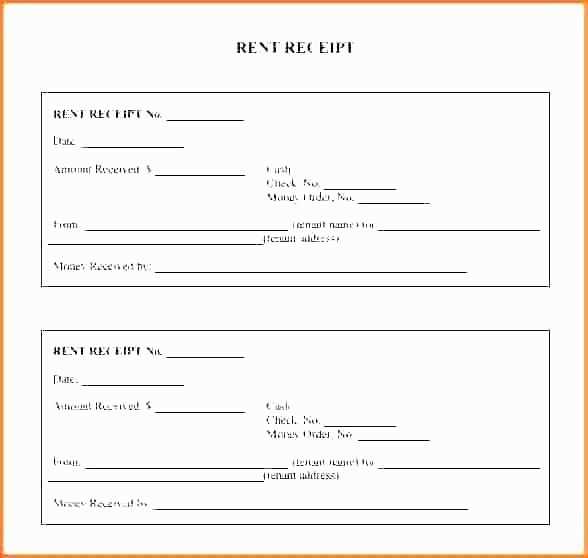

Next, clearly mention the payment method. Whether the tenant paid via bank transfer, check, or cash, always note it. This helps establish clarity in case of any disputes or discrepancies later.

Don’t forget to include the rental period. This should reflect the exact dates the payment covers–usually a month. Always match the rental period with the payment schedule to avoid misunderstandings.

Finally, leave room for a signature. Both parties should sign to confirm receipt of payment. The landlord’s signature serves as an acknowledgment, and if needed, the tenant’s signature can also be added for extra confirmation.

Make sure the document is clear and legible, as it serves as a legal receipt. Keep copies for both parties to reference later, especially for tax purposes or when verifying past payments.

A rent receipt must clearly display all the required information to comply with legal standards. This includes the names of both the landlord and tenant, the rental property address, and the payment amount. You must also specify the date the payment was made and the payment method (e.g., cash, check, bank transfer). If the payment is in cash, include a statement confirming the amount was received in full.

Important Details

Ensure the rental period covered by the payment is listed, such as the start and end date for the month or week being paid. If any extra charges like late fees or utility payments are included, break these out separately. For long-term leases, add any relevant terms that clarify whether the payment applies solely to rent or includes other services or fees.

Local Requirements

Check local regulations for any specific details that might be required on a rent receipt. Some jurisdictions may require a unique receipt number, a tax statement, or particular wording for compliance purposes. Keeping the receipt clear and thorough helps prevent disputes and ensures the document holds up in legal or financial situations.

Ensure your rent receipt template has the following key elements for clarity and accuracy:

1. Tenant Information: Include the tenant’s full name and address to avoid any confusion over who made the payment. It ensures the receipt is tied to the correct individual or entity.

2. Landlord Information: Clearly state the landlord’s name or business name and contact details. This is essential for identification and any future communication regarding the property or payment.

3. Payment Date: Always mention the exact date the payment was received. This helps in keeping records aligned with the lease agreement’s terms and tracking any late payments if applicable.

4. Payment Amount: Specify the amount received in both numbers and words to prevent misunderstandings. Make sure to include any deductions or adjustments made to the total amount.

5. Payment Method: Indicate whether the payment was made via cash, check, or bank transfer. This provides clarity in case there are discrepancies or disputes in the future.

6. Rental Period: Clearly state the period the payment covers, such as “for the month of February 2025” or “for the week of January 15-21, 2025.” This connects the payment to a specific timeframe.

7. Receipt Number or Transaction ID: Assign a unique receipt number or include a transaction ID for tracking purposes. This simplifies referencing past payments if needed.

8. Signature or Acknowledgment: Either the landlord’s signature or a digital acknowledgment should be included to verify that the payment has been received. This adds an extra layer of validation.

By incorporating these elements, you’ll create a straightforward, reliable rent receipt that both parties can easily reference.

Ensure accuracy in every detail when issuing a receipt. Small errors can lead to confusion for both you and the recipient. Here are key mistakes to avoid:

- Incorrect or Missing Information: Always verify that the names, addresses, and amounts are correct. A missing or incorrect name can lead to disputes.

- Wrong Date: Double-check the date on the receipt. An incorrect date may cause issues when referencing the transaction later.

- Omitting Payment Details: Include all relevant payment information, such as the method of payment (cash, credit card, etc.), and the amount paid. This helps in case of a refund request or audit.

- Failure to Specify Itemized Charges: If applicable, provide a detailed breakdown of goods or services purchased. Vague receipts can raise questions and create ambiguity.

- Not Including a Receipt Number: Assign each receipt a unique identifier. This allows for better tracking and prevents errors in record-keeping.

- Inconsistent Formatting: Maintain consistent formatting in the receipt. Clear fonts, proper spacing, and alignment make the document more readable and professional.

Additional Tips

- Review Before Issuing: Always double-check the receipt before handing it over. This small step can prevent major mistakes.

- Clear Signature: Ensure that any signatures or initials on the receipt are clear and legible. This ensures its authenticity.

Receipt Template Details

Ensure that the rent receipt template contains all necessary information for clarity and legal purposes. A good template should have clearly defined fields for tenant and landlord details, property address, rent amount, payment date, and the signature of both parties. This helps prevent confusion and establishes an accurate record of payment.

Key Sections in a Rent Receipt

| Section | Description |

|---|---|

| Tenant Information | Include the tenant’s full name, contact information, and unit number or address. |

| Landlord Information | Provide the landlord’s full name and contact details. This ensures both parties are easily identifiable. |

| Property Details | List the property address where the tenant resides. If applicable, mention unit or apartment number. |

| Payment Information | Specify the rent amount paid, the payment method, and the period it covers (e.g., January 1–31, 2025). |

| Date | Include the exact date the payment was received. This serves as proof of transaction timing. |

| Signatures | Both parties should sign the receipt. The tenant confirms the payment, and the landlord verifies the transaction. |

By following these guidelines, you can ensure that the receipt serves its purpose effectively without leaving room for misunderstanding or legal complications.