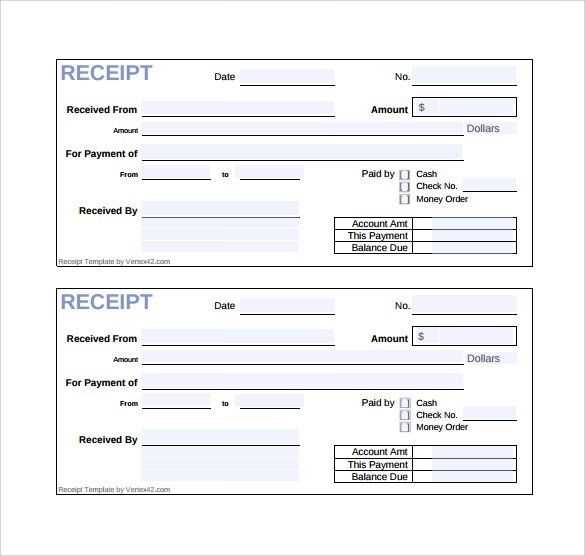

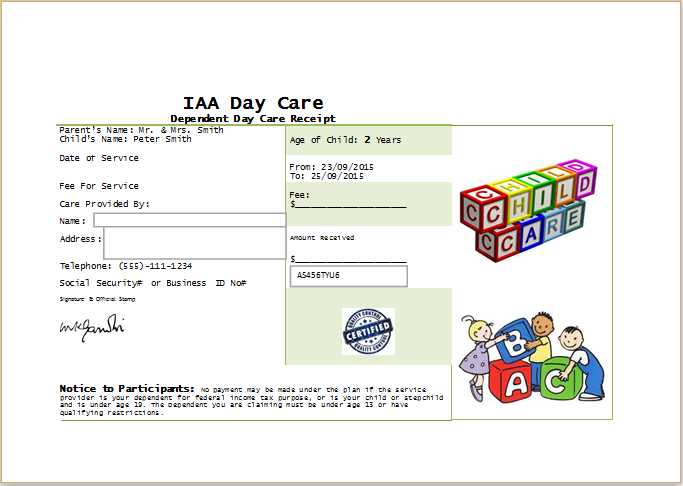

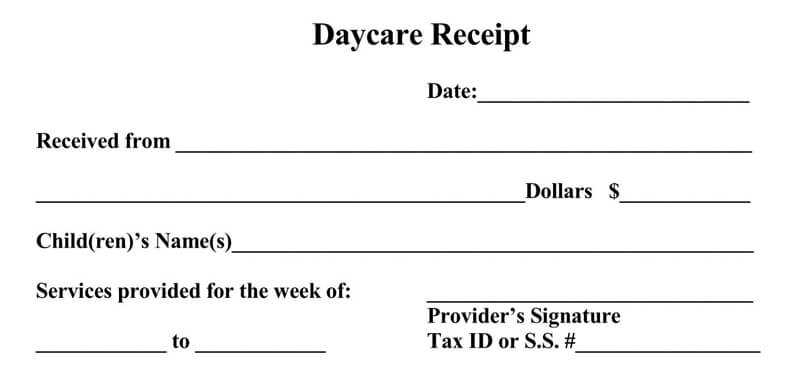

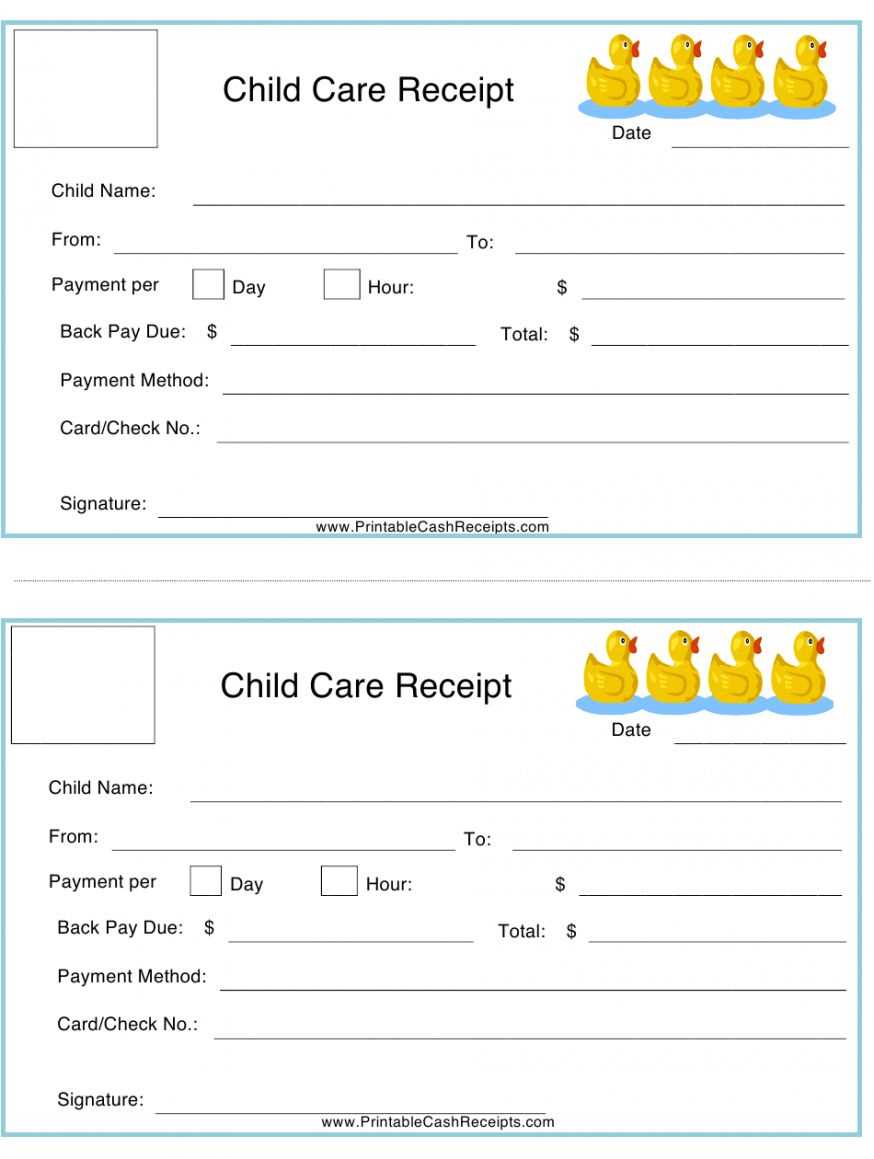

To create a clear and professional receipt for child care services, include the child’s name, the date of service, and the total amount paid. This helps both the provider and the parent track payments accurately. Each service provided, such as hourly care or special activities, should be itemized with corresponding rates.

Ensure the receipt reflects the name and contact details of the child care provider, as well as the method of payment (e.g., cash, check, or digital transfer). You may also want to include a section for any outstanding balance or pre-paid amounts.

By providing a well-structured receipt, you establish transparency and clarity for both parties. It’s a simple but effective way to maintain organized records and minimize misunderstandings related to payments.

Here’s the corrected version:

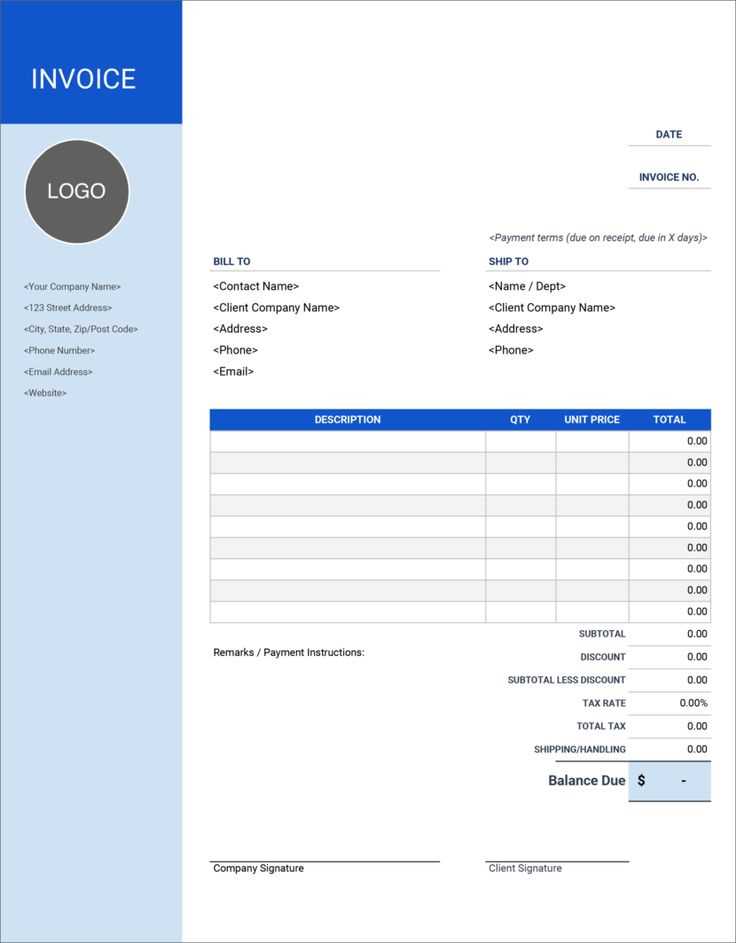

To create a child care services receipt, include the following key details:

Service Provider Information

Begin with the full name of the child care provider or company. Include their business address, phone number, and email for easy contact.

Details of the Service Provided

List the dates of service, hours worked, and the rate charged per hour. If applicable, break down any additional fees (e.g., late pick-up or early drop-off charges). Specify the child’s name to avoid any confusion.

Ensure that the total amount due is clearly stated. This can be done by adding a subtotal for hours worked, applying any discounts or additional fees, and then calculating the final total. If taxes apply, list them separately and indicate the tax rate used.

Finish by confirming payment terms, such as whether the receipt is for a full payment or partial payment. If partial, note the remaining balance and due date.

- Receipt for Child Care Services Template

For clarity and transparency, use a well-structured template when issuing receipts for child care services. This helps ensure both parties have a clear record of the transaction. Below is a basic outline you can follow:

Key Elements of the Receipt

Include the following details in the receipt:

- Service Provider’s Information – Name, address, and contact details of the child care provider.

- Parent or Guardian’s Information – Full name and contact information of the person receiving the service.

- Child’s Information – Name and age of the child receiving care.

- Dates of Service – Specify the exact dates the child care was provided.

- Hours Worked – Clearly outline the number of hours worked each day or week.

- Rate – Indicate the hourly or daily rate for child care services.

- Total Amount – Total charge based on the number of hours or days of service provided.

- Payment Method – Cash, check, or other payment methods used for the transaction.

Additional Tips

It’s helpful to have a unique receipt number for each transaction to keep everything organized. You might also consider adding a brief note or description of the services provided if there are specific activities or special arrangements involved.

Lastly, always ensure that both the provider and the client receive a copy of the receipt for future reference or potential tax purposes.

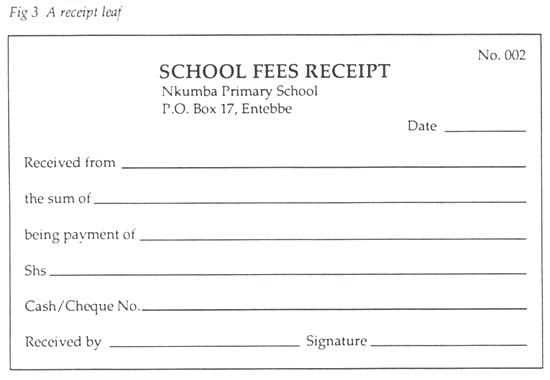

Begin with the provider’s name, business name (if applicable), and contact details. Include the client’s name and contact information as well. This identifies both parties involved in the transaction.

Detail the Service Period

Clearly state the start and end dates of the child care service. For example, “Services provided from February 1 to February 5, 2025.” This ensures accuracy in tracking the specific service provided.

List the Charges

Include the rate per hour or per day and the total amount charged. For example, “Hourly rate: $20, Total: $200 for 10 hours of care.” If there were any additional fees or discounts, list them separately for transparency.

Indicate the total amount due or paid, along with the payment method (cash, check, credit card, etc.). This provides clear financial information to both the provider and client.

Conclude the receipt with a thank you note for the client’s business, helping to maintain a professional relationship.

Start by including the name and contact details of the child care provider. This establishes clear identification for both parties involved.

Details of the Child

- Include the full name of the child receiving care.

- Specify the dates the services were provided, including start and end times, for each day if applicable.

Payment Information

- Clearly list the total amount paid for the services.

- Itemize any additional charges, such as late fees or extra hours, if they apply.

- State the payment method used, whether by check, cash, or card.

Lastly, ensure the receipt includes a unique receipt number for easy reference and a signature from the provider. This adds a layer of professionalism and trust to the transaction.

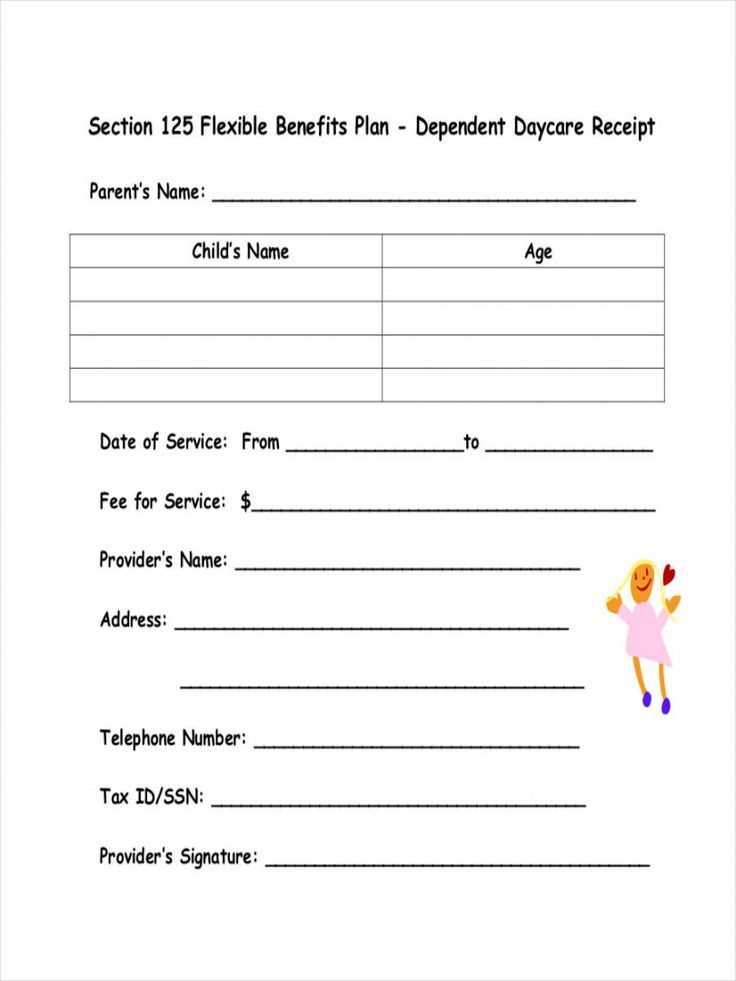

To use a child care services receipt template for tax deductions or reimbursement, fill in the required information carefully. Make sure all fields, including the provider’s name, address, and tax ID number, are accurate. If you’re submitting this for reimbursement, ensure it matches the format requested by your employer or reimbursement program.

For tax purposes, ensure the receipt includes the total amount paid, date of payment, and the service period. Include any details of services rendered, such as the number of hours or days. Some templates may require a separate breakdown of services, such as care for a specific number of children or special needs care.

If submitting for reimbursement, attach additional documents such as a payment confirmation or bank statement if required by your provider. Ensure the template includes the provider’s signature or certification that the services were rendered and payment received.

| Information to Include | Purpose |

|---|---|

| Provider’s Name and Address | Tax and reimbursement verification |

| Tax ID Number | For tax deduction eligibility |

| Service Dates | Verify the period for which care was provided |

| Total Amount Paid | Documentation for expense reporting |

| Breakdown of Services | Provide details for specific care needs |

| Provider’s Signature | Confirmation of services rendered |

Double-check the template for accuracy before submitting it. Inaccurate or incomplete information can delay processing or affect your eligibility for tax deductions or reimbursement. Once complete, submit the template along with any required forms to the appropriate agency or program for processing.

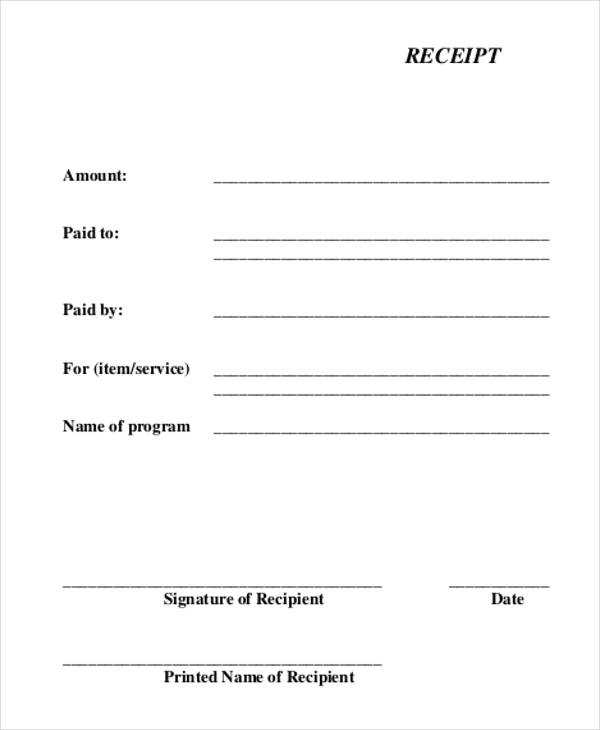

To create a child care receipt, ensure you include key details for clarity and accuracy. Begin with the date of service and the total amount charged. Next, list the child’s name, the service provider’s name, and any relevant contact details. The service description should briefly outline the care provided, such as the number of hours or type of care. Make sure the receipt is signed by both parties and includes any applicable tax information if required.

What to Include in the Receipt

- Date of service

- Total amount charged

- Provider and client names

- Description of the service provided

- Provider’s contact details

- Signature from both parties

Additional Tips

Double-check the amounts and details before finalizing the receipt. If the service includes any discounts or special fees, be sure to list them clearly to avoid confusion. Providing a clear, well-organized receipt ensures both parties have the correct information for future reference or tax purposes.