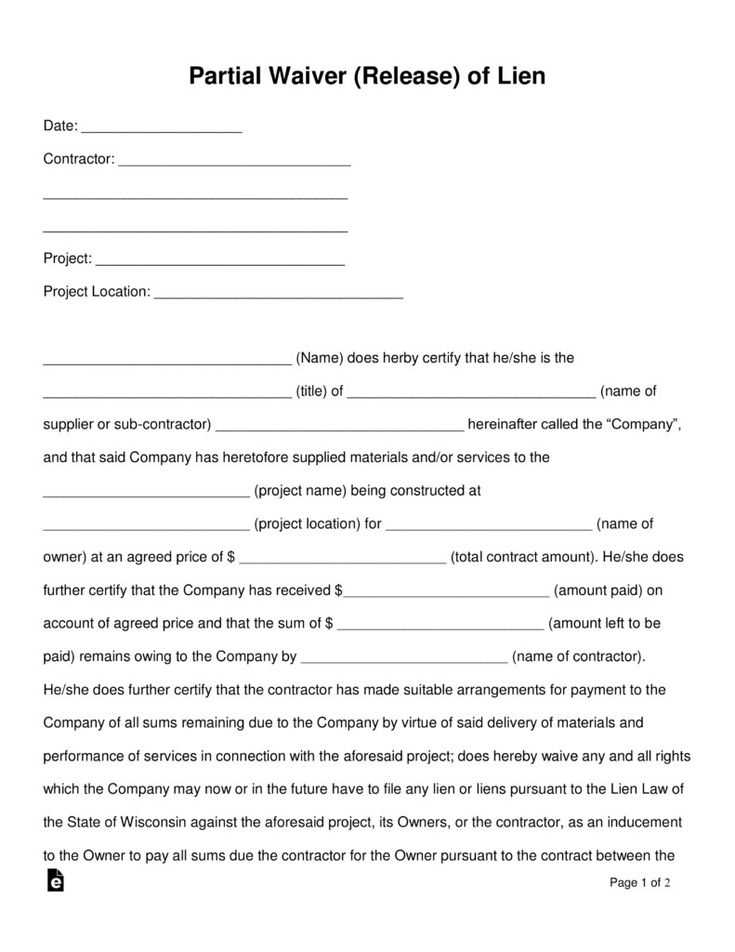

When drafting a partial lien waiver, it’s crucial to specify the amount received and the corresponding work or materials for which payment was made. This template serves as an official document stating that the lien rights for the specified amount are waived, while leaving the remaining balance subject to future claims.

Ensure that the template clearly indicates the date of payment, the project details, and a statement that the waiver is partial. The document should protect both parties by outlining what has been paid and confirming that the lien rights are relinquished only for the paid portion. It’s important to avoid ambiguity and keep the terms straightforward to prevent any misunderstandings later on.

Additionally, the waiver should be signed by the relevant parties involved. This will affirm that both sides agree to the conditions laid out, making the document legally binding. Keep a copy for your records and provide the original to the party making the payment for their protection as well.

Partial Lien Waiver Upon Receipt of Payment Template

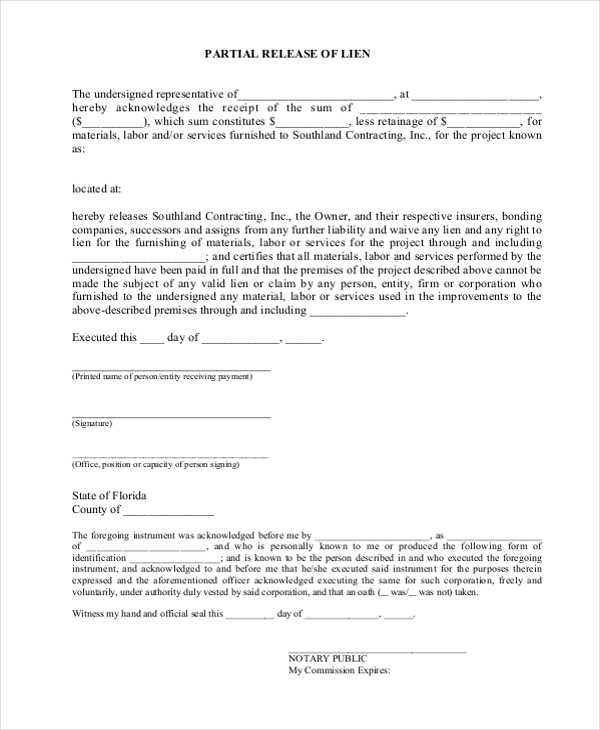

To ensure clarity in construction payments, a partial lien waiver serves as a legal acknowledgment that a contractor, subcontractor, or supplier has received payment for a portion of the work completed. This waiver releases the payer from any further claims or liens for the paid amount. It’s essential to use a template that outlines the specific conditions under which the waiver applies, protecting both the payer and the recipient. Below is an effective template to consider:

Partial Lien Waiver Template:

Parties Involved:

[Name of Contractor/Subcontractor]

[Name of Payer]

[Project Name/Description]

[Date of Payment Received]

Agreement:

Upon receipt of the payment in the amount of $[Amount Paid], the undersigned hereby waives and releases any claim or lien for labor, materials, or services provided up to the date of this waiver in connection with the above-referenced project. This waiver covers all work completed and services rendered through [Date], and the amount paid as indicated. No further claims or liens will be filed regarding this payment.

Limitations:

This waiver does not cover any additional work performed after the stated date nor any amounts that remain unpaid under the terms of the contract. The undersigned acknowledges that this waiver is not a release of all claims but only for the amount specified in this document.

Signed:

[Signature of Contractor/Subcontractor]

[Signature of Payer]

Date: [Date Signed]

Make sure that both parties review the template carefully, ensuring that it accurately reflects the agreed-upon payment terms and project scope. Keep copies of this document for future reference in case any disputes arise regarding the payment or additional claims. A partial lien waiver offers peace of mind and protects all parties involved by documenting payment received and confirming the resolution of related claims up to that point.

Understanding the Purpose of a Partial Lien Waiver

A partial lien waiver serves as a document that releases a contractor, subcontractor, or supplier from any claims to a property for the portion of the payment already received. It confirms that the payee has been paid for a specific amount of work or materials, while still retaining the right to file a lien for any outstanding balance. This waiver protects property owners, ensuring they are not held responsible for future claims on the paid portion of a project.

Benefits for Property Owners

- Reduces the risk of double payments by confirming funds have been disbursed for a specific part of the work.

- Offers clarity and transparency in the payment process, showing how funds are applied to various stages of the project.

- Helps prevent mechanic’s liens from being filed on completed work that has already been compensated.

Why Contractors Use Partial Lien Waivers

- Provides assurance to property owners that progress payments have been made, helping to build trust in the project.

- Allows contractors to continue receiving payments while retaining their right to file a lien for unpaid portions of the contract.

- Ensures smoother project progression by confirming financial exchanges are being tracked properly.

Steps to Create a Legally Binding Partial Lien Waiver

Ensure the waiver is clear and specific. It should outline the amount being waived, the date of payment, and the scope of the lien being released. The language must leave no room for ambiguity to avoid future disputes.

1. Identify the Payment and Work Covered

Clearly state the payment amount and specify the work or materials the payment covers. Be precise about which portion of the contract is being settled. For instance, indicate whether the waiver applies to labor, materials, or both for a particular project phase.

2. Include Signatures and Relevant Details

The waiver must include signatures from both the lien claimant and the property owner or contractor. Ensure each party’s full name, title, and the date of signing are documented. A legally binding waiver requires these signatures to be witnessed or notarized, depending on your jurisdiction.

Conclude by stating that the lien release applies only to the agreed payment and not to any future claims related to the project. This ensures clarity and protects both parties from unintended consequences.

Key Elements to Include in the Template

Clearly state the payment amount that has been received. This ensures both parties are aligned on the exact figure and prevents future disputes.

Specify the scope of work or materials covered by the waiver. It’s critical to list the particular tasks or items for which the payment is being acknowledged. This avoids confusion regarding what has been compensated.

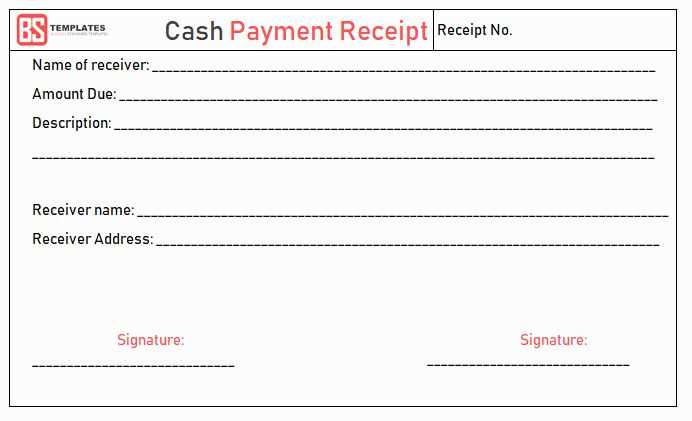

Payment Details and Conditions

Include the payment date, method, and any relevant reference numbers. This creates a clear record for both the payer and payee. Additionally, indicate whether this is a full or partial lien waiver and explain the conditions of the release.

Waiver Language and Signatures

Ensure the waiver includes clear language stating that the payment clears any claims or liens to the specified amount, but not necessarily for any future payments. Have both parties sign and date the document, verifying the transaction.