A non-cash donation receipt serves as formal documentation for charitable contributions that don’t involve money. Whether it’s clothing, furniture, or even services, a receipt helps both the donor and the receiving organization maintain clear records for tax purposes. It’s a simple yet important tool for ensuring transparency and trust between both parties.

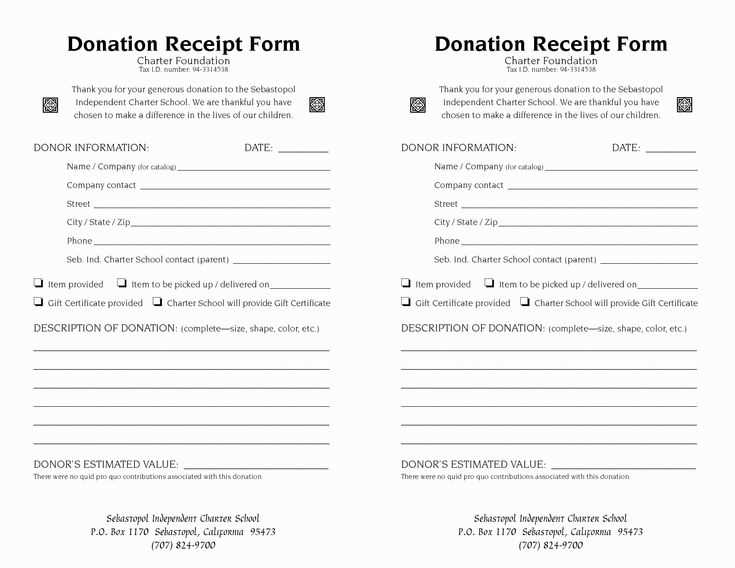

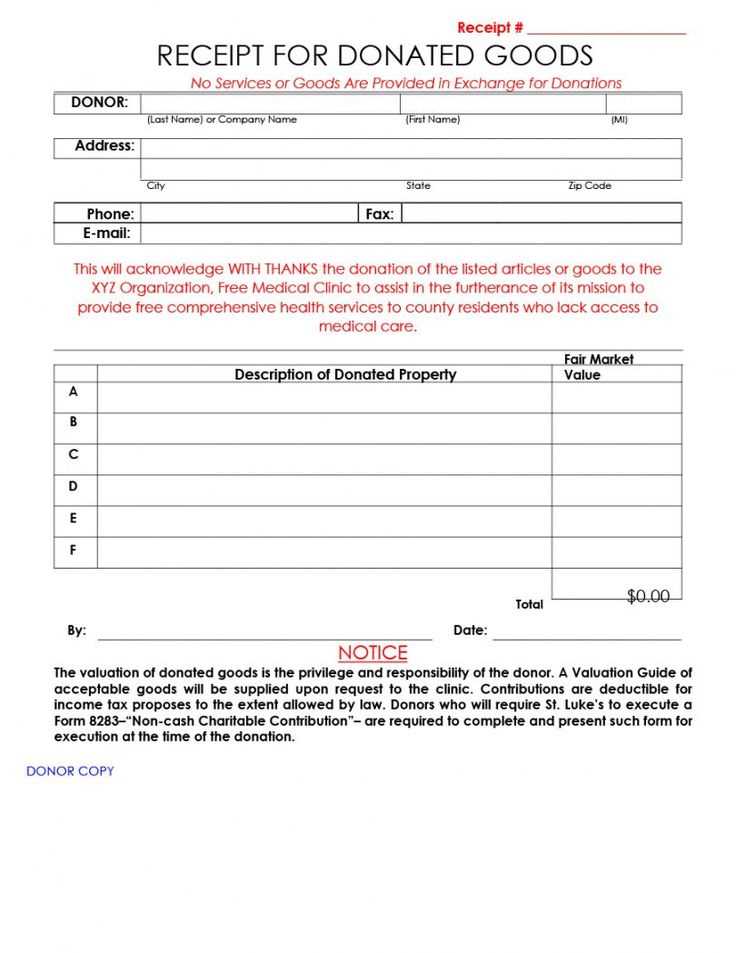

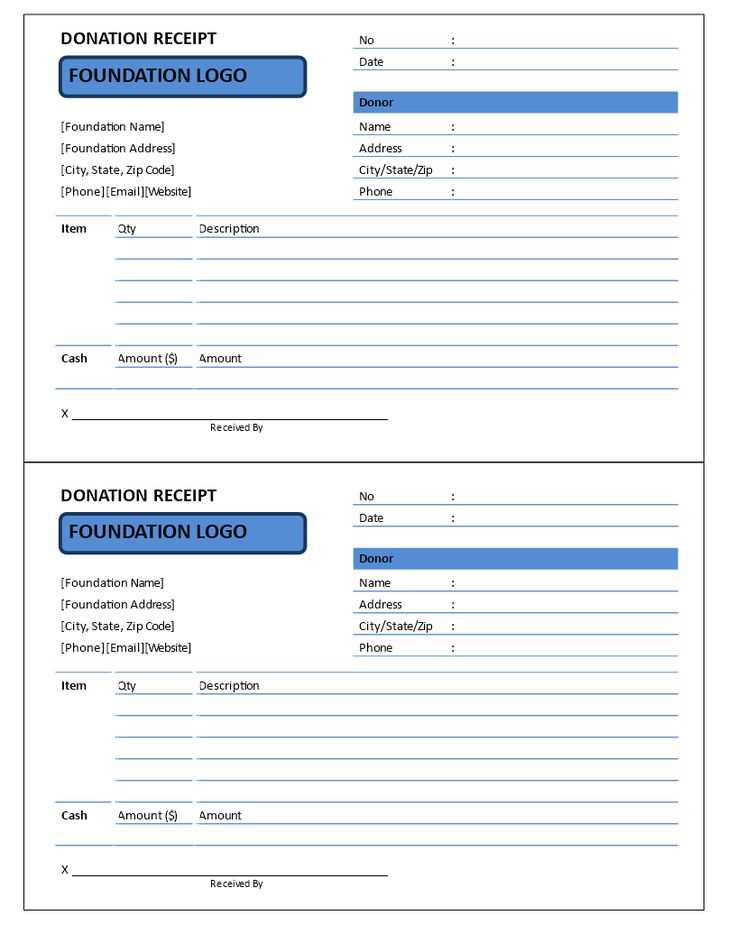

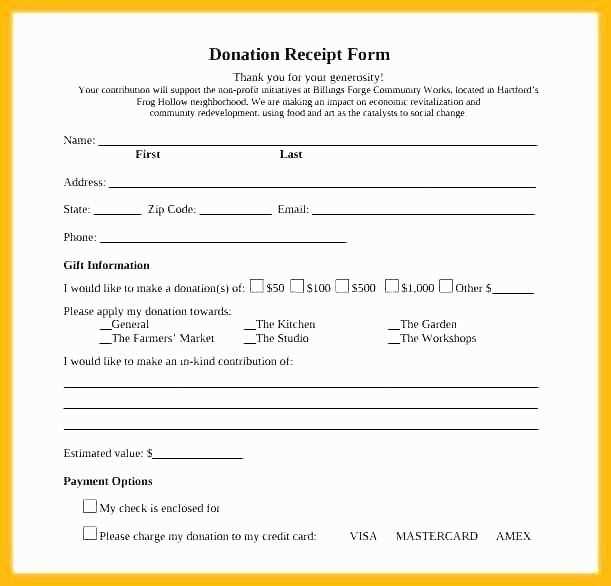

To create a reliable non-cash donation receipt template, include essential details such as the donor’s name, the date of the donation, and a description of the items donated. It’s also helpful to provide an estimated value of the goods or services, though this is not always required. Donors should understand that the IRS doesn’t require organizations to provide a valuation of the items, but an accurate description of the donated items is important.

Make sure the receipt also contains the name of the charitable organization, its tax-exempt status, and the signature of a representative if possible. This will reinforce the authenticity of the receipt, making it more valuable for both tax reporting and future reference.

Lastly, maintain simplicity in your template design. A straightforward layout, with clear sections for all relevant information, will make it easier for both donors and organizations to fill out and use the receipt without confusion.

Non-Cash Donation Receipt Template Guide

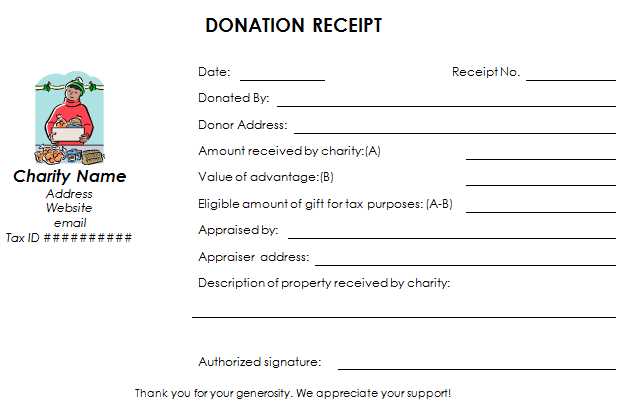

When creating a non-cash donation receipt, include the donor’s name, address, and a description of the items donated. Make sure to note the date of the donation and whether the donor received any goods or services in exchange.

Start with the donor’s full name and contact information, followed by the organization’s name and address. Specify the type of non-cash items donated (e.g., clothing, furniture, electronics), and avoid including personal information about the items that could be misinterpreted or vague.

Description of the Donated Items: List the donated items with a brief description. Avoid assigning a specific dollar value. If the donor estimates the value, it should be indicated as an estimate rather than an appraisal. If an appraisal is required, the donor must provide it separately.

Donation Date: Clearly state the date the donation was made. This is necessary for tax purposes and tracking purposes.

Value of the Donation: While you should not assign a value to the items, you can note that the donor was responsible for determining the value of the donation. This allows the donor to report it accurately on their tax returns.

Signature of Authorized Representative: An authorized person from the charity should sign the receipt, confirming the donation and providing an official acknowledgment. Include the title or position of the signatory for added clarity.

Additional Notes: If any goods or services were provided in exchange for the donation (such as tickets or benefits), mention the fair market value of those services. The value of the goods or services received must be subtracted from the total donation amount for tax purposes.

This template helps ensure that both the donor and the organization maintain clear records and comply with IRS requirements for non-cash donations. Keep it simple, clear, and accurate to avoid misunderstandings later.

How to Structure a Non-Cash Donation Receipt Template

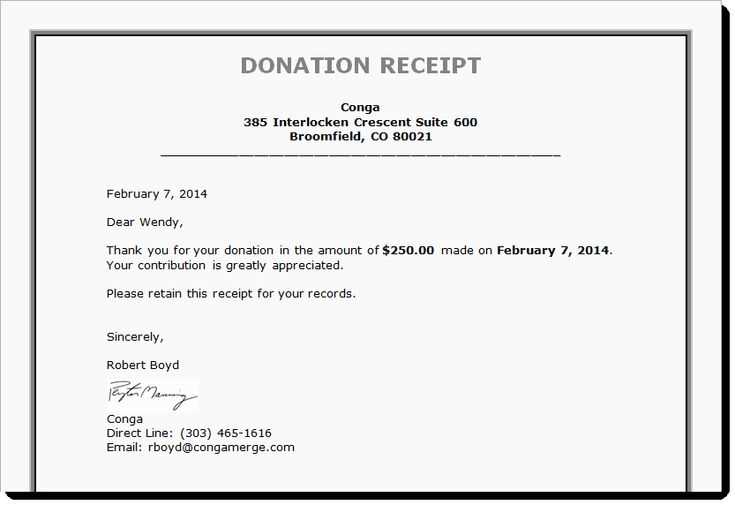

Begin by including the donation’s key details: the name of the donor, the organization receiving the donation, and the date of the donation. These basics form the backbone of the receipt and ensure accurate record-keeping. A clear, professional header should feature the organization’s name, logo, and contact information to make the receipt look official and trustworthy.

Item Description

Next, provide a detailed list of the donated items. For each item, include a description, quantity, and condition. If possible, attach an estimated fair market value for each item. This helps both the donor and the organization track the donation’s worth, which may be necessary for tax purposes. Avoid vague descriptions–specificity will prevent confusion later.

Donor Acknowledgment

Make sure to explicitly acknowledge that no goods or services were exchanged for the donation. This section ensures compliance with IRS requirements for tax deductions. Include a statement such as: “No goods or services were provided in exchange for this donation.” This should be placed near the bottom of the receipt to make it easy to locate.

Finally, include a thank you message at the end. A simple line like, “Thank you for your generous donation” personalizes the receipt and builds goodwill with the donor. Sign or electronically authorize the document to validate the receipt.

Key Legal Information to Include in a Non-Cash Donation Receipt

Ensure the receipt includes the name and address of your organization. This helps the donor identify where the donation is coming from. You should also state the date the donation was received. It’s crucial for tax reporting purposes.

List the description of the donated items. Avoid assigning a value to them, as only the donor can determine the fair market value. However, if the items are easily appraised, you can include a general description such as “furniture,” “electronics,” or “clothing.”

Include a clear statement that no goods or services were provided in exchange for the donation. If any benefit was provided, such as a token of appreciation, mention the fair market value of that benefit.

Specify whether the donor received anything in exchange for their contribution. If so, outline the value of the exchange to make sure the donor knows what part of the donation is tax-deductible.

For tax purposes, include a statement that the donor should consult their tax advisor regarding the value of the donation. This gives transparency and guidance for the donor’s reporting responsibilities.

Finally, make sure the receipt is signed by an authorized representative from your organization. This adds legitimacy to the document and provides a point of contact for the donor.

Got it! If you ever want to talk more about garden equipment or parts, feel free to ask. Do you have a specific machine or part in mind right now?