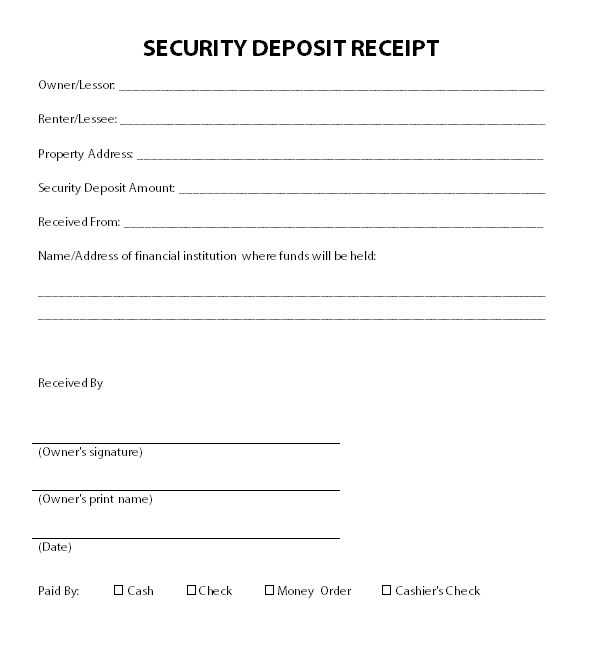

A clear and detailed cash receipt for rent deposit is a must when handling rental transactions. This document helps both parties–landlord and tenant–track payments, ensuring no disputes arise over the deposit. The template should include critical details like the date, amount received, and the parties involved.

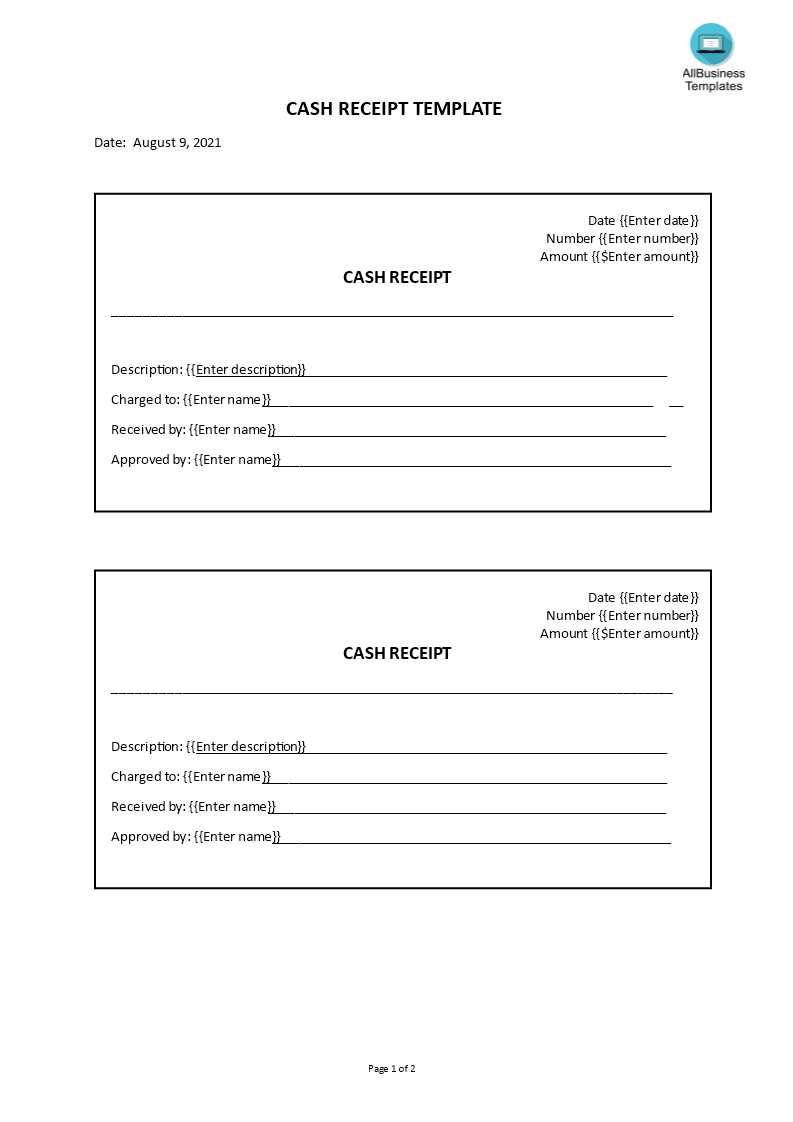

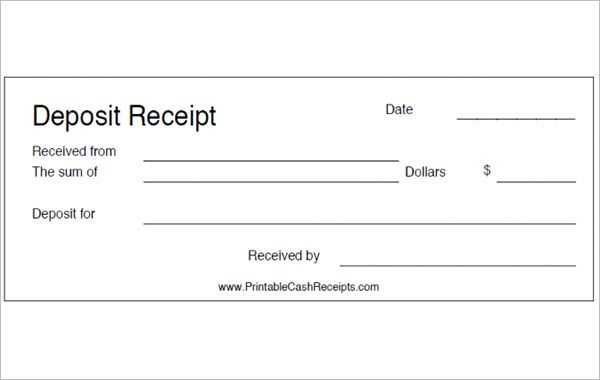

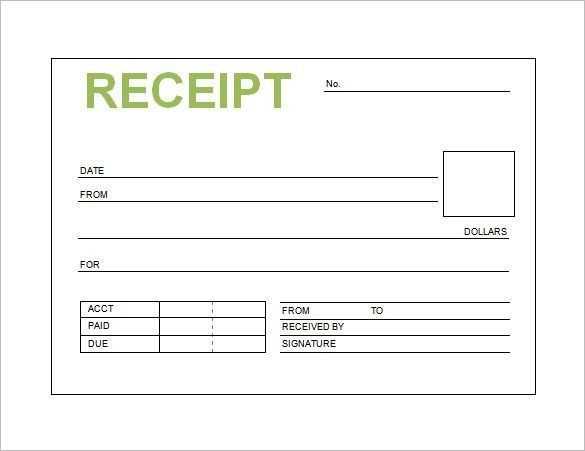

Start with a header that identifies the type of transaction, such as “Cash Receipt for Rent Deposit.” Below, include the tenant’s name, address, and rental unit information. Then, clearly state the amount received in both numbers and words. It’s also helpful to note any payment methods, whether it’s cash, check, or another form.

Ensure the receipt specifies the purpose of the deposit, such as “security deposit” or “advance payment,” and include any terms related to its return or deductions. A signature line at the bottom adds a layer of accountability, confirming both parties acknowledge the receipt.

How to Structure a Rent Deposit Receipt

Clearly state the amount received, specifying the currency. This sets the foundation for the document, ensuring there is no confusion later. Next, include the date of the transaction to indicate when the deposit was paid.

Identify the payer by including their full name and address. This information is critical for linking the receipt to the correct individual or party. Similarly, list the recipient’s details, such as the landlord’s or property manager’s name and address.

Describe the purpose of the deposit. Clarify that it is a rent deposit and include any relevant details, like the rental property address and the rental period covered by the deposit. This helps both parties understand what the deposit is specifically intended for.

Provide any conditions or terms related to the deposit. This may include whether the deposit is refundable, under what conditions it may be retained, or if it will be applied toward future rent. Including these specifics can prevent disputes later on.

Conclude with the signature of both parties. This solidifies the agreement and provides verification that both the payer and recipient agree to the terms outlined. Ensure the receipt is dated to reflect the exact time of agreement.

Legal Requirements for Rent Deposit Receipts

Ensure the receipt for a rent deposit includes the following key information:

- Tenant’s Full Name: Include the full name of the tenant paying the deposit.

- Landlord or Agent’s Information: Clearly state the landlord’s or agent’s name, address, and contact details.

- Amount of Deposit: Specify the exact amount received as the deposit.

- Date of Payment: Indicate the exact date when the deposit was made.

- Purpose of Payment: State that the deposit is for securing a rental property and outline its potential use (e.g., damage coverage, unpaid rent).

- Signature: Both the landlord (or agent) and tenant should sign the receipt as acknowledgment of the transaction.

- Terms for Deposit Return: Briefly explain the conditions under which the deposit will be returned, including any deductions for damages or unpaid rent.

Check local laws for specific requirements regarding security deposits, as they can vary by location. Ensure that all details are clear and legally binding to avoid potential disputes later on.

Customizing Your Rent Deposit Receipt for Specific Situations

Adjust the receipt details based on the rental arrangement. If the deposit covers more than one month or specific damages, note that clearly on the document. Specify the amount allocated for each purpose, such as “advance payment” or “damage coverage,” to avoid confusion later.

For short-term rentals, include the rental period to ensure clarity. If the deposit is refundable under certain conditions, state those terms explicitly to manage expectations. Be specific about timeframes for the refund, such as “Refund within 30 days of lease termination, subject to property inspection.”

If there are any non-refundable portions, like cleaning fees or pet deposits, highlight them separately. This ensures transparency and eliminates potential disputes about what the deposit covers.

In cases where multiple tenants share the rental, list all parties responsible for the deposit. This helps if one person needs to pay the full amount or if someone is subletting, providing a clear record of who made the payment.

If the deposit is tied to specific conditions like repairs or upgrades, mention the exact nature of the work. For example, “Deposit held for repair of window panes broken during the lease term.” This will keep both parties on the same page about the deposit’s purpose and avoid misunderstandings.